What is a challenger bank, and how to start one?

Early 2010’s were the time where new fintechs were popping up everywhere. Atom Bank, Monzo, or N26–just to name a few.

What happened to those that survived the initial funding rounds and didn’t lose traction along the way?

Many of them made it to the next base, drifting away from the neobank phase and getting closer to really challenging the traditional banks: they got a banking license and became challenger banks.

In this article, we’ll:

- explore the beginning of the challenger bank phenomenon,

- explain how they’re different from neobanks and traditional banks,

- tell you how to build a challenger bank based on our experience partnering with them, and

- discuss whether challenger banks still… challenge.

TL;DR – how to start a challenger bank?Here’s what you should remember about starting a challenger bank after reading this article:

Also, check our article about starting a fintech company for even more actionable insights. |

What is a challenger bank?

Challenger banks are halfway between neobanks and traditional banks.

They’re financial institutions that offer alternative banking services with a focus on technology and customer-centric solutions–just like neobanks.

On the other hand, they hold a full banking license. However, their services might be limited, compared to traditional banks, and they rarely have physical branches.

The term “challenger bank” gained traction first in Europe, particularly the UK. While the term originated in Europe, challenger banks are definitely present in the US as well. Examples include SoFi or Varo Bank.

What are the characteristics of a challenger bank?

A challenger bank:

- Holds a banking license;

- Is fully-digital, with little to no reliance on physical branches;

- Prioritizes a super-smooth user experience;

- Innovates, which gives it a competitive advantage over traditional banks;

- Offers lower fees (by cutting the overhead costs of physical branches);

- Often targets a specific niche (sustainable banking) or demographics (like mobile banking for Gen Z).

How were challenger banks born?

Challenger banks came in waves.

Based on what Chris Skinner writes in his text Is it true that challenger banks no longer challenge?, we could say there were two phases of challenger banking: the 90s and 2010s (but it’s worth noting that the way we define challenger banking nowadays doesn’t quite match the 90s challengers–but we’re mentioning them for the sake of context).

The challenger banks of the 1990s, like Sainsburys, Tesco and Virgin (and even Metro Bank, launched in 2010, the first high street bank to launch in the UK in over 150 years), failed to compete with the established banks in the long run because they relied on physical branches and outdated technology. These banks were built for a different era, before the internet and mobile banking became widespread.

The second wave came in the early 2010s.

In the aftermath of the 2008 financial crisis, when trust in traditional banks hit rock bottom, accessing financial services for many people felt like pulling teeth without anesthesia. The only option was the banking dinosaurs, with their high fees, poor customer service, and a pace of innovation worthy of a sloth on vacation. Frustration was mounting, and customers were desperately in need of a change.

In the face of these challenges, there were those who saw an opportunity. Their goal was to create disruptive solutions – financial services accessible 24/7, user-friendly, and free from bureaucratic ballast.

The birth of the first challenger banks was like a breath of fresh air in the stale atmosphere of traditional banking.

They rejected not only physical branches but also the obsession with paperwork, putting customer experience and mobility at the forefront. For many traditional bankers, this sounded like heresy. A bank without branches? However, it became possible.

Regulatory changes, particularly by the UK’s Financial Conduct Authority (FCA) in 2013, lowered the barriers to entry for new banks. These reforms reduced capital requirements and streamlined the application process, making it easier for new entities to obtain banking licenses. Additionally, venture capital and other investments provided the necessary funding for these new banks to scale rapidly and compete effectively with established institutions.

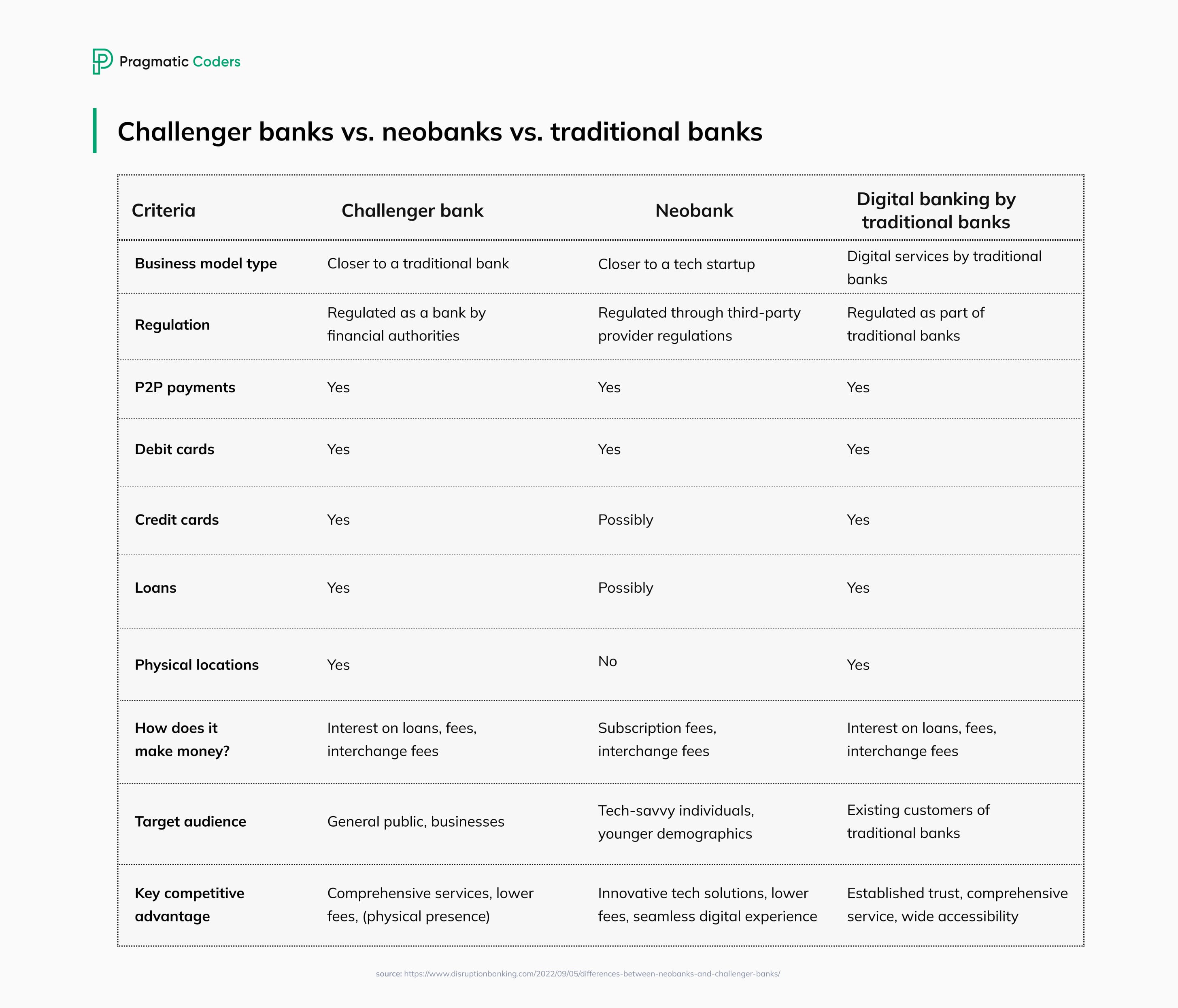

Comparison: Challenger bank vs. neobank vs. digital banking

How are challenger banks different from neobanks and traditional banks?

Compared to traditional banks

- Focus on digital experience: Challengers prioritize a user-friendly mobile app for all banking needs. Traditional banks might offer mobile apps, but their core focus might still be on physical branches.

- Lower fees: Challenger banks often have lower fees for account maintenance, international transactions, or overdrafts compared to traditional banks.

- Faster innovation: They are nimble and can adapt to new technologies and customer needs quicker than traditional banks with complex legacy systems.

- Limited services: Currently, challenger banks typically offer a narrower range of products compared to traditional banks, which might have wealth management, safety deposit boxes, or extensive loan options.

Compared to neobanks

- Banking license: Such banks hold a full banking license.

- Regulatory oversight: Challenger banks are subject to stricter regulations due to their license, which can build trust with customers. (Neobanks might have less regulatory oversight.)

- Physical presence: While rare, some challenger banks might have a limited number of physical branches for specific needs. Neobanks are entirely digital with no physical presence.

Part 4A Permission

According to PSP Lab’s article, one more difference between neobanks and challenger banks is whether they have Part 4A Permission to take deposits:

- […] neobank is sometimes referred to as a financial services firm which is entirely cloud or online-based offering a lot of the services that a traditional bank does but that does not, however, have Part 4A Permission to take deposits. Challenger banks on the other hand do have Part 4A Permission under the FSMA to take deposits. Examples of challenger banks are Monzo and Starling Bank, while those of neobanks are Monese and Revolut.

In a nutshell: The key difference between challenger banks and neobanks is the Part 4A Permission. In comparison to traditional banks, challenger banks are less established, might have limited product offering, no physical presence–but lower fees and faster innovation cycles.

Challenger banks. Examples

Let’s take a look at a few most successful challenger banks.

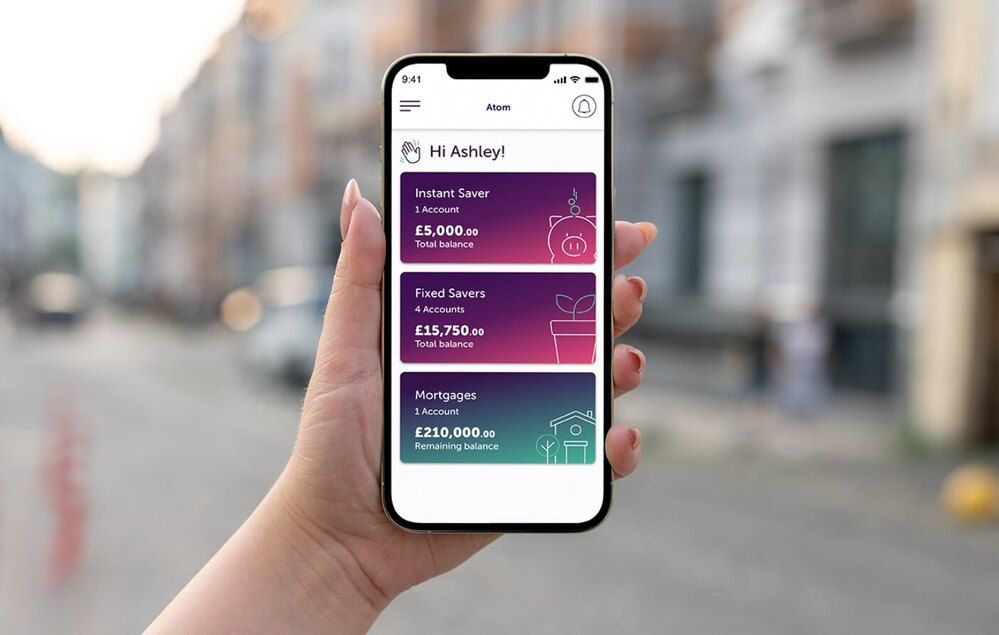

Atom Bank

- Founded: 2014

- Country: UK

- Focus: SAVINGS. MORTGAGES. BUSINESS LOANS.

Atom Bank is a digital-only bank that provides savings accounts and mortgages, and, so it happens–our long-term client.

Problem

The UK market lacked sufficient qualified developers due to high demand and Brexit. They were looking for experienced, high-quality fintech software developers to complement the existing UK team and add engineering capacity.

Solution

With our help, Atom built a new 30-person developer team in Poland within 12 months (using the Build-Operate-Transfer model).

Effects

After just the first 8 initial months of collaboration, we:

- Completed the team building ahead of schedule.

- Hired over 30 developers with various technologies (.net, React, etc.) and experience levels.

- Increased Atom Bank’s development speed, especially for the mobile app.

- Conducted feedback sessions and Agile training sessions.

- Established trust between both companies’ teams– we gained trust to recruit for other roles (RPA, AI, etc.)

It’s been a few years now since we started to collaborate with Atom in 2024, and we’re continuing to make strides in our partnership. Read the full Atom Bank case study.

N26

- Founded: 2013

- Country: Germany

- Focus: Simplicity. The bank aims to make money management beautifully simple and easy to manage.

N26’s focus is on becoming the go-to mobile bank for a tech-savvy generation in Europe. They prioritize a user-friendly app with all the financial tools needed (spending, saving, investing) to manage money conveniently and securely, all from a smartphone.

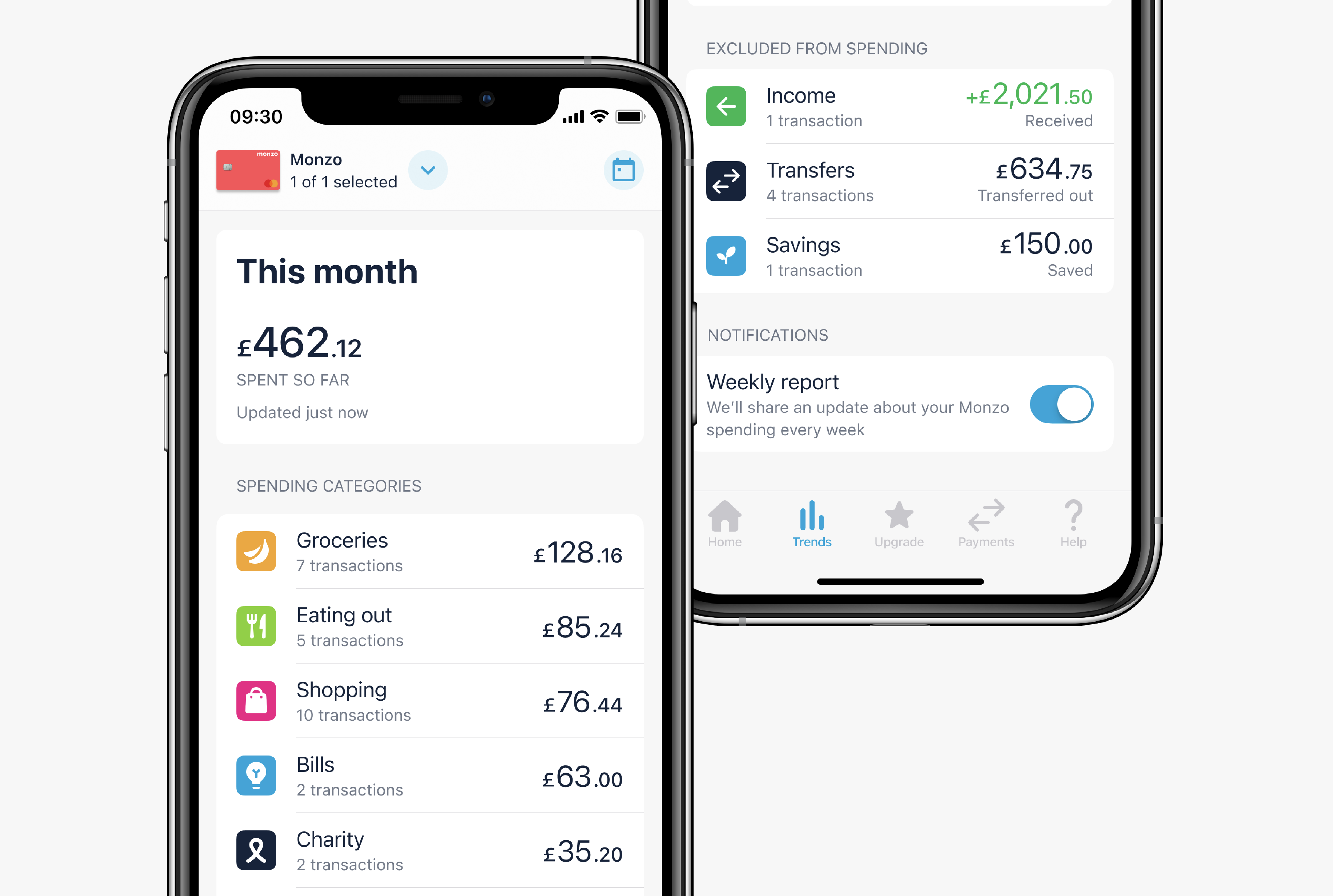

Monzo

- Founded: 2015

- Country: UK

- Focus: Simplifying money management

Their platform allows users to view all their finances in one app, track income and spending, and set aside money for savings goals.

Monzo promotes confident spending with real-time notifications and budgeting tools. They also emphasize no fees for foreign exchange, overdrafts, or ATMs. Safety and customer support are prioritized, with FDIC insurance through Sutton Bank.

How to start a challenger bank?

That’s for the theory: But how do you start a challenger bank? What is worth focusing on? What could be your advantage and what certainly will not?

We have cooperated with several companies from the fintech industry, now it’s time to draw conclusions.

One does not simply challenge a banking system, but…

We’ve already mentioned Revolut. Founded in 2015 has been growing all the time, has over 1000 developers working on it (interesting fact: according to Revolut’s LinkedIn, most of them are from Poland), and is able to deliver updates even several times a week.

By this, we want to tell you: it is not worth trying to monopolize the market that will look completely different in the future. (The other thing is that you most probably couldn’t do it, or, at least, that would be extremely difficult. Revolut has already monopolized the market, just take a look at this statistic on challenger bank downloads).

That’s why, when you think about how to start a challenger bank the first thing you need to do is to focus on getting a niche.

🌟 How to find your niche?

Finding a market niche is all about striking a balance between your interests and what resonates with potential customers.

The 5 basic steps you can take to find it are:

- Identify your skills and passions.

- Research and understand your target audience.

- Analyze the competition.

- Refine your niche and assess profitability.

- (Optional) Test the waters.

It might seem like a lot of work, but here’s a twist: we’ve created a tool that does points 2, 3, and 4 for you (and we can help with what comes after it too, by the way). Just use our free AI market research tool as many times as you like, and download your results!

Why is getting a niche important?

At the heart of the bank challenger is the delivery of solutions that are not provided by traditional entities. The problem is that the market is getting tighter and tighter due to the rapidly growing number of challengers. If you want to fit in you need to find a niche for yourself and give it a value that no one else guarantees.

What to do for a start?

Our experience allows us to suggest you start by creating a clear list of core banking functionalities you need, and hypotheses for Unique Value Propositions (UVP), which meant functions that were to stand out. Then, you’ll have to sort them out, starting with what is most important for your niche. All our business partners founding a challenger bank had such a list.

For a detailed guide on essential core banking functionalities and their importance in establishing a new bank, you can refer to our comprehensive article on core banking systems.

Instead of creating all functions at once, you should start in a pragmatic way by building the direction in which you are going. Use User Story Mapping to choose the basic functionalities.

Having many user stories divided into different areas of the banking application, so-called “backbone”, (customer registration, transfers within the application, local transfers, card, customer application, compliance, etc.) you can decide what to focus on first.

Also using Business Model Canvas would be a great solution to identify strategic suppliers, sources of expenditure and revenue, target groups, and personas. We used it every time we worked on challenger banks. We tailored the product development plan to the marketing strategy adopted by the business partner as well. With this in mind, it was possible to jointly establish a definition of Minimum Viable Product.

MVP – what should it be?

For all the challengers we work with, MVP was core banking functionalities + at least one UVP.

Why is that?

Because people don’t like change, especially if they don’t see the benefits in it for themselves. So, if you want to enter the market with a product offering only basic functions, your only chance to win first customers will be aggressive marketing ( as we say: “communicate benefits not features”) or dumping. In this case, you have to reckon with high costs and no feedback to check your hypotheses.

That’s why we and our business partners decided to create at least one of UVPs before the first users start using the product. Such an MVP gives you an answer for questions: is your product attractive for a niche market and in which direction should you develop it next?

Ready-made components: Start a challenger bank in a pragmatic way!

Recently we worked together with the founders of a new challenger bank who pleasantly surprised us with their approach.

They turned to us after a year of doing detailed research for information and had the concept of bank challenger construction ready, which consisted of creating it from already completed components. They also prepared the list of providers. Founders didn’t want to create a bank application from scratch.

Why were we delighted with this? Because it fits with our pragmatic thinking about building products.

Using already completed components is time and energy saving especially if you choose a proven supplier, and you can be sure that they have been tested several times already.

So the challenge is to find trustful companies that provide these components and the development teams that will bring these components together into your challenger bank.

Our mission, as a product development partner and technology advisor, is to suggest the most effective solutions.

As we mentioned before, our business partners usually come to us having research on providers done. However, that’s not a rule: our UX researchers have prepared many studies on our clients’ target audiences (like the one for a green blockchain solution or handicraft marketplace).

Then, we check what integration with components could look like, which means: exact comparisons, meetings with providers’ representatives, and inspection of documentation. After that, we recommend to our partners the most optimal components, especially that we already have experience with some of them. Of course, the final decision is up to our clients, and we are flexible in our approach to their needs.

What components are we talking about? For example:

- The payment processor that deals with the transactions;

- Component for customer identity verification (KYC);

- Cloud solution infrastructure (like AWS).

Building a challenger bank from already ready components has many advantages.

- First of all, the sooner the product is completed, the sooner it will appear on the market. You will get feedback from users or check if your strategic assumptions were correct to avoid a shot in the dark approach when developing further functionalities.

- Moreover, it takes many months to build everything from scratch, and, instead, at the same time you can have a working and user-tested application and a vision of how to develop it next.

- Also, with the advent of AI, connecting the components and designing UIs is faster and cheaper than ever.

Bet on a very convenient UX

It won’t make a big difference to other challenger banks, but it will make a big difference to traditional banks. This applies to countries like the UK where many people remain loyal to the biggest brands present on the market for years.

And if you think there is a slight difference between challengers and traditional ones, just look at the number of clicks needed to set up an account with different banks. In Revolut only 24 are needed, in Santander, for example, 91, and in HSBC–99.

UX is the Achilles heel of traditional banks which creates an opportunity for you to stand out, so, accordingly, challengers should pay a lot of attention to user experience. What is worth thinking about?

As an example, during the recent development of a challenger bank our UX Design team prepared:

- a questionnaire for internal users (100 people);

- clickable mock-ups

- in-depth interviews with end-users.

All this to understand what we should focus on when building the basic banking functionality, and how users navigate the application.

People might have similar banking needs, but their preferences can differ greatly depending on the country. To create a truly great banking app, you need to understand these differences. This is where tailored UX research comes in – it helps uncover what makes a perfect banking experience for users in specific regions, and what features to feature in your banking app.

Challenger bank and cryptocurrency exchange – what do they have in common?

By the way, have you read an article on our blog about building a cryptocurrency exchange or fintech software development outsourcing? To put it in a nutshell: we are pretty sure that creating all the structure and mechanisms from scratch is a good idea only in a few, rare cases. In all the rest, which means 80-90%, it is much better to use white label solutions. Reading this, you will see some analogies with challenger banks.

Do they still challenge? The future of challenger banks

There’s a Statista chart that shows the number of new challenger banks launched annually worldwide from 2014 to 2022.

If you look at it, you’ll see the numbers have been continuously increasing, from just 8 challenger banks in 2014 to 83 in 2019. The number peaked in 2020–there were 94 new challenger banks launched. However, from 2021, the numbers started to decrease. In 2021, we had just 59 new challenger banks started, and three less in 2022.

It seems like the challenger bank landscape has consolidated in the recent time.

The startups that started in early- or mid-2010’s are now unicorns. By October of last year, 2023, there were seven digital banks in Europe that had achieved this status. (The unicorn term refers to startups that have received venture capital funding and are now valued at over one billion US dollars.) Others were acquired (Virgin Money).

Does it mean there’s no use trying to build a neobank or a challenger bank? Absolutely not. Everything comes down to finding your niche in the banking sector by finding what obstacles bank app customers face using them, and how you can solve these problems with your product, to your advantage.

There are target audiences (for example, banking for Gen Z) and niches (like sustainable banking, gamified banking, or hyper-personalization in banking) that still wait to be filled and banking trends to be leveraged–it’s up to you if you take the chance.

Want to build a fintech app and are looking for a reliable software partner with a proven record of building fintech & banking products?