Core Banking System: A Breakdown of Software and Solutions

In today’s fast-paced financial world, core banking systems are essential. They are the backbone of a bank’s operations, handling daily transactions, managing accounts, and providing various banking services. Understanding what these back-end systems are and why they are crucial offers insight into modern banking. In this article, we’ll help you gain such insight.

Key Points

|

Definition of Core Banking System

A core banking system is the technological foundation of a bank. It’s a system that processes daily transactions, manages accounts, and enables banking services. It acts like the central nervous system of a bank, ensuring smooth operations.

These systems handle an array of essential functions. They process deposits and withdrawals, manage loans and credits, and update customer information. They provide real-time processing, allowing 24/7 access to accounts and operations, whether in-branch, online, or via mobile apps.

Such banking infrastructure is complex and integrates various software components. These include databases, application servers, web servers, and firewalls. Each part is vital for maintaining the system’s functionality and security.

Importance in Modern Banking

Core banking systems are critical for banks today. They enhance operational efficiency by automating manual processes, reducing errors, and speeding up transfers. This automation helps retail banks cut costs and improve service delivery, making them more competitive.

Customer satisfaction is another key benefit. With a robust core banking framework, banks offer seamless services across multiple channels. Customers can easily access accounts, make transfers, and manage finances. This convenience boosts customer loyalty and attracts new clients.

Furthermore, such systems support overall financial stability. They ensure accurate record-keeping and compliance with regulations. This reliability is essential for maintaining trust with customers and regulatory bodies.

As a fintech software development company, we create innovative applications that leverage existing core banking systems. We specialize in mobile and web apps for banking, payment processing, and financial management, integrating advanced technologies like AI, blockchain, and machine learning. By integrating these advanced technologies with core systems, we help banks provide better services and ensure a secure, efficient financial environment for their customers.

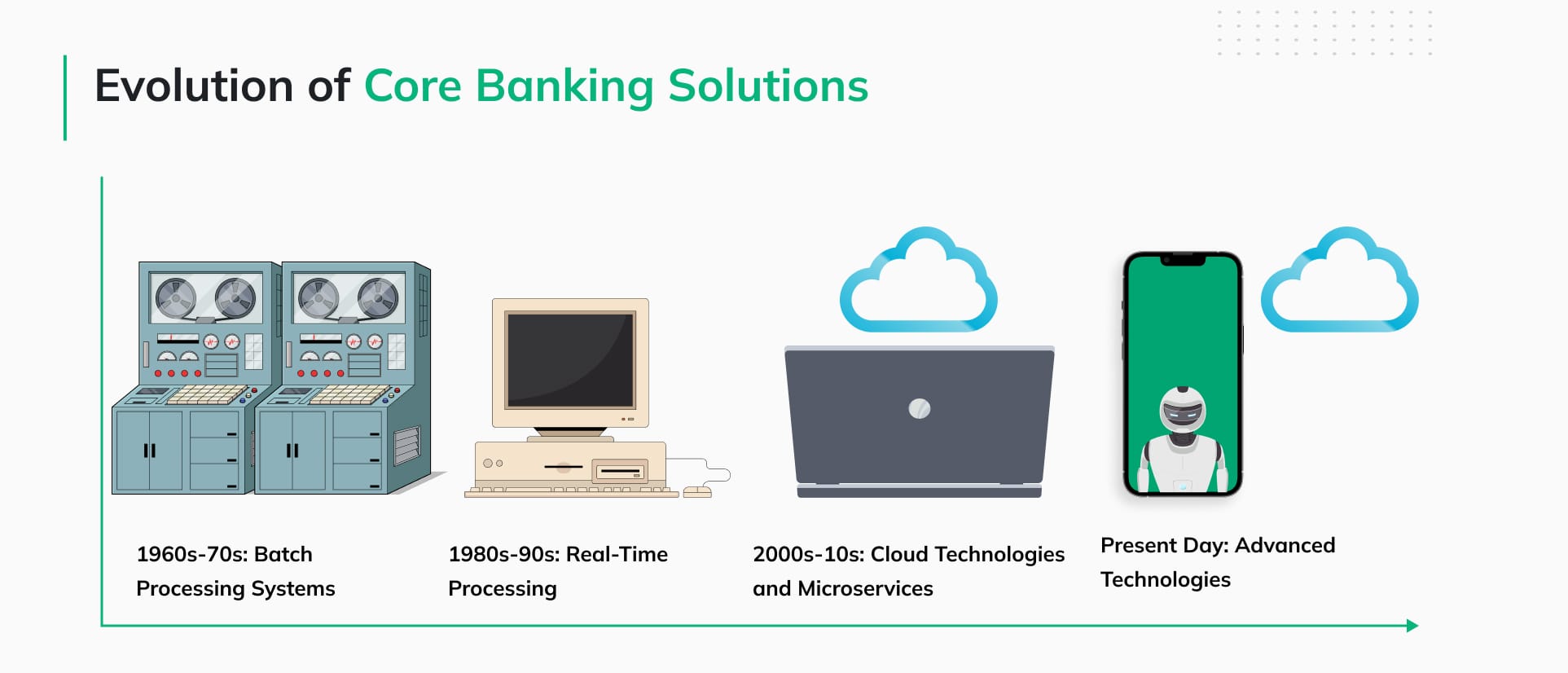

Evolution of Core Banking Solutions

Such systems have evolved greatly over the decades, driven by technological advancements.

1960s-70s: Batch Processing Systems – Initially, core banking relied on batch processing systems. Mainframe computers and COBOL programming were used. Transactions were processed in batches, often overnight. This method was efficient but lacked real-time capabilities and flexibility.

1980s-90s: Real-Time Processing – In the 1980s and 90s, real-time processing was introduced. N-tier architectures emerged, separating business logic from data access layers. This allowed for more dynamic and responsive banking operations. Front-office applications and online banking transformed customer interactions, offering immediate access to services.

2000s-10s: Cloud Technologies and Microservices – From the 2000s to the 2010s, they adopted cloud technologies and microservices. These innovations broke down monolithic systems into smaller, manageable services. Cloud computing reduced costs, improved scalability, and enhanced disaster recovery. Integration with fintech solutions expanded the range of services, making banks more competitive and flexible.

Present Day: Advanced Technologies – Today, core financial systems use advanced technologies like artificial intelligence, machine learning, and blockchain. Cloud-native solutions offer unmatched scalability and accessibility. These technologies enhance data analytics, customer service, and security, making banking operations more agile and customer-focused.

Key Components of Core Banking Systems

Banking systems have essential components that ensure smooth banking operations. These manage everything from account services to regulatory compliance, forming the backbone of modern financial institutions.

Account Management

Account management is a fundamental feature here. It handles the lifecycle of customer accounts, from opening to closing. This component manages customer information, tracks account balances, and oversees account activities. The system keeps account details up-to-date and securely stored, giving customers reliable access to their financial information.

Daily Banking Transactions

Processing daily banking transactions in real-time is critical. This includes deposits, withdrawals, fund transfers, and bill payments. Real-time processing provides immediate activity updates and accurate account balances. This component offers quick and seamless payment services, enhancing customer satisfaction.

Loan and Credit Processing

Core banking software also manages the complexities of loan and credit processing. This covers the entire loan lifecycle, from application to repayment. The system automates credit scoring and risk assessment, ensuring efficient and low-risk loan processing. Streamlined processes lead to quicker loan approvals and better credit portfolio management.

Customer Relationship Management (CRM)

Integration with CRM tools is another vital component of such systems. CRM integration stores and manages customer data, including operation histories and personal information. This data helps banks offer personalized services and targeted marketing. Better customer service capabilities increase loyalty and satisfaction.

Risk & Compliance Management

Risk and compliance management is a must for security and regulatory adherence. Core banking systems monitor transactions for fraud, manage anti-money laundering (AML) and know-your-customer (KYC) processes, and ensure compliance. This component helps banks mitigate risks and protect customers from financial crimes.

Benefits of Core Banking Systems

Core banking systems offer many benefits that improve the function and efficiency of modern banks. Here are some key advantages:

Improved Customer Experience

Core banking systems greatly improve the customer experience. They provide features like 24/7 online banking and mobile apps. Customers can access their accounts and make transfers anytime, anywhere. This convenience leads to higher customer satisfaction and loyalty. Offering seamless digital services helps banks meet the expectations of tech-savvy customers and stay competitive.

Operational Efficiency

Automation is a key feature of core banking systems. By automating manual processes, banks can reduce costs and minimize errors. Tasks like transfer processing, account management, and compliance reporting are streamlined. This frees up staff to focus on more valuable activities. Increased efficiency cuts costs and speeds up service delivery, making operations more responsive and reliable.

Scalability and Flexibility

Core systems are built to grow with the bank. They can handle more operations and support new branches or services. This scalability is crucial for banks looking to grow and adapt to market changes. Additionally, these systems offer flexibility, allowing banks to integrate new technologies and services easily. Such adaptability ensures that banks can continuously innovate and meet the evolving needs of their customers.

Enhanced Security

Security is a top priority in core banking systems. They use advanced measures like data encryption, multi-factor authentication, and intrusion detection. These features protect customer data and ensure secure transactions. Compliance with regulatory requirements is also a key aspect, as these systems help banks adhere to laws and regulations, thereby maintaining trust and avoiding legal penalties.

Cloud Core Banking Services

Cloud-native core banking solutions represent the next evolution in banking technology. These systems utilize cloud computing to offer banking services through internet-based platforms. This shift to the cloud brings numerous benefits:

- Cost savings are significant. Cloud-based systems reduce the need for expensive hardware and maintenance. Banks can adjust computing resources based on demand, paying only for what they use. This flexibility is better than legacy banking systems that need big upfront investments and ongoing costs.

- Scalability is a major benefit. Cloud platforms handle increasing transaction volumes easily as banks grow. They support new services and branches without big infrastructure changes. This is crucial for banks that want to grow and adapt quickly.

- Accessibility is greatly enhanced. Cloud systems provide 24/7 access to banking services from any location with internet. This ensures that customers and bank employees can access the system anytime, anywhere, which is vital for modern, global banking operations.

Adoption Challenges and Solutions

While the advantages are clear, adopting cloud-based banking comes with its challenges.

- Data migration is a major hurdle. Moving large amounts of data from old systems to the cloud needs careful planning to avoid data loss. Banks should do thorough data audits and cleanups before migration. Using phased migration strategies can help make the transition smoother.

- Regulatory compliance is another challenge. Banks must ensure their cloud solutions comply with industry regulations and standards. This includes maintaining data privacy and security standards required by laws like GDPR in Europe. Working with cloud providers that have strong compliance frameworks can simplify this process.

- Security concerns are critical. Security concerns are critical. Moving to the cloud brings new security risks, such as cyber-attacks and data breaches. In fact, cyber risk and data security are already the most prevalent threats to the banking sector. Banks need strong security measures, including data encryption and multi-factor authentication. Regular security audits and working with cloud providers that offer advanced security features can help mitigate these risks.

Core Banking Platforms and Software Providers

Several companies lead the core banking system market. Each offers unique features and benefits for different banking needs:

- IBM – IBM’s core banking solutions are robust and innovative. They use advanced technologies like AI and blockchain to improve banking operations. IBM’s platform is highly scalable and integrates well with other financial systems. This makes it a popular choice for large banks seeking to modernize.

- Fiserv – Fiserv is a top contender, recognized as “Best in Class” by the Aite Group. Its core platform focuses on API-enabled integration, responsive design, and a unified user experience. These features help banks streamline operations and improve customer engagement. Fiserv’s suite supports various banking functions, from payments to digital banking.

- Microsoft – Microsoft offers a strong core banking solution built on its Azure cloud platform. Known for scalability and flexibility, it provides advanced analytics, AI capabilities, and seamless integration with other Microsoft products. This makes it attractive for banks leveraging cloud technologies for better performance and innovation.

- Google Cloud – Google Cloud provides an excellent foundation for cloud-based core banking, emphasizing scalability and advanced data analytics. Its platform efficiently handles large transaction volumes and offers robust security features to protect financial data. It is preferred by banks looking to innovate with cutting-edge cloud technologies. Mambu’s SaaS Cloud Banking Platform is based on Google Cloud.

- Infosys Finacle – Infosys Finacle is a leader in the Gartner Magic Quadrant for Global Retail Core Banking. Its platform is known for composable technologies, cloud maturity, and supporting ecosystem innovations. Finacle supports a wide range of services, from retail to corporate banking, making it a versatile solution for banks of all sizes.

Future of Core Banking Software

Technological Innovations

Emerging technologies are set to transform back-end banking systems, bringing new efficiencies and capabilities. Here are some key advancements driving this change:

- Artificial Intelligence and Machine Learning – AI and machine learning are revolutionizing data analytics in banking. These technologies enable banks to predict customer behaviors, detect fraud in real-time, and provide personalized financial advice. By analyzing vast amounts of data, AI can identify patterns and trends that human analysts might miss, enhancing decision-making and operational efficiency.

- Blockchain – Blockchain technology offers a new level of transparency and security for financial transactions. Its decentralized nature reduces the risk of fraud and ensures that all transactions are recorded in a tamper-proof ledger. This technology is particularly useful for cross-border payments, as it can significantly reduce transaction times and costs.

- Open Banking – Open banking is reshaping the banking landscape by allowing third-party developers to build applications and services around a financial institution. This trend promotes innovation and competition, leading to better services for consumers. Open banking APIs enable seamless integration with fintech applications, expanding the range of financial products and services available to customers. Additionally, Banking as a Service (BaaS) further enhances this landscape by enabling non-bank companies to offer financial services through these APIs, providing more customized and diverse banking solutions.

Market Trends and Predictions

- Increased Collaboration with Fintech – Studies show that banks are working more with fintech companies. This helps them use new solutions quickly. Fintech partnerships let banks offer new services without building them in-house. These partnerships improve digital offerings and customer experience. They also help all parties stay competitive.

- Rise of Digital-Only Banks – Digital-only banks, or neobanks, are becoming more popular. They operate online without physical branches. Customers use mobile apps for a wide range of services. Lower costs allow these mobile banking providers to offer competitive rates and fees. The global market volume of neobanks was estimated at 4.96 trillion U.S. dollars in 2023, and it is projected to grow to 10.44 trillion U.S. dollars by 2028, showcasing their rapidly increasing popularity and adoption.

- Focus on Cybersecurity – As financial services undergo digital transformation, cybersecurity becomes more important. Protecting customer data and securing transactions are top priorities. Advanced security measures like biometric authentication, encryption, and securing APIs are now standard. Banks invest in strong cybersecurity frameworks to detect and respond to threats quickly.

- Sustainability and Ethical Banking – Sustainability is a growing concern for banks and customers. Being one of the biggest subsegments of the climate fintech market, the banking sector, it plays a key role in addressing climate change. Banks are using environmental, social, and governance (ESG) criteria in their operations. Ethical banking practices, like transparent fees and sustainable investments, are important to consumers. These practices influence customer choices of financial institutions.

Conclusion

Core banking systems are the backbone of modern banking. They process transactions, manage customer accounts, and support many services. These systems have evolved from simple batch processing to advanced cloud-based solutions. They now use AI, machine learning, and blockchain. Such systems offer many benefits. They improve customer experience and operational efficiency. They also provide scalability, flexibility, and strong security measures.

The future of core banking looks promising. Technological innovations and market trends will drive continuous improvement. Banks that embrace these changes will better meet customer needs and stay competitive. As banking transforms, core banking systems will remain essential for providing secure and efficient services.