Mobile banking application development company

We create mobile apps for Europe's digital banks. Build a cutting-edge mobile banking app with experienced fintech app developers.

Mobile banking app development from concept to deployment

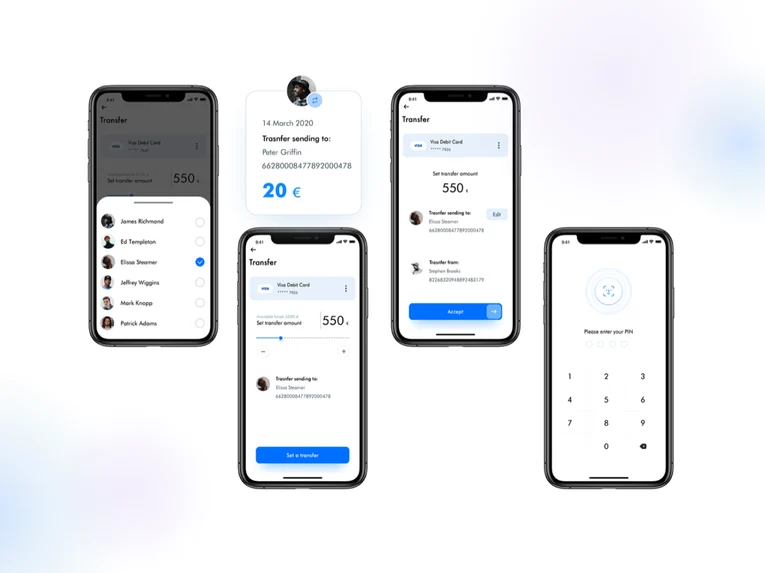

Bank account management

Simplify account management for your customers with our intuitive and user-friendly mobile banking app development services. Allows users to view balances, transfer funds, pay bills, and manage their finances with ease.

E-wallet integrations

Integrate popular e-wallets into your mobile banking app & provide our customers with unparalleled convenience. Facilitate seamless money transfers, bill payments, and online purchases.

Personal finance management

PFM tools are the key differentiator to keep the users within your app. Elevate their financial well-being through budgeting, spending tracking, and goal setting, empowering them to make informed financial decisions.

Card management

Provide your users with complete control over their cards. Enable real-time balance checks, transaction monitoring, card activation, and lost or stolen card reporting.

Our mobile banking application development process

This is how we work

Deliver & Scale

- Product Development

- DevOps Architecture

- Continuous User Feedback & Delivery

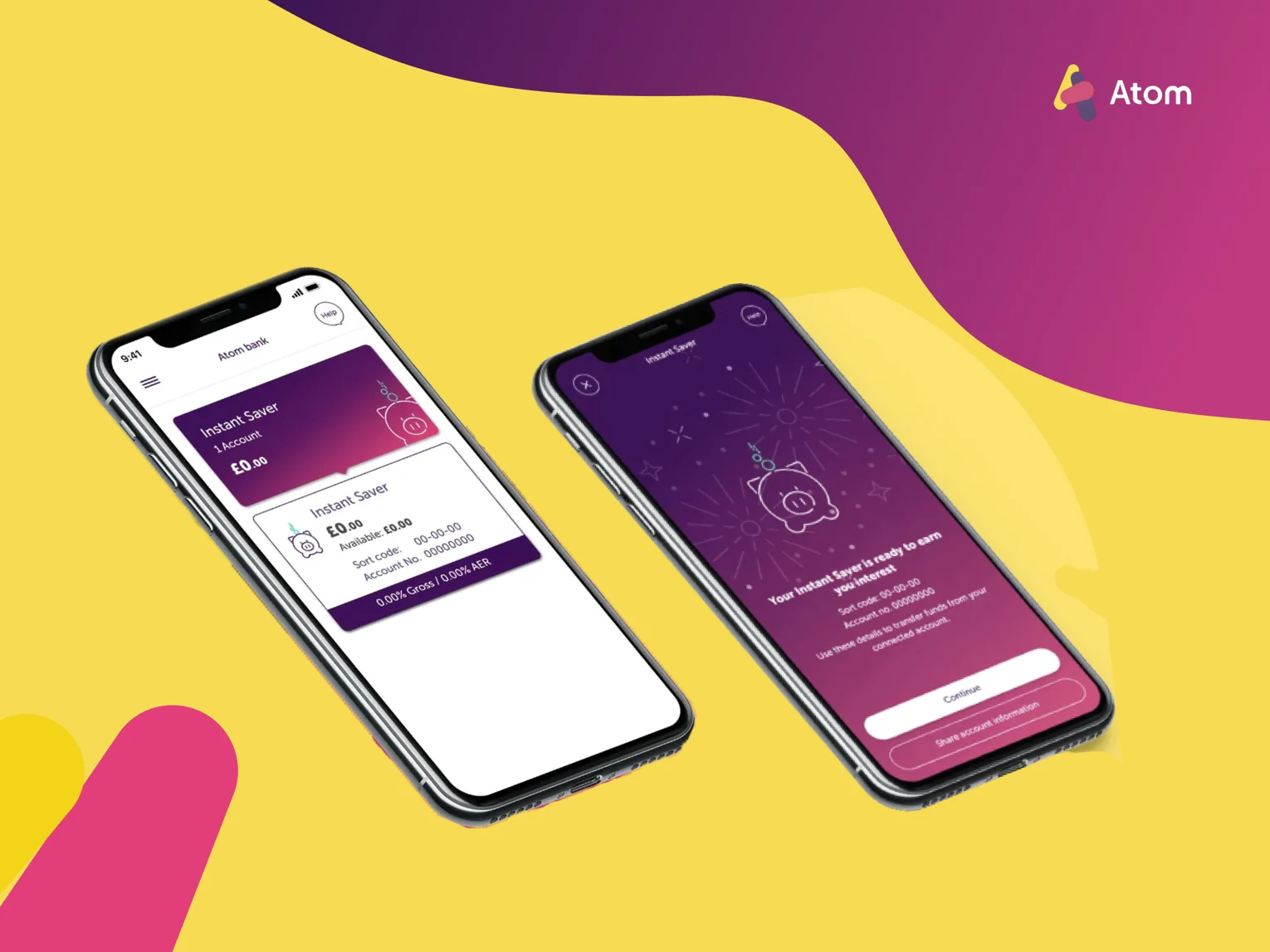

Atom Bank: Establishing an entirely new, remote team for the UK’s first fully digital bank

Atom Bank was looking for a solution that could increase their ability to deliver business changes fast. We've provided experienced, high-quality programmers to complement the existing UK team and add engineering capacity.

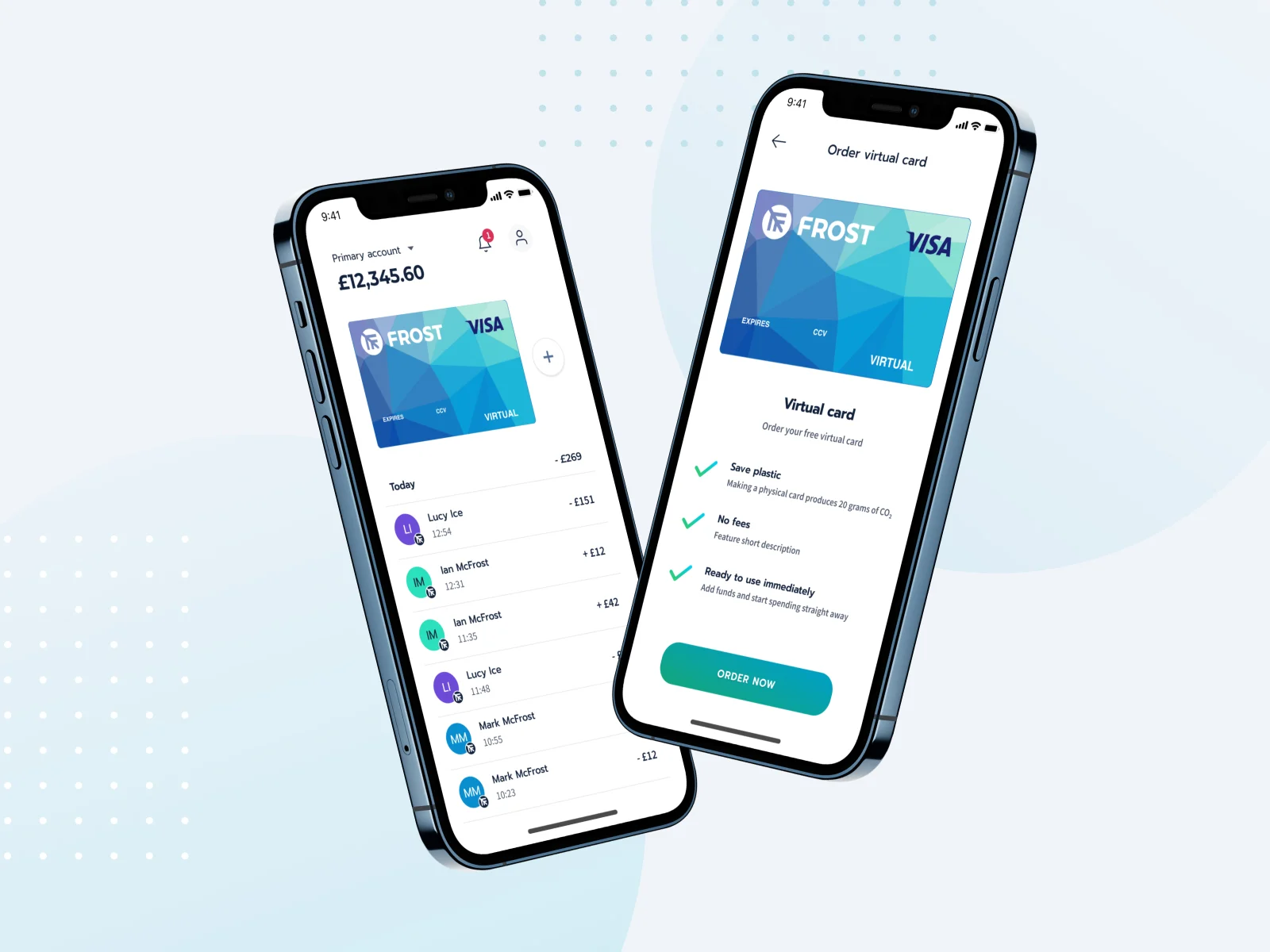

Frost: Providing nearshore software developers for intuitive e-money institution

Meet Frost - the mobile banking app that makes budgeting and financial management a breeze. Get organized and take control of your finances today with Frost!

Challenger Bank: Creating a full product strategy and roadmap for a new cryptocurrency-fiat mobile banking app

We've developed a new crypto-FIAT banking application available for Android and IOS that will compete with legacy banking providers.

KodyPay: Scaling a software development team for one of the best mobile payment startups

KodyPay is a point-of-sale (POS) solution that uses a mobile app-based technology platform to simplify the payment process.

Thanks to Pragmatic Coders, KodyPay was able to improve its development process and add experienced developers to its team.

Why choose our mobile banking app development services?

Alternative investment technology solutions, trading platforms, banking software – we’ve been successfully creating fintech software since 2014.

Intuitive mobile app design

Craft an engaging and user-friendly mobile banking app that delights your customers with its intuitive design.

Our team of experienced UX and UI design specialists will create an interface that is easy to navigate and visually appealing to make your users enjoy a seamless and enjoyable banking experience.

Secure integrations

We'll help you securely integrate your banking product with third-party apps in a way that protects your customers' sensitive financial data.

We employ cutting-edge security protocols and best practices so that your mobile banking app is impenetrable to cyber threats, safeguarding your customers' trust and loyalty.

Fintech-oriented product management

Empower your mobile banking app with our fintech-oriented product managers.

We'll align the app's development with your business goals and ensure that it delivers the features and functionality you need to drive customer loyalty and achieve business success.

Financial app developers

Tap into our pool of highly skilled financial app developers, each with extensive experience in fintech mobile app development.

Our team possesses a deep understanding of the financial industry and the unique needs of your customers, enabling them to create an innovative and secure apps.

We ensure security and regulatory compliance of your mobile banking app

Technical expertise alone is not enough in such highly regulated sectors as fintech and banking.

We understand the unique challenges and requirements of the financial sector.

That’s why we ensure the mobile banking apps we develop are always secure and compliant with all the fintech regulations and standards.

Mobile banking app development FAQ

Everything you need to know about mobile banking app development before partnering with software developers.

Are your mobile banking software development services for me?

We've cooperated and are collaborating with multiple various banking institutions. We've built mobile banking apps for both startups (Frost) and corporate-level banking institutions (Atom Bank).

No matter the size and structure of your financial institution (central bank, investment bank, commercial bank, private bank, exchange bank, credit union, retail bank, virtual bank, startup), we can build reliable and secure products that meet your business needs.

What sets you apart from other fintech companies?

We're an experienced financial software development company that excels in:

Quality Assurance: At Pragmatic Coders, we integrate testing and quality checking into our development process, reducing costs, minimizing bugs, and ensuring code quality through continuous monitoring.

Modern development with Agile methodology: Unlike traditional methods, our apps undergo multiple releases during development, eliminating the need for post-testing stabilization. We embrace Agile practices like Continuous Delivery, Test-Driven Development, and Scrum for efficient deployment.

Product management focus: Our Product Managers oversee the entire banking app development lifecycle, prioritizing value, speed, and revenue generation, ensuring products meet customer needs and business requirements, and get a competitive edge over your competitors.

Effective Scrum implementation: We adopt Scrum for iterative development, gathering early feedback and optimizing MVP outcomes. Cross-functional teams and self-organization enhance collaboration and productivity for outstanding client results.

What's your experience in UX research and product design for financial apps?

Our expertise extends to conducting in-depth UX research and crafting intuitive interfaces, ensuring a seamless customer experience for mobile users of various banking services.

UX research:

Designs:

How long and how much does it take you to build a mobile banking app MVP?

The cost and time to develop a banking app for mobile devices depend on the specific requirements of the project. In general, building an MVP (minimum viable product) takes us on average 3 months and roughly $90k.

To learn more about our MVP-building process, read this guide:

How long and how much does it take to build an MVP?

Don't hesitate to contact us for tailored time and budget estimates for your mobile application development.

What's your technology stack for mobile banking software solutions?

Our core technologies include React, JavaScript, Node.js, and AWS. We have both Android and iOS fintech app developers on board. If a specific technology isn't in our wheelhouse, we can always bring in the right developer for the job.

What collaboration model do you offer?

Our main collaboration model is a dedicated development team - we put together a team of experienced developers just for you to work on your financial app development.

The dedicated development team model offers cost-effectiveness, faster development, higher quality, improved communication, and greater flexibility.

Apart from that, we offer outsourcing services.

I don't want to develop my mobile banking app yet - what can you offer?

If you're not ready to start the development of your banking app, you might want us to carry out a Product Discovery Workshop for you.

A Product Discovery Workshop is a collaborative session where we - together with you as our client, based on our experience building 80+ digital products - define what needs to be done to make your product successful.

If you want to learn more about the workshops (scope, cost, agenda & more), read this article:

Can I get free consulting?

Yes, we offer a free consultation to discuss your business requirements - just contact us through the form below.

If you want to learn more about the workshops (scope, cost, agenda & more), read this article:

Choose a trusted fintech outsourcing company

Need to outsource fintech developers? We’ve assisted numerous small, medium, and large enterprises in overcoming challenges when establishing successful remote fintech software development teams or entire IT hubs in Poland.

Mobile banking app development services: challenges, opportunities & key features

In the era of digital transformation, the financial sector is undergoing a significant revolution, with mobile banking apps playing a pivotal role in shaping the future of banking operations.

Mobile banking app development services have emerged as a critical component for financial institutions seeking to provide a seamless, secure, and personalized banking experience for their customers.

Challenges and opportunities in mobile banking app development

Despite the transformative potential of mobile banking, there are several challenges that financial institutions and mobile banking app development companies must address:

Security concerns: Ensuring the security of financial transactions and protecting customer data is paramount for gaining user trust and preventing cyberattacks.

Regulatory compliance: Complying with evolving data privacy regulations, such as the General Data Protection Regulation (GDPR), is crucial for safeguarding customer information.

Legacy systems integration: Integrating mobile banking apps with legacy core banking systems can be complex and time-consuming.

Key features of a secure and user-friendly mobile banking app

A secure and user-friendly mobile banking app should encompass several key features, for example:

Biometric authentication: Biometric authentication methods, such as fingerprint or facial recognition, provide an additional layer of security for accessing the app and authorizing transactions.

Personalized financial insights: Data-driven insights and personalized financial recommendations can help users make informed financial decisions.

Push notifications: Real-time push notifications inform users about account activity, transaction alerts, and important updates.

Secure transactions: Multi-factor authentication and data encryption ensure the protection of sensitive financial information during transactions.

Contents

What our fintech clients say about working with us

I'm impressed by how flexible Pragmatic Coders is (...). Culturally, they're a really good fit for us, and the team is very responsive to feedback. Whenever I ask them to do something, they look at it, and they're not scared to push back. I've found it very easy to work with them — we have more of a partnership than a client-supplier relationship.

Pragmatic Coders pay attention to detail and understand the business domain correctly. They led us to a successful launch of our product this year. We’re happy with the effects of their work. Our team is still using the platform and building on top of it.

The entire focus was on the product and the customer, and I loved it. (...) The team was turning up with solutions to problems I didn't know we had.

It’s truly been a partnership. They have an in-depth understanding of our client base and what services we provide, anticipating evolving needs and addressing them by adding new features into our system. Their team also makes sure that there is a shared understanding so that what they deliver meets my organization's and our clients’ expectations.

(...) Pragmatic has highly skilled engineers available immediately but most importantly, passionate people who love what they do and learn new things very quickly. I recommend Pragmatic Coders to anyone who requires expert software development no matter the stage of their business.

They responded to our queries almost immediately, and they were consistently polite and professional in their interactions. If there was something even more impressive than their communication, it was definitely their transparency. We were well informed about every aspect of their work, including what they did, why they did it, and how long it was going to take (...).

Our other fintech software services

Trading Software Development Services & Solutions Company

Learn moreCustom Blockchain Software Development Services

Learn moreCustom Financial Software Development Services Company

Learn moreCustom Mobile Banking Software Development Services Company

Learn moreInsurance Software Development Services & Solutions Company

Learn moreCustom Wealth & Investment Management Software

Learn moreLet's talk

We’ve got answers on anything connected with software development.

Message us

Feel free to reach out using the form below, and we’ll get back to you as soon as possible.

Schedule a meeting

You can also schedule an online meeting with Wojciech, our Senior Business Consultant.

founders who contacted us wanted

to work with our team.

Check our fintech-related articles

Newsletter

You are just one click away from receiving our 1-min business newsletter. Get insights on product management, product design, Agile, fintech, digital health, and AI.