What Is Technical Debt in FinTech? Short Guide

In the United States alone, technical debt quietly, quitely drains around $2.41 trillion from the economy every year. Quite a serious figure for a problem that many businesses don’t even measure.

This guide is for the leaders who need to turn this abstract technical problem into a concrete business variable. We’ll give you a helicopter view on what it is, why it can lead to a catastrophe, how much it costs, and most importantly, how to build a pragmatic strategy to manage it.

Key takeaways

|

1. What is technical debt?

At its core, technical debt is a trade-off. In 1992, Ward Cunningham, a pioneer of agile development, first coined the term. He explained tech debt as the consequence of shipping a quick but suboptimal solution that will require extra work to fix or replace later.

Shipping first-time code is like going into debt. A little debt speeds development so long as it is paid back promptly with refactoring. The danger occurs when the debt is not repaid. Every minute spent on code that is not quite right for the programming task of the moment counts as interest on that debt. Entire engineering organizations can be brought to a stand-still under the debt load of an unfactored implementation, object-oriented or otherwise. – Ward Cunningham (source)

What causes tech debt in FinTech?

The main causes are pressures every FinTech leader knows well: the race to capture market share, the need to quickly validate business ideas with a Minimum Viable Product (MVP), and the expectations of investors demanding fast growth.

- Speed-to-Market Pressure: FinTech startups often cut corners to launch their MVPs as fast as possible.

- Investor Expectations who want to see fast growth.

- Legacy Systems: Older banks or acquired platforms come with their own sets of old, outdated solutions.

- Limited resources: If your engineering team is limited, they will most likely deprioritize refactoring or testing.

What are the types of technical debt?

However, not all debt is created equal. We can distinguish, for example, these two types: Deliberate (Prudent) Debt and Accidental (Reckless) Debt:

- Deliberate (“Prudent”) Debt: This is a conscious, strategic decision. You know you’re taking a shortcut to hit a critical deadline or test a market hypothesis with an MVP, and you have a plan to address it later. It’s a calculated risk.

- Accidental (“Reckless”) Debt: This is the debt that accumulates from neglect, poor engineering practices, or a lack of awareness. It’s the result of messy code, outdated architecture, and a “we’ll fix it later” attitude that never gets prioritized. This is the type that leads to uncontrolled spirals of risk and slowdowns.

But that’s just an example. You can categorize technical debt by its “form” (code debt, testing debt, architecture debt etc.) or origin (inherited vs. caused by rapid growth). If you really try, you can actually distinguish 16 types of tech debt in FinTech – we have a separate article about that.

To sum this up, understand which kind of debt you have. It’s the first step to manage it effectively.

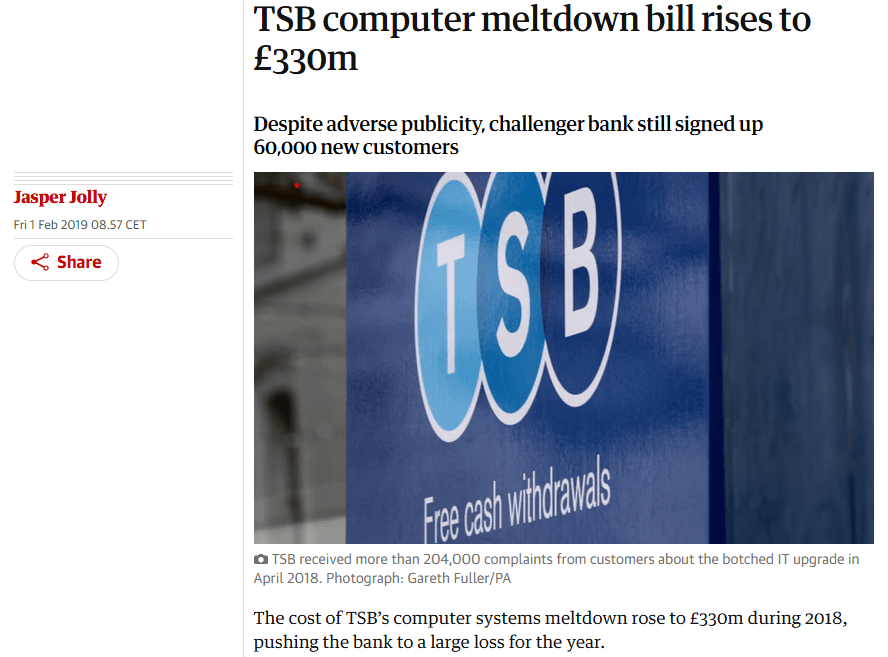

2. TSB Bank Case Study: How Can Technical Debt Lead to Business Failure?

The catastrophic IT migration of TSB Bank in 2018 – a complete failure of corporate governance where years of tech risk finally blew up.

After being acquired by the Spanish banking group Sabadell, TSB decided to migrate its 5.2 million customers from its old IT platform to Sabadell’s new, custom-built “Proteo4UK” system. The leadership team opted for a “big bang” approach. As a result, they switched everything over in a single weekend.

This risky approach, rushed timeline, and lack of testing backfired – fast. The system failed almost instantly, and the fallout was serious, to say the least.

- Operational Collapse: Up to 1.9 million customers were locked out of their accounts, some for weeks. The bank received over 225,000 complaints as customers reported missing funds and failed payments.

- Financial Ruin: The direct cost of the disaster was over £330 million. It included covering customer compensation, fraud, and managing operational crises. Regulatory fines added another £48.65 million, so the total measurable cost was nearly £400 million.

- Reputational Damage: TSB lost 80,000 customers in 2018, and its brand reputation was left in tatters.

Lesson learned: If technical debt is mismanaged, it can put the whole company on the line.

More about the TSB incident:

1.Final Notice 2022: TSB Bank

2. FCA, TSB fined £48.65m for operational resilience failings.

3. Independent, TSB IT meltdown cost bank £330m and 80,000 customers

3. What is the real cost of technical debt?

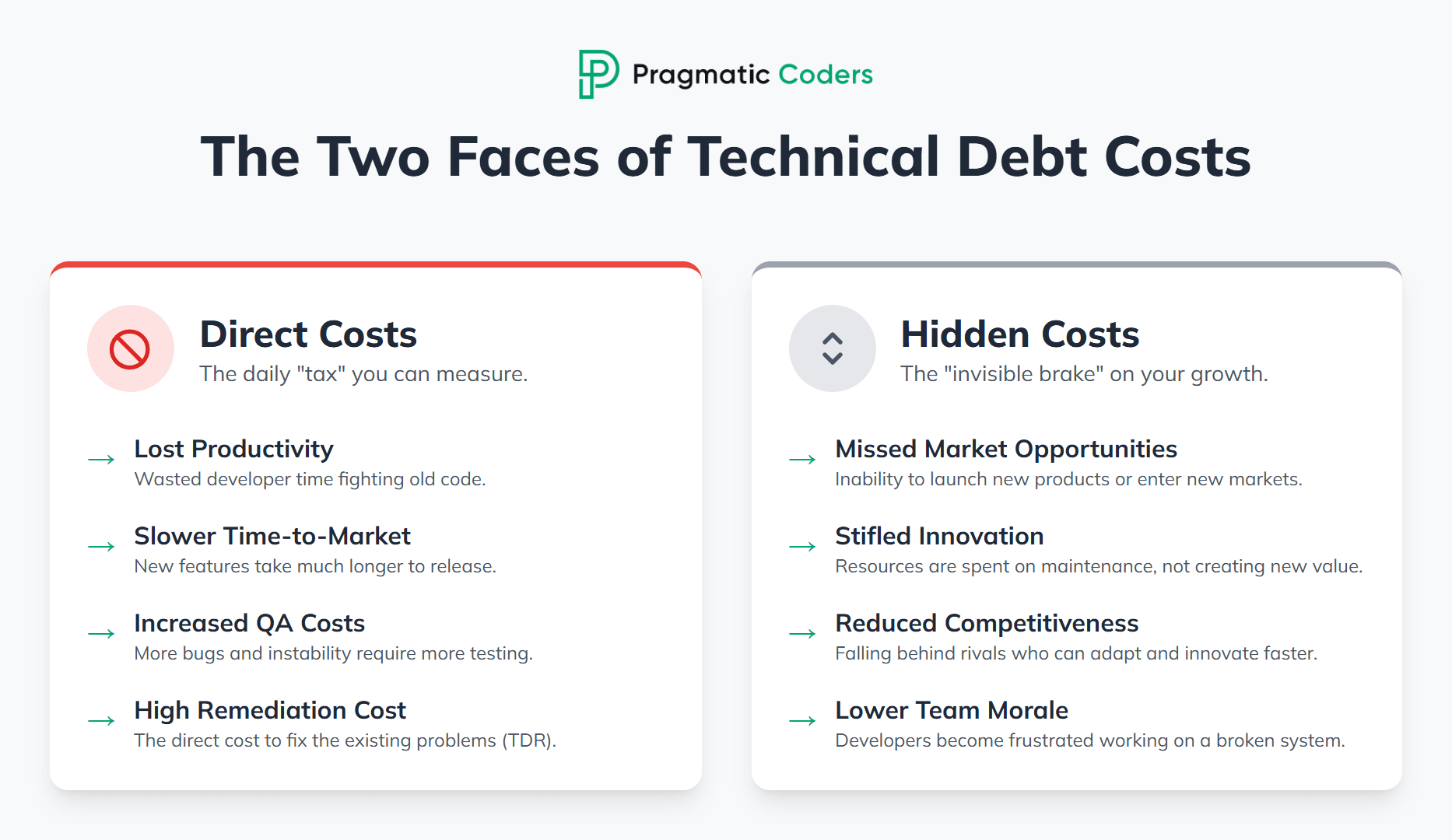

To get buy-in for tackling technical debt, you have to speak the language of business: numbers, costs, and risk. Measuring debt turns a developer complaint into a P&L number. The costs fall into two main categories.

What are the direct costs of tech debt?

These are the measurable expenses you pay every day for past shortcuts: lost developer productivity, increased QA testing, and emergency fixes.

- Lost Productivity Cost: This metric calculates the financial drain on your development team. For a team of 10 developers with an average salary of $120,000 each, who spend 30% of their time working around issues caused by tech debt, the annual productivity cost is $360,000. They’re not building anything innovative, they’re just fixing the problems of what already exists.

- Increased QA Costs: Unstable systems need much more testing. Engineers spend 33% of their time just dealing with technical debt.

Let’s consider these scenarios:

- A Rushed Product Launch: A FinTech startup rushes a P2P payment app to market. They skip key security tests. The total cost of this debt is $250,000. It includes bug fixes, increased customer support, lost revenue from bad reviews, and an emergency security patch.

- Delayed Security Updates: A bigger company delays key security patches to avoid downtime. This leads to, let’s say, a $2.25 million data breach (according to IBM, currently the average global cost of a data breach is $4.4 million). They need to cover response costs, fines, legal fees, and lost revenue from broken customer trust.

What are the hidden costs of tech debt?

Even more damaging might be… the opportunities you lose: lost market opportunities and innovation delays. And the more competitive your branch is, the more it hurts. Every dollar and every hour your team spends wrestling with old code is a dollar and hour not spent on innovation.

Imagine your company couldn’t launch a competitive P2P payment feature because its legacy architecture was too inflexible. A financial analysis could reveal that:

- With a potential market of 13 million (let’s assume this is a regional subset of the overall global market users, for example, UK’s market) and a modest $0.05 transaction fee, the annual lost revenue from this single missed opportunity could be nearly $15 million.

Here, technical debt drags you down, and makes it harder for you to adapt or meet customer needs.

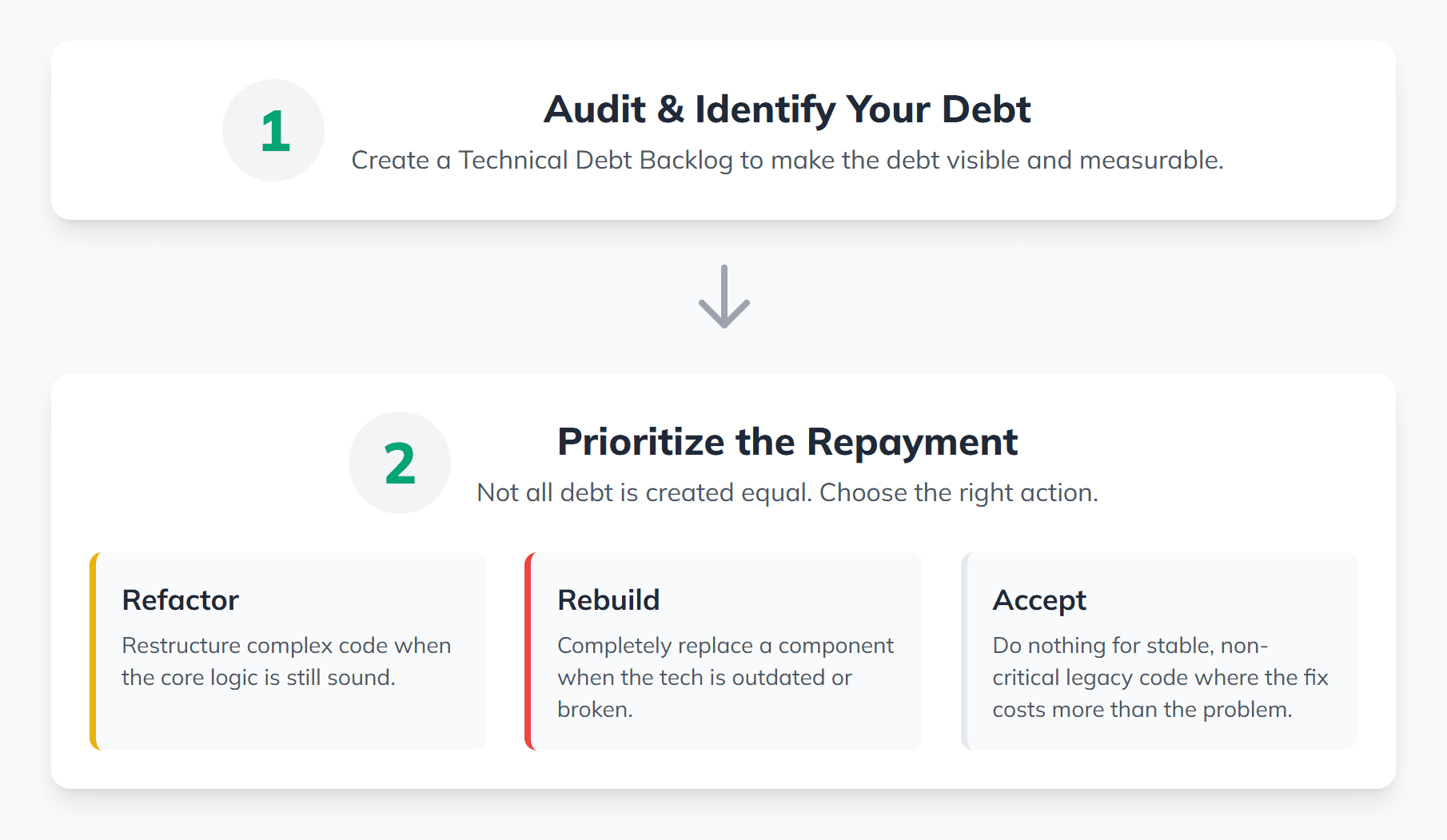

4. How to manage technical debt, then?

The goal isn’t to eliminate technical debt entirely. In fact, a zero-debt stance could signal an aversion to risk that stops innovation. The goal is to find the optimal level of debt and manage it with discipline.

Here’s a pragmatic framework for getting it under control:

- Audit and Identify Your Technical Debt: You can’t manage what you don’t measure. The first step is to make the debt visible. Create a Technical Debt Backlog, treating each identified issue like a user story or a task. This log should detail the problem, its business impact, and the estimated cost to fix it. There are also metrics you can use to measure the cost of your technical debt.

- Prioritize the Repayment: Not all debt is created equal. Some can be safely ignored, while other debt is crippling your business. Choose the right action:

- Refactor: Restructure existing code without changing its external behavior. This is ideal when the core logic is sound, but the code has become overly complex.

- Rebuild: Completely replace a component or system. Go this route when the architecture is broken, the tech is outdated, or the system’s holding back key business goals.

- Accept: Sometimes, the most pragmatic choice is to do nothing. For stable, legacy modules that are rarely changed and aren’t core to your strategy, the cost of fixing them may outweigh the benefits.

- Build the Business Case for Investment: Use the metrics from the previous section to justify the work. Don’t ask for a budget to “refactor the payments module.” Instead, present a clear investment case: “By investing $X to modernize this module, we can free up $360,000 in annual developer productivity and unlock our ability to enter the $15 million P2P payments market.” This entirely reframes the conversation.

Check related articles:

- 16 types of technical debt in fintech

- How to find & manage technical debt

- Does AI make technical debt more expensive?

- Why software projects fail and how to fix them

- From MVP to Scale-Up: The “Technical Debt” You Should Actually Keep

5. Summary and Your Next Steps

Good management of technical debt is how you keep moving fast without things breaking.

The hardest part? Just figuring out how big the problem is. A straight-up audit turns guesswork into a real plan.

If you’re ready to stop paying interest on past decisions and start investing in your future, let’s talk. We can help you figure out where to start.

Technical debt FAQ

Technical debt is the implied cost of rework caused by choosing an easy (or limited) solution now instead of using a better approach that would take longer. Like financial debt, it offers a short-term boost (you can launch a product faster). However, eventually, the debt must be repaid, often with steep interest. That “interest” comes in the form of slowed development, rising bug counts, security vulnerabilities, and scalability issues. Technical debt isn’t always bad. It can be a smart trade-off when taken on purpose to hit a goal fast, like launching an MVP. But if it’s unplanned or unmanaged, it turns into a problem: more bugs, slower development cycles, higher upkeep, and less flexibility. The 80/20 rule for technical debt suggests that 80% of the negative impact from tech debt typically comes from 20% of the codebase. Tackling the most critical 20% can unlock big gains. It’s a smart way to prioritize what to fix first. You can identify technical debt by looking for: Creating a technical debt audit or backlog helps structure and prioritize these findings. To minimize future technical debt: Some debt is inevitable. However, if you proactively work on reducing it, you’re decreasing the chance of long-term risk.What is technical debt in SCRUM?

Is technical debt bad?

What is the 80-20 rule for tech debt?

How to identify tech debt?

How to avoid tech debt?