Embedded insurance: All you need to know

Picture this: You’re booking a flight online, ready to get your dream vacation. As part of the process, a pop-up window appears, offering travel insurance that fits your trip perfectly. With just a few clicks, you get complete coverage that will give you peace of mind for the whole trip.

This is the essence of embedded insurance – making risk protection convenient, personalized, and accessible at our fingertips. You don’t need to go to another website or call an insurance agent; you get your insurance product right away.

In this article, you’ll learn what embedded insurance is and how it’s used in various industries. This is poised to become the next big thing in the tech industry, so don’t dilly-dally. Start looking for an insurance software development provider right now!

Key points

|

What is embedded insurance?

Goodbye, traditional insurance hassles!

Traditional insurance models often involve a laborious research process, comparison, and separate purchasing. This can be time-consuming, frustrating, and even discouraging, leading many consumers to forgo insurance entirely. Embedded insurance eliminates this hassle, weaving insurance seamlessly into our daily interactions.

Embedded insurance: definition

Embedded insurance is a new way to sell insurance by enabling third-party providers to integrate insurance products into a customer journey of non-insurance products or services.

Customers don’t have to switch apps or websites to buy insurance – they can get personalized coverage at a competitive rate right there, at the moment.

It’s worth noticing that embedded insurance, along with embedded lending or investment, is a subset of a bigger trend of embedded finance.

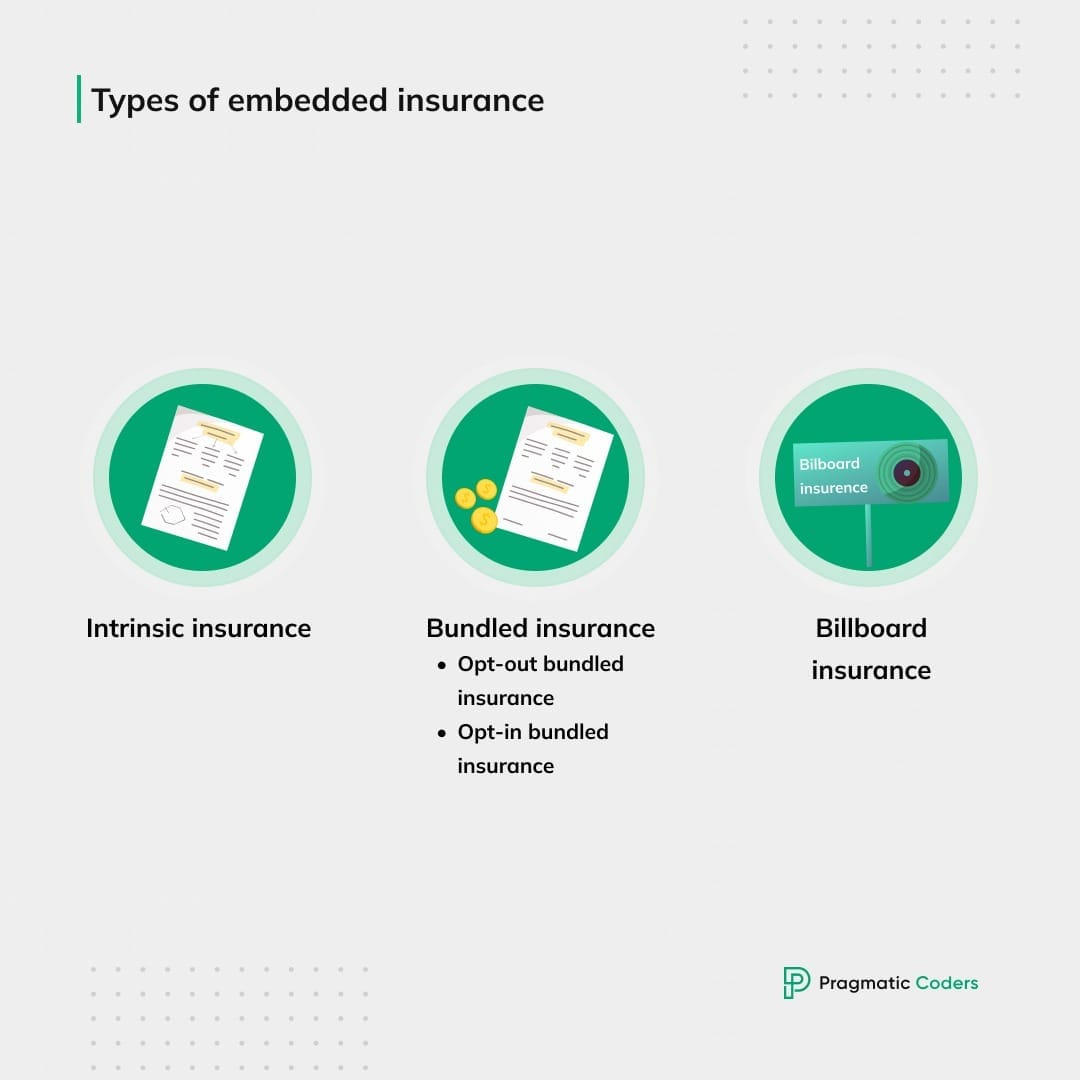

Types of embedded insurance

Embedded insurance comes in various forms, catering to different needs and preferences.

- Intrinsic insurance: The insurance coverage is built into the product or service itself. It’s typically offered as a warranty that is included with the product, as is often the case with electronics and automobiles.

- Bundled insurance: This is a type of embedded insurance where the insurance policy is bundled with the purchased product or service.

- Opt-out bundled insurance: The insurance coverage is automatically included with the product or service being purchased, but customers can opt-out if they do not want it. For instance, when purchasing expensive electronics from an e-commerce website, customers are automatically enrolled in a basic insurance plan that covers accidental damage, theft, or loss, but they can choose to opt out if they wish.

- Opt-in bundled insurance: The insurance coverage is not automatically included with the product or service being purchased, but customers can opt-in if they want it. For example, when you purchase a flight ticket, you may be offered the option to add on travel insurance.

- Billboard insurance: A type of embedded insurance that promotes insurance products alongside other services offered by a brand (insurance coverage does not go as an add-on to other services; it’s a standalone product).

Embedded insurance market

How big is embedded insurance?

The embedded insurance market is projected to expand significantly from its current size of USD 63.1 billion in 2022 to a staggering USD 482.8 billion by 2032, showcasing a remarkable growth rate of 22.6% over the decade. If you want to become a part of this rapidly growing niche, our insurance software development guide is a great place to start.

Embedded insurance per region

According to DataHorrizon Research, embedded insurance is especially big within the North American automotive industry. American car buyers are increasingly drawn to embedded car insurance because it allows them to customize their coverage to match their individual needs and preferences. It also gives them greater flexibility and control over their auto insurance plans.

Interestinly, consumers in the United States and Canada demonstrate a heightened interest in purchasing embedded insurance products from their banks, as these offerings are tailored to their individual needs and preferences based on their banking history. This makes it easier for people to get relevant insurance options, especially when making big purchases.

In the future, the Asia Pacific region is expected to see the fastest growth in embedded insurance. This is due to India and China’s growing population and insurance awareness.

Why embedded insurance is the future of insurance

Why is embedded insurance good? First of all, it lets you buy insurance right where you are without having to switch to another website or app.

However, its benefits extend far beyond convenience. It’s a win-win for businesses, consumers, and the insurance industry as a whole:

Benefits of embedded insurance for businesses

- New revenue streams: By offering insurance alongside their core products or services, businesses can tap into a broader market and generate additional revenue streams.

- Strengthened customer loyalty: Many customers feel more secure buying insurance from a brand they have an established relationship with. Already have a banking app developed? Good for you! Add an insurance solution to your offering, and you’ll foster stronger brand loyalty and customer experience.

Benefits of embedded insurance for consumers

- Unparalleled convenience: Embedded insurance makes it incredibly easy to purchase insurance without disrupting a purchase journey. Users can secure protection with a few simple clicks or taps right within the context of their interactions.

- Personalized protection: Embedded insurance can be tailored to specific customer needs and risk profiles, ensuring that customers are getting coverage that’s truly relevant to their circumstances. This can become a business game-changer if you target your product at customization-craving, tech-savvy Gen Z.

- Potential cost savings: Economies of scale and targeted marketing may lead to lower premiums for embedded insurance, making it an attractive option for many consumers.

Benefits of embedded insurance for the insurance industry

- Closing the global insurance protection gap: By integrating insurance into existing customer journeys, embedded solutions make insurance more seamless. They increase accessibility and address the affordability challenges that contribute to the global protection gap.

- Expanded market reach: Embedded insurance can broaden the reach of insurance products beyond traditional distribution channels.

Real-world examples of embedded insurance in action

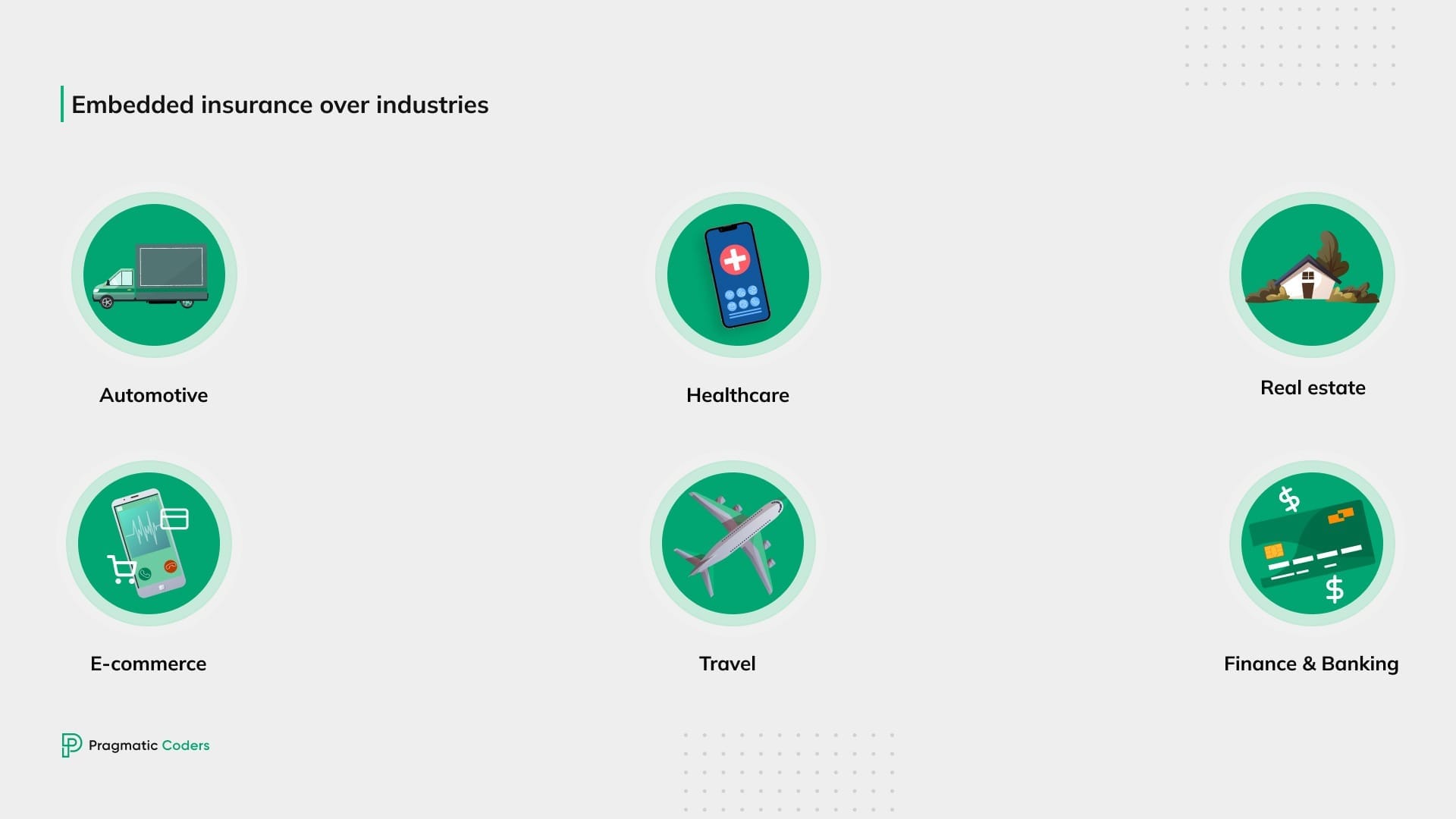

Embedded insurance is already transforming how we interact with insurance across various industries.

In the travel realm, Airbnb seamlessly integrates travel insurance into its platform, ensuring both hosts and guests are protected. Expedia makes it a breeze for travelers to add travel insurance during the booking process without having to leave their website or app. Alaska Airlines goes the extra mile by offering a travel insurance solution alongside flight bookings, covering potential disruptions like trip cancellations, medical expenses, and lost luggage.

When it comes to e-commerce, Amazon’s A-to-Z Guarantee program protects online purchases, covering items that don’t meet expectations, arrive damaged, or don’t arrive on time. In China, Taobao, Alibaba’s e-commerce platform, integrates insurance options for online purchases, adding another layer of security to online transactions.

The finance industry is joining the embedded insurance bandwagon, too. Neobanks (Revolut) are bundling insurance products like travel insurance alongside their financial services, providing a more comprehensive approach to customer protection. Other examples here include Bank Millenium (life insurance), or Union Bank of India with their care health insurance policy.

Navigating the embedded insurance hurdles

Embedded insurance, the innovative newcomer to the insurance landscape, is poised to revolutionize the industry. However, there are a few challenges that businesses and insurers need to overcome before embedded insurance can take off.

First, they must protect customer data from misuse. Second, they need to take care of user experience and find a way to integrate insurance into other products without making it too complicated for customers. And finally, they need to ensure they’re following all the rules and regulations that apply to insurance. How can they achieve this? Check our detailed guide on fintech software development to find out.

Conclusion: Embracing embedded insurance’s transformational power

As businesses and insurance companies embrace embedded finance, we can expect to see a future where insurance is seamlessly integrated into our daily lives, providing protection and peace of mind whenever we need it most.

Embedded insurance is not just a fintech trend; it’s a paradigm shift that will reshape how we interact with risk and insurance. By embracing embedded insurance, we can take control of our protection, ensuring that we’re always covered wherever life takes us.