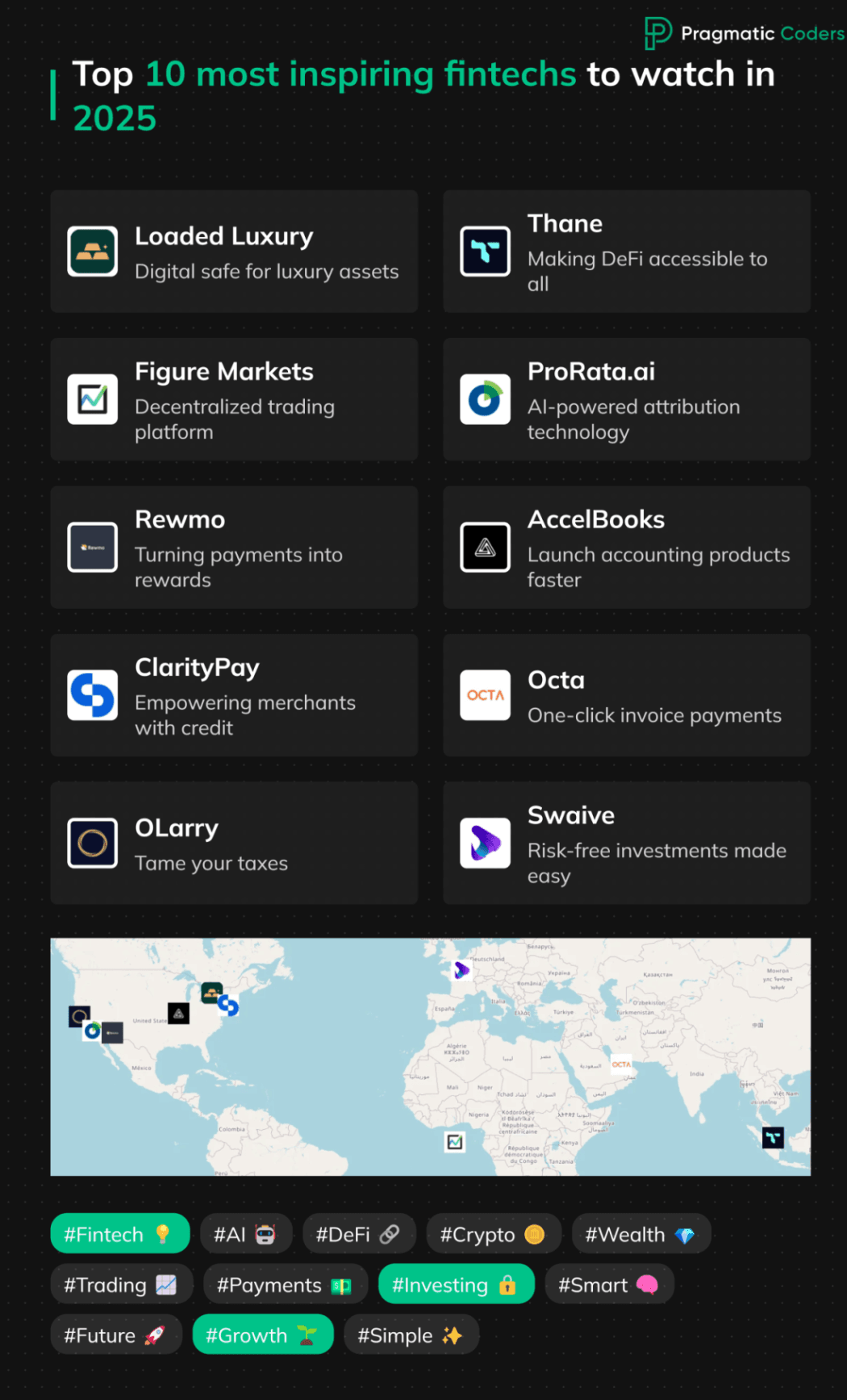

Top 10 most inspiring fintech startups to watch in 2025

What is the fintech startup industry up to in 2025?

What types of initiatives are investors interested in funding?

What specific features and functionalities are users looking for?

We’re sharing the top 10 operational fintech startups (excluding blockchain startups) launched in 2024 with the highest Dealroom Signal score to give you an idea of what’s trending in the industry and what ideas will gain the most traction in 2025.

Custom fintech dev

| Have a startup idea? Then here’s something you must check out. Our AI-driven Market Research Tool can quickly validate and perform market research for your business concept. It offers comprehensive market analysis, competitor insights, and potential revenue opportunities. Who knows, you might be featured in the next edition of our list? |

Top 10 fintech startups to watch in 2025

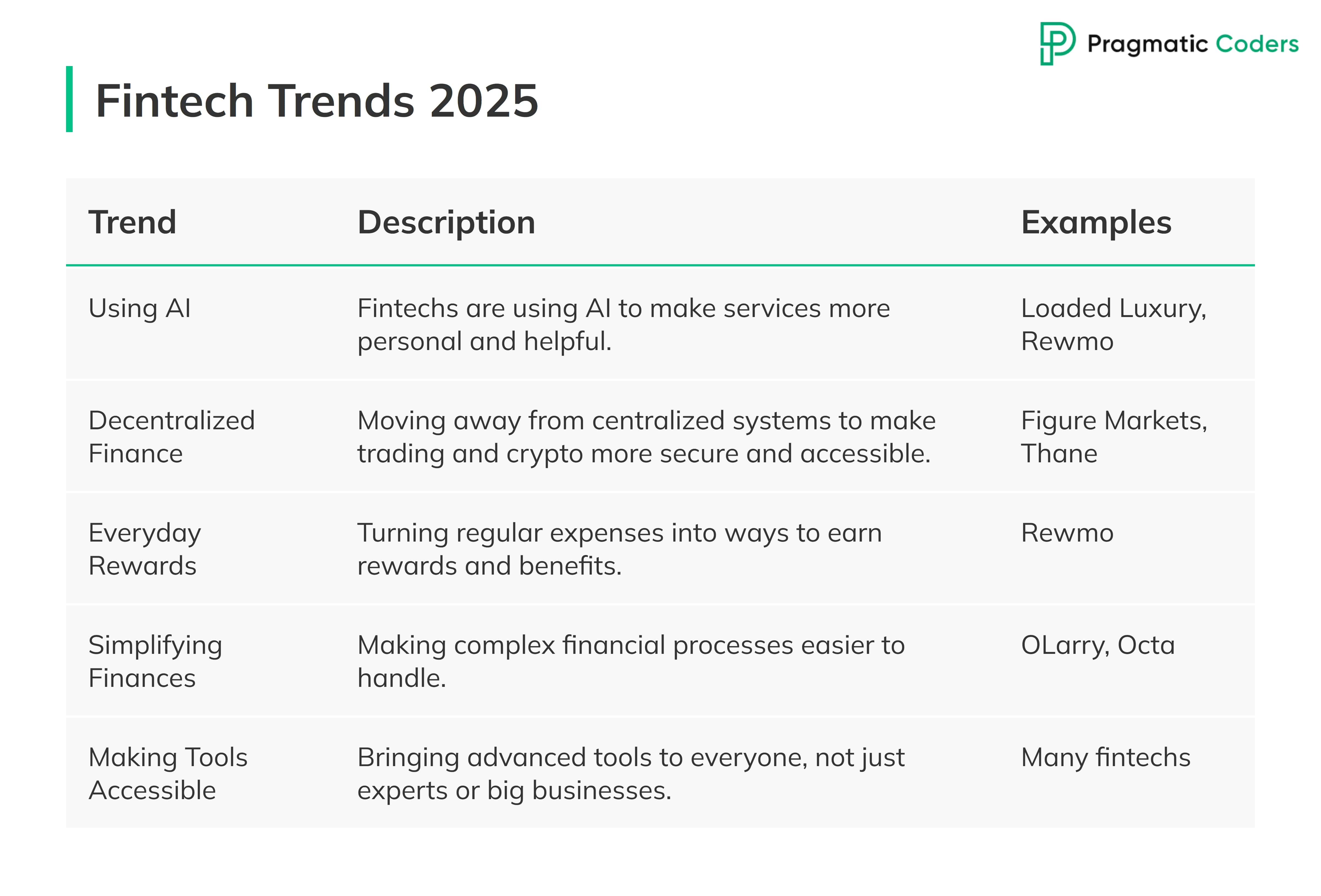

In 2025, expect fintech innovations to continue focusing on solving niche problems with AI-powered solutions-making money management, rewards, decentralized finance, and investments easier, safer, and more tailored to individual needs.

1️⃣ Loaded Luxury: The digital safe for your wealth

Loaded Luxury is a platform designed to help individuals securely manage and track their high-value possessions, ranging from fine art to luxury vehicles. The app consolidates asset management into a single digital solution.

Founders: Randy Frisch, a tech entrepreneur and author.

Headquarters: Toronto, Ontario

Problem They Solve: Wealthy individuals often rely on fragmented systems to manage various luxury assets. This leads to inefficiency and potential oversight. Loaded Luxury provides a centralized, AI-driven platform to organize, document, and secure these assets effectively.

Features:

- AI: Automatically recognize and categorize a wide range of luxury items, including art, watches, and wine.

- Digital Memorandum: Maintain detailed records for insurance and estate planning purposes.

- Digital “Safe”: Sort and store assets by customizable categories, such as “Most Valuable” or “Top 5.”

- Documents: Attach relevant documentation, such as proofs of purchase and authentication certificates.

- Insurance: Tag assets with existing insurance coverage for streamlined claims.

- Managers & heirs: Assign estate managers and designate heirs for efficient asset distribution.

Expansion Plans: The team is exploring partnerships with major insurance providers and estate planning services to enhance integration options for users. Additionally, a global rollout is anticipated by late 2025, targeting key luxury markets in Europe and Asia.

2️⃣ Thane: Making DeFi Accessible to All

Thane is a platform designed to simplify navigating Decentralized Finance (DeFi). It provides tools for both beginners and experienced crypto enthusiasts to manage and optimize their investments.

Founders: Lena Roesch & Alex Robinson

Headquarters: Northwest Singapore

Problem They Solve: DeFi often overwhelms users with complexity – it requires interaction across multiple blockchain networks and decentralized applications. Thane centralizes and simplifies these processes, making it easier to discover, monitor, and execute DeFi strategies.

Features:

- Trends & strategies: Discover the latest DeFi trends and strategies.

- Thane’s community features: Their roadmap includes introducing video-first mobile apps and enhancing interaction among users,. The goal is to further bridging the gap between education and execution in the DeFi space.

- Social investing: Share and replicate strategies within the Thane community.

Headquartered in Northwest Singapore, Thane launched in 2024 and is valued between $500,000 and $750,000 as of mid-2024. A beta version of its platform, including a Telegram-based mini-app, is live and gathering feedback for refinement. A full platform launch is expected in early 2025.

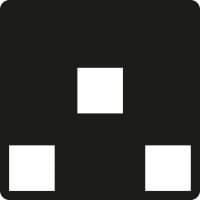

3️⃣ Figure Markets: Decentralized trading

Figure Markets is building a decentralized custody marketplace where investors can trade a wide range of blockchain-native assets, including cryptocurrencies, stocks, bonds, and credit

Founders :Figure Markets was founded by Mike Cagney, who also co-founded SoFi and Figure Technologies.

Headquarters: San Francisco, California, USA

Problem They Solve:

Traditional financial markets often face issues like centralized custody risks, limited asset accessibility, and inefficiencies in trading various asset classes. Figure Markets addresses these challenges by offering a decentralized platform that enhances security, broadens asset accessibility, and streamlines trading processes.

Features:

- Decentralized Custody: Instead of holding all your assets in one place, Figure splits keys across a network. This reduces the risk of hacking or loss.

- All-in-One Trading Platform: You’ll be able to trade cryptocurrencies, stocks, bonds, and more in one spot.

- Crypto-Backed Loans: Need cash but don’t want to sell your crypto? Figure lets you borrow against it.

Figure markets ranked 7th on our list of the Top 10 most inspiring startups to watch in 2025. Check it out!

4️⃣ ProRata.ai: The digital safe for your wealth

ProRata.ai addresses a critical issue in the age of generative AI: ensuring that creators and publishers are properly credited and compensated for their work. The platform focuses on developing innovative attribution technologies for generative AI systems.

Founders: Bill Gross, a veteran entrepreneur known for his work at Idealab.

Headquarters: Pasadena, California, USA

Problem They Solve: Many generative AI systems reuse copyrighted material without attribution or compensation. ProRata.ai’s technology ensures that content owners receive fair credit and a share of the revenue generated by their contributions.

Features:

- Attribution Technology: Multi-dimensional algorithms analyze generative outputs to determine the fractional contribution of each source.

- Generative AI Applications: Supports attribution across text, images, music, and video.

- Revenue Sharing: Offers a 50/50 revenue split for publishers and creators who register their content.

- Search Engine: Gist.ai, an AI-powered search engine using licensed, high-quality content to deliver accurate and concise answers.

Current Status: Headquartered in Pasadena, California, ProRata.ai launched in 2024 and raised $25 million in Series A funding. The company’s Gist.ai search engine is currently in early access, with a full release planned for 2025. ProRata.ai has partnered with major publishers, including Universal Music Group, The Atlantic, and the Financial Times, to promote ethical AI use and fair compensation for content owners.

5️⃣ Rewmo: Turning Rent, Loans & Payments into Rewards

Rewmo changes how people handle personal finance by turning everyday expenses into rewards and credit boosts. Users can earn points on rent, loans, and utility payments, which can be redeemed for cash, travel, or other benefits.

Founders: Gary Reinhold (CEO), Edward Ellis (CGO)

Headquarters: Fountain Hills, Arizona, USA

Problem They Solve: Traditional rewards systems often overlook significant expenses like rent and loan payments. Rewmo addresses this gap. It enables users to convert these large, recurring payments into redeemable rewards and financial benefits.

Features:

- Rewards System: Users earn points for rent, utilities, and loans, redeemable for travel, dining, shopping, and more.

- Generative AI Optimization: Personalized insights and strategies to maximize rewards and improve credit scores. More: Guide to hyper-personalization

- Financial Ecosystem: Partners with banks, real estate firms, and retailers to create a comprehensive financial network.

- No Membership Fees: Free-to-use platform with no transaction charges.

Current Status: Based in Fountain Hills, Arizona, Rewmo launched in 2024 and has secured $28M in funding. It is preparing to roll out services across five major states, including California, Texas, and New York, with plans to expand nationwide by 2025.

Vision: Rewmo creatively integrates rent, utilities, and loan payments into a rewarding ecosystem, allowing hard working Americans to earn points that contribute towards major financial goals like downpayments for homes while also enhancing their credit scores. With a personal and AI optimized system, Rewmo can improve financial health virtually for everyone.

- Learn more: Gamification in banking | 2025 guide

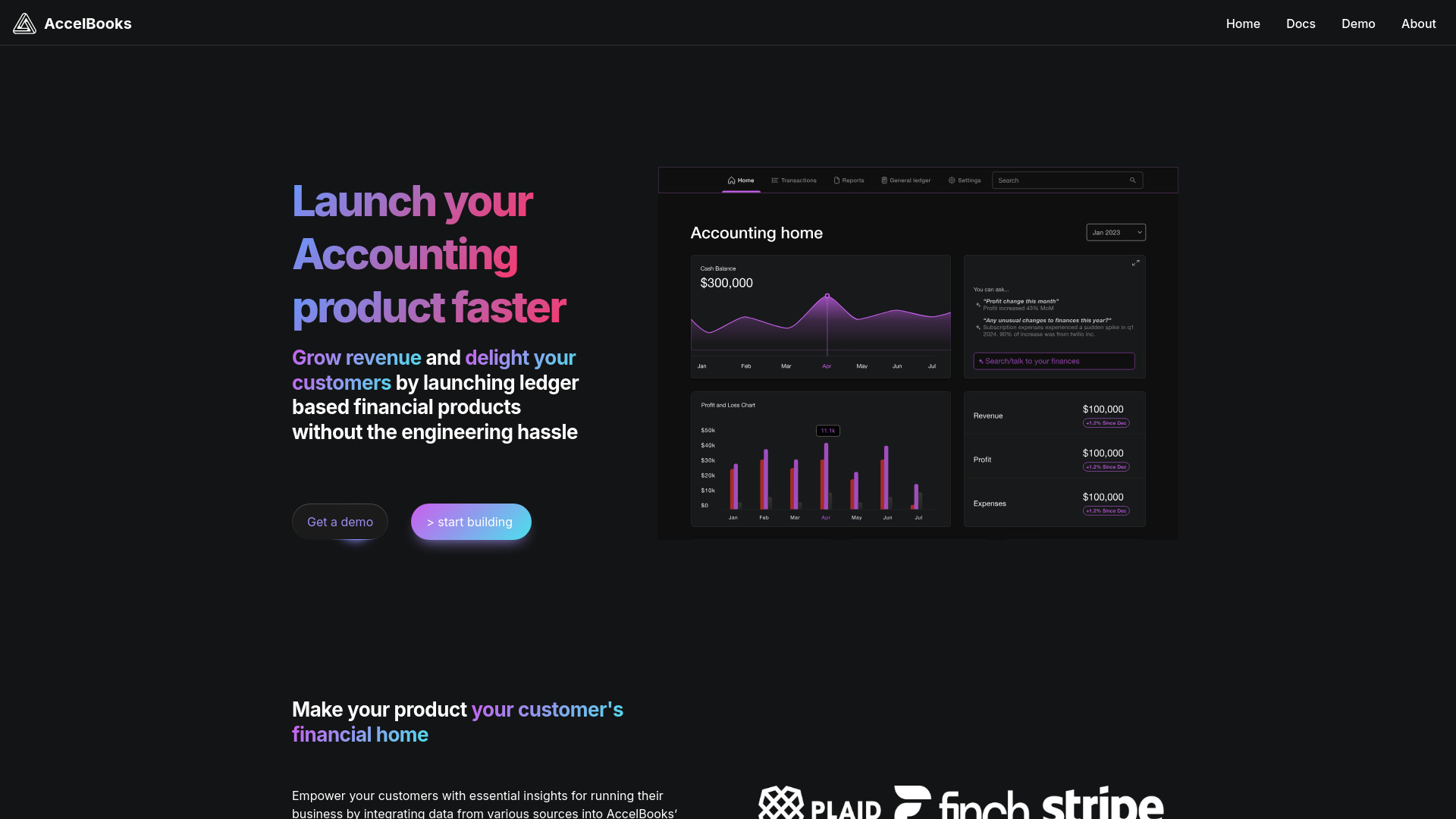

6️⃣ Open Ledger (prev. AccelBooks): Launch Your Accounting Product Faster

AccelBooks provides businesses with a white-labeled, AI-powered financial management platform. The tool integrates data from various sources to deliver detailed accounting insights and reporting capabilities.

Founders: Pryce Adade-Yebesi, former CPO at Utopia Labs

Headquarters: St. Louis, Missouri, USA

Problem They Solve: Developing an accounting platform is time-consuming and requires significant engineering resources. AccelBooks gives you a ready-to-deploy solution for businesses that want to provide financial management tools to their customers.

- This product can be usefull for businesses like accounting software providers, fintech companies, and enterprise resource planning (ERP) platforms that want to enhance their offerings with integrated accounting features. It also caters to financial institutions aiming to provide clients with advanced financial tools.

Features:

- Transaction Categorization: Users can categorize transactions using industry-specific general ledger categories.

- Custom Reports: Businesses can create standard financial reports like P&L statements, balance sheets, or customize reports with AI assistance.

- Unified Data Connections: Integrates payment, banking, payroll, and inventory data into a single system for streamlined reporting.

- White-Label Customization: Offers businesses the ability to embed a fully branded accounting experience using AccelBooks’ APIs and component libraries.

Current Status: Headquartered in St. Louis, Missouri, AccelBooks launched in mid-2024 and is helping businesses deploy accounting platforms in as little as two weeks. The company is exploring additional features like AI-powered forecasting to expand its offerings further.

7️⃣ ClarityPay: Empowering Merchants with Credit Control

ClarityPay is a platform designed to help businesses offer their customers instant loan options at checkout. It acts as a payment solution where customers can break down the cost of their purchases into manageable payments.

Founders: Houman Motaharian

Headquarters: New York City, New York, USA

Problem They Solve: A lot of businesses find it hard to offer their customers flexible credit options, which can lead to lost sales. ClarityPay makes it easier by providing simple lending solutions that are easy to set up and use.

Features:

- Real-Time Lending: Merchants can offer instant loans at checkout, backed by bank-grade security.

- Flexible Payment Plans: Customers can spread their purchase costs over time with clear fees and lower interest rates compared to credit cards.

Target Audience: ClarityPay serves small to mid-sized businesses and large retailers looking to improve customer retention and drive sales with innovative payment solutions.

Current Status: Based in New York City, ClarityPay launched in 2024 and is actively partnering with merchants across various industries.

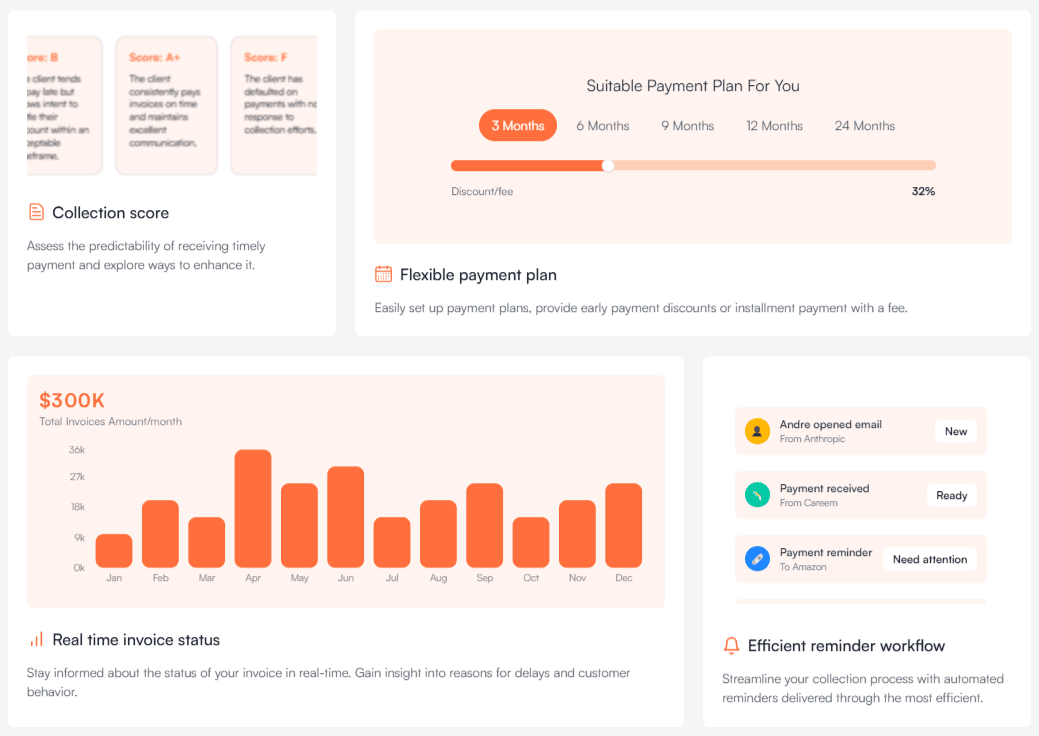

8️⃣ Octa: One-Click Invoice Payment Collection

Octa makes it easier for businesses to stay on top of their cash flow by automating invoice tracking and payments. It saves time and takes the hassle out of chasing unpaid bills.

Founders: Nupur Mittal, a former Careem and BCG executive & Jon Edward Santillan, former CEO of Denarii.com (acquired by Careem)

Headquarters: Abu Dhabi, United Arab Emirates

Problem They Solve: Businesses often deal with late payments and spend too much time managing invoices manually. This creates cash flow problems and wastes resources. Octa solves this by automating the process, making it easier for companies to get paid on time.

Features:

- Invoice Tracking: Monitor the status of all invoices in real-time.

- Automated Reminders: Send follow-ups to customers for overdue payments.

- Payment Collection: Offer one-click payment options to customers.

- Integration with Tools: Syncs with accounting software like QuickBooks, Xero, and Sage.

Target Audience: Small and medium-sized enterprises (SMEs) and businesses in the MENA region that want to streamline their invoicing and payment processes.

Current Status: Based in Abu Dhabi, Octa launched in 2024 and has raised $2.25M in pre-seed funding.

9️⃣ OLarry: Tame Your Taxes

OLarry is a tax advisory service that uses expert advice and smart technology to make managing taxes easier for both people and businesses.

Founders: Eric Rachmel (CEO), Corey Heldreth (CAO), Becky Hobbs (COO)

Headquarters:

Problem They Solve: Dealing with taxes can feel overwhelming, especially for people and businesses with complicated finances. OLarry makes it easier by providing customized strategies, helpful advice, and simple tools to take the stress out of tax planning and filing.

Features: Mill Wallvey, California, USA

- Personalized Tax Strategies: Customized solutions for individuals, families, and businesses based on their specific financial needs.

- Scenario Planning: Proactive advice to navigate changes in tax laws and minimize liabilities.

Target Audience: OLarry serves emerging wealth individuals, high-net-worth families, founders, investors, executives, and private businesses looking for comprehensive and efficient tax solutions.

Current Status: Based in Mill Valley, California, OLarry launched in February 2024 and has raised $4.5M in seed funding.

🔟 Swaive: Secure, Risk-Free Investments Made Easy

Swaiveffers secure, risk-free investment solutions for households and businesses, simplifying fund management and ensuring returns.

Founder: Karen-Laure Mrejen

Headquarters: Paris, France

Problem They Solve: A lot of people and businesses keep their money in accounts that don’t earn much interest, missing out on extra cash. Swaive fixes this by offering safe investments that pay more and don’t come with any risks, helping users take better care of their money.

Features:

- Guaranteed Security: All investments come with a 100% capital guarantee, ensuring no loss of the initial deposit.

- Flexible Terms: Options range from short-term investments (as little as one day) to longer durations, tailored to user needs.

- Transparency: Clear and easy-to-understand investment options without confusing financial jargon.

Target Audience: Swaive targets individuals looking to grow their personal savings without risk and businesses aiming to maximize returns on their excess funds.

Current Status: Headquartered in Paris, Swaive launched in January 2024. Backed by $2.4M in pre-seed funding.

Conclusions

While AI, payments, and sustainable tech grab the spotlight, true success lies in practical execution that addresses real business challenges. The real winners will be those who rise above the hype to deliver effective, working solutions.

How did you choose the companies for your list?

All data about the startups comes from Dealroom’s company database and the listed startups’ websites or social media profiles.

The startups in this list are characterized as follows:

- Launch date: 2024

- Status: Operational

- Dealroom signal: Have the highest Dealroom signal* out of all the startups meeting the above criteria.

- Social media activity: Have been active on LinkedIn or another social platform within the last 3 months as of December 2024.

- Webpage status: Active

*Dealroom signal is Dealroom’s predictive algorithm that identifies and ranks the most promising upcoming funding opportunities in the fintech sector. It analyzes various factors, including a company’s growth metrics, hiring activity, fundraising timing, and team composition.

Guys, how can I keep up with your content?

Be sure to follow us on LinkedIn. Or, even better, subscribe to our newsletter.