Bank API Integration: A Complete Guide to Open Banking APIs

We’ve all grown accustomed to having real-time access to data, especially in banking. Today, we all expect instant information to manage our finances effectively. And we’re not just talking about banking apps; we’re talking about all kinds of financial applications (check out our article about embedded finance for more info). Knowing this, providers are actively seeking bank APIs that will let them satisfy these demands.

This article will be your step-by-step guide to API banking. You’ll learn what bank APIs are, how they work, and the benefits they offer. We’ll also walk you through the process of integrating them into your systems, complete with real-life examples. By the end, you’ll have a clear understanding of how to leverage bank APIs to enhance your financial services and meet your customers’ expectations.

Key Points

|

What is Bank API?

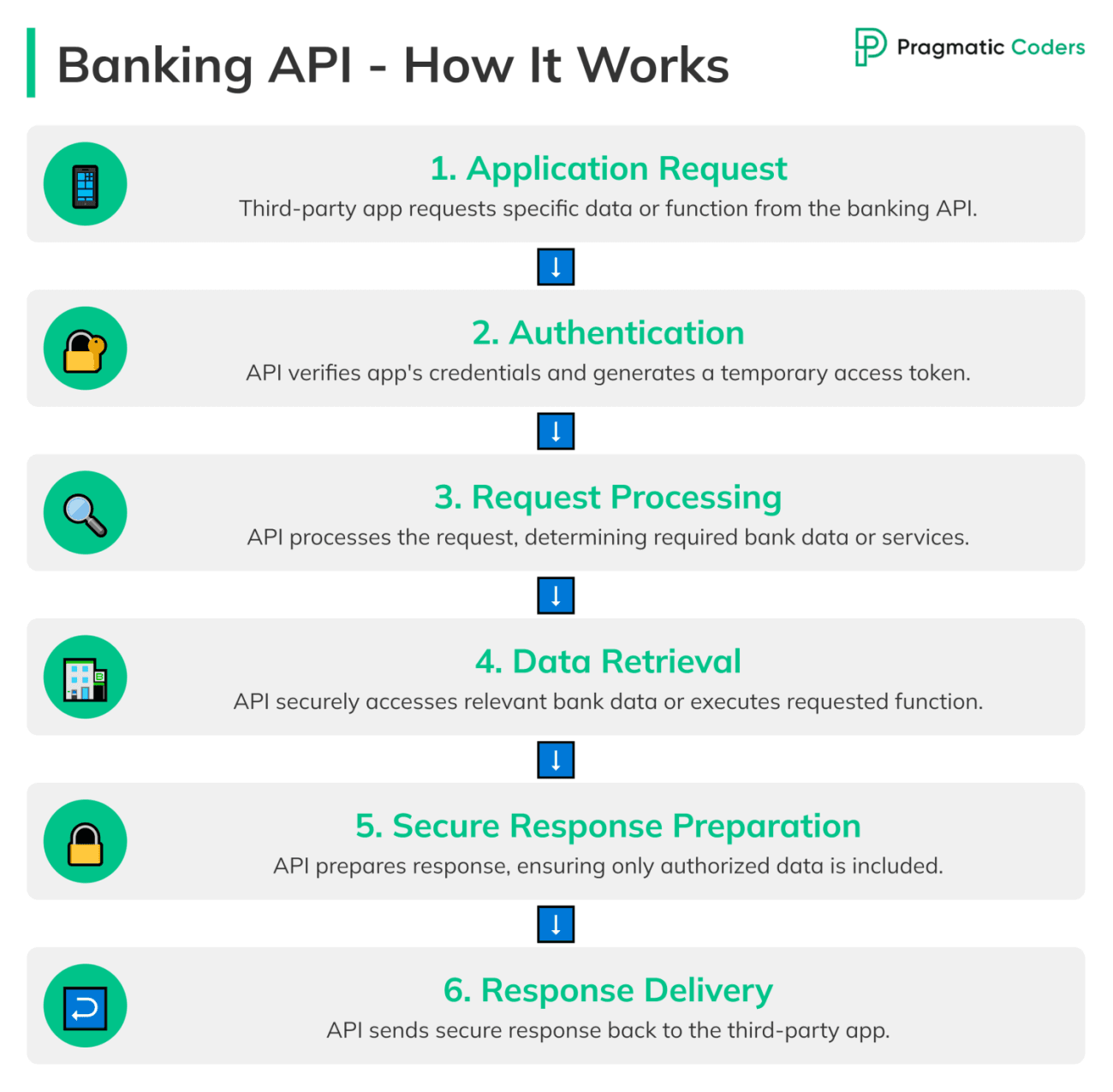

API stands for Application Programming Interface. It’s a way for different software systems to talk to each other and share data. In the context of online banking, API integration allows different financial systems, apps, and platforms to connect seamlessly.

Think of it like this: APIs are the digital bridges that link your bank’s core system to other applications. For example, when you use a budgeting app that connects to your bank account, that’s API technology at work. The app can pull in your transaction data in real-time, giving you an up-to-date view of your spending.

Using bank APIs makes transactions more convenient, faster, and more secure. Instead of manually entering data or dealing with slow, outdated systems, everything works smoothly and automatically.

Types of Bank APIs

There are three main types of APIs used in banking: Private APIs, Partner APIs, and Open APIs. Each serves a different purpose and offers unique benefits.

Private APIs

Private APIs are used within a bank’s internal systems. They are not exposed to external developers or third parties. This API type helps banks improve their internal processes by allowing different departments to share data efficiently. For instance, a private API might connect the bank’s customer service platform with its transaction processing system, making it easier for representatives to assist customers.

Partner APIs

These APIs are shared with specific business partners. These are not open to the public but are available to select external parties that have a business relationship with the bank. For example, a bank might share its partner APIs with a mortgage company. This allows the mortgage company to access customer data, with the customer’s consent, to speed up the loan approval process. Partner APIs help banks and their partners provide better, more integrated services to their mutual customers.

Open Banking APIs

Open APIs, also known as public APIs, are available to external developers and third parties. These APIs are designed to encourage innovation by allowing developers to build new apps and services that can interact with the bank’s data and systems. For example, an open API might allow a fintech startup to create a new budgeting tool that integrates with various bank accounts. TAB Bank, for instance, uses open APIs to enable third-party developers to create new financial products that enhance customer experience. Open APIs are crucial for fostering a competitive and innovative banking environment.

Open Banking APIs: A Closer Look

Open Banking APIs share financial data in new ways. They go beyond standard public APIs by connecting banks to approved third parties under strict security rules. Customers can view multiple accounts in one place, track transactions in real time, and enjoy tailored financial tools. With this level of openness, banks collaborate with fintechs to craft fresh services that improve everyday banking and drive innovation.

The Saudi Arabian open banking market is particularly exciting. Since 2021, the Saudi Central Bank (SAMA) has followed a clear roadmap, leading to the Open Banking Framework in November 2022 and the Open Banking Lab in January 2023. These steps empower customers to share financial data safely with approved TPPs, fostering innovation, competition, and financial inclusion. Interested in learning more? Check out our list of 11 must-know Saudi Arabian open banking apps to see these developments in action.

Open Finance: Beyond Banking

Open Finance takes these ideas even further. It includes data from many financial sources, not just bank accounts. Think of insurance, mortgages, pensions, and even newer assets. This creates a single, holistic view of a person’s financial life. For example, you could track monthly bills, savings, and investments all in one app. This clarity often leads to smarter financial decisions and faster approvals for services like loans or insurance.

Regulations in Europe and the UK are fueling this shift. In the European Union, the Second Payment Services Directive (PSD2) requires banks to give licensed third-party providers secure access to customer account data. This fosters innovation, strengthens competition, and promotes robust security practices. Meanwhile, the UK’s Open Banking initiative started in 2016. It made the nine largest banks share their data with regulated third parties. They do this through standard APIs designed to ensure consistency and safety.

These measures highlight the benefits of data sharing when it’s done responsibly. As more financial institutions embrace Open Finance, consumers can expect better advice, smarter tools, and a smoother user experience. That’s the power of open data. It opens doors for fresh ideas, fairer competition, and a transparent ecosystem where all financial elements work together.

Benefits of Bank API Integration

Integrating bank APIs comes with numerous benefits for banks, developers, and customers. Let’s dive into these advantages to understand why API integration is a game-changer in the financial sector.

For Banks

- New Revenue Streams – Bank APIs can create new revenue opportunities. By offering APIs to third-party developers and businesses, banks can charge for access, creating a new income stream. For example, BBVA offers APIs for payments, identity verification, and financial data aggregation, generating revenue from these services. If you’re interested in developing your own APIs to unlock new revenue streams, our API development guide provides comprehensive steps to help you get started.

- Improved Customer Experience – APIs enable banks to offer more personalized and seamless services. For instance, using APIs, banks can integrate with personal finance management apps, providing customers with tools to better manage their money. This leads to higher customer satisfaction and loyalty.

- Increased Operational Efficiency – With API integration, banks can automate and streamline their operations. This reduces the need for manual data entry and minimizes errors. For example, an API can automatically update customer information across various systems, saving time and resources.

For Developers

- Faster Integration – APIs simplify the process of integrating banking services into applications. Developers can quickly connect their apps to bank systems without having to build complex infrastructure. This speeds up the development process and allows for faster deployment of new features.

- Access to Customer Data with Consent – APIs provide developers with access to valuable customer data, but always with the customer’s consent. This data can be used to create more tailored and relevant services. For instance, a budgeting app can access transaction data to offer personalized financial advice.

- Enhanced Reach and Growth Opportunities – By integrating with bank APIs, developers can reach a wider audience. They can offer their applications to the bank’s customer base, expanding their market reach. This is especially beneficial for fintech startups looking to grow their user base quickly.

For Customers

- Convenience and Efficiency – Bank APIs make financial management more convenient. Customers can use various apps and services that connect directly to their bank accounts, providing real-time updates and easy access to their financial information. This means no more manual tracking or waiting for bank statements.

- Personalized Financial Services – APIs allow for the creation of personalized financial services tailored to individual needs. For example, mobile banking apps can analyze spending habits and financial goals to offer customized investment advice. This helps customers make better financial decisions.

- Improved Financial Management – With API integration, customers have a comprehensive view of their finances in one place. Apps that use bank APIs can aggregate data from multiple accounts and financial institutions, providing a complete financial picture. This makes budgeting, saving, and investing more straightforward and effective.

How to Integrate a Bank API

Integrating a bank API might seem daunting, but with the right steps, it can be straightforward. Here’s a step-by-step guide to help you through the process.

Pre-Integration Preparation

- Assessing Business Needs – Before diving in, understand why you need the API. Are you looking to improve customer service, streamline operations, or develop new financial products? Identifying your goals will help you choose the right API and plan your integration effectively.

- Choosing the Right API Provider – Research and select an API provider that meets your business needs. Look for reliability, comprehensive documentation, and good support. Some popular providers include Plaid, Yodlee, and BBVA. Compare their features, pricing, and customer reviews to make an informed decision. Here’s a shortlist of some well-regarded banking API providers:

- Plaid: A data network and payments platform offering a user-friendly interface and strong financial institution coverage.

- Yodlee: Specializes in data aggregation and financial wellness tools, making it a good choice for those aspects.

- Tink (Visa): A European provider known for its strong security focus and open banking solutions.

- TrueLayer: Another European provider offering real-time transaction data and a developer-friendly API.

- Salt Edge: Provides a global open banking API solution with a focus on B2B use cases.

- Security Considerations – Security is paramount in banking. Ensure the API provider follows robust security protocols. While providers operate in a heavily regulated environment and most likely follow the highest security standards, the saying goes, “Trust, but verify.”

Integration Steps

- API Documentation Review – Start by thoroughly reading the API documentation provided by your chosen provider. This will give you a clear understanding of how the API works, what endpoints are available, and how to use them. For example, Plaid’s documentation offers detailed instructions and examples for integrating their services.

- Setting Up Development Environment – Next, set up your development environment. This includes installing necessary software, libraries, and tools. Ensure your system is configured correctly to handle API requests and responses. This step is crucial for a smooth integration process.

- Sandbox Testing – Before going live, use the sandbox environment provided by your API provider to test your integration. This allows you to simulate real-world scenarios without affecting actual data. For instance, you can test how your application handles different types of transactions or account information.

- Live Deployment – Once you’re confident in your testing, it’s time for live deployment. Deploy the API integration in a controlled manner, starting with a limited audience before rolling it out widely. Monitor the system for any issues and be ready to address them quickly.

Common Challenges and Solutions

- Data Standardization Issues – One common challenge is data standardization. Different banks may format data differently, which can cause issues in your application. To address this, implement data normalization processes that convert varied data formats into a consistent structure.

- Regulatory Compliance – Regulatory compliance can be complex. Ensure your integration adheres to relevant regulations such as PSD2 in Europe or the Dodd-Frank Act in the US. Work closely with legal experts to navigate these requirements and avoid penalties.

- Ensuring Seamless User Experience – A seamless user experience is critical. Ensure your application is user-friendly and performs well. For example, minimize load times and create an intuitive interface. Continuously gather user feedback and make improvements as needed. If you need expert help, discover our UX services for a smoother, more engaging user journey.

Bank API Integration with Pragmatic Coders

If you’re looking for expert assistance with bank API integrations, look no further than Pragmatic Coders.

At Pragmatic Coders, we focus on understanding your specific business needs. Our team works closely with you to assess your requirements and design a tailored integration plan. Whether you’re aiming to improve customer service, streamline operations, or launch new financial products, we have the expertise to help you achieve your goals.

Examples of Bank API Integration

Let’s look at some real-world examples to showcase the versatility of bank APIs. These show how different industries leverage bank APIs to improve services, streamline operations, and create new opportunities.

Payment Processing

- Uber – They use banking APIs to streamline payment processing for rides and other services. When a customer takes a ride, the banking API processes the payment securely and efficiently in the background. This seamless integration ensures that payments are quick, secure, and hassle-free for both riders and drivers.

- Shopify – an e-commerce platform, uses banking APIs to manage transactions for online stores. When a customer makes a purchase, the banking API processes the payment, whether it’s through credit cards, bank transfers, or other payment methods. This integration allows Shopify to offer a smooth and reliable payment experience to its merchants and their customers.

Personal Finance Management

- Mint – A popular personal finance app that uses bank APIs to aggregate data from various banks and financial institutions. By connecting to your bank accounts, Mint provides a comprehensive overview of your financial health. It tracks your spending, helps you set budgets, and offers personalized financial advice. This real-time data integration, made possible by APIs, allows users to manage their finances more effectively.

- Personal Capital – An app that uses banking APIs to provide financial planning and wealth management services. By linking to various bank accounts and investment portfolios, Personal Capital gives users a detailed view of their financial situation. The app uses this data to offer insights and recommendations for better financial management and investment strategies.

Business Financial Management

- QuickBooks – An accounting software widely used by small and medium-sized businesses. It uses bank APIs to connect directly to business bank accounts. This integration simplifies bookkeeping by automatically importing bank transactions into QuickBooks. For example, a business owner can see all their transactions in one place, categorize them for tax purposes, and generate financial reports effortlessly. This saves time and reduces the risk of errors.

- Xero – Another accounting software that leverages bank APIs to provide seamless financial management for businesses. By connecting to bank accounts, Xero imports transaction data automatically, allowing businesses to reconcile accounts, manage invoices, and track expenses efficiently. For instance, a business can instantly match transactions from their bank statement with those in Xero, ensuring their books are always up-to-date.

API Banking vs Open Banking

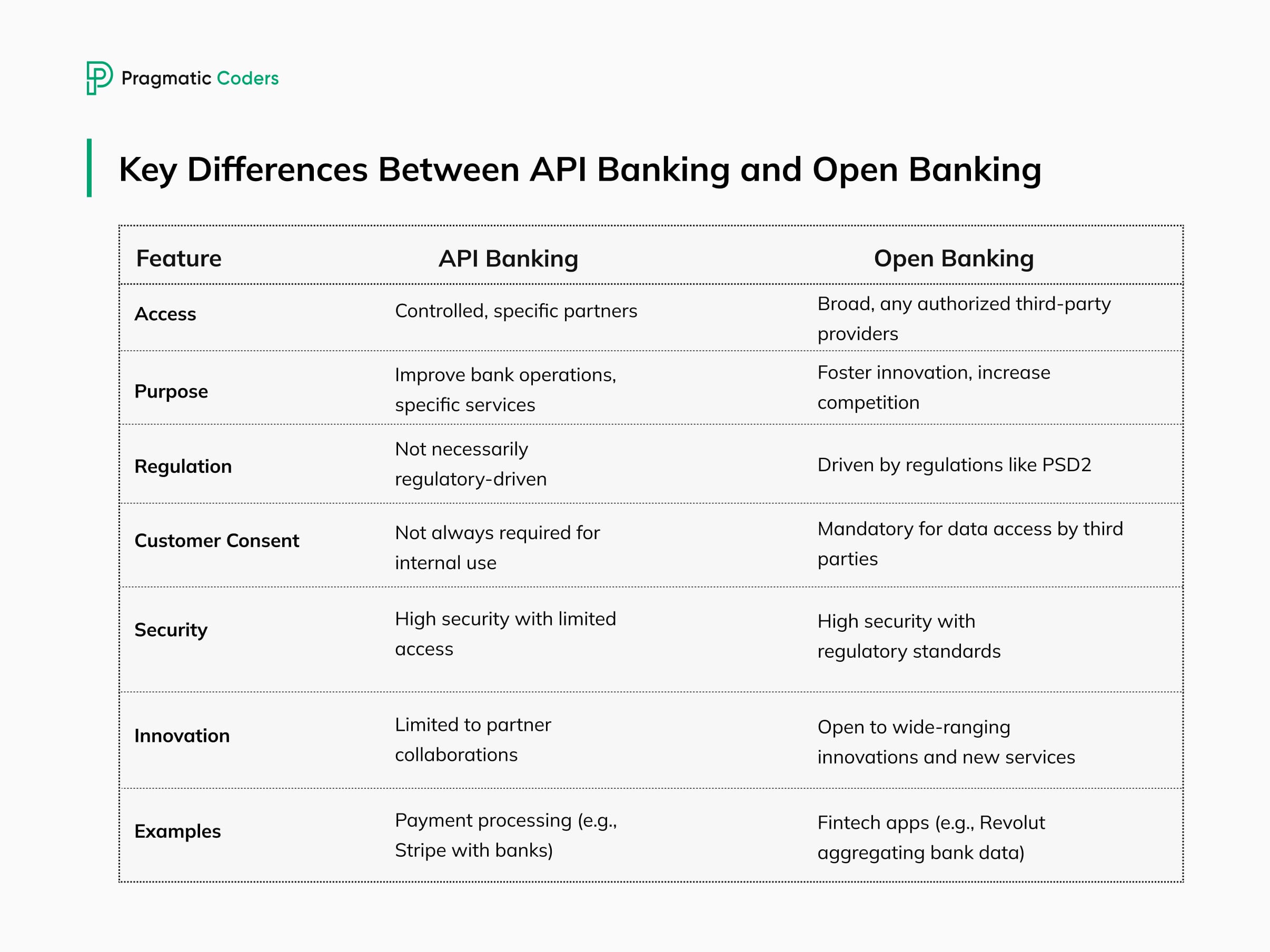

While API banking and open banking may seem similar, they have distinct differences. Understanding these differences can help you choose the right approach for your needs.

- API banking involves the use of APIs by banks to offer various services and functionalities. These APIs can be for internal use or shared with trusted partners. API banking is controlled and specific, often used to improve operations and customer services within a bank’s ecosystem.

- Open banking is a regulatory-driven initiative aimed at fostering competition and innovation in the financial sector. It requires banks to provide third-party providers with access to customer data and services through APIs, with the customer’s explicit consent. This model opens up the banking ecosystem to a broader range of developers and businesses.

Here’s a simple comparison to highlight the key differences:

Practical Implications

- API Banking: If a bank wants to improve its internal processes or work with specific partners, API banking is ideal. For example, banks use APIs to connect with payment processors like Stripe, ensuring secure and efficient transactions.

- Open Banking: For fostering innovation and allowing a broad range of financial services, open banking is more suitable. Companies like Revolut use open banking APIs to provide customers with comprehensive financial services by aggregating data from multiple banks.

Conclusion

Integrating bank APIs is a game-changer for financial services. It streamlines operations, creates new revenue streams, and enhances customer experiences. By leveraging bank APIs, you can improve your services and meet your customers’ expectations. Start exploring the possibilities today with our fintech software development services to take your financial solutions to the next level.