Top 6 Gen Z banking trends for 2026

While Baby Boomers have the most purchasing power, and Gen Y is the biggest generation group, it’s Gen Z that’s growing the fastest. In fact, by 2034, my US-based peers will overtake millennials as the US’ largest cohort.

In 2025, the oldest of us are already in our late 20s, and we’re a consumer group that banking institutions need to reckon with.

So, who’s Gen Z? And how can banks attract us? This article will give you unique – true and personal – insights into the life and finance experiences of the group because I’m Gen Z myself.

Here are 6 insights to consider when developing banking software for Zoomers.

What do you need to attract Gen Z to your bank?

|

Who is Gen Z?

Generation Z, also known as Zoomers or iGen, is the demographic cohort succeeding Millennials and preceding Generation Alpha. Researchers and popular media use a starting birth year range of between 1996 and 2012. In 2024, Gen Z will be between 12 and 28.

I was born in 1998, so I lean more towards Millenials than Alphas, but I wholeheartedly endorse the insights below.

Characteristics of Gen Z

- Digital natives: Gen Z is the first generation to grow up with the internet and social media as an integral part of their lives. They are highly tech-savvy and comfortable using digital tools for communication, learning, and entertainment.

- Diverse and inclusive: Zoomers are the most open-minded, tolerant, and racially and ethnically diverse generation in history.

- Entrepreneurial and ambitious: iGen is known for its entrepreneurial spirit and ambition, and it is more likely than previous generations to start their own businesses.

- Financial security: Gen Z is concerned about financial security and is highly motivated to save money and learn about banking and finance from a young age.

So, what do Zoomers want from their banking apps?

1. Let’s get phygical!*

Phygical banking is the combination of traditional brick-and-mortar banking with digital banking channels, such as online banking and mobile banking.

The goal of phygical banking is to provide customers with the best of both worlds: the convenience of online banking with the personal touch of in-person service.

Examples of phygical banking:

- A traditional bank with a mobile app and online banking platform.

- A credit union with a network of ATMs and branches.

- An online bank with a limited number of physical locations.

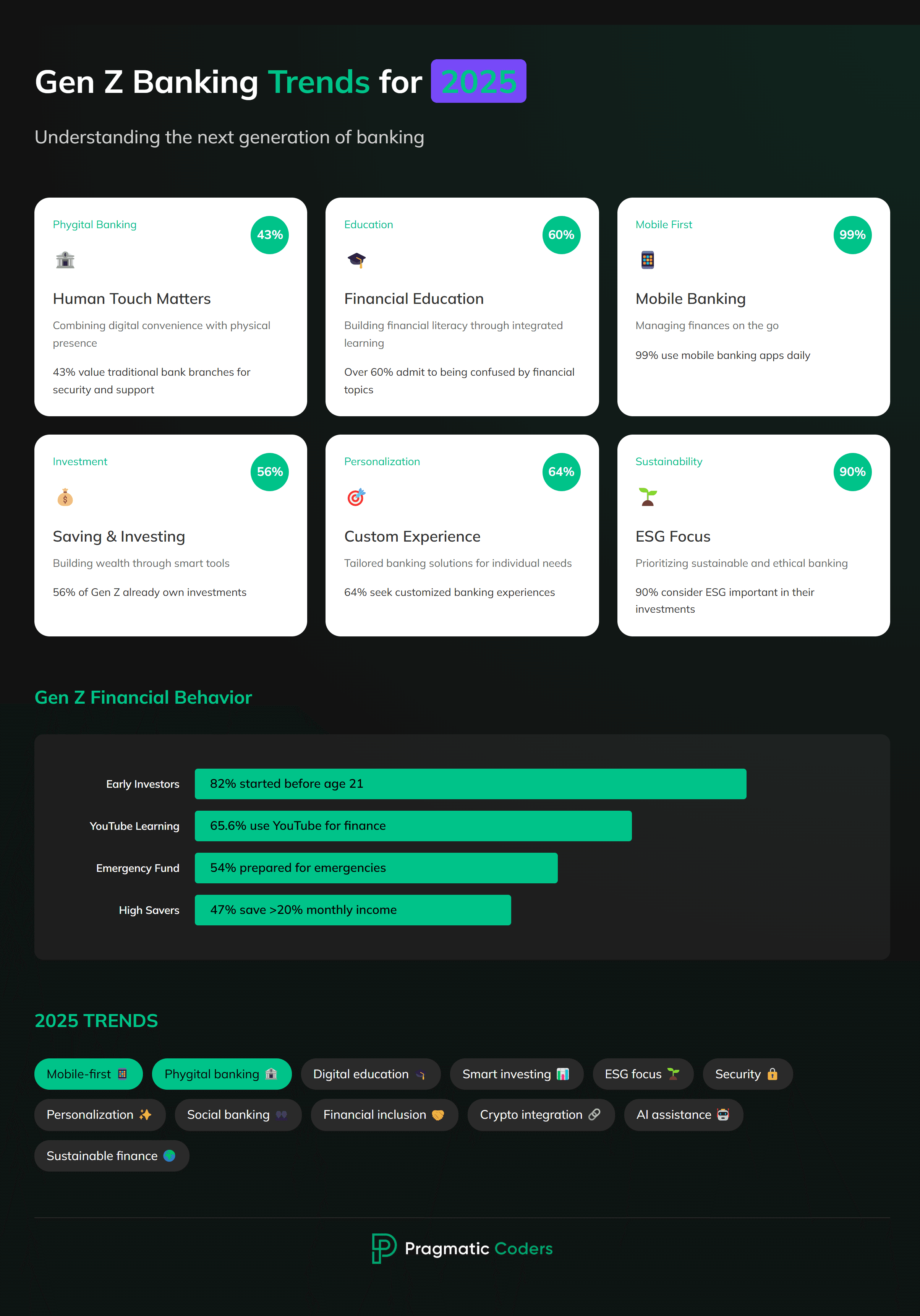

Zoomers might be tech-savvy, but they still appreciate the ability to visit a banks’ physical branch. Nearly half of Gen Z individuals, or 43%, value the security and reassurance provided by traditional brick-and-mortar bank branches, as revealed in the Oliver Wyman Forum’s Global Consumer Sentiment (GCS) survey.

I found this part of an interview with Steve Turley, head of retail growth and transformation at TD Bank, especially on point:

When I think about Gen Z and some of the issues and challenges that they’re battling, there’s almost too much information coming at them. They have so many ways to assimilate information, but it really comes back to what you can trust.

And I often think, we’re not really in the banking business; we’re in the trust business. And it is about building that relationship. To your point, there is still a significant number of Gen Zs that we’re seeing that want to come into a branch, want to sit down and have that advice related conversation because they get so much information coming in. They want to know what I can zero in on. What can I trust for my future?

That’s why providing users with an omnichannel banking experience is or soon will be a key differentiator in the banking industry.

| My opinion My bank’s ING. I visited a physical location only once – when opening my first-ever banking account. Nevertheless, I appreciate the fact that I can rely on real-person customer support. If I finally go more into investing and saving, I will definitely contact them and ask for guidance, just as Turley said. I’m overwhelmed with information, feel there are still too many things I don’t understand about finance, and need a reliable source of information and a person to whom I can ask questions. |

*To all non-Zoomers out there, this is a reference to Dua Lipa’s hit song Physical. If you didn’t catch that, you probably understand Gen Z less than you think. 😉

2. We don’t need no financial education

Double negative is positive, and as much as I like Pink Floyd, the heading above should actually say: We need financial education. And that’s so, so true.

- Gen Z has the lowest financial literacy levels. More than one-quarter of Gen Z admits to lacking confidence in their financial knowledge (Yahoo Finance).

- And, over 60% of Gen Z admit to being confused by financial topics, which is twice as much as Baby Boomers. (The Financial Brand).

The reasons “why” vary: lack of financial education at school or living in a not especially financially literate homes.

According to Bank Of America, Generation Z feels prepared to handle basic financial tasks, such as budgeting. However, their confidence decreases when it comes to future financial planning, with only 54% feeling prepared to build an emergency fund, 43% to save for retirement, and 29% to invest.

We feel we lack knowledge of how to manage our finances, so what do we do? We Google it.

YouTube is the top social media platform that US Gen Z consumers (65.6% of all respondents) turn to for banking information, per Insider Intelligence’s survey. Then follow TikTok, Facebook, Instagram, Reddit, and X.

As stated in Lexis Nexis insight, Gen Z is eager to listen to “Finfluencers” (financial influencers) online who promise high returns on certain stocks. However, this led to a widespread prevalence of “get rich quick” scams among Gen Z. As a result, there’s a heightened sense of caution within this generation, making them particularly wary of enticing investment propositions.

How can you leverage it?

- Gen Z is pragmatic; you may expect they will check your social media before trusting you with their customer data and money. So, it’s important you convey an authentic, professional, and cohesive message across all your social platforms.

- Moreover, banking institutions should use YouTube to connect with young people as they start learning about finance to later convert them into customers of their financial services. They can partner with YouTubers to create videos that show different ways to invest, save money, and manage their funds.

My opinion

|

3. Mobile banking

Gen Z expects to manage all banking needs via smartphones, including account opening, money transfers, and bill payments. Over 80% of Gen Z prefers digital interactions with their financial institutions, and 99% regularly use it for a variety of tasks, like tracking towards a savings goal (Chase Digital Banking Attitudes Study).

They have high customer expectations, too: 48% of Gen-Zers would switch to a bank if it had a better user experience. That’s why UX design is the part of your mobile banking app development process you don’t want to miss.

Here are some specific UX needs of Gen Z:

- Mobile-first design: The app should enable easy financial transactions on a smartphone.

- Simple and intuitive interface: Easy to learn and use.

- Personalized features: Users can personalize the user experience based on their individual needs and preferences.

- Banking gamification: Use gamification mechanics to make it more engaging and fun to use.

- Financial education tools: The app should provide financial education tools to help Gen Z learn about managing their money.

My opinion

|

4. Saving & investing options

I’ve already mentioned a few times how important saving investing is for Gen Z, but let’s examine the issue in more detail.

Why is Gen Z so keen on investing and saving?

Before I explain how let’s discuss the “why’s” behind this preference. Bank of America’s Better Money Habits study explains that quite clearly:

- For 52%, the high cost of living is their main financial challenge.

- 37% feel they don’t “make good money.

- 54% receive financial assistance, primarily from parents or other family members.

We want extra income, so turn to saving and investing as a way to get us there.

How does Gen Z save money?

- Gen Z is the most saving-focused generation yet. State of Savings survey report found that Gen Z (ages 18-27) is the generation most likely to save more than 20% of their monthly household income each month at 47%, compared to 36% of Millennials (ages 28-43), 17% of Gen X (ages 44-59) and 18% of Boomers (ages 60-78).

- Gen Z asks their families and friends for saving advice. The factors considered when decking out how to save money are recommendations from friends and family (37%), how easy it is to understand the account/how it works (35%), or ROI (27%).

How does Gen Z invest?

- Gen Z is the most investing-savvy generation yet. According to a study by the CFA Institute, over half (56%) of the Zoomers surveyed own some investments. The financial transactions here mostly involve investing in cryptocurrency (55%) and stocks (41%). They are less likely to use mutual funds than older generations and more likely to invest in cryptocurrency and NFTs than Gen Xers.

- Gen Z is investing early. More than four in five (82%) U.S. Gen Z investors began investing before they were 21.

- Gen Z experiences 3 main barriers to investing. Most Gen Zs in the US who don’t invest say they don’t have enough savings (65%), don’t earn enough money (64%) or don’t know enough about investing (56%).

As you can see, Zoomers want to invest, and they do it. And if they don’t, in more than half of cases, that’s because they lack investing knowledge – which is a substantial market to address.

| My opinion I do very basic saving operations within my bank account, and I haven’t gotten into investing yet. The main reason behind it is, again, lack of knowledge. ING sends me in-app notifications from time to time, with short article-like pieces of information on investing/spending options, but I didn’t feel informed enough to actually start doing it. I wish my banking app had more structured education modules I could go through (maybe with some banking gamification elements like progress bars to keep me engaged?). |

5. Personalization

It might seem personalization is nothing more than a buzzword at this point, but it’s not!

Gen Z is the first generation to be born into the digital age; they are accustomed to having personalized customer experience online. According to W1TTY’s research, 64% of Gen Z respondents said they are looking for a customized banking experience with product and service recommendations relevant to their unique situation.

Yet, that’s where many banks and neo-banks still fall short with their “one-fit-all” solutions.

| My opinion For me, an ideal banking app would educate me, assist me in achieving my financial goals, and give suggestions based on my spending habits. |

6. Sustainability & financial inclusion (to some extent)

Many sources highlight how important sustainability & inclusion is for Gen Z. 64% of Gen Z would switch banks if their current provider fell short on ethics and environmental sustainability, according to Insider Intelligence.

This suggests that Gen Z is more likely to prioritize environmental and social responsibility when choosing a bank. However, the sustainability concern isn’t limited to just choosing the right basic banking services provider; it extends to other subsets of the climate fintech market, including the investment sector, too. That’s why ESG investing might become the new trend among the generation.

ESG investing, also known as socially responsible investing (SRI) or sustainable investing, is an investment approach that considers environmental, social, and governance (ESG) factors alongside traditional financial metrics.

Gen Z is the generation of investors who are most likely to consider ESG factors in their investment decisions. According to a 2022 survey by Morgan Stanley, 90% of Gen Z investors said that ESG is important to them, and 85% said that they would be willing to sacrifice some of their returns to invest in companies that align with their values.

| My opinion I find this true, but just to some extent. Being given the option to invest in more sustainable companies would be a great feature. Yet, I’m rather skeptical about these green initiatives (because of greenwashing). It feels like Inception: I’m not sure I can trust a financial company claiming they’re green. In the end, they might be promising to be such just because they believe that’s what Gen Z wants. What’s more, sustainability is more of a nice-to-have option for me. It’s like in Maslow’s pyramid, with investing and saving being way closer to the bottom than sustainability. |

Youth banking trends. Summary

Solely following fintech trends or implementing fancy mobile banking app features won’t get you far. First and foremost, you need to understand your audience before reaching it.

Gen Z has directly witnessed the digital transformation of the world. That’s why they have specific needs for the financial sector. I hope this article helped you understand us better.

For more generation-related content, check also:

- How to design a mobile banking app for Gen Z

- Gen Z healthcare: App preferences, trends, and features that resonate

- How to market to Gen Z

- What you need to know about Generation Beta – the generation after Gen Alpha, born into a fully AI-native world, with even higher expectations for digital services