AI in Fintech – trends for 2024 and beyond

Artificial Intelligence has been rapidly changing the fintech product development landscape, with new and more sophisticated solutions emerging seemingly every other day. Fintech companies, known for their agility, are well-positioned to leverage AI, giving them a considerable advantage over traditional financial organizations. We can safely say that the industry is on the cusp of an AI-driven revolution.

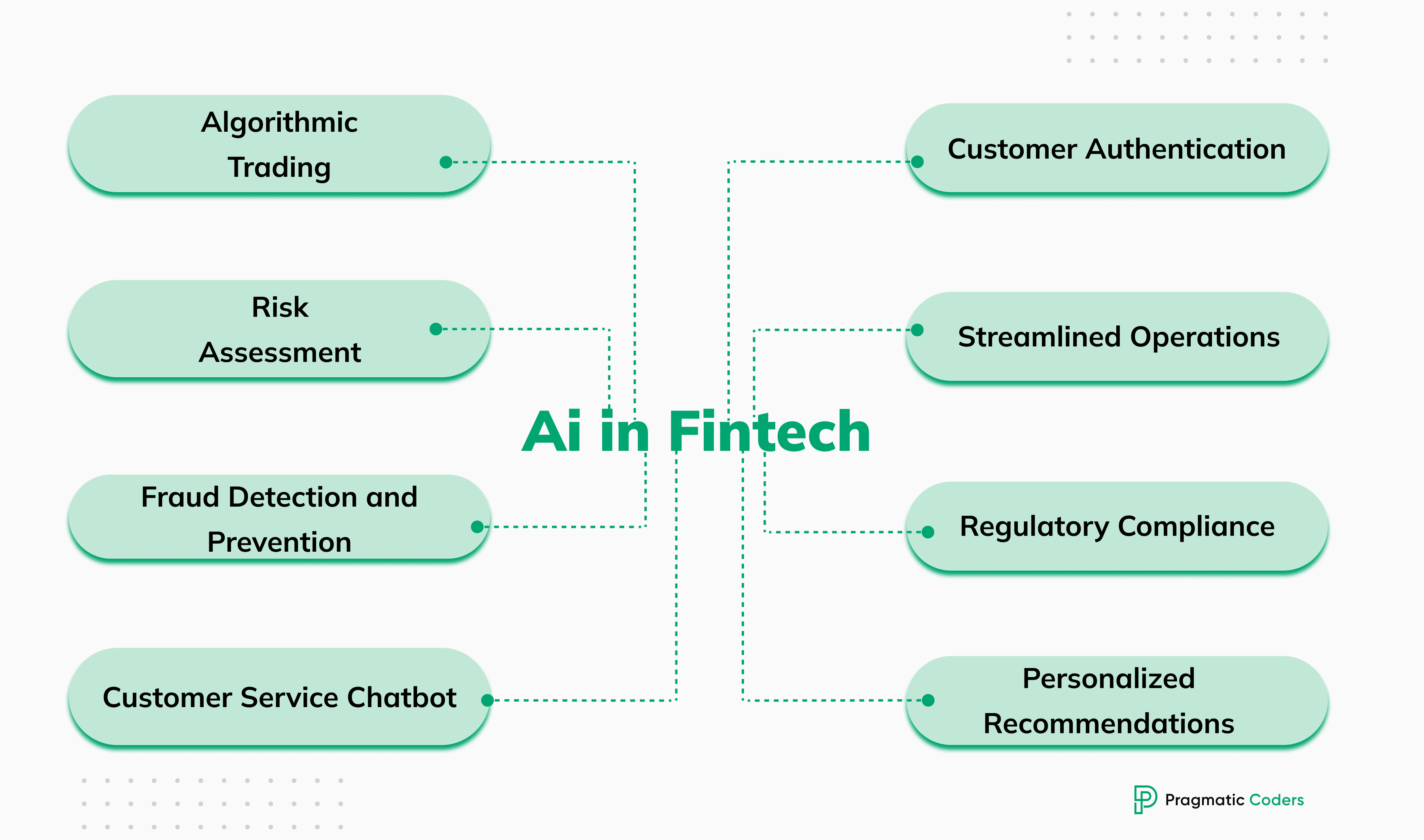

Top 8 AI trends in Fintech for 2024

In this article, we will explore the top AI trends in fintech for 2024 and beyond, showcasing how AI is set to make the industry more user-friendly, convenient, personalized, and secure. We’ll also highlight how AI could affect the fintech software development process itself.

If you’re interested in a more general look into AI trends, don’t forget to check our “AI predictions: Top 26 AI trends for 2024” and “The future of AI in 5, 10, and 15+ years” as well!

1. Algorithmic trading

Algorithmic trading is set to evolve in 2024, with AI at its core. While current AI trading apps may need refinement and we don’t recommend using them in their current state, the technology’s potential is undeniable. AI can analyze vast datasets in real time, identifying patterns and executing trades more efficiently than humans. As practice catches up to theory, Algorithmic Trading is poised to become a game-changer in, revolutionizing the way assets are traded and managed.

In the next 2-3 years, we can expect to see AI being used to develop new types of trading algorithms and strategies. For example, AI could be used to develop algorithms that can:

- Trade in multiple markets simultaneously

- Adapt to changing market conditions in real-time

- Take into account non-traditional data sources, such as social media sentiment or news events

By automating many of the tasks involved in trading, AI can free up traders to focus on higher-level activities, such as developing new strategies and managing their portfolios.

2. Risk assessment

AI is revolutionizing how fintechs approach assessing risk, making the entire process faster and more accurate. This transformation enables them to become more competitive lenders. AI can assess credit risk by analyzing financial histories, allowing for better (and much faster) lending decisions. This empowers fintechs to optimize their business strategies, making more informed decisions and enhancing their profitability.

Here are the two main ways AI is transforming risk assessment in fintech:

- More accurate credit scoring: AI-powered credit scoring models can take into account a wider range of data points than traditional models, including non-traditional data such as social media activity and online shopping habits.

- Faster loan approvals: AI can be used to automate the loan approval process, making it faster and more efficient for both fintechs and borrowers. This is especially beneficial for borrowers who may have been overlooked by traditional lenders, such as those with thin credit files or who are seeking small loans.

- Smart underwriting: Advanced AI-driven underwriting systems use dynamic data sources to tailor policies to individual risk profiles. This not only minimizes losses and fraud but also expands access to insurance for customers who may have been underserved by traditional models.

In addition to revolutionizing risk assessment, AI is also changing the way fintechs approach fraud detection and prevention.

3. Fraud detection and prevention

AI, with its machine learning algorithms, is transforming fraud detection and prevention in fintech. It can identify unusual transaction patterns and potential fraudulent activities in real time, enabling fintechs to take swift action to protect their customers. This enhanced security is set to become the new standard in fintech, increasing user confidence. AI-based security measures will also ensure that fintech apps remain secure and resilient against various cyber threats.

We can also expect to see AI being used to develop new fraud detection and prevention techniques in the future. For example, AI could be used to develop models that can predict fraud more accurately for specific types of transactions or industries. It could also be used to develop models that can adapt to changing fraud trends in real-time.

The future of fraud detection and prevention in fintech is bright, and AI is playing a key role in shaping it. By enabling fintechs to detect and prevent fraud more effectively, it is helping to make fintech more secure and trustworthy for users.

4. Customer service chatbots

AI-powered chatbots are set to become a standard addition to fintech solutions in 2024. These chatbots can offer 24/7 customer support, address inquiries, and handle basic tasks. What sets them apart is their ability to personalize interactions, learning about individual customers, and providing polite, ever-available service.

In addition to the benefits mentioned above, AI-powered chatbots can also help fintechs to reduce costs and improve efficiency. For example, chatbots can automate many of the tasks that are currently performed by human customer service representatives. This can free up human representatives to focus on more complex issues and provide a higher level of service to customers.

The future of customer service in fintech is AI-driven and tailored to the needs of each user. With automated, personalized, and always available helpdesk support, fintech companies will become even more convenient and accessible in 2024 and beyond.

5. Personalized recommendations

Personalization is key in the modern financial landscape, and AI is here to deliver. It can analyze a user’s financial behavior and provide personalized recommendations for saving, investing, and budgeting. Robo-advisors driven by AI can create and manage investment portfolios that align with individual risk tolerance and financial goals.

One of the most exciting aspects of AI-powered personalized recommendations in fintech is the potential to make custom financial services available to everyone. By making personalized financial advice and investment management more affordable and accessible, AI can help people of all income levels to achieve their financial goals. Furthermore, by providing personalized insights and recommendations, it can assist people in avoiding financial pitfalls and making more informed financial decisions.

The level of personalization in financial services is set to reach unprecedented heights in the upcoming years, making users’ financial journeys more tailored and efficient.

6. Regulatory compliance

Staying compliant with ever-evolving financial regulations is a major challenge for fintech companies. AI has the potential to streamline and automate compliance checks and reporting, helping fintech companies to adhere to regulations while saving time and resources. The integration of AI in regulatory technology will enable fintech to navigate the complex landscape of regulations more effectively in 2024 and further down the line.

We expect to see AI being used to develop new and innovative solutions for regulatory compliance in the future. For example, AI could be used to develop models that can predict the risk of compliance violations based on a variety of factors, such as customer behavior and transaction patterns. AI could also be used to create models that can help fintech companies to implement more effective compliance programs.

By helping fintech companies to identify and mitigate risks more effectively, AI can help to protect consumers and investors from fraud and other financial crimes. It can also free up fintech companies to focus on other strategic initiatives by automating many of the tasks involved in compliance.

7. Streamlined operations

In 2024, AI automation will go beyond regulatory compliance, extending to various back-office tasks such as loan processing, Know Your Customer (KYC) checks, and more. The ability to analyze and process vast amounts of data will make AI a valuable asset for improving efficiency and reducing operating costs. These cost savings will further enhance the competitive edge of fintech companies.

In the upcoming year, we will witness AI being used to automate a wider range of tasks, including more complex ones. For instance, AI could be used to develop models that predict customer churn and recommend interventions to prevent it. It could also be used to develop models that can optimize pricing and marketing strategies.

AI-powered back-office automation is already freeing up fintech companies to focus on developing new products and services and further enhancing the customer experience.

8. Customer authentication

Account security is of paramount concern in fintech, and AI will play a vital role in ensuring it in 2024. AI-powered biometric authentication methods such as facial recognition and voice recognition could help to prevent identity theft and fraud. Additionally, AI could analyze unique behavioral patterns, such as typing style and mouse movements, for accurate user identification. Significant differences in these patterns could trigger a request for user identity verification.

This multi-layered approach to customer authentication will provide a robust defense against potential security breaches. It will make it difficult for attackers to gain unauthorized access to accounts, even if they have one factor of authentication.

AI-powered customer authentication will not only be more secure but also more convenient for users. For example, facial recognition and voice recognition can be used to authenticate users without them having to enter any passwords or PINs. This can make the authentication process faster and easier for customers, especially on mobile devices.

Conclusions

The integration of AI in fintech is an ongoing process, offering numerous opportunities for innovation and improvement in the financial services industry. Fintech companies that leverage AI are well-positioned to provide more efficient, secure, and personalized financial services to their customers. With AI’s potential to revolutionize the fintech industry, financial services will become more accessible, and tailored to individual needs. What’s more, AI-based solutions are also trending in more traditional banking. In the years to come, AI will solidify its role as a transformative force in fintech and banking, making it an exciting and rapidly evolving field to watch.