Fintech outsourcing in 2024: how to outsource fintech software development?

In the rapidly evolving fintech landscape, the decision to outsource fintech software development has become a strategic imperative. Companies aim to stay at the forefront of innovation. This guide delves into the why and how of fintech development outsourcing. It offers insights into its benefits. It also addresses potential challenges and how to navigate them effectively. It is designed to help you select the right outsourcing service from a fintech software development company.

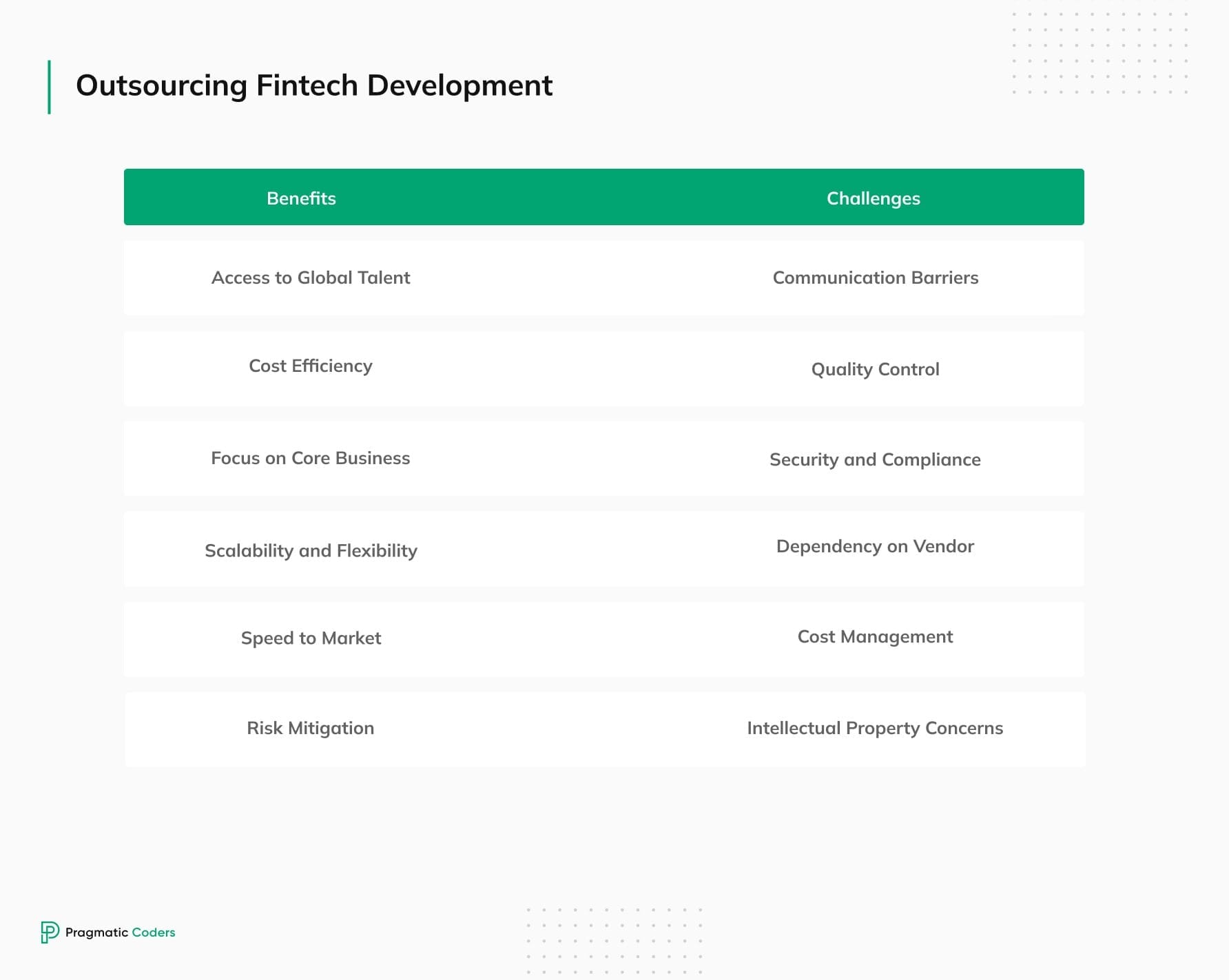

Benefits of fintech software development outsourcing

In the quest for innovation and staying competitive, financial service providers are increasingly turning to outsourcing companies. Whether you’re just starting a fintech startup or running a large financial company, outsourcing seems like the right move. Here, we’ll explore why the popularity of fintech software development outsourcing seems to rise year by year. Let’s break down the core reasons.

Access to talented fintech software developers from around the world

One of the main benefits of outsourcing fintech development is the unparalleled access it provides to global talent. Imagine having the pick of the world’s best fintech software developers, designers, and tech innovators at your fingertips. Outsourcing allows you to break geographical barriers. It connects you with global fintech talent who bring diverse perspectives, skills, and experiences to the table. This diversity fuels creativity and innovation. It allows you to develop a fintech software product that stands out in a crowded market.

Delving into offshore outsourcing further amplifies this advantage. It opens the door to regions with rich software engineering talent pools and more cost-effective labor markets. By partnering with fintech developers in these areas, you benefit from significant cost savings. You also gain access to more specialized fintech software development services. These may be scarce or more expensive in your local market. Offshore outsourcing can be a strategic move for large financial companies. It offers round-the-clock development cycles due to time zone differences. This accelerates product development and launch timelines. This approach requires careful management and clear communication channels. They are necessary to overcome any potential challenges such as cultural and language differences. However, when executed well, it can propel a fintech project forward. It blends innovation, diversity, and efficiency in a way that local outsourcing or in-house development might not match.

Cost efficiency of outsourced fintech development services

Outsourcing in the fintech industry is also a smart financial move. It’s about doing more with less, without compromising on the quality of product development. By choosing to outsource, you can significantly reduce costs. These costs are associated with hiring an in-house development team. Think about salaries, benefits, workspace, and technology. This financial flexibility is crucial, especially for small fintech businesses, startups, and SMEs. Why? Because it allows them to allocate resources more effectively while scaling their operations. Essentially, outsourcing fintech product development lets you adjust your expenditure. This adjustment fits your project’s size and scope, ensuring you’re not overspending.

Outsourcing fintech development allows for a focus on core competencies

Fintech companies thrive on innovation. However, the intricacies of software development can divert attention from core business activities. Outsourcing the technical workload means you can concentrate on what you do best. This could be refining your product offering, strategizing for market expansion, or enhancing customer experience. Hire fintech experts to handle the development work. Your job is to steer the ship towards its next big milestone.

Scalability and flexibility of outsourced fintech development

Fintech market demands can change in the blink of an eye, and agility is key to responding effectively. Outsourcing development allows for the scalability and flexibility needed to adapt quickly. Whether ramping up app development efforts to launch a new product or scaling back to focus on refining an existing fintech service, outsourcing partners can adjust swiftly to your needs. This elasticity is a significant advantage. It ensures you’re always positioned to meet market demands head-on.

Fintech software development outsourcing challenges

Outsourcing fintech software development is packed with advantages. However, it comes with a set of challenges as well. The key to a successful partnership lies in recognizing these hurdles early and addressing them proactively. Let’s explore strategies to ensure your outsourcing efforts yield the best results.

Cost optimization in outsourced fintech product development

The decision to outsource the fintech software development process is often driven by the objective of achieving more with less. This means maximizing output while minimizing costs. Contrary to the misconception that outsourcing is an expensive venture, it emerges as a beacon of cost efficiency. This is especially true for startups and SMEs venturing into the fintech app development domain. The ability to leverage global talent pools without the overhead associated with full-time in-house teams presents a compelling case for outsourcing. These overheads include salaries, benefits, and workspace costs. However, achieving true cost-effectiveness hinges on selecting the right outsourcing model (nearshoring vs offshoring). It also depends on maintaining open lines of communication about pricing structures and financial expectations.

Outsourcing fintech development offers several pricing models. Each comes with its unique advantages and considerations for cost optimization:

- Fixed-Price Contracts: Ideal for projects with well-defined scopes, these contracts allow for a predictable budget. They help in minimizing financial uncertainty.

- Time and Materials (T&M): This flexible model suits projects where the scope may evolve. It bills for actual work done, thus aligning costs closely with project needs.

- Dedicated Team: You pay for the full-time services of a dedicated team. This is beneficial for long-term projects that require continuous development and support.

Cost-saving strategies in fintech outsourcing also include selecting offshore or nearshore development centers. These centers are in regions with lower labor costs but do not compromise on quality. Additionally, engaging in partnerships that offer scalable resources can adjust team sizes. This adjustment is based on project phase and necessity, ensuring you only pay for what you need when you need it.

Transparency in fintech development outsourcing

A critical aspect of any fintech outsourcing relationship is transparency, particularly regarding costs and budgetary expectations. Open discussions about potential cost fluctuations, additional charges, and the overall financial model are essential from the outset. This transparency builds trust. It also enables better budget planning and reduces the risk of unexpected expenses disrupting the project flow.

Clients and providers should engage in regular financial reviews throughout the project lifecycle. They should address any changes in scope or requirements that might affect the budget. This approach ensures that both parties remain aligned on the project’s financial health and objectives. It fosters a partnership characterized by mutual understanding and respect for financial constraints.

Quality assurance in fintech software outsourcing

Quality can never be compromised. And in fintech, where the stakes involve financial transactions and data integrity, it’s out of the question in particular. Ensuring outsourced projects meet your high-quality standards starts with selecting a partner with a proven track record. Look for firms that showcase their successes and are open about their process methodologies and quality assurance (QA) protocols. Implementing a transparent, continuous feedback loop allows for early detection and resolution of issues. This aligns the development process with your expectations. Regular milestones and deliverables should be part of your agreement. They ensure the project stays on track and meets your standards.

Communication and cultural differences between outsourcing partners

Effective communication is the backbone of any successful outsourcing relationship. Differences in language, time zones, and culture can pose significant barriers. However, these can be overcome with clear strategies. Opt for partners who demonstrate strong communication skills. They should also be willing to adjust their working hours to have overlapping time with your team. Establishing a robust communication framework is crucial. This involves using tools and practices that ensure updates, feedback, and discussions flow smoothly. Encouraging cultural exchange and sensitivity training can help bridge any cultural gaps. This fosters a more cohesive working environment.

Security and compliance in the fintech industry

In the world of fintech, where financial data and user privacy are paramount, security and regulatory compliance cannot be overstated. Your outsourcing partner must have a deep understanding of the fintech regulatory landscape. This includes global standards like GDPR or specific regional requirements. Before initiating the project, conduct a thorough assessment of their security protocols, data handling practices, and compliance credentials. It’s also wise to involve your legal and compliance teams in drafting the contract. Include clauses that protect your company’s and your customers’ interests. Ensure all developed software adheres to the necessary regulatory standards.

Fintech software outsourcing process step-by-step

Fintech software development outsourcing requires meticulous strategy, clear communication, and effective execution. In a way, it’s similar to developing your own fintech product from start to finish. To navigate this process smoothly and ensure successful collaboration, follow the steps written below. they incorporate best practices for hiring the right fintech software development partner.

Step 1: Define project scope and objectives

Clear objectives guide the outsourcing journey. Establish the scope of your fintech software project scope by:

Setting Clear Goals: Outline what you intend to achieve with this fintech project. Specify the desired outcomes.

Understanding Requirements: Collaborate with stakeholders to define both technical and business requirements of your future fintech product. Your goal is to ensure full clarity.

Communicating Expectations: Share your project goals and requirements with your outsourced development team. Align your expectations with them from the outset.

Step 2: Choose the right engagement model and draft a comprehensive contract

The foundation of a successful fintech outsourcing project lies in selecting an appropriate engagement model and drafting a detailed contract:

Engagement Models: Choose between fixed-price, time and material, or a dedicated team model. Base the choice on your project’s requirements and complexity.

- Clear Contracts: Ensure the contract specifies project deliverables, timelines, payment schedules, confidentiality, compliance stipulations, and intellectual property rights. Highlight the importance of data protection.

- Negotiation and Flexibility: Engage in negotiations that safeguard the interests of both parties, remaining adaptable to the project’s changing needs.

Step 3: Conduct thorough research to find the right fintech developers

Efficiently sourcing potential fintech development partners involves:

- Leveraging Networks: Utilize corporate connections and industry networks. Many companies have experience with fintech development outsourcing and can provide recommendations.

- Utilizing Online Platforms: Explore LinkedIn, freelance portals, and tech marketplaces for skilled fintech developers. Review platforms can also guide you to reputable development service providers.

- Engaging with Offshore Agencies: Consider partnering with specialized outsourced software development agencies for streamlined service.

Step 4: Evaluate the chosen fintech software developers

After identifying potential candidates for fintech development outsourcing, evaluate them based on:

- Alignment with Requirements: Ensure the candidates meet, or preferably exceed, your established criteria.

- Interview Insights: Use interviews to delve into their work culture, past projects, and technical expertise in financial software development.

- Final Selection: Choose the team that best aligns with your fintech project’s goals and company values.

Step 5: Hire the right fintech outsourcing provider

Selecting the ideal fintech software development outsourcing company is crucial. Here’s what to consider:

- Expertise and Experience: Ensure the company has a solid fintech portfolio. Look for projects that reflect the complexity and scope of your requirements, highlighting their success stories.

- Technical Proficiency: Verify the development team’s proficiency in the latest fintech technologies and methodologies. The outsourcing team should offer a skill set that aligns with the requirements of your fintech project.

- Cultural Fit: Compatibility with your company’s culture and values facilitates smoother collaboration. Assess this fit through discussions and evaluations.

- Client Testimonials and References: Feedback from previous clients can offer valuable insights into the company’s reliability and quality of work.

Step 6: Kickstart your fintech software outsourcing collaboration

With the right outsourced fintech software development team in place, finalize the collaboration by:

- Signing a Legally Binding Contract: Use a comprehensive agreement that covers all aspects of the project and collaboration.

- Selecting Project Management Tools: Discuss and agree on the most suitable project management tools to facilitate seamless communication and collaboration.

Intellectual Property (IP) ownership and protection in fintech outsourcing

Now that we’ve covered how to hire fintech software developers, it’s time to talk about protecting your intellectual property. When custom fintech software is concerned, vague ownership status is the last thing you’ll want. Understanding IP ownership rights is crucial. Securing these rights through contracts is a key step in safeguarding your precious new fintech software solution. Let’s delve into how you can ensure your IP remains your own. We’ll also discuss how to protect confidential information throughout the outsourcing process.

Ensuring IP ownership through proper software outsourcing contracts

When embarking on fintech software development outsourcing, the delineation of IP ownership is a foundational element of the partnership. Clear contractual agreements specify that any developments, innovations, or technologies created during the project belong to you, the client. These contracts serve as your legal safeguard. They ensure that your outsourcing partner transfers all IP rights upon project completion. It’s vital to include detailed clauses in the contract. These should cover the ownership of the developed fintech software and any patents that may arise from the project. They should also specify the rights to use and modify the software.

To fortify this agreement, ensure that your contract explicitly defines what constitutes IP within the scope of your fintech project. This could range from the software code itself to any unique processes developed, data models created, or algorithms employed. By clearly outlining these elements in your contract, you mitigate the risk of future disputes over IP ownership.

Protecting confidential information and data

The protection of confidential information and data is another pillar of a successful fintech outsourcing partnership. Your outsourcing provider should have stringent security measures in place to safeguard sensitive data. This includes encryption, secure access controls, and regular security audits. Additionally, nondisclosure agreements (NDAs) form part of the contractual framework. These agreements bind the provider to confidentiality regarding your project’s details. They also ensure confidentiality for any proprietary information shared during the development process.

Discuss with your provider their methods for protecting data, both at rest and in transit. Ensure they align with your security standards and regulatory requirements of the fintech industry in 2024. These requirements include GDPR or PCI DSS. This alignment is crucial for maintaining the integrity and confidentiality of your financial services.

Navigating complex IP scenarios in the fintech industry

Outsourcing agreements in fintech development can involve intricate IP scenarios. This is especially true when developing cutting-edge custom software technologies or when multiple parties contribute intellectual assets. In such cases, a tailored approach to IP rights allocation is necessary. Joint ownership agreements might be beneficial when innovation arises from collaborative efforts. They provide all parties with usage rights while protecting the IP from external misuse.

However, joint ownership is complex. It requires clear rules about the exploitation, licensing, and duties of each party. Alternatively, defining specific rights for each contribution can simplify IP management and ensure clarity. Regardless of the approach, the goal remains the same. It is to secure your interests and maintain the flexibility to utilize and capitalize on the fintech software solutions developed.

The future of fintech software development outsourcing

As we look towards the horizon of fintech software development, several emerging trends and technologies are set to shape the future of outsourcing in profound ways. Here’s what’s on the cards for fintech development outsourcing as we move into 2024 and beyond.

Innovative technologies shaping the future of fintech companies

The fintech sector is on the cusp of a technological revolution. AI, blockchain, and cloud computing are leading the charge. These technologies are not just buzzwords. They are the backbone of the next wave of fintech innovation. They offer unprecedented opportunities for security, efficiency, and customer service.

AI and Machine Learning: AI is transforming the way fintech companies operate. It enables them to deliver more sophisticated and user-centric solutions. This includes everything from personalized banking services to fraud detection.

Blockchain Technology: Beyond cryptocurrencies, blockchain is making its mark. It is creating secure, transparent, and efficient systems. These systems are used for everything from payments to smart contracts.

Cloud Computing: Cloud services provide scalability and flexibility. They are indispensable for fintech firms looking to innovate rapidly and cost-effectively.

The growing importance of cybersecurity in the fintech industry

As fintech firms increasingly rely on digital technologies, the spotlight on cybersecurity has never been brighter. Cyber threats are evolving. So are the strategies to combat them. Outsourcing partners must demonstrate not just compliance with current security standards. They also need a proactive approach to predicting and mitigating future risks. This includes regular security audits. It also involves adherence to international cybersecurity standards. Furthermore, the implementation of advanced security protocols is essential to protect sensitive financial data.

Sustainability and ethical software development outsourcing

Sustainability and ethical practices are moving to the forefront of the fintech outsourcing conversation. Companies are recognizing the importance of responsible outsourcing. This encompasses environmental considerations, ethical labor practices, and economic fairness. Fintech firms are increasingly selecting partners who share their commitment to sustainability. This includes green computing practices and ensuring fair labor practices across the supply chain.

Green Computing: Outsourcing partners are adopting energy-efficient technologies and practices. They aim to minimize the environmental footprint of their operations.

Ethical Practices: There is a growing emphasis on ethical labor practices and economic fairness. The goal is to ensure that outsourcing does not contribute to exploitation. Instead, it should support sustainable development.

Conclusions

As the fintech landscape rapidly evolves, outsourcing software development has become a strategic necessity for companies aiming to lead in innovation. There simply isn’t enough time to develop fintech software independently anymore. This guide has illuminated the advantages of tapping into global talent, optimizing costs, and focusing on core competencies. At the same time, it addresses the challenges of quality assurance, communication, and security compliance.

Looking forward, the integration of AI, blockchain, and cloud computing into fintech solutions promises to drive unprecedented innovation. Meanwhile, the emphasis on cybersecurity, sustainability, and ethical practices reflects a commitment to responsible growth.

In summary, fintech software development outsourcing is not just a trend. It is a cornerstone strategy for companies seeking to navigate the complexities of the digital age. By adopting a thoughtful approach to outsourcing, fintech firms can leverage external expertise. This enables them to accelerate growth, innovate continuously, and emerge as leaders in the financial technology sector.