What is Embedded Finance? Everything there is to know

Welcome to the bustling world of embedded finance, a game-changer in how we interact with money in our daily lives. It’s like having a financial Swiss Army knife, always at your disposal, seamlessly integrated into the apps and services you use every day. This article unpacks this revolutionary concept, showing you why it’s much more than a fleeting trend.

Embedded Finance explained

Picture this: You’re buying a new gadget online, and bam, there’s an option to get a loan for it, right there and then. No need to hop over to a bank’s site or fill out tedious forms. Welcome to the world of embedded finance, where financial services aren’t just for banks anymore.

Embedded finance is all about sneaking financial services into places you wouldn’t expect them. It’s like finding a wallet in your new pair of jeans – convenient and a pleasant surprise. This concept is shaking up the old-school financial scene. Imagine getting insurance with your car rental or investing in stocks while checking your favorite shopping app. It’s happening, and it’s changing the game.

We’ve got different flavors of embedded finance. There’s embedded payments (think buying coffee with your phone), lending (those ‘buy now, pay later’ offers), insurance (get coverage for that new phone you just bought, on the spot), and even investments (making it rain in your savings account while you shop). These aren’t just add-ons; they’re becoming part of the experience.

What drives Embedded Finance?

So, what’s cooking behind the scenes? First off, technology is king. APIs (those digital handshakes that let different software talk to each other) and open banking (banks sharing your financial data, but only if you say so) are big players here. They’re like the conductors of an orchestra, making sure everyone’s in tune.

Cloud computing and big data analytics are the backbone. They’re like the stage crew, working in the shadows to make sure the show goes on without a hitch. This tech makes it possible to blend financial services into your digital life seamlessly. It’s like magic, but with servers and algorithms.

And let’s not forget us, the modern consumers. We’re not just looking for products anymore; we want experiences. Personalized, convenient, and right now. Embedded finance meets us where we are, in our digital haunts, offering the financial stuff we need in a way that feels natural. It’s like having a financial butler in your pocket, ready to serve.

How Embedded Finance affects the market

Think of embedded finance as the new kid on the block, the one who’s shaking things up in the traditional financial neighborhood. Banks and old-school financial institutions are sitting up and taking notice. Embedded finance adoption has become one of the main trends in the banking industry. Why? Because now, virtually any company can jump into the finance game. That’s right, your favorite online store or food delivery app could be your next financial service provider.

This shift is huge. It’s not just about adding more players to the game; it’s about changing the rules. Financial services are no longer a walled garden where only the big banks roam. They’re becoming a community park, open to all. This means more choices and, often, lower costs for you and me. Think of it as financial democracy in action.

But wait, there’s more. Embedded finance isn’t just about making things cheaper and more varied; it’s about fitting into your life like that favorite pair of jeans. Need a loan? Get it while you’re shopping online. Want insurance? Add it to your travel booking. It’s all about real-time solutions that make sense in the context of what you’re already doing. This approach is not just convenient; it’s changing how we interact with money. It’s like having a financial assistant tucked away in every app you use.

Types of Embedded Finance

Let’s dive into the different types of embedded finance. It’s like exploring different toppings for your favorite pizza – each adds a unique twist!

- Embedded Payments: This is the most common slice of the pie. Imagine buying a coffee through your favorite app – no cash, no card, just a tap on your phone and voila, it’s paid for. Apps like Starbucks and Uber have nailed this. It’s all about making payments so smooth, you barely notice them.

- Embedded Lending: Ever seen a ‘buy now, pay later’ option while online shopping? That’s embedded lending. It’s like having a friendly banker in your shopping cart, offering a quick loan to grab that new gadget you’ve been eyeing. Klarna and Afterpay are big names here. It’s lending made so easy, you might forget you’re borrowing!

- Embedded Insurance: This one’s like a safety net you didn’t know you needed. Booking a trip? Add travel insurance right there. Buying a phone? Get accidental damage cover as you check out. Companies like Lemonade are making waves here. It’s about slipping in peace of mind when you least expect it but most need it.

- Embedded Investment: This is for those who like their money to work while they shop. Imagine investing in stocks through your regular shopping app. Apps like Acorns make investing as easy as rounding up your change. It’s like planting a financial seed every time you spend.

- Embedded Banking Services: This is a bit like having a bank branch in your pocket. Digital banking services integrated into non-financial platforms. You could be managing your bank account while chatting on a social media app. It’s banking without the bank visit.

- Embedded Savings: This one’s like a piggy bank inside your usual apps. Save money while you’re doing everyday things. It could be rounding up your change or stashing away a few bucks every time you workout. It’s about making saving so automatic, you’ll hardly notice it.

- Embedded Cards: Picture having a credit or debit card offered by a non-bank brand. Think Amazon or Apple offering their own cards. It’s like your favorite brand extending their relationship with you into your wallet.

- Embedded Rewards: Here’s the cherry on top. Loyalty and rewards programs integrated right into your buying experience. It’s about earning points or getting special deals as you use an app or service. It’s turning loyalty into tangible benefits.

As you can see, embedded finance isn’t just one thing; it’s a spectrum of financial services sneaking into your everyday digital experience. Each type brings its own flavor, making our interaction with money more seamless, more integrated, and let’s be honest, a bit more exciting. So next time you’re using your favorite app, take a moment to appreciate the embedded finance magic happening right under your nose!

Real-life examples of Embedded Finance

Let’s paint a picture of embedded finance in the real world. It’s one thing to talk about it in theory, but seeing it in action is where the magic happens.

First up, e-commerce. You’re eyeing that fancy new gadget but short on cash? No problem. Many online stores now offer instant financing options. Just a few clicks and you’re sorted. No separate bank visit, no lengthy approval process. This is made possible by providers such as:

- Klarna: A Swedish financial services company that offers point-of-sale financing and installment plans to consumers.

- Affirm: A US-based fintech company that provides financing options for online and in-store purchases.

- Afterpay: An Australian fintech company that offers a “buy now, pay later” option for online purchases.

Travel booking platforms are getting in on the action too. Booking a trip? Why not add travel insurance to your purchase, right there and then? It’s about making your travel prep seamless and worry-free. Some of the booking platforms that offer embedded travel insurance are:

- Booking: The largest online travel agency in the world, offering accommodations, flights, tours, activities, and more.

- Expedia: A major online travel agency that provides a variety of travel products and services, including flights, hotels, rental cars, vacation packages, and more.

- Priceline: A discount travel website that allows users to name their own price for travel accommodations.

- CheapOair: An American online travel agency that offers a wide variety of travel products, including flights, hotels, cruises, and vacation packages.

- Trivago: A German metasearch engine for hotel bookings. It compares hotel prices from various websites and displays the best rates on its own website.

Ever taken a ride-hailing trip and marveled at how you just hop out at the end without fumbling for cash or cards? That’s embedded finance, making payments feel like they’re hardly there. Need some examples? Bet you’re already thinking of a few, but here they are anyway:

- Uber: A global ride-hailing company that connects riders with drivers through a mobile app. It is the largest ride-hailing company in the world, with operations in over 70 countries and over 110 million active riders.

- Lyft: Uber’s main competitor in the U.S. It is the second-largest ride-hailing company in the United States, with operations in over 600 cities and over 30 million active riders.

- Bolt: a European ride-hailing company that is expanding rapidly into new markets. It is the largest ride-hailing company in Europe outside of Russia, with operations in over 45 countries and over 40 million active users.

And let’s not forget retail stores. Many now offer branded credit cards, loaded with perks and rewards, making you feel like a VIP every time you shop. Here are some of them:

Embedded Finance trends

Alright, let’s zoom out a bit and look at the big picture. The embedded finance landscape is like a fast-moving train, and there are a few key drivers keeping this train on the tracks and speeding ahead.

First off, fintech companies. These are the trailblazers, the innovators in the room. They’re not just following trends; they’re making them. Fintechs are the ones pushing the boundaries, figuring out new, slick ways to integrate financial services into our digital lives. They’re the heart of this revolution.

Next up, open banking and Banking as a Service. This is a biggie. It’s all about banks opening up their data vaults (with your permission, of course) to let third-party providers in on the action. It’s like a financial data freeway, and it’s making all these cool embedded finance features possible.

Then there’s the cloud. Oh, the cloud. It’s the stage where this whole play unfolds. Cloud-based infrastructure means companies can scale up their embedded finance offerings without a hitch. It’s cost-effective, it’s flexible, and it’s powerful.

And we can’t forget AI. Artificial intelligence is adding the smarts to financial services. Imagine getting financial advice that’s tailored just for you, right when you need it. AI is making financial services not just more accessible, but also a lot more intelligent.

Embedded Finance: challenges and considerations

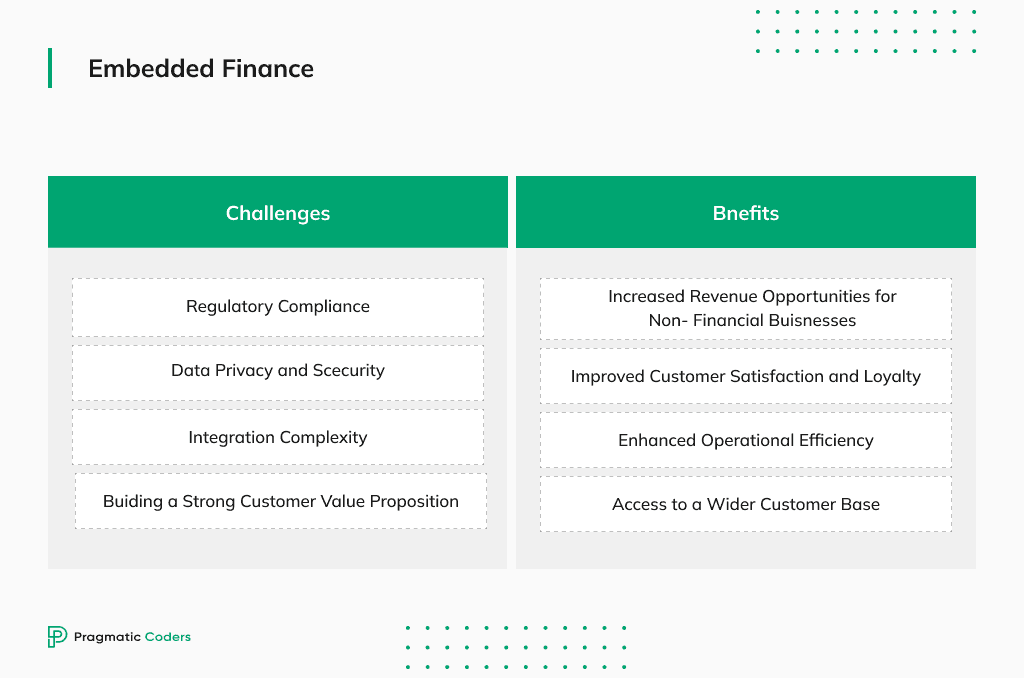

Now, it’s not all smooth sailing. With great innovation comes great challenges, and embedded finance has its fair share.

Let’s talk regulation. The finance world is a jungle of rules and regulations, and for good reason. But with embedded finance, staying compliant can be like walking a tightrope. Companies need to navigate this carefully to keep things above board.

Then there’s the integration challenge. It’s like fitting a square peg into a round hole. You’ve got financial services trying to blend seamlessly into non-financial platforms. It’s not just about making it work; it’s about making it feel natural. That’s easier said than done.

And lastly, the value proposition. This is the golden ticket. Companies need to figure out what makes their embedded finance offering stand out. It’s not just about adding a service; it’s about adding value. They need to answer the big ‘Why’: Why would a customer use this? Get this right, and you’ve hit gold.

But security can’t be overlooked. Embedded finance connects financial services across platforms, creating potential vulnerabilities. Open banking APIs, for instance, enable seamless transactions but can expose systems to cyber threats if not properly secured. Robust security isn’t optional—it’s essential. For more on securing these APIs, check out my article on open banking API security. In embedded finance, trust is everything, and one breach can shatter it.

How Embedded Finance boosts non-financial businesses

Let’s swing the spotlight onto non-financial businesses for a sec. These guys are finding a goldmine in embedded finance. It’s not just about adding a cool feature; it’s a strategic move.

First off, new revenue streams. It’s like finding a hidden path to a treasure trove. By adding financial services, businesses open up new ways to make money. Plus, this isn’t just about cash; it’s about loyalty. Offer your customers a loan, and they’re more likely to stick around and shop more. And speaking of new ways to generate income, understanding different monetization strategies is crucial.

Efficiency is another big win. Embedding finance smooths out a lot of financial wrinkles. It’s like ironing a shirt – suddenly, everything looks neater. Streamlining payments, credit checks, or insurance claims can save a ton of time and money.

And then there’s reach. It’s like shouting from the rooftops instead of just chatting with your neighbor. Embedded finance lets businesses reach a broader audience. Why? Because now, they’re not just selling products; they’re offering a whole financial package. It’s a game-changer.

Conclusions

So, what’s the big picture? Embedded finance is reshaping the way we think about developing fintech software. It’s a fundamental shift in how financial services are woven into our daily lives. From big banks to your local online store, it’s changing the game.

For non-financial businesses looking to jump on this train, remember: it’s about more than just technology. It’s about strategy, compliance, and adding real value to your customer’s experience.

The potential here is massive. We’re talking about a future where financial services are as ubiquitous and easy to use as sending a text message. For consumers, it means more choices, better access, and a whole lot of convenience.

Embedded finance isn’t just the future; it’s the present, and it’s redefining our financial world one transaction at a time. Stay tuned, because this story is just getting started.