Custom banking software solutions

Innovative, secure, and regulation-compliant product development for both banking startups and enterprise companies.

We're experts in building regulation compliant banking software

Security and data privacy

Regulatory compliance

Secure integrations

Support and maintenance

Custom financial software development services

We combine technical expertise with a strong understanding of the banking sector’s unique requirements.

Achieve the digital acceleration in fintech with our comprehensive range of banking solutions.

Core banking systems

Banking CRM

ATM software

Mobile banking

AI integration for banks

Neobank development

Banking software development for front, middle, and back office

As fintech software experts, we offer an extensive range of banking development services, spanning from front office to middle office, and all the way to back office functions. Designed to support banking operations at every level.

Front office software development

- Account opening & onboarding

- Bots & virtual assistants

- Authentication & biometrics

Middle office software development

- AML, KYC & identity

- Fraud & risk management

- Legal & compliance

Back office software development

- Cybersecurity

- Finance & treasury

- RPA

- Lending & underwriting

- Infrastructure & APIs

- Core banking & BaaS

Our financial software development process

This is how we work

Deliver & Scale

- Product Development

- DevOps Architecture

- Continuous User Feedback & Delivery

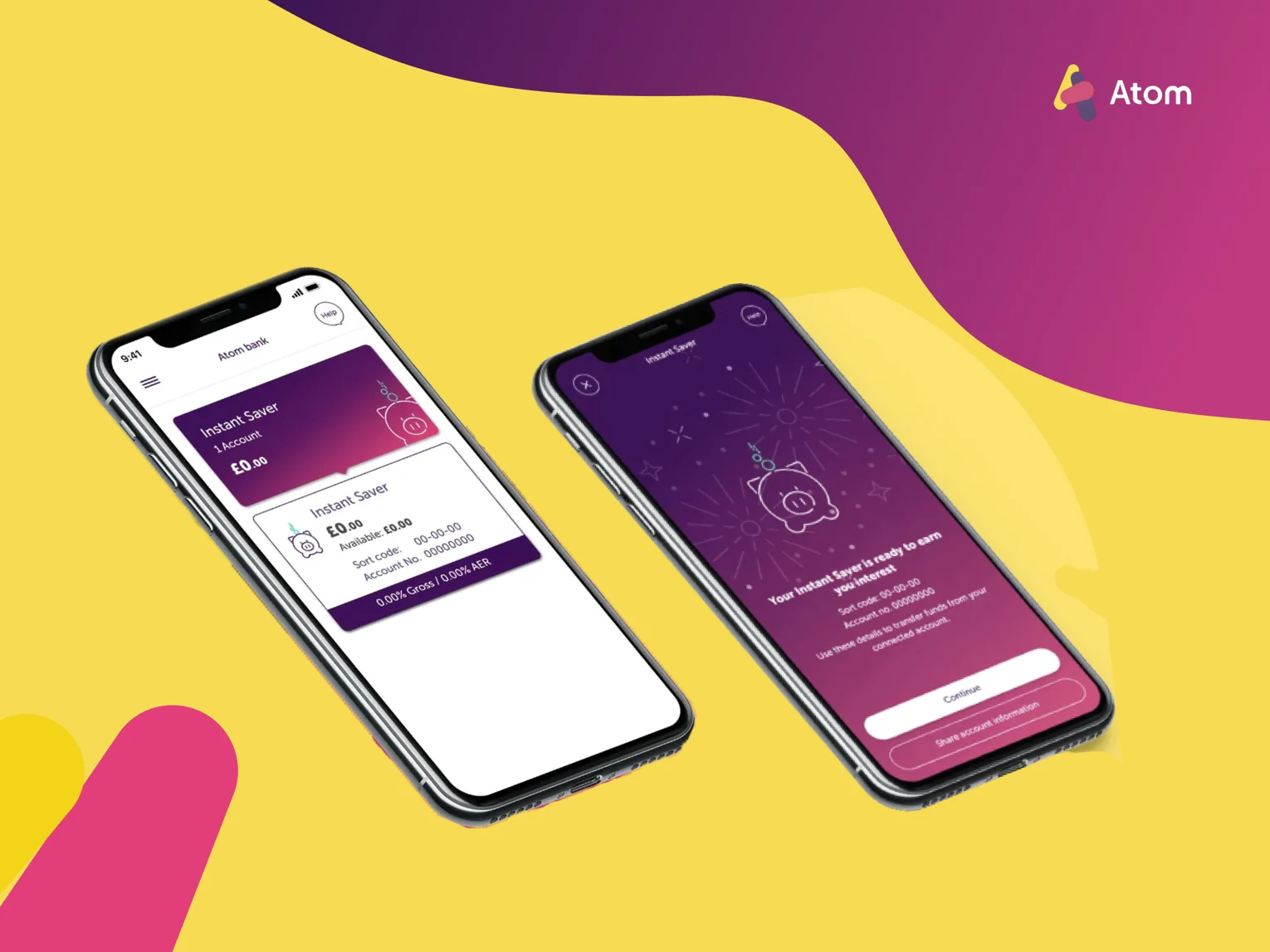

Atom Bank: Establishing an entirely new, remote team for the UK’s first fully digital bank

Atom Bank was looking for a solution that could increase their ability to deliver business changes fast. We've provided experienced, high-quality programmers to complement the existing UK team and add engineering capacity.

Read the case study

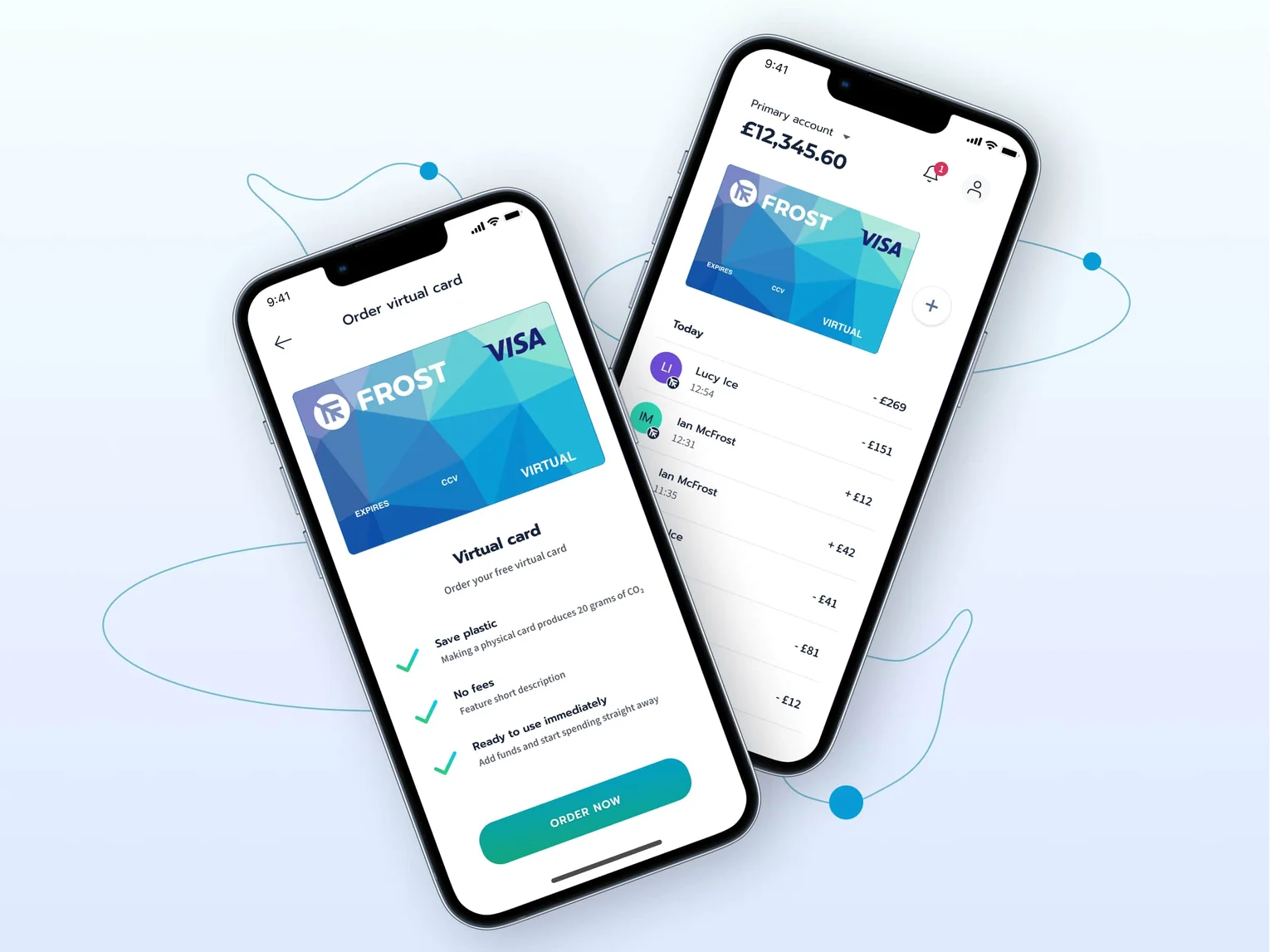

Frost: Providing nearshore software developers for intuitive e-money institution

To stay ahead of the fintech curve, Frost has always focused on finding the right people with the right skill set. And Pragmatic Coders has been helping them to achieve this since well before their public launch.

Read the case study

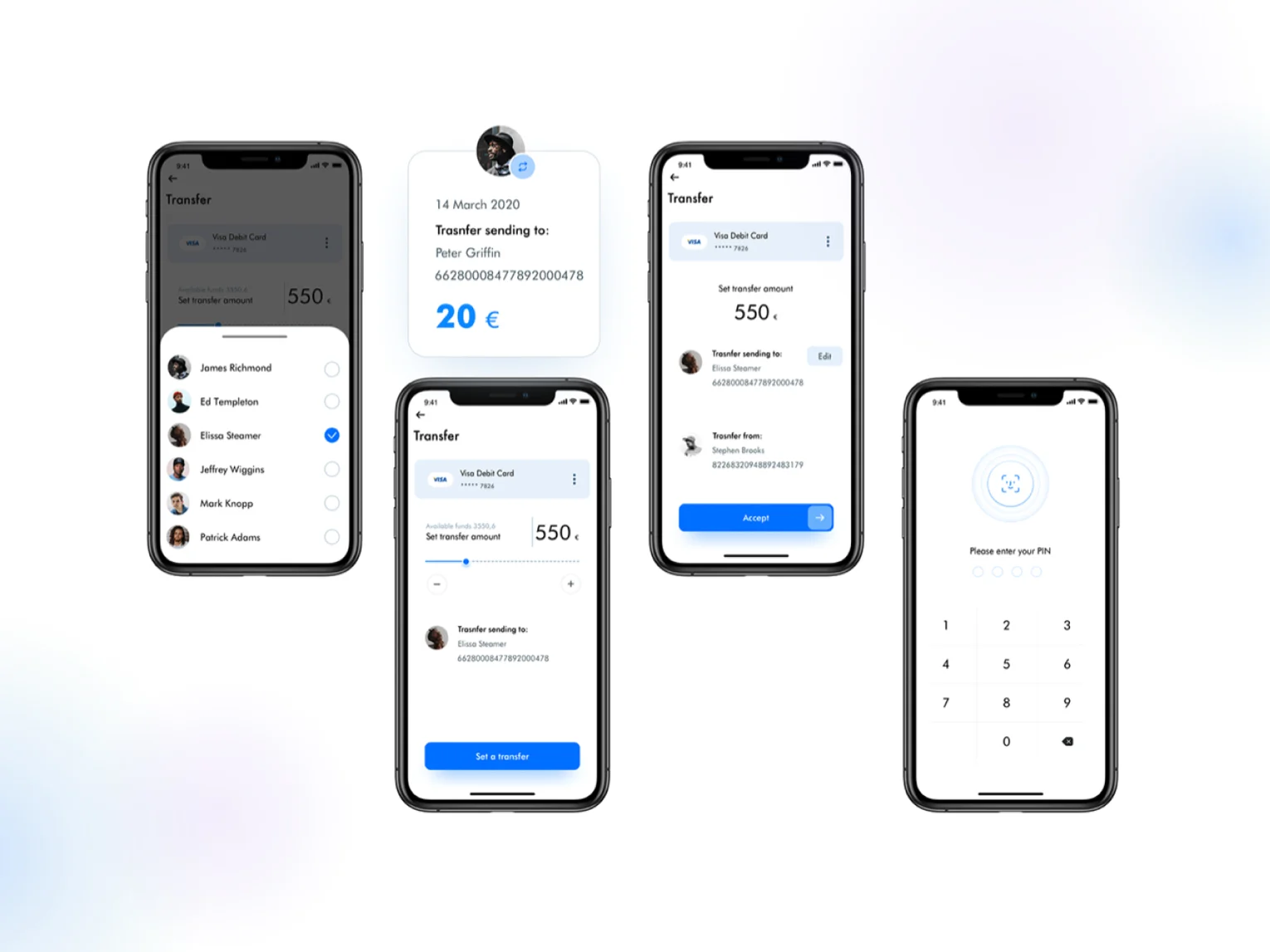

Challenger Bank: Creating a full product strategy and roadmap for a new cryptocurrency-fiat banking application

We've developed a new crypto-FIAT banking application available for Android and IOS that will compete with legacy banking providers.

Read the case study

I'm impressed by how flexible Pragmatic Coders is (...). Culturally, they're a really good fit for us, and the team is very responsive to feedback. Whenever I ask them to do something, they look at it, and they're not scared to push back. I've found it very easy to work with them — we have more of a partnership than a client-supplier relationship.

We ensure security and regulatory compliance

Technical expertise alone is not enough in such highly regulated sectors as fintech and banking.

We understand the unique challenges and requirements of the finance industry.

That’s why we ensure the software we develop is always secure and compliant with all the fintech regulations and standards.

Banking software development FAQ

Are your banking software development services for me?

We've cooperated and are collaborating with multiple various banking institutions. We've built software products for both startups (Frost) and corporate-level banking institutions (Atom Bank).

No matter the size and structure of your organization (central bank, investment bank, commercial bank, private bank, exchange bank, credit union, retail bank, virtual bank, startup), we can build reliable and secure products for you.

What sets you apart from other banking and financial software development companies?

We're an experienced financial software development company that excels in:

- Quality Assurance: At Pragmatic Coders, we integrate testing and quality checking into our development process, reducing costs, minimizing bugs, and ensuring code quality through continuous monitoring.

- Modern development with Agile methodology: Unlike traditional methods, our apps undergo multiple releases during development, eliminating the need for post-testing stabilization. We embrace Agile practices like Continuous Delivery, Test-Driven Development, and Scrum for efficient deployment.

- Product management focus: Our Product Managers oversee the entire financial software development lifecycle, prioritizing value, speed, and revenue generation, ensuring products meet customer needs and business requirements, and get a competitive edge over your competitors.

- Effective Scrum implementation: We adopt Scrum for iterative development, gathering early feedback and optimizing MVP outcomes. Cross-functional teams and self-organization enhance collaboration and productivity for outstanding client results.

What's your experience in UX research and product design for fintech products?

Our expertise extends to conducting in-depth UX research and crafting intuitive interfaces, ensuring a seamless customer experience for a multitude of financial solutions.

UX research:

Designs:

How long does it take you to build an MVP?

Building an MVP for the finance industry takes us up to 3 months. To learn more about our MVP-buidling process, read this guide:

What's your technology stack for banking software solutions?

Our core technologies include React, JavaScript, Node.js, and AWS. We've built a diverse portfolio of mobile and web apps. If a specific technology isn't in our wheelhouse, we can always bring in the right developer for the job.

How long will it take you to gather the software development team for my product?

Usually from 0 days to 2 months.

To learn more about the delivery time for different types of outsourcing, check this site:

Choose a trusted fintech outsourcing company

Need to outsource fintech developers? We’ve assisted numerous small, medium, and large enterprises in overcoming challenges when establishing successful remote fintech software development teams or entire IT hubs in Poland.

Banking development services: trends, challenges, opportunities

What challenges are banks facing right now?

- Modernizing mobile banking: Traditional banks are partnering with FinTech software developers to revamp their outdated mobile apps, enhancing usability and competing with sleek fintech offerings, ultimately accelerating the evolution of the mobile banking sector.

- Personalized offers: Banks are turning to AI and machine learning to deliver customized offers, recognizing the shift from a one-size-fits-all approach and the need to meet individual customer expectations in 2023.

- AI adoption: Large banks are challenged by AI adoption, primarily due to a lack of strategy, employee apprehension, and an expertise gap. To stay competitive, they must formulate comprehensive AI adoption plans, educate their workforce, and consider AI fintech solutions, potentially through collaboration with specialists.

- User-centered innovation: Banking technology is evolving rapidly, necessitating innovation. Banks must cater to the diverse expectations of different generations by considering separate branches tailored for specific demographics and embracing tailor-made solutions.

- Cost management: Retail banks seek to reduce expenses as operating costs rise. They do so through automation and fintech solutions, streamlining processes, optimizing customer experiences, and ensuring regulatory compliance. Collaboration with fintech firms provides access to advanced technology and expertise for cost reduction.

What are the fintech trends for 2024 and beyond?

Seven key trends will shape the financial and banking industries in the coming months.

- Biometric authentication: Fintech apps lean towards facial recognition and fingerprint scanning to ensure secure and user-friendly logins.

- AI-powered personal finance guidance: Fintech applications incorporate AI-driven advisors that offer tailored financial advice, covering areas like budgeting, investing, and debt management.

- Stablecoins: Digital currencies, known as stablecoins, are poised to bridge the gap between traditional and digital money, focusing on transparency, efficiency, and global accessibility.

- Neobanking apps: A neobank is a type of bank that operates entirely online or through a mobile app, without physical branch locations. With their convenience, affordability, and innovation, they provide a competitive alternative to conventional banks.

- Blockchain integration: The adoption of blockchain technology will enhance security, reduce costs, and improve efficiency in various fintech solutions, particularly in cross-border payments, lending, and trade finance.

- Embedded finance: Financial services will become integrated into non-financial products and platforms, offering users added convenience, affordability, and a wider range of options.

- Financial inclusion initiatives: Fintech companies will put efforts into ensuring that affordable financial services are accessible to underserved populations, achieved through mobile banking, digital payments, alternative credit scoring, and microfinance.

What are the traits of a successful bank in 2024?

A bank should exhibit several vital characteristics to thrive in the future of banking.

It must be intelligent – capable of suggesting and automating important choices and tasks.

Personalization is crucial as it leverages insights into customers’ behaviors and needs to offer timely and relevant solutions.

Extreme automation (streamlining manual tasks and decision-making processes) is essential. To keep pace with fintech competitors, the bank should prioritize speed and agility, releasing frequent updates while maintaining security measures.

Finally, a competitive bank must operate with an omnichannel approach. It can seamlessly integrate digital and physical products, catering to users’ diverse needs across the web, mobile apps, call centers, and smart devices. This ensures effortless transitions and prompt issue resolution for a user-centric experience.

Why is it so important for banks to become “AI-first”?

Becoming “AI-first” in the banking industry is imperative. Why?

The adoption of AI technologies in the banking sector is expected to generate substantial business value. Statista predicts a value of around 99 billion US dollars in the Asia-Pacific region by 2030.

Missing out on AI technologies could lead to being out-competed by other banks and non-banking tech giants like Meta, Microsoft, Amazon, Google, and Apple. These tech companies are racing to create all-in-one apps encompassing various services, including payments and digital IDs, thus disrupting the traditional methods for discovering banking services.

Consequently, banks must embrace AI to remain competitive in an evolving landscape of both traditional financial institutions and tech-driven innovators.

How is AI used in the banking industry?

AI is used in banking and finance for various tasks, whether dealing with customers, managing information behind the scenes, or handling administrative work.

A few examples involve:

- Security – machine learning is utilized for fraud detection, and biometrics for authentication;

- Automation – robotic process automation (RPA) lets streamline structured operational tasks, chatbots automate customer support, and optical character recognition (OCR) is used to process documents fast;

- Personalization – banks use AI-based recommender systems to provide personalized offers.

Contents

Our other fintech software services

Trading Software Development Services & Solutions Company

Learn moreCustom Blockchain Software Development Services

Learn moreCustom Financial Software Development Services Company

Learn moreInsurance Software Development Services & Solutions Company

Learn moreMobile Banking Application & Software Development Company

Learn moreCustom Wealth & Investment Management Software

Learn moreLet's talk

We’ve got answers on anything connected with software development.

Message us

Feel free to reach out using the form below, and we’ll get back to you as soon as possible.

Schedule a meeting

You can also schedule an online meeting with Wojciech, our Senior Business Consultant.

founders who contacted us wanted

to work with our team.

Check our fintech-related articles

Newsletter

You are just one click away from receiving our 1-min business newsletter. Get insights on product management, product design, Agile, fintech, digital health, and AI.