Last updated: September 30, 2024

Step-by-step guide to custom fintech software development in 2024

Welcome to our fintech software development guide. Think of it as your trusty map in the bustling world of financial app development. We’re about to embark on a thrilling journey, exploring every nook and cranny of creating a fintech product. From sparking that initial idea to navigating the complex web of tech, security, and regulations, we’ve got you covered.

This guide is packed with insights, tips, and a dash of wisdom, all served up in an easy-to-digest style. Whether you’re just starting your first fintech company or already running a successful firm in the fintech arena, these pages are designed to provoke thought, guide your steps, and inspire your next big move.

So, buckle up! We’re diving into a world where finance meets technology, challenges spark innovation, and every step forward could revolutionize how the world handles money. Also, if you’d rather outsource fintech development to someone else, you should check our financial software development page.

Here are our other guides – even more knowledge awaits!

Key Points

- Fintech combines finance with technology, transforming financial services with innovations like mobile banking, cryptocurrency, and blockchain.

- Successful fintech products must solve real market needs, stand out from competitors, and comply with regulations.

- Development methodologies such as Agile or Waterfall help streamline fintech app creation, while the right tech stack ensures security, scalability, and performance.

- Regulatory compliance is essential to protect customer data and gain trust in fintech.

- Data security and cybersecurity are critical for safeguarding financial information.

- User experience (UX) and a well-designed interface are key to fintech success, ensuring ease of use across devices.

- Continuous improvement, risk management, and staying updated on industry trends are vital for long-term success.

1. Introduction to the fintech industry

To start things off, let’s explore the vibrant fintech market, its history, and the movers and shakers shaping its future. Get ready for a whirlwind tour of this dynamic industry.

A brief introduction to the fintech sector

Fintech – it’s where finance shakes hands with technology. It’s booming, transforming how we handle money, from banking to investing. Think mobile banking, online payments, and even cryptocurrency. It’s all about making financial services faster, easier, and often cheaper. And the market? It’s sizzling hot, growing rapidly as tech advances and consumer habits shift. The speed of its expansion is simply unprecedented.

Historical perspective and evolution of the fintech market

Rewind a bit, and fintech might seem like a new kid on the block. But it’s not. It’s been around, evolving quietly. It started with credit cards in the 1950s, then ATMs, electronic trading floors, online banking, and now, blockchain and AI. Each step, a game-changer. It’s a journey from physical to digital, from waiting in line to instant clicks. And recently, fintech’s quiet evolution turned into a rapid digital revolution.

Key players and emerging fintech market trends

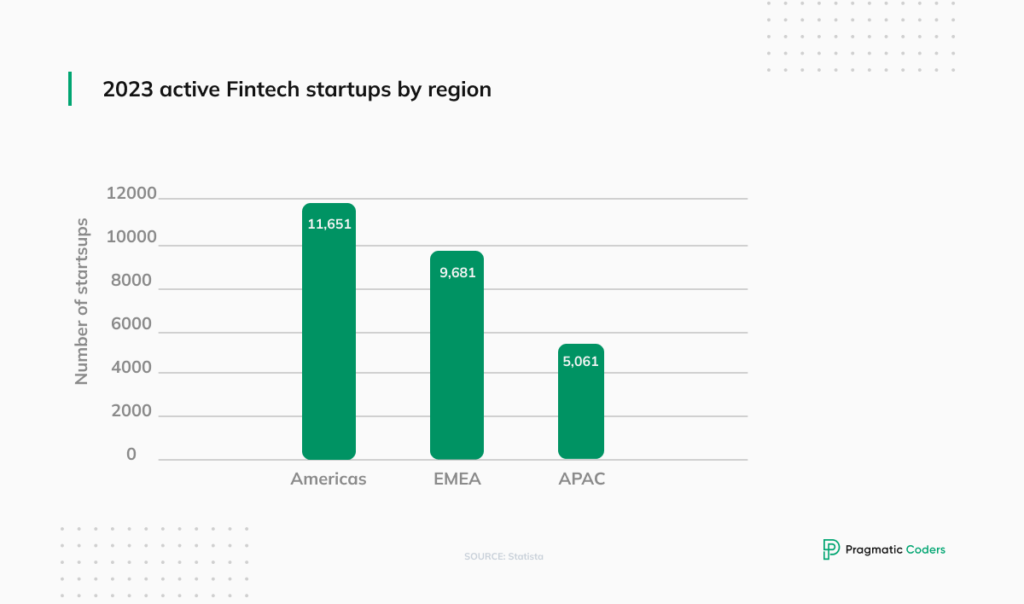

Who’s driving this fintech revolution? A mix of startups shaking up the status quo and big finance getting tech-savvy. You’ve definitely heard of Revolut, Stripe, Coinbase, or PayPal (yes, that too) before. What you probably didn’t hear about is the number of fintech startups – it’s ~26,400. And trends? Oh, they’re exciting. We’re talking about AI making financial advice smarter, blockchain for security, and even neobanks redefining banking. It’s a landscape that’s constantly shifting, with new ideas popping up all the time.

2. Idea validation in fintech development

Now, let’s tackle market needs, competition, and the ever-important regulatory landscape.

Identify market needs in 2024

Got a fintech idea? Great, but does it solve a real problem? That’s the first puzzle piece. Understand what people or businesses struggle with in finance. Maybe it’s tedious loan processes or clunky payment systems. Your idea should hit the nail on the head, solving a genuine need. However, solving a real problem isn’t enough, to be honest. To maximize your chance for success, you’ll have to pick the right problem to solve.

Do a competitive analysis of existing fintech apps

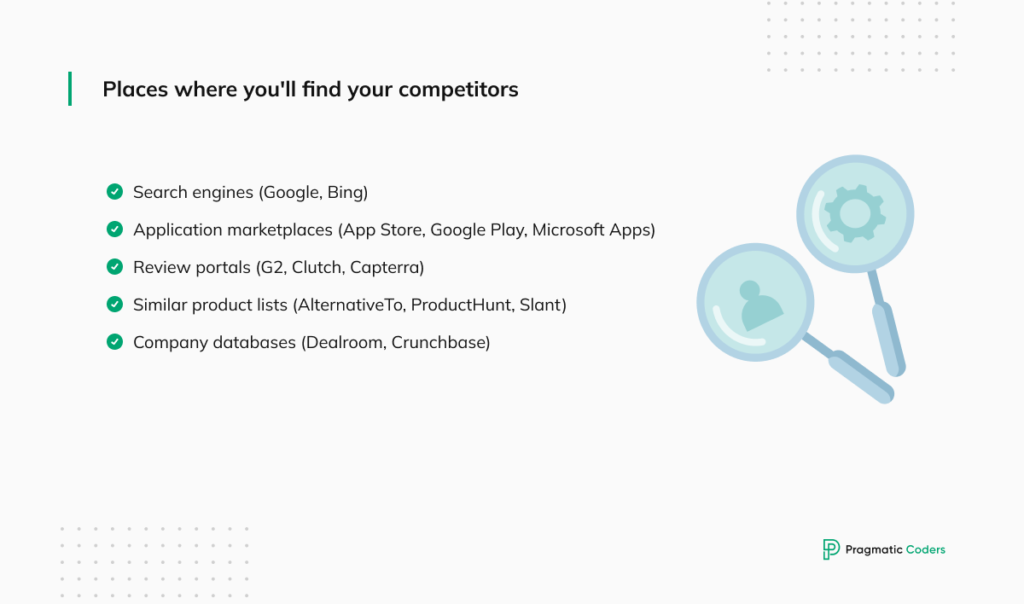

Next, who else is playing in your sandbox? It’s a crowded market, so knowing your competition is crucial. What are they doing well? Where do they stumble? This isn’t just about knowing your enemies; it’s about learning from them. Your product needs that edge – something that makes it stand out. A successful competitive analysis consists of three steps:

- Identifying your competitors

- Gathering information about them

- Analyzing your position

Remember about the regulatory considerations and compliance

Here’s the tricky part: regulations. Fintech isn’t the Wild West. There are rules, lots of them, about how money moves, how data is handled, and so on. You need to be on top of this. Being compliant isn’t just a legal need; it’s a trust factor for your customers. Slip up, and it’s not just fines; it’s your reputation on the line. Much more on this in chapter 6.

Define a clear Unique Value Proposition for your fintech product

Alright, so you’ve eyed the market, scoped out the competition, and navigated the regulatory maze. Now, what’s your hook? Every successful fintech application has a clear value proposition – a compelling reason why customers should pick you over others.

Think of it as your product’s elevator pitch. It should be crisp, clear, and punchy. What unique benefit does your product offer? Maybe it’s unrivaled speed, unbeatable security, or an innovative feature nobody else has thought of. This isn’t just about being different; it’s about being meaningfully different in a way that resonates with your target audience.

Remember, in fintech, trust and reliability are king. Your unique value proposition should not only highlight the innovation but also underline the security and reliability of your service. Get this right, and you’ll have a beacon that guides everything from your marketing to product development. It’s your “why” that will attract customers, investors, and even potential partners.

3. Ideation and concept development of your fintech application

From a spark of imagination to a detailed concept – this chapter is all about bringing your fintech solution to life. We’ll guide you through refining your idea, crafting a comprehensive concept document, outlining core functionalities, and understanding your future users. Let’s start shaping your idea into reality.

Our AI-based and completely free-to-use Market Research Tool will be of great help to you at this stage!

Brainstorm and create a fintech app idea

So, you’ve got a fintech project idea. Cool. But ideas are like seeds; they need nurturing. Start brainstorming, double-check fintech trends. Throw ideas on the wall, see what sticks. This isn’t about finding the perfect financial technology idea right away. It’s about exploring possibilities, mixing and matching, and then refining. Think of it as sculpting your idea into something real and viable. One great way to refine your ideas is to have a Product Discovery Workshop.

Develop a detailed Product Vision Statement for your future fintech solution

Now, get down to the nitty-gritty. Draft a product concept document. This is your blueprint. It should detail what your product is, what it does, and why it matters. Lay out your vision, the problem it solves, and how it stands out in the fintech jungle. This document will become your roadmap and your pitch – the thing you’ll use to convince others that your idea isn’t just good; it’s gold.

Define the core functionalities and features of your fintech product

Features and functionalities – they’re the heart of your product. What key features will your product have? Think about user needs and your value proposition. Is it an app that makes investing a breeze? A tool that simplifies payments? Make sure each feature aligns with your product’s core purpose. Don’t clutter it with bells and whistles. Keep it sleek, keep it functional. Prepare a solid product development strategy.

Create user personas to represent your target audience

Who’s going to use your product? Create user personas – semi-fictional characters that represent your ideal users. This helps you understand their needs, behaviors, and pain points. It makes your idea more than just a concept; it gives it a face and a story. This step is crucial for user-centric design, ensuring your product truly resonates with its intended audience.

4. Fintech software development methodology – step-by-step guide

Building a fintech app in 2024 is like crafting a masterpiece. It requires the right approach and process. Here, we’ll discuss choosing the best development methodology for your project, setting up a clear process, defining milestones, and effectively managing your resources. Let’s build something amazing.

Choose an appropriate software/product development methodology

Development methodology – it’s not one size fits all. Agile, Waterfall – there are several paths. Agile is flexible, adapts to changes fast. Waterfall is structured, one step at a time. Pick one that aligns with your project’s nature and your team’s working style. Remember, the right methodology is key to turning your concept into a reality efficiently.

In a niche as dynamic as fintech, the more outcome-focused you are, the better. Why? Because your potential clients aren’t interested in how much code you’ve produced; they want a good product. They want it right now, and if you don’t deliver, they’ll look for something else. Yes, it’s a harsh reality, but you have to accept it.

Establish a clear development process and timeline

Set up your development process. Define phases, from design to testing to launch. Establish a timeline – it’s your project’s heartbeat. This timeline should be realistic, giving enough room for development, iterations, and unforeseen hiccups. It’s not just about speed; it’s about rhythm and flow, ensuring everything moves smoothly towards the finish line. Do things right, and you’ll reduce development costs.

Define milestones and deliverables for your fintech project

Break down your project into milestones and deliverables. These are your checkpoints, moments to assess progress, tweak things, and celebrate small victories. They help keep the team focused and motivated, and they’re vital for tracking the project’s health. Each milestone is a step closer to your goal.

Manage your development team and other resources effectively

Resource management – it’s a juggling act. You’ve got people, time, and money. Balance them wisely. Ensure your team has the right skills and that they’re not overburdened. Keep an eye on the budget; fintech development isn’t a place for financial surprises. Effective resource management can mean the difference between a smooth ride and a rocky road. Want advice? Hire a good product manager who will help you avoid development traps. Fixed scope and fixed budget are your product’s worst enemies.

5. Fintech software technology stack selection

Choosing the right tech stack is crucial in fintech. In this chapter, we’ll navigate the world of technologies essential for your product. From scalability and security considerations to selecting the right programming languages and cloud solutions, we’re laying the technical foundation of your fintech software product.

Identify the core technologies required for your financial software

Time to talk tech. What’s under the hood of your finance app? Identifying the right technology stack is crucial. It’s like choosing the right ingredients for a recipe. You need a mix that’s robust, efficient, and fits the dish you’re cooking – in this case, your fintech product. Whether it’s handling transactions, data analysis, or user interface, each technology plays a vital role.

Consider factors such as scalability, security, and performance

These are your non-negotiables: scalability, security, performance. Fintech apps need to handle growth, protect sensitive financial data, and perform flawlessly. Nobody likes a slow app, especially when money’s involved. Your tech stack should support rapid scaling, ward off security threats, and ensure smooth, fast transactions.

Select appropriate programming languages, frameworks, and tools

Now, the building blocks: programming languages, frameworks, tools. Python for its versatility? Java for its robustness? Maybe blockchain for security? The choices you make here set the foundation. It’s about picking tools that not only work today but can adapt to tomorrow’s tech evolution. And remember, it’s not just about what’s trendy; it’s about what works for your specific product.

Evaluate Cloud-based solutions for infrastructure and data storage

Cloud or not to cloud? In fintech, cloud-based solutions offer flexibility, scalability, and cost-efficiency. They can simplify infrastructure, data storage, and even security challenges. But it’s not a one-size-fits-all. Weigh the pros and cons. Look at data sovereignty, compliance, and integration capabilities. The cloud can be a powerful ally if used wisely. Or it can just be someone else’s computer you’re paying to use.

6. Ensuring the regulatory compliance of your fintech product

Fintech and regulations go hand in hand. This chapter focuses on understanding the regulatory landscape, implementing compliance measures, adhering to financial guidelines, and obtaining necessary licenses. It’s about ensuring your product plays by the rules while innovating.

Understand the regulatory landscape for fintech solutions in relevant jurisdictions

The fintech world is a labyrinth of regulations. It varies from one place to another. Understanding this landscape is not just important; it’s essential. You need to know what rules apply to your product, in every market you’re eyeing. It’s complex, but hey, nobody said changing the financial world was easy.

You might be wondering, “What regulations and compliance laws, exactly?”. Well, that depends on the region you plan to operate in (you’ll find the answer in the link).

Implement appropriate compliance measures to protect customer data and privacy

Data is king, but it’s also a huge responsibility. Implement measures to protect customer data and privacy. We’re talking encryption, secure protocols, compliance with data protection laws like GDPR. This isn’t just about avoiding fines; it’s about earning your users’ trust. And in fintech, trust is your most valuable currency.

Adhere to financial service regulations and guidelines

Financial regulations are your guardrails. They’re there for a reason – to protect users, markets, and even your own company. Adherence isn’t optional; it’s foundational. This means keeping up with KYC (Know Your Customer), AML (Anti-Money Laundering) guidelines, and other financial regulations. It’s a balance between innovation and compliance.

Obtain necessary licenses and approvals from regulatory bodies

Last but not least, get your paperwork in order. Depending on your product, you might need licenses or approvals from regulatory bodies. This process can be long and winding, so start early. It’s part of legitimizing your product, and it can often be the gatekeeper to launching and operating your fintech solution. The primary fintech regulatory bodies in the US include:

- The Securities and Exchange Commission (SEC): The SEC regulates the securities industry, including investment advisors, mutual funds, securities exchanges, brokers, and dealers.

- The Consumer Financial Protection Bureau (CFPB): The CFPB protects consumers from unfair, deceptive, or abusive practices in the financial services industry.

- The Commodity Futures Trading Commission (CFTC): The CFTC oversees the US commodities markets and businesses including trading platforms and brokerage houses.

- The Financial Industry Regulatory Authority (FINRA): FINRA is an independent, nonprofit agency that writes and enforces regulations that govern licensed brokers and broker-dealer businesses in the United States.

- The Office of the Comptroller of the Currency (OCC): The OCC regulates the operations of national banks, federal savings banks, and foreign bank branches that hold federal banking licenses and FinTech firms that take deposits and pay employees or engage in lending activities.

Of course, other countries (and international bodies like the EU) have their own regulatory bodies. So, there are many more important acronyms than the above-mentioned five. Especially if you want your fintech solution to be international. Buckle up; it’s a regulatory rollercoaster out there!

7. Data security and cybersecurity in fintech app development

Security is paramount in fintech. We’ll delve into robust security measures, data encryption, access controls, and the importance of regular security audits and staying informed about cybersecurity threats. It’s about building a fortress around your finance project.

Employ robust security measures to protect sensitive financial data

When it comes to fintech, security isn’t just a feature; it’s the foundation. You’re dealing with people’s money and data – it’s as sensitive as it gets. So, wrap your product in a security blanket. This means using top-notch security measures, layers of protection that guard against breaches. It’s not paranoia; it’s essential.

Implement data encryption and access controls

Encryption is your secret code. It turns sensitive data into a jumble of characters, unreadable to anyone without the key. Pair it with strict access controls. Who can see what? Keep it on a need-to-know basis. This combo of encryption and access controls is like a double lock on your data’s front door.

Conduct regular security audits and penetration testing

Regularly check under the hood. Conduct security audits and penetration testing. It’s like a drill, testing your defenses against possible attacks. You might find weak spots, and that’s good – better you than a hacker. Patch up, strengthen, and stay vigilant. In cybersecurity, the only constant is change.

Stay up-to-date on the latest cybersecurity threats and vulnerabilities

Finally, keep your eyes open. Cyber threats evolve fast. Stay informed about the latest tactics and vulnerabilities. It’s an ongoing battle, but staying ahead of the curve is your best defense. In fintech, being outdated isn’t quaint; it’s dangerous.

8. User interface and user experience (UI/UX) design

A great financial software is not just about what’s under the hood. It’s also how it looks and feels. This chapter is all about crafting a user-friendly and intuitive interface, designing inclusively, testing with real users, and optimizing your UI/UX across devices. Let’s make your product a joy to use.

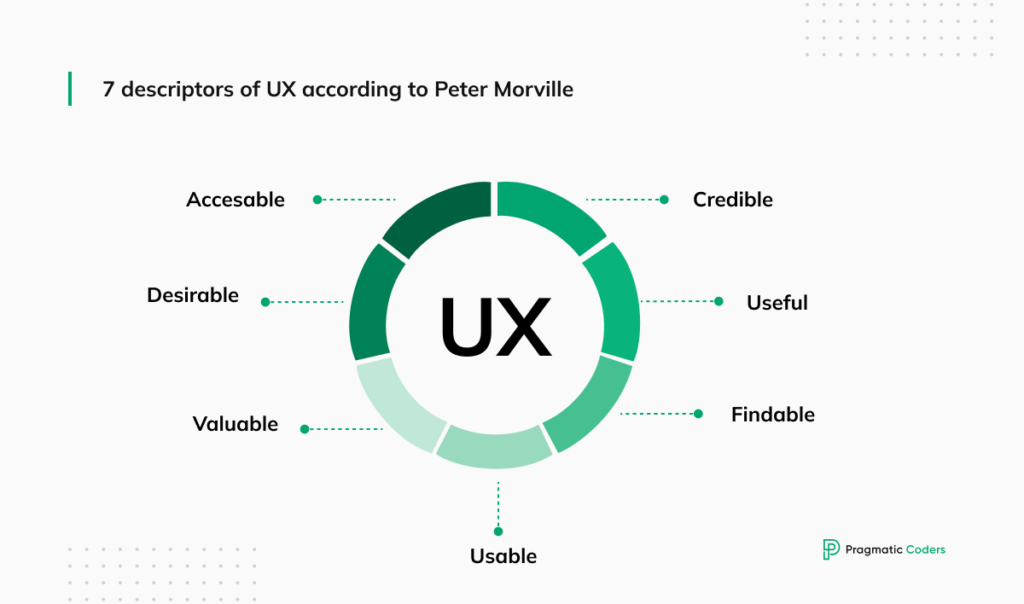

Create a user-friendly and intuitive interface for your fintech product

Moving to the front-end: UI/UX. This is where your product meets the user. Make it count. Your interface should be clean, intuitive, and, frankly, a joy to use. Fintech can be complex, but your app shouldn’t be. It should guide the user smoothly, making complex financial tasks feel simple.

Design for accessibility and inclusivity

Design for everyone. Accessibility isn’t a ‘nice-to-have’; it’s a must. Ensure your app is usable for people with different abilities and from various backgrounds. Inclusivity in design broadens your product’s appeal and reinforces its usability. It’s about creating an experience that welcomes all. Effective UX research will be crucial here.

Conduct user testing to gather feedback and iterate on designs

Test, then test again. Get real people to poke around your app. Gather feedback – the good, the bad, the confusing. Use this goldmine of insights to iterate and refine your designs. User testing is a reality check, ensuring your product not only looks good but works well in the real world. Never underestimate the value of an optimized user experience.

Optimize the UI/UX for different devices and platforms

Lastly, go multi-platform. People use a myriad of devices today – phones, tablets, laptops. Ensure your modern finance project shines on all of them. An awesome experience on one device but a clunky one on another? That’s a no-go. Seamless, responsive design across platforms is the key.

9. Testing and quality assurance

Testing is where your financial software gets refined. We’ll cover implementing a comprehensive testing strategy, various types of testing, using automated tools, and the importance of prompt bug fixing. Quality assurance is the key to a product that’s not only functional but also reliable.

Implement a comprehensive testing strategy to ensure product quality

Software Testing – it’s not just a phase; it’s a critical ongoing process. Your fintech app can’t just be good; it needs to be bulletproof. Implement a comprehensive testing strategy that covers all the bases. This means looking at your product under a microscope, testing every single feature, and making sure everything clicks just right.

Conduct Unit Testing, Integration Testing, and User Acceptance Testing

Dive into the details with unit testing. Each module, each piece of code – give it the spotlight. Then comes integration testing. How well do these pieces play together? Finally, don’t forget user acceptance testing. It’s the real-world test drive. Do users get what they need from your app? It’s their verdict that ultimately counts.

Utilize automated testing tools and frameworks

Manual testing is great, but it’s a big world out there. Bring in the bots – automated testing tools and frameworks. They work round the clock, catching things a human eye might miss. They speed up the process, making your testing strategy more efficient and thorough. In fintech, a small bug can be a big deal. Automation helps keep those bugs at bay.

Fix bugs and defects promptly to maintain product stability

When bugs pop up, and they will, squash them fast. Time is of the essence. Each bug, each defect is a chink in your product’s armor. Quick fixes maintain product stability and user trust. In fintech, stability isn’t just nice; it’s non-negotiable. When your clients’ money is at stake, compromises are not an option.

10. Fintech software deployment and maintenance

Launching and maintaining your fintech business is a crucial phase. In this chapter, we discuss choosing the right deployment strategy, monitoring performance, implementing updates, and providing ongoing support. It’s about ensuring a smooth journey from launch to long-term success.

However, before we start, there’s one extremely important topic I want to cover…

Continuous product discovery: always learning, always improving

Mainly, I want to emphasize the importance of continuous product discovery. This ongoing process involves actively seeking user feedback, gathering market data, and analyzing usage patterns to refine your product and ensure it meets evolving user needs. Here are some ways to achieve this:

- User interviews and surveys: Regularly gather feedback from your target audience to understand their pain points, desires, and how they interact with your product.

- A/B testing: Experiment with different features and functionalities to see what resonates best with users.

- Data analysis: Mine usage data to identify areas for improvement and opportunities for new features.

By continuously learning and adapting, you can ensure your fintech product stays relevant and delivers exceptional value to your users. Now, back to deployment and maintenance.

Choose an appropriate deployment strategy for your financial software

Deployment – it’s showtime. Choose a strategy that aligns with your product’s needs and your users’ expectations. It could be a phased rollout, a big bang launch, or something in between. The goal is a smooth transition from development to real-world use. Think of it as a soft landing for your product. The best time to launch your product? Yesterday.

Monitor performance and usage patterns to identify potential issues

Once live, keep an eye on your product. Monitor its performance and how users interact with it. This isn’t just about watching for problems; it’s about understanding usage patterns. It’s your window into what works and what could be better. In fintech, the learning never stops. Always be on top of the UX and optimization game.

Implement regular updates and bug fixes

Stay on your toes with regular updates and bug fixes. The fintech landscape changes fast, and your product needs to keep pace. Updates keep it fresh and relevant. And when bugs slip through the cracks, patch them up quickly. It’s about keeping your product at its best, always.

Maintain ongoing support for users

Last but not least, support your users. They might have questions, encounter issues, or need help navigating your product. Ongoing support is key to user satisfaction. Regular updates aid in client retention and improve security. It’s not just about fixing problems; it’s about building a relationship with your users. In fintech, a happy user is your best advocate.

11. Marketing and launch strategy

Ready to make some noise? This chapter is all about marketing your fintech product and creating a buzz around your launch. We’ll discuss developing a comprehensive marketing plan, utilizing various channels, creating engaging materials, and generating excitement. Let’s get your product the attention it deserves.

Develop a comprehensive marketing plan to reach your target audience

Alright, you’ve built it, but will they come? Time for some marketing magic. Craft a comprehensive plan that speaks directly to your target audience. Who are they? Where do they hang out? What do they care about? Your marketing plan should be a map to reach them, engage them, and get them excited.

Utilize various marketing channels

Dive into the marketing toolbox. Social media, content marketing, paid ads – each has its role. Social media for buzz, content marketing for depth and trust, paid ads for that extra push. Mix and match them to create a blend that spreads your message far and wide. Remember, it’s not just about shouting louder; it’s about speaking smarter.

Create engaging marketing materials that highlight the Unique Value Proposition of your product

Your marketing materials are your ambassadors. Make them pop. They should scream (politely, of course) the unique value of your fintech product. What problem does it solve? Why is it better? Why should anyone care? Answer these questions in a way that’s not just informative but also engaging and memorable.

Generate buzz and excitement around your product launch

And now, for the drumroll – your product launch. This is where you turn up the volume. Start the hype train, generate buzz, and get people talking. Use teasers, sneak peeks, early access offers. Make your launch an event people don’t want to miss. It’s your grand entrance; make it count. Also, this is not a magic show; there’s science behind building up mass hype.

12. Business development and partnerships

Building bridges can take your fintech product further. We’ll explore establishing partnerships, seeking strategic alliances, networking at industry events, and leveraging these relationships for market and resource access. It’s time to expand your reach through collaborative growth.

Establish partnerships with complementary businesses to expand your reach

No fintech is an island. Look around for potential partners – businesses that complement yours. Maybe it’s a bank, a tech company, or another fintech. Partnerships can open doors, offering new channels and audiences. They can be a force multiplier for your business, adding value and reach.

Explore opportunities for strategic alliances and collaborations

Get strategic with alliances and collaborations. These relationships should be more than just handshakes; they should bring something tangible to the table. Maybe it’s a technology exchange, co-branding, or a joint venture. The goal is to create win-win scenarios that propel your business forward. An example? Apple Pay.

Attend industry events and conferences to network with potential partners

Hit the road. Industry events, conferences – they’re not just for handing out business cards. They’re a goldmine for networking. Rub shoulders with potential partners, investors, even competitors. The fintech world thrives on connections and relationships. Be present, be engaged, be ready to talk shop. Also, maintain those relationships long-term.

Leverage partnerships to gain access to new markets and resources

Finally, use your partnerships as a ladder to new markets and resources. A good partnership can help you navigate unfamiliar territories, provide local insights, and even share resources. It’s about leveraging each other’s strengths to achieve more than you could alone.

13. Risk management and mitigation

In the world of fintech, risks are inevitable, but disaster is not. This chapter focuses on identifying potential risks, implementing mitigation strategies, monitoring changes, and establishing contingency plans. It’s about navigating through uncertainties with confidence.

Identify and assess potential risks associated with your Fintech product

Risk – it’s like the weather; always there, always changing. In fintech, you’ve got to be a bit of a weatherman. Identify and assess the risks tied to your product. Is it technical glitches, cybersecurity threats, or regulatory changes? Understand these risks inside out. It’s not about being paranoid; it’s about being prepared. Most risks you’ll face will depend on the nature of your product, but there are six that are as certain as taxes:

- Cybersecurity Threats: Fintechs are loaded with precious financial data, making them juicy targets for cyber villains. What you’re facing here are data breaches, ransomware attacks, and a whole host of cyber nasties. The stakes? Huge. A breach can torpedo your company’s rep, hurt your pocket, and shake customer trust to its core.

- Regulatory Compliance: Picture the fintech landscape as a game where the rules keep changing. Staying on top of the latest regulations is like navigating a maze that’s always reshaping. Slip up, and you’re hit with fines, penalties, or worse. Keeping up with compliance isn’t just good practice; it’s survival.

- Technology Failures: Tech is the lifeblood any fintech solution. But what happens when the tech goes haywire? You get service disruptions, data going poof, and customers pulling their hair out in frustration. In a world where downtime is a dirty word, you must ensure your tech is not just cutting-edge but also rock-solid reliable.

- Fraud: Here’s a harsh truth – fintech companies are like magnets for fraudsters. Identity theft, payment fraud, account takeovers – these are the monsters under the bed. They’re not just scary because of the financial hit; they can smear your company’s name and make customers lose sleep over trust issues. And so, deploying the latest security measures to prevent fraud is a must.

- Competition: The fintech arena is like a high-speed race, with new players zooming in constantly. Standing out in this crowded field means not just being different, but being distinctly better. It’s a dog-eat-dog world where only the most innovative and user-focused survive.

- User Retention and Customer Experience: Now, getting customers is one thing, but keeping them? That’s where the real game is. You must roll out the red carpet for your users, offering seamless, delightful experiences. Happy customers don’t just stick around; they become cheerleaders for your brand.

Implement risk mitigation strategies to minimize potential losses

Once you spot the risks, don’t just stare at them. Act. Implement strategies to minimize potential losses. This could mean stronger security protocols, better compliance checks, or more robust technology infrastructure. Think of these strategies as your fintech product’s armor against the slings and arrows of outrageous fortune.

Monitor risk factors and adapt strategies as needed

Keep your eyes on the horizon. Risks evolve, and so should your strategies. Regularly monitor the risk landscape. Are new threats emerging? Are old ones morphing? Adapt your strategies accordingly. It’s a game of chess. Your goal is to stay a number of steps ahead of potential issues.

Establish clear contingency plans for handling unexpected events

And then, have a Plan B. And C, maybe. Establish clear contingency plans for those unexpected curveballs. Tech fails, market crashes, regulatory surprises – know what you’ll do if they happen. These plans are your safety net, ensuring that even when things go south, you can bounce back.

14. Future trends and innovations in fintech

Lastly, let’s look ahead. This chapter is all about staying ahead of the curve by exploring emerging technologies, keeping up with industry trends, and continuously adapting and innovating. The future of fintech is bright, and you can be at the forefront of it.

Explore emerging technologies that could impact the future of fintech

The fintech world is a fast-moving train. Don’t just ride; look ahead. What new technologies are emerging? Blockchain, AI, quantum computing – these aren’t just buzzwords; they’re the future. Explore how they could impact and transform fintech. Stay curious, stay open to possibilities.

Stay up-to-date on the latest industry trends and developments

Keep your finger on the pulse. The fintech landscape shifts constantly. New trends, new regulations, new consumer behaviors. Stay informed. Read, network, attend webinars, workshops. The more you know about the industry’s flow, the better you can navigate its waves.

Adapt your product and strategy to remain competitive in the evolving fintech landscape

Change is the only constant. Be ready to pivot. Your product and strategy might need to evolve to stay competitive. This could mean adding new features, exploring new markets, or even rethinking your business model. Flexibility and adaptability are your allies in the fintech race.

Embrace innovation and continuous improvement to maintain a leading edge

Last but not least, embrace innovation. Don’t just settle for the status quo. Push boundaries, experiment, innovate. And always aim for continuous improvement. It’s not just about being better than your competitors; it’s about being better than you were yesterday. Stay hungry, stay foolish, as they say.

Conclusions

So, we’ve been on quite the journey, haven’t we? From the bustling crossroads of the fintech industry to the intricate art of launching and nurturing a fintech product. Let’s wrap it up with some key takeaways.

Fintech is more than just a sector; it’s a revolution, blending finance and technology in ways that were once just a dream. It’s a field ripe with opportunities but also filled with challenges. To navigate it, you need clarity, creativity, and a dash of courage.

We’ve explored the importance of understanding your market, refining your idea, and building a product that’s not just good, but great. Remember, your technology stack and security measures are the backbone of your product. They need to be robust and reliable.

Your marketing and partnerships are your megaphones and allies in this noisy world. They amplify your message and extend your reach. But never forget the importance of risk management. It’s your radar and shield, helping you foresee and fend off potential troubles.

And finally, stay agile, stay informed. The fintech landscape is ever-evolving, so your product and strategies should be fluid, adaptable to change and innovation.

This handbook isn’t just a guide; it’s a companion on your fintech journey. Whether you’re a seasoned entrepreneur or a budding innovator, these insights are here to help you chart a course through the exciting, challenging, and potentially rewarding world of fintech.

Remember, every great fintech journey starts with a single step. And in fintech, that step could lead to a leap in financial innovation. So, go ahead, take that step. The fintech future is waiting.

Contents

Would you like to talk about your project?

We are here to help! We take care of the entire product development process. Your success will make us successful.