Top 6 Fintech trends for 2024 and beyond

Fintech products are at the forefront of reshaping the financial landscape. They’ve come a long way from simple mobile banking tools to robust platforms and next-gen solutions. The upcoming years are going to bring significant milestones for Fintech initiatives.

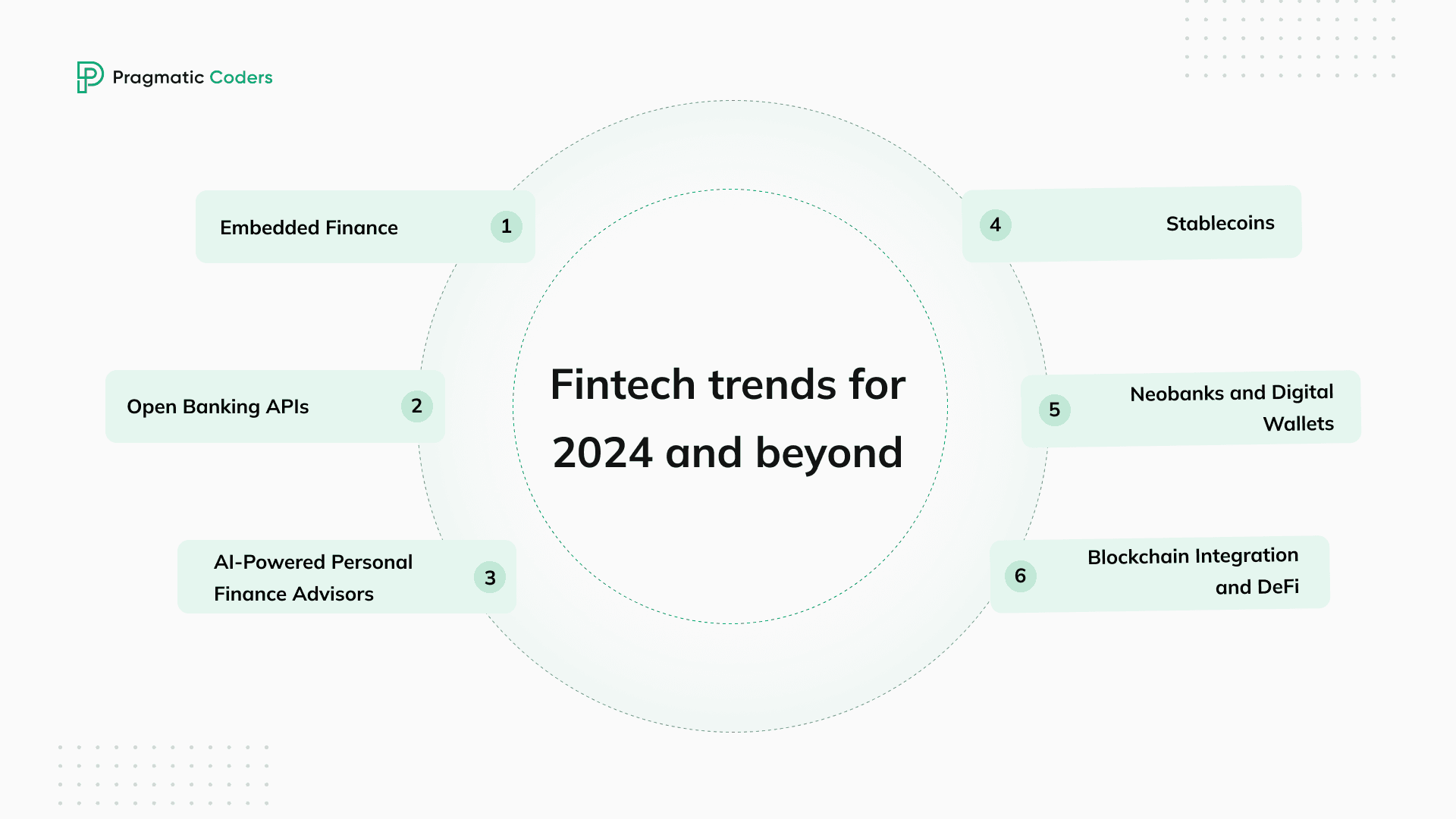

Fintech trends for 2024 and beyond

In this article, we’ll delve into the trends in fintech that will shape the future of the financial industry in 2024 and beyond. We will also discuss how they are poised to revolutionize the way we interact with our money.

1. Embedded finance

Embedded finance is the integration of financial services into non-financial products and platforms. This fintech trend is changing the way we think about payments, financing, and loans. Services like Buy Now, Pay Later (BNPL) are gaining traction, offering a seamless experience within non-financial platforms. This happens because they offer a number of advantages over traditional financial services:

- Convenience: Embedded finance is more convenient than traditional financial services because it is integrated into the products and platforms people already use. For example, a customer can apply for a BNPL loan at checkout without having to leave the retailer’s website.

- Affordability: Embedded finance can be more affordable than traditional financial services because it reduces the costs associated with customer acquisition and risk assessment.

- Choice: Embedded finance gives consumers more choices when it comes to financial services. For example, a customer can choose to pay for a purchase using a BNPL loan, a credit card, or a debit card.

Embedded finance may still be a rather new concept, but it is growing very rapidly. Just look at the numbers: the Grand View Research report states that the global market for embedded finance hit a whopping $83.32 billion in 2023. Impressive, right? But that’s just the beginning. By 2030, it’s projected to reach a staggering $588.49 billion! So, why should you keep an eye on embedded finance in 2024? It’s simple: it’s shifting financial control into users’ hands. We’re talking less dependence on traditional banks and a way richer, more varied financial landscape.

While there are multiple types of embedded finance—such as embedded lending, embedded payments, and embedded investment, to name a few—one type to particularly keep an eye on is embedded insurance. Its market value is projected to reach over $70 billion by 2025. Now is a good time to kick off insurance software development projects.

2. Open banking APIs

Open banking gives you the power to share your financial data with third-party service providers through APIs. This sharing is the key to unlocking a whole new world of financial services and apps. It’s like a puzzle piece that fits perfectly with embedded finance.

Why are we so sure open banking is the next big thing for 2024? Here are some of the reasons:

- Open Banking acts as a bridge, linking your financial data across different institutions for a unified view. This is key for embedded finance, enabling seamless services like BNPL.

- It’s a breeding ground for new, innovative apps and services, all using your financial data (with your permission) for more personalized solutions. Fintech shows its strength here.

- Banks are no longer the only ones holding your financial data. Now, other tech-savvy players are stepping in, stirring up competition. This will unavoidably result in better services, more choices, and often, lower costs for you.

- Open Banking puts you in control. You choose who accesses your financial data and how it’s used. This opens a sea of possibilities for service providers.

Also, open banking is closely linked to embedded finance, which bolsters our confidence in its significant impact on the 2024 fintech landscape even more.

3. AI-powered personal finance advisors

Generative AI and Machine Learning are already transforming personal finance management. In the upcoming years, AI-fueled finance advisors will become quite common. This emerging trend becomes evident when observing fintech companies. Significantly, industry giants like JPMorgan are also developing their own Generative AI-based financial advisors. These advisors will analyze your spending habits and financial goals to provide tailored recommendations.

Here’s how Generative AI-based advisors can revolutionize the way we manage our finances:

- Budgeting: AI advisors could create personalized budgets based on your income and expenses, track spending, and identify savings opportunities.

- Investing: They could potentially align investments with your goals and risk tolerance, and adjust your portfolio based on market changes. Algorithmic trading market continues to grow, by the way! And even if traders won’t adapt AI as soon – they just will have to implement some back-office automations (like post-trade management automation) to not be left behind.

- Debt repayment: AI could help us devise efficient debt repayment plans, monitor progress, and adjust strategies as needed for faster payoff.

We anticipate a widespread adoption of Artificial Intelligence-based personal finance advisors in 2024. It will be like having a financial expert in your pocket, available 24/7. A real game-changer in financial services.

4. Stablecoins

Stablecoins are the bridge between traditional and digital currencies. In the near future, they could revolutionize payment methods and financial interactions. Why? Because they offer the stability of fiat currencies with the transparency of blockchain. Their main advantages include:

- Transparency: Stablecoins are rooted in blockchain technology. This ensures transparency and verifiability for all transactions.

- Efficiency: Stablecoins facilitate quick and seamless payment transactions, eliminating the need for intermediaries.

- Global reach: These digital assets enable cross-border payments. With them, users can transact with anyone worldwide, regardless of their location.

At the 2024 World Economic Forum in Davos, Jeremy Allaire, CEO of Circle, dropped a hint that’s got everyone talking. He believes the U.S. might pass stablecoin laws in 2024. This is huge, especially considering the whopping $135.3 billion in stablecoins floating around unregulated. If Allaire’s right, we could see a seismic shift in how stablecoins are used and trusted. This also indicates that digital currencies issued by central banks are likely to become more prevalent soon.

As a result, we expect 2024 to be the year where stablecoins really take off, finding new roles and wider acceptance in our financial toolkit. As the technology continues to mature and becomes more regulated, we will also witness an increase in stablecoins being issued by central banks and other financial institutions.

5. Neobanks and digital wallets

Neobanks are the digital disruptors of traditional banking. Their raise is one of the biggest fintech trends in recent years. They offer a range of financial services, from financial transactions to loans, all within a user-friendly mobile app. What’s more, they’re nimbly merging with mobile payment systems and digital wallets. They’re also very cost-effective and flexible, as they’re often outsourcing their software development efforts. Overall, Neobanks’ agility gives them a competitive edge in multiple areas:

- Convenience: Neobanks are much more convenient than traditional banks. Customers can open an account and start using their debit card within minutes, all from their smartphone.

- Affordability: Neobanks often charge lower fees than traditional banks. This is because they have lower operating costs, as they do not need to maintain physical branches. Digital wallets add to this, reducing transaction, simplifying financial operations, and allowing cross-border payments.

- Innovation: Neobanks are constantly on the move, rolling out new features to suit customer needs. This includes seamless integration with mobile payments and digital wallets, offering a holistic financial ecosystem right from your smartphone. Also, Neobanks are no strangers to digital currencies.

Neobanks won’t cease their rapid expansion; they’ll continue to accelerate it to meet the demand for convenient, cost-effective banking. In 2021, neobanks had over 145 million customers worldwide. This number is expected to reach over 360 million by 2026. The future of banking isn’t just in neobanks; it’s in the fusion of these digital banks with mobile payment technologies and digital wallets.

6. Blockchain integration

Blockchain technology is not fading away; it’s becoming more embedded in fintech products. Its transparency and security features make it essential for online financial processes. Its integration is going to be pivotal in 2024, especially with the rising tide of Decentralized Finance (DeFi). The most promising uses of blockchain in 2024, including its role in DeFi are:

- Cross-border payments: Blockchain-based solutions can process payments in seconds at a fraction of the cost of traditional methods. This is particularly evident in DeFi platforms, where cross-border transactions bypass traditional banking systems, offering a more direct, economical route.

- Lending and borrowing: Decentralized lending and borrowing platforms eliminate the need for intermediaries while maintaining security.

- Trade finance: Blockchain can improve the efficiency and security of trade finance by reducing fraud and errors, as well as by enhancing transparency and traceability. DeFi takes this a step further by decentralizing the process, ensuring more equitable access and efficiency in trade finance.

This key trend is already having a major impact on the fintech industry. Its synergy with DeFi is particularly striking, so expect it to drive down costs and increase accessibility to banking services in 2024.

Conclusions

The fintech sector stands at the precipice of significant advancements in 2024 and beyond. These innovations promise to make banking more secure, personalized, and accessible than ever before.

You might want to learn more about what’ else i up in the (finance) tech industry from our articles on app hyper-personalization, gamification in mobile banking, and the super-app trend.

As technology evolves, so too will the ways we interact with our finances, with fintech firms leading the charge in this exciting new era. Therefore, staying up-to-date with the latest fintech software development methods is crucial for competitiveness. The future of finance is digital, decentralized, and customer-focused, and it’s unfolding right before our eyes.