GENIUS Act Explained: U.S. Stablecoin Law (S.1582) for Issuers & Developers

This article is your practical, up-to-date roadmap to the GENIUS Act.

Why keep reading:

- It’s based on the latest version (S.1582, June 2025): not old drafts or speculation.

- It’s clear and useful: summaries, tables, and a glossary break down legal jargon.

- It’s global: U.S. or abroad, you’ll see how the rules affect you or your project.

- It’s grounded: covers rules and penalties.

- It’s built for doers: from compliance leads to blockchain devs – what to follow, avoid, and anticipate.

However, here’s an important note: Remember that this article was not consulted with a GENIUS Act legal expert. Please don’t treat it as legal advice.

UPDATE: The GENIUS Act became law on July 18, 2025.

1. What is the GENIUS Act and why does it matter?

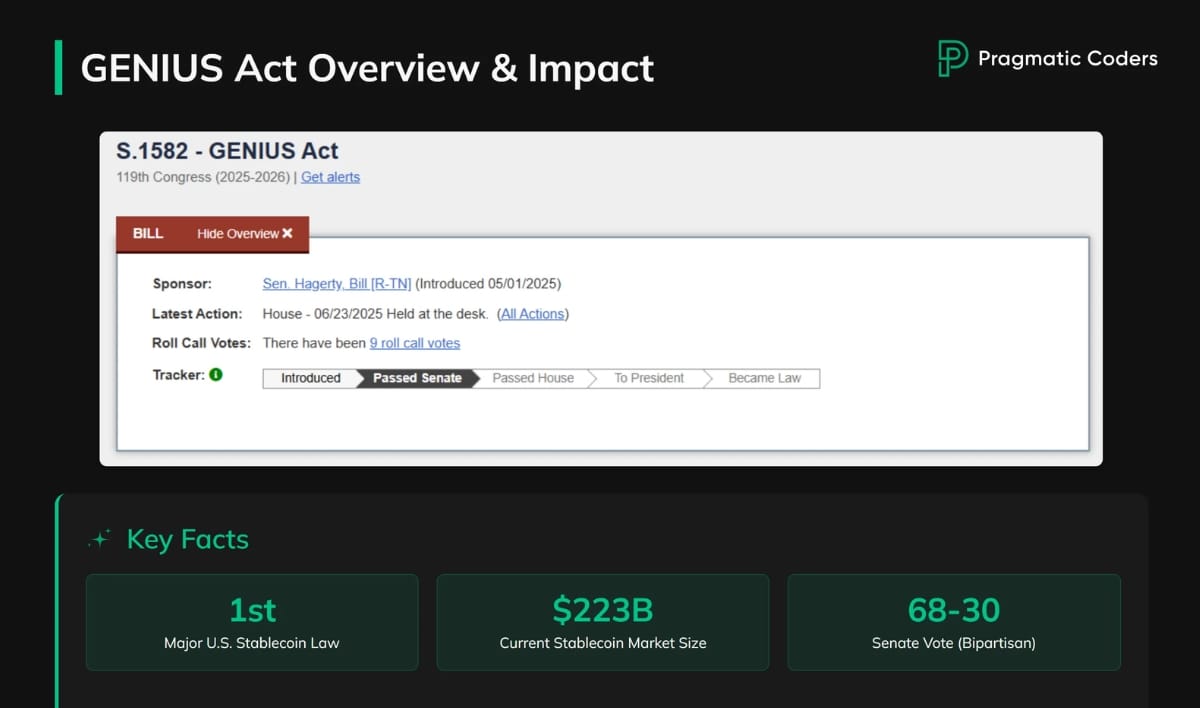

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), passed by the Senate in June 2025 (68-30, bipartisan) that became law on July 18, 2025, is the first major federal law regulating U.S. dollar-pegged stablecoins. (congress.gov)

It sets clear, strict issuance rules to protect users, promote responsible innovation, and clarify regulation.

2. What are stablecoins and why do they matter?

Stablecoins are digital money designed to maintain a stable value, commonly pegged to the U.S. dollar. Unlike Bitcoin, which can swing wildly in price, a stablecoin should always be worth about $1.

They’re hugely popular – there are over $250 billion worth of stablecoins circulating globally, with more than $700 billion moving through the system every month.

People use stablecoins for cross-border payments (much cheaper than traditional bank transfers), trading crypto, and storing digital dollars without the wild price swings of other cryptocurrencies.

But until now, they existed in a legal gray area with little regulation. If it passes, Yet, once it was signed, the GENIUS Act will finally bring clear rules to stablecoins and help these “digital dollars” go mainstream in the U.S. and beyond.

EXPERT INSIGHT: How will Genius Act affect business & economies?

Hard to say exactly how the GENIUS Act will play out, but odds are a bunch of companies will start launching their own stablecoins. Not sure it makes sense for all of them, but for the U.S., it’s a smart move—it locks in the dollar’s position. – Przemysław Trepka, Senior Blockchain Developer

What stablecoin issuers need to know ⬇️

3. Who can issue stablecoins under the GENIUS Act?

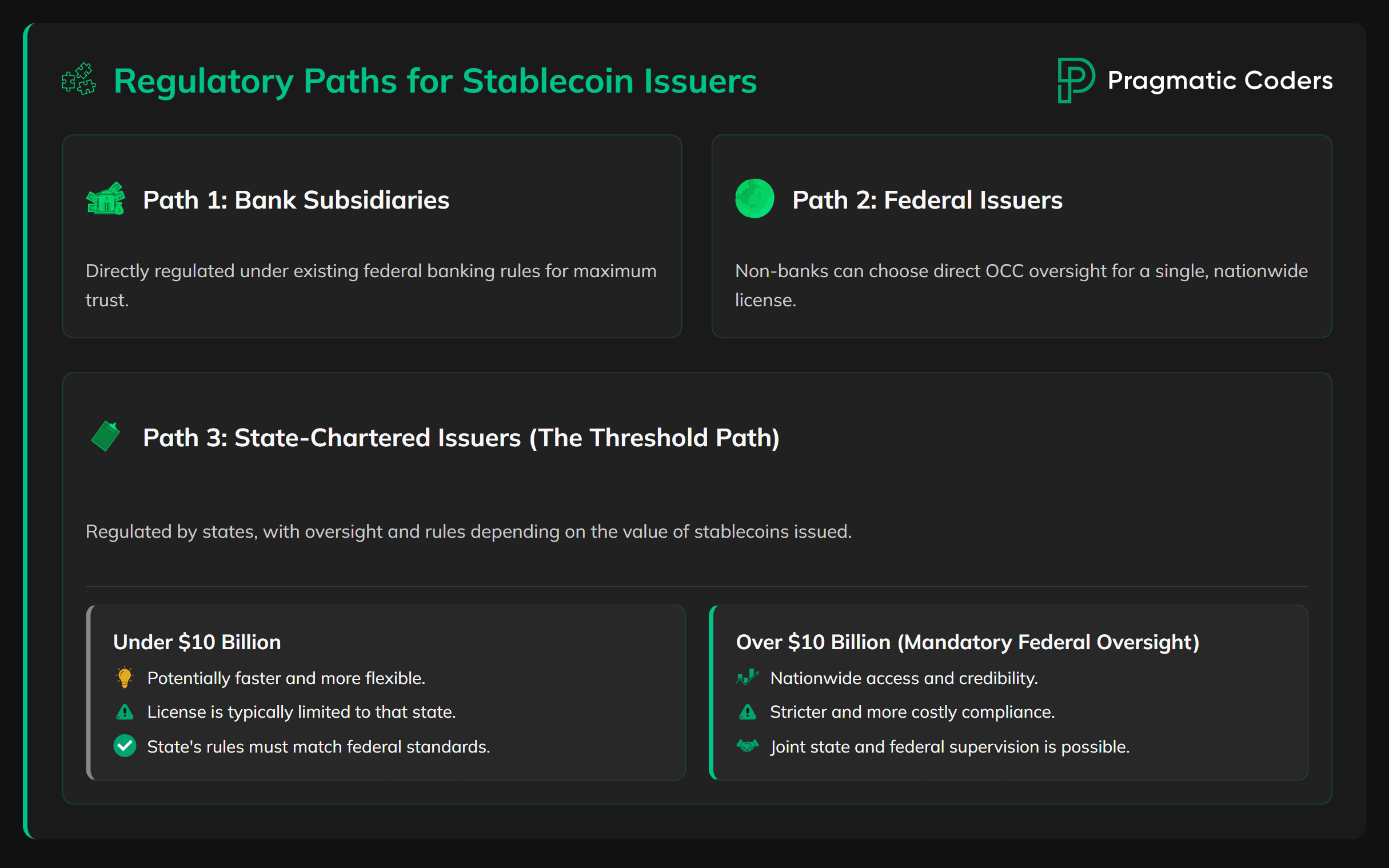

The law creates three types of companies that can legally issue stablecoins in the U.S. (SEC. 2 (15) (A) (B) (C))):

- Bank subsidiaries – Companies owned by regular banks

- Federal issuers – Non-bank companies regulated by the federal government (specifically by the Office of the Comptroller of the Currency)

- State issuers – Companies regulated by individual states

There’s a key threshold: if your stablecoin is worth more than $10 billion, you must be regulated by federal authorities. Smaller ones can choose state regulation if the state’s rules are “substantially similar” to federal standards. (SEC. 4 (c) & (d))

4. How does state vs. federal regulation work?

Here’s a simple explanation of how state vs. federal regulation works under the GENIUS Act:

- If you’re a small stablecoin issuer (with less than $10 billion in coins out there), you can choose to be regulated by your state—but only if your state’s rules are almost the same as the federal rules and your state gets certified by a special review committee.

- If you grow bigger than $10 billion, you have to switch to federal regulation (handled by federal banking regulators), unless you get a special waiver to stay under state supervision.

- States and the federal government can work together: Even after you switch to federal oversight, both state and federal regulators can supervise you jointly.

- States keep some power: States still handle chartering and consumer protection, but if you’re federally regulated, you don’t need a separate state license.

- If a state’s regime isn’t certified or loses certification, issuers there have to follow the federal rules.

More: sections 4(c), 4(d), 5(h), 7.

What does the $10B threshold mean for issuers?

State-Level Regulation (for stablecoins under $10 billion)

- Supervision by state regulators.

- Benefit: This can be more flexible. State regulators might be quicker and more used to dealing with new tech ideas.

- Limitation: Your license only works in that one state. To operate across the country, you’d need to get permission from every other state

Federal Regulation (mandatory for stablecoins over $10 billion)

- Federal supervision mandatory above $10 billion; optional for smaller issuers.

- Benefit: You get a single “master key” to operate across the entire United States. This gives you huge credibility and makes it easier to work with big banks.

- Limitation: Stricter compliance standards and rigorous oversight. It’s more expensive and demanding to comply.

5. What reserves are required under the GENIUS Act?

This is the most important part. Every stablecoin must be backed 1:1 with real, safe assets (SEC. 4. (a)). That means for every digital dollar in circulation, the company must hold $1 (or ut worth of:

- Cash and bank deposits

- U.S. Treasury securities (short-term, 93 days or less)

- Government money market funds

- Approved repurchase agreements

No risky investments like stocks or corporate bonds are allowed. Companies can’t use these reserves for anything else – they’re locked up to back the stablecoins.

6. What transparency and reporting are required?

Approved stablecoin issuers need to keep 1:1 liquid reserves, share monthly reserve reports, fees, redemption policies, CEO/CFO statements, and accountant reviews.

If they’re over $50B, they also have to publish audited financials and disclose related-party deals each year. (SEC. 4(a)(10)(A)-(B))

| Requirement | Details | Section in Act | Penalties for Non-Compliance |

|---|---|---|---|

| Reserve Composition | 1:1 backing with high-liquidity assets; monthly public reporting | 4(a)(1)(A) & (C) | Criminal penalties for false reports [4(a)(3)(C)]; Civil fines up to $100,000/day [6(b)(5)] |

| Redemption Policy Disclosure | Clear, public procedures and fee disclosure; 7-day notice for fee changes | 4(a)(1)(B) | Civil fines up to $100,000/day [6(b)(5)]; Marketing violations: $500,000/violation [4(e)(3)(B)] |

| Monthly Certification | CEO/CFO certification; accounting firm examination | 4(a)(3) | Criminal penalties for false certifications [4(a)(3)(C)]; Civil fines up to $100,000/day [6(b)(5)] |

| Annual Audits (Large Issuers) | >$50B issuers: annual GAAP financials, related party disclosure, PCAOB audit, public | 4(a)(10) | Civil fines up to $100,000/day [6(b)(5)]; Revocation of issuer approval [6(b)(1)] |

7. What consumer protections does the GENIUS Act include?

The Act includes several protections for consumers.

It bans reserve reuse and interest payments, and it puts holders first in bankruptcy. It also requires honest marketing and blocks forced bundling of products. On top of that, it safeguards data privacy and makes sure customer assets stay separate from issuer debts.

| Protection Measure | Details | Section in Act | Penalties for Non-Compliance |

|---|---|---|---|

| Prohibition on Rehypothecation | Reserves cannot be reused except for specific, permitted purposes | 4(a)(2) | Civil fines up to $100,000/day [6(b)(5)] |

| Prohibition on Interest/Yield | No interest or yield may be paid to stablecoin holders | 4(a)(11) | Civil fines up to $100,000/day [6(b)(5)] |

| Bankruptcy Protection | Stablecoin holders have priority in claims over other creditors | 11 | N/A (Structural protection) |

| Truth in Marketing | Bans misrepresentation as gov-backed/insured/legal tender; clear marketing rules | 4(e), 4(a)(9) | $500,000/violation for unlawful marketing [4(e)(3)]; Referral to Treasury [4(e)(3)(D)] |

| Prohibition on Tying | Issuers cannot tie services to purchase of other products | 4(a)(8) | Civil fines up to $100,000/day [6(b)(5)] |

| Data Privacy for Public Companies | Non-financial public companies must limit data use and avoid cross-selling | 4(a)(12)(B)(II) | Civil fines up to $100,000/day [6(b)(5)] |

| Custody Protection | Customer assets must be segregated and protected from issuer’s creditors | 10(b)(2) | Civil fines up to $100,000/day [6(b)(5)]; Cease-and-desist orders [6(b)(2)] |

8. What prudential and supervisory requirements must stablecoin issuers meet under the GENIUS Act?

Issuers need to follow regulator-set rules on capital, liquidity, and risk management, plus Bank Secrecy and sanctions laws.

| Requirement | Details | Section in Act | Penalties for Non-Compliance |

|---|---|---|---|

| Criminal Penalties | Executives filing false reports face criminal penalties | 4(a)(3)(C) | Criminal penalties under 18 U.S.C. §1350(c) (fines + up to 5 years imprisonment) |

| Capital/Liquidity/Risk Management | Regulator-tailored requirements for safety and soundness | 4(a)(4) | Civil fines up to $100,000/day [6(b)(5)]; Cease-and-desist orders [6(b)(2)] |

| AML/Sanctions Compliance | Issuers must comply with Bank Secrecy Act and sanctions laws | 4(a)(5) | Criminal penalties for BSA violations; Civil fines up to $100,000/day [6(b)(5)] |

9. What penalties are enforced for non-compliance?

Penalties for non-compliance under the GENIUS Act include daily civil fines (up to $200,000 per day for knowing violations), criminal penalties (up to $1,000,000 and 5 years imprisonment), $500,000 fines for misrepresentation, executive liability for up to six years after leaving the company, and strong regulatory enforcement powers including cease-and-desist, removal from office, and bankruptcy priority for stablecoin holders ([Sections 3(f), 4(a)(3)(C), 4(e), 6(b)(2), 6(b)(5)(E), 11]).

10. What’s banned under the GENIUS Act?

- Issuing payment stablecoins without federal/state approval.

- Falsely claiming stablecoins are FDIC-insured, government-guaranteed, or legal tender.

- Labeling any product as a “payment stablecoin” without GENIUS Act compliance.

- Algorithmic stablecoins – TerraUSD-style stablecoins aren’t considered “payment stablecoins” and are effectively banned.

- Issuers can’t pay holders interest or yield just for holding stablecoins.

- Forcing customers to buy extra products to get services (tying).

- Using terms like “United States Government” in stablecoin names or marketing to suggest official backing.

- Anyone convicted of financial felonies like fraud or money laundering can’t be an officer or director.

What developers & companies outside the US need to know ⬇️

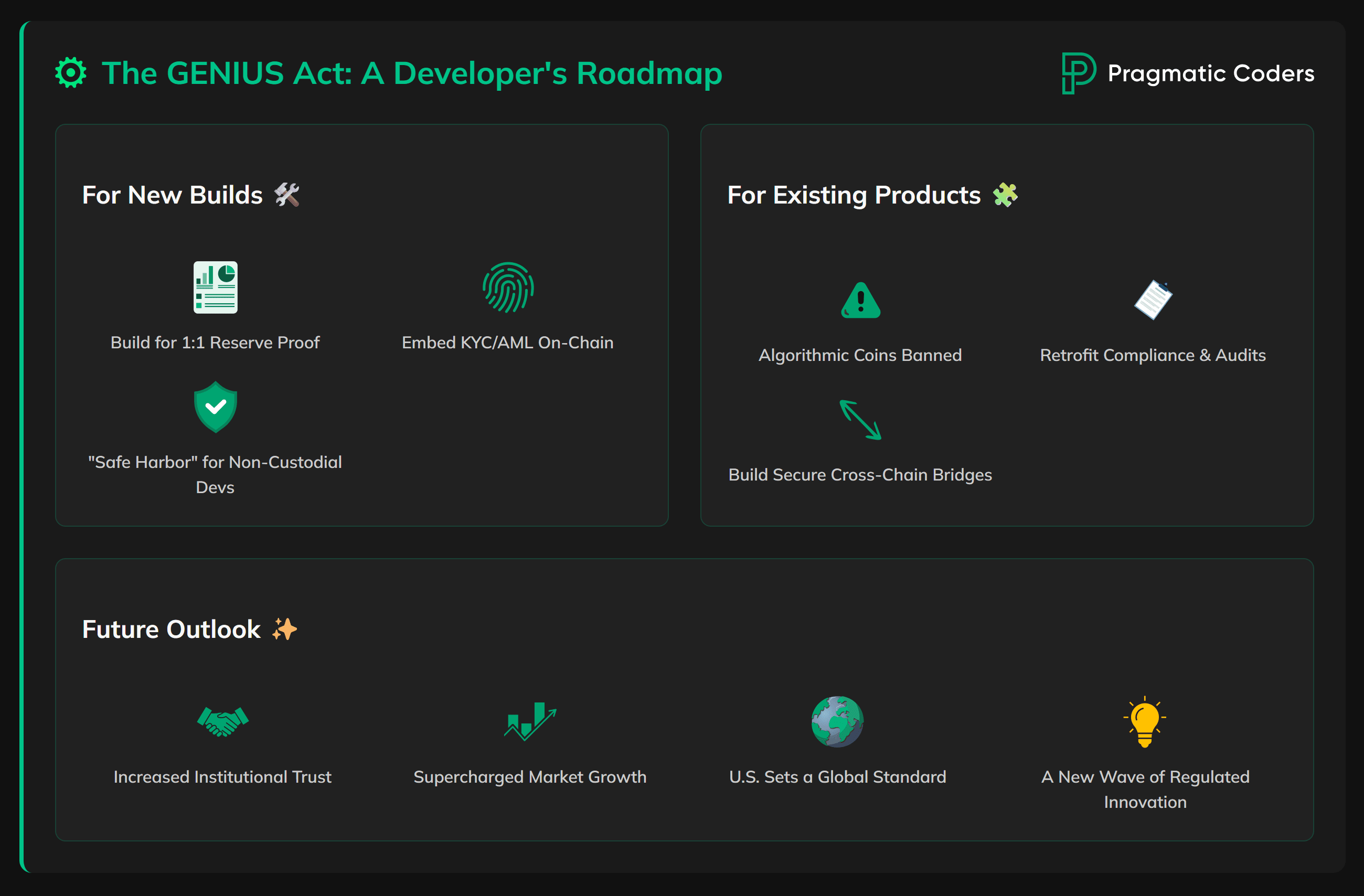

11. How does the GENIUS Act impact blockchain development?

The GENIUS Act brings tighter rules to stablecoins. This means that developers will face new compliance steps. Yet, on the other hand, we can count on a great mainstream adoption of stablecoins as they become more reliable.

How is the GENIUS Act Affecting Current Blockchain Development?

Stablecoins now have to be backed 1:1 with liquid assets like cash or Treasury bills. That means more work for developers, who need to build systems that track and prove reserves in real time – transparency is now part of the product.

Compliance is changing too. KYC and AML checks used to happen off-chain or through partners. Now apps have to follow the rules from the ground up.

The good news: the Blockchain Regulatory Certainty Act says devs who don’t control user funds don’t need a money transmission license. Specifically, this applies to anyone who:

(A) develops, publishes, or maintains distributed ledger protocol software or self-custodial software interfaces;

(B) develops, operates, or maintains a distributed ledger protocol; or

(C) validates transactions or operates a distributed ledger.

More: Sections 4 & 7

What’s Happening to Existing Blockchain Products?

Projects using stablecoins—especially in DeFi—are facing new rules. Many now have to bolt on compliance features they never needed. Algorithmic stablecoins like TerraUSD are basically banned, which could kill off some DeFi models. But clearer rules might bring in big institutional money.

Stablecoin payments (over 60% of on-chain volume) are shifting from experimental technology to real financial tools. As a consequence, teams need to add monitoring, reporting, and audits from the start.

Cross-chain stablecoin moves are also becoming more complex. Every chain involved has to meet the same rules, making bridges more complex, but also more trustworthy and scalable.

What does it mean for the future of blockchain development?

The most important mindset shift for developers is clear: compliance must be built in from day one. The GENIUS Act makes it clear – if your app touches money (be it a DAO, on-chain payroll, or a token-gated service), it needs a compliance-first approach.

Long-term, this clarity could supercharge growth. Analysts predict that the stablecoin market could reach $2 trillion within the next decade if President Trump signs the act.

Globally, the U.S. is effectively setting the tone for how crypto is regulated. It’s likely that many countries will adopt similar models, giving developers who solve these challenges now a competitive edge worldwide.

What’s coming? Legally sound blockchain finance—programmable money, tokenized assets, and smart wealth tools. Plus, a new race: building privacy-friendly tech that still meets regulations.

More: Section 4

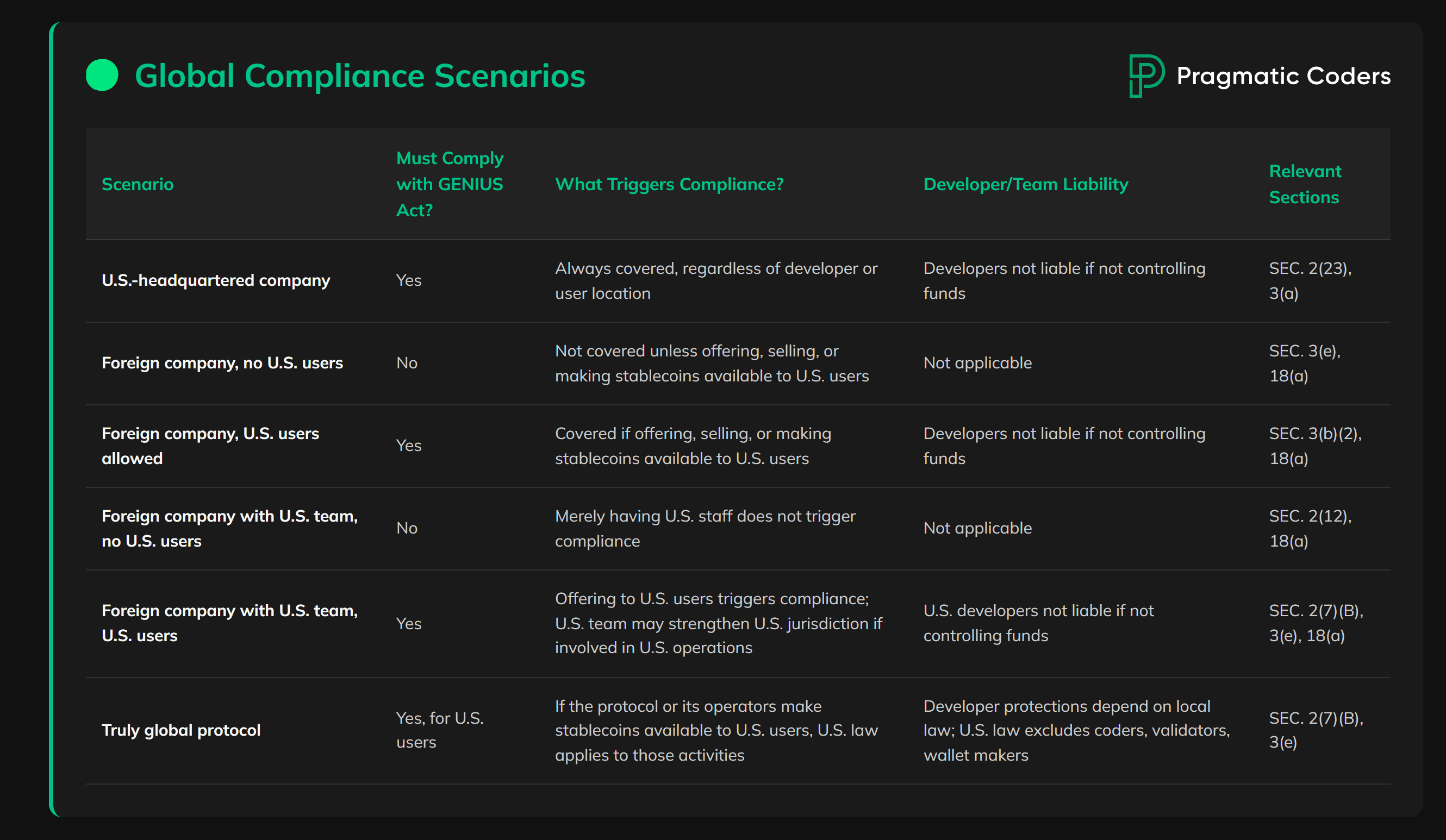

12. How does the GENIUS Act Affect Companies Worldwide?

The GENIUS Act doesn’t just impact U.S. companies – it has global reach that affects foreign businesses and development teams too. Here’s what you need to know:

Scenario 1: Foreign Companies Wanting U.S. Customers

If a company outside the U.S. wants Americans to use their stablecoins, they must play by U.S. rules. They need to:

- Register with U.S. banking regulators (OCC – Office of the Comptroller of the Currency)

- Allow U.S. officials to inspect their operations

- Hold cash reserves in U.S. banks

- Follow U.S. sanctions (can’t be from restricted countries like Russia or Iran)

Real impact: Big players like Tether must comply if they want American users.

Scenario 2a: U.S. Companies with Overseas Teams

If your company is based in the U.S. but has developers in Europe or elsewhere:

- The U.S. company must follow GENIUS Act rules

- Foreign developers are protected if they don’t control user money

- Development location matters less than where the company is headquartered

Example: A New York company with programmers in Germany must comply fully, but those German coders aren’t liable for money transmission rules.

Scenario 2b: Overseas Companies with U.S. Teams

If your company is incorporated outside the U.S. but employs developers or staff based in America:

- The overseas company must comply with GENIUS Act rules if it offers stablecoins to U.S. customers

- The presence of a U.S. team does not automatically make your company a “U.S. issuer,” but it can strengthen regulatory ties to the U.S. If your U.S. staff are involved in operations, marketing, or support for U.S. users, regulators may treat your business as actively engaging in the U.S. market.

- Development location matters less than where the company is legally based, but U.S. authorities may assert jurisdiction if your U.S. team is key to serving American users.

Example: A Singapore-based company with engineers in California must comply with the GENIUS Act if it serves U.S. customers, but those California developers are not personally liable for money transmission rules if they do not control user funds.

Scenario 3: Truly Global Protocol

If your product operates across many countries and serves users worldwide:

- Rules apply where users/nodes are concentrated, regardless of where the developers or company are based

- Multiple countries’ laws might apply simultaneously

- Developer protections vary by location

More details for all scenarios: Sections 2 & 3

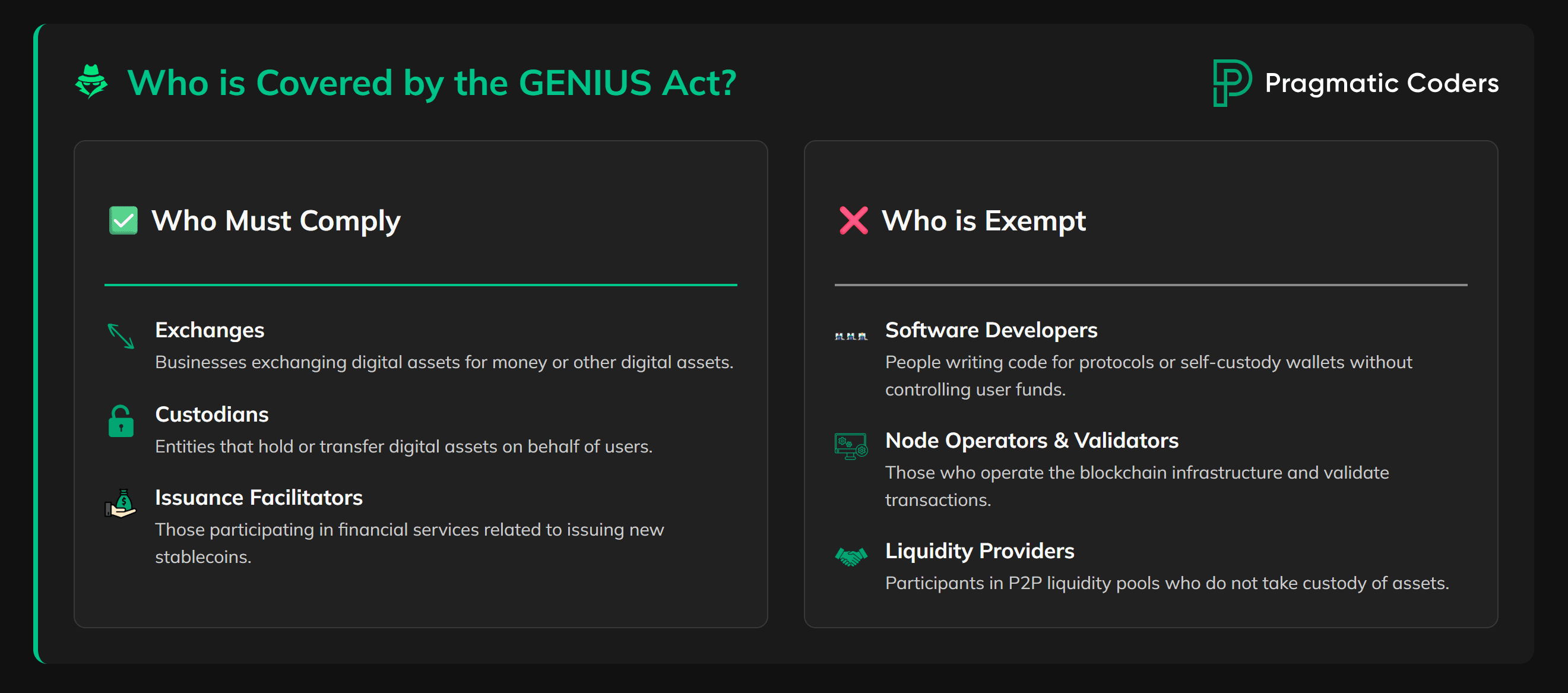

13. Who is and isn’t now covered by the GENIUS Act in the crypto space?

The GENIUS Act covers stablecoin issuers and intermediaries who exchange, transfer, or custody digital assets for others, but does not cover coders, node operators, or wallet makers who do not control user funds

(A) Who is covered (“digital asset service provider” means…)

A person or business is a digital asset service provider if, for compensation or profit, they conduct any of the following activities in the United States (including on behalf of U.S. customers or users):

- Exchanging digital assets for money (e.g., crypto-to-fiat exchanges)

- Exchanging digital assets for other digital assets (e.g., crypto-to-crypto exchanges)

- Transferring digital assets to a third party (e.g., payment processors, custodians who send assets on behalf of users)

- Acting as a digital asset custodian (e.g., holding crypto on behalf of others)

- Participating in financial services relating to digital asset issuance (e.g., underwriters, certain facilitators of new token offerings)

(B) Who is NOT covered (explicit exclusions)

The following are not considered digital asset service providers (and thus are not regulated as such by the Act):

- A distributed ledger protocol (the protocol itself is not regulated)

- Developers/operators of distributed ledger protocols or self-custodial wallet software (writing code, building open-source/self-custody wallets, or running the protocol is not regulated)

- Immutable and self-custodial software interfaces (wallets/interfaces that do not take custody or control)

- Validators and node operators (those validating transactions or operating the blockchain infrastructure)

- Participants in liquidity pools or similar mechanisms for peer-to-peer liquidity (e.g., providing liquidity to DEXs, as long as they don’t take custody/control)

Practical Impact

- Centralized exchanges, custodians, and payment processors are regulated as digital asset service providers.

- Software developers, protocol maintainers, node operators, and self-custody wallet providers are explicitly excluded from this regulatory definition, unless they also engage in the regulated business activities above.

More: Section 2(7)

14. If I’m a developer or tech provider outside the U.S., do I need to follow GENIUS Act’s rules?

If you are solely writing code, providing self-custody wallet software, or operating validator nodes—and do not control user funds, issue stablecoins, or otherwise act as a financial intermediary—you are explicitly excluded from the GENIUS Act’s regulatory requirements, even if you serve U.S. customers. (2(7))

What are the anti-money laundering (AML) requirements?

Stablecoin issuers must comply with AML standards, including:

- Customer identification and verification

- Transaction monitoring

- Reporting suspicious activities

- Sanctions compliance

15. How does the U.S. decide if it can regulate a foreign crypto company or project?

If your business has significant operations that touch the U.S.—such as marketing to U.S. users, processing U.S. customer payments, or making your service available to U.S. persons—U.S. rules can apply, even if the company is foreign-based or the infrastructure is outside the U.S.

More: Section 3(e)

Here’s an alphabetical list of terms useful for analyzing the GENIUS Act.✨Glosssary

- Learn more about the MiCA blockchain regulation.

✅ GENIUS Act-compliant blockchain software development

We’re one of the first blockchain software development companies in Europe. We’ve worked on multiple blockchain projects (here are some). Need to improve your current stablecoin product or build a new one ? Work with experienced developers who know how to comply with the GENIUS Act – just contact us.