Future of Mobile Banking: Trends and Innovations to Watch

Mobile banking is changing fast. It’s now a key part of how people manage their money. Customers want more personal, seamless, and instant experiences. This pushes banks to keep up with new demands. Digital-only banks, AI services, and hyper-personalization are all making waves.

To stay ahead, it’s vital to understand what’s coming next. This article covers the main trends shaping the future of mobile banking experiences. By embracing these changes, banks can meet customer needs and find new ways to grow in a digital world.

Future Trends in Mobile Banking

|

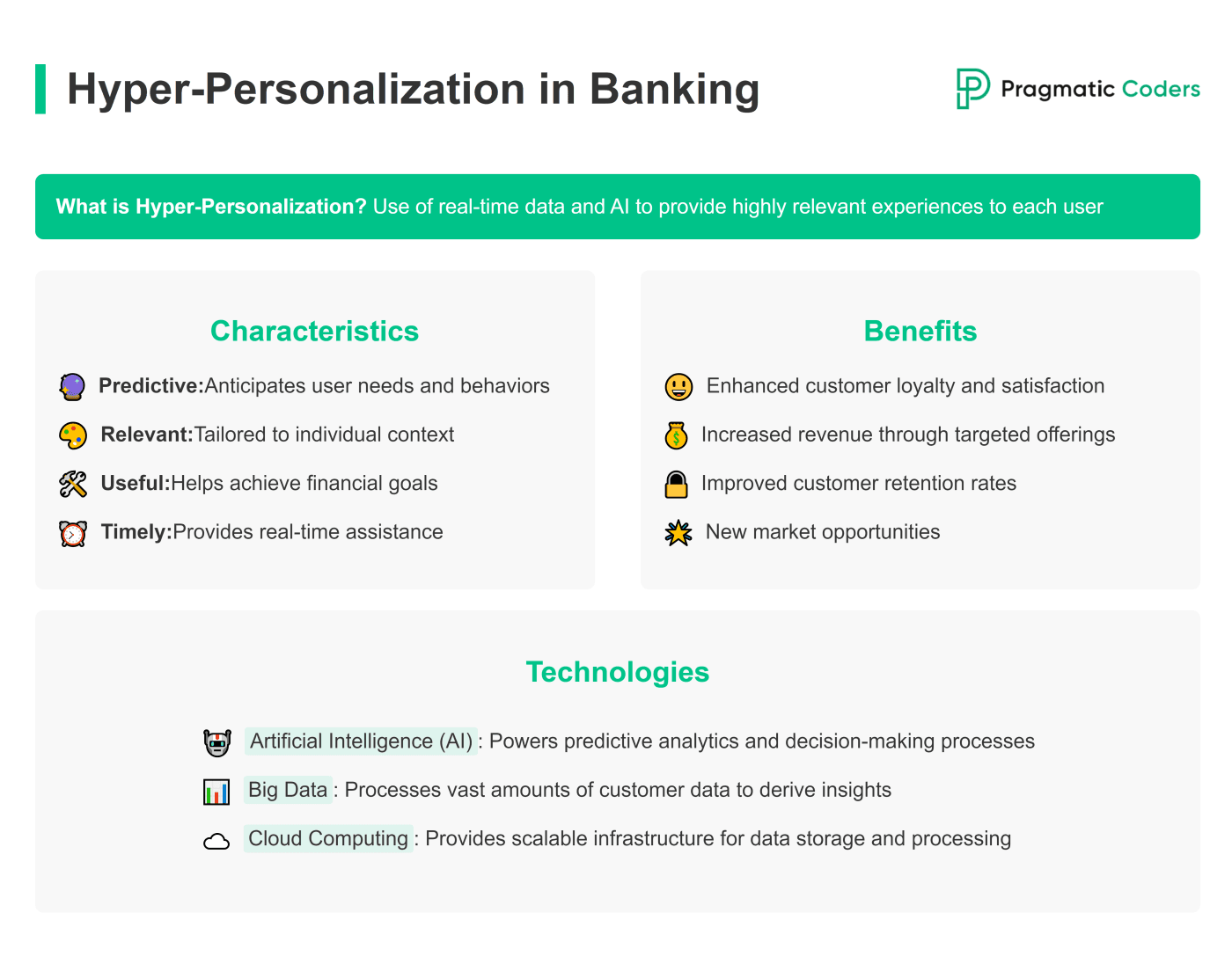

1. Hyper-Personalization

Hyper-personalization is changing how banks connect with customers. It allows banks to tailor experiences for each person in real-time. The result is advice, products, and alerts that meet their specific needs.

Banks achieve this through AI, machine learning, and big data. These technologies analyze customer behavior and predict what they want next. This allows banks to provide the right service at the right time, making banking services feel personal and relevant.

The benefits are clear. Customers feel understood and valued, which leads to higher satisfaction and loyalty. For banks, this means better conversion rates, long-term growth, and higher customer retention. Hyper-personalization is quickly becoming key to staying competitive.

2. Super Apps

Super apps are changing mobile banking by combining many services into one platform. Users can manage finances, chat, shop, and book rides—all within a single mobile application. This approach simplifies both banking and daily tasks by putting everything in one place.

In Asia, mobile apps like WeChat and Alipay are leading this trend. They blend social media, payments, and banking, becoming part of everyday life. There’s now a push to bring this model to Western markets, where it could reshape mobile banking.

The power of super apps lies in how they keep users engaged. By offering financial services alongside other daily needs, super apps make digital banking easier. And they build customer loyalty. These features position them as key players in the future of mobile banking apps.

3. AI-Powered Customer Service

AI is transforming customer services in mobile and online banking. Chatbots and virtual assistants now handle many routine tasks, making support faster and more efficient. These tools can answer questions, assist with transactions, and offer personalized advice.

The benefits are clear. AI reduces operational costs and improves the user experience. Customers get quick, accurate responses without needing human help. This saves time. It also allows human agents to focus on complex issues.

A major advantage of AI-powered service is 24/7 support. Customers can get help anytime, day or night. This is crucial in today’s connected world. The round-the-clock service meets the demand for instant assistance. It keeps customers satisfied and loyal.

Many high-profile banks are already using AI chatbots to improve customer support. As technology advances, these will take on increasingly complex tasks. AI is an inherent part of the customer experience already, and this trend is bound to continue.

4. Gamification

Another key trend in mobile banking is gamification. By adding game-like elements, banks boost user engagement and retention. Rewards, challenges, and interactive experiences make banking more enjoyable.

For example, Aspiration (a US-based neobank) uses a reward system where customers earn points for smarter spending or choosing climate-friendly brands. Other mobile banking apps offer challenges or financial education through games. This helps users learn about money management in a fun way. These features keep users engaged and encourage positive financial habits.

Gamifying in-app activities is quickly becoming a key strategy in mobile banking. Why? Because it keeps customers engaged and satisfied. It boosts app usage as users return to complete tasks and earn rewards. All this leads to higher customer loyalty and a stronger connection with the bank. The business impact is clear.

5. Real-Time Services

The next big trend driving mobile banking is the demand for real-time services. Customers now expect banking transactions and updates to happen instantly.

To meet this need, banks are using advanced technologies like APIs and instant payment networks. These tools ensure that money moves quickly and account information stays current.

Speed is now a top priority in the banking industry. Whether it’s transferring money, checking a balance, or receiving a notification, customers want everything to happen immediately. Banks that deliver this speed will definitely win their customers over.

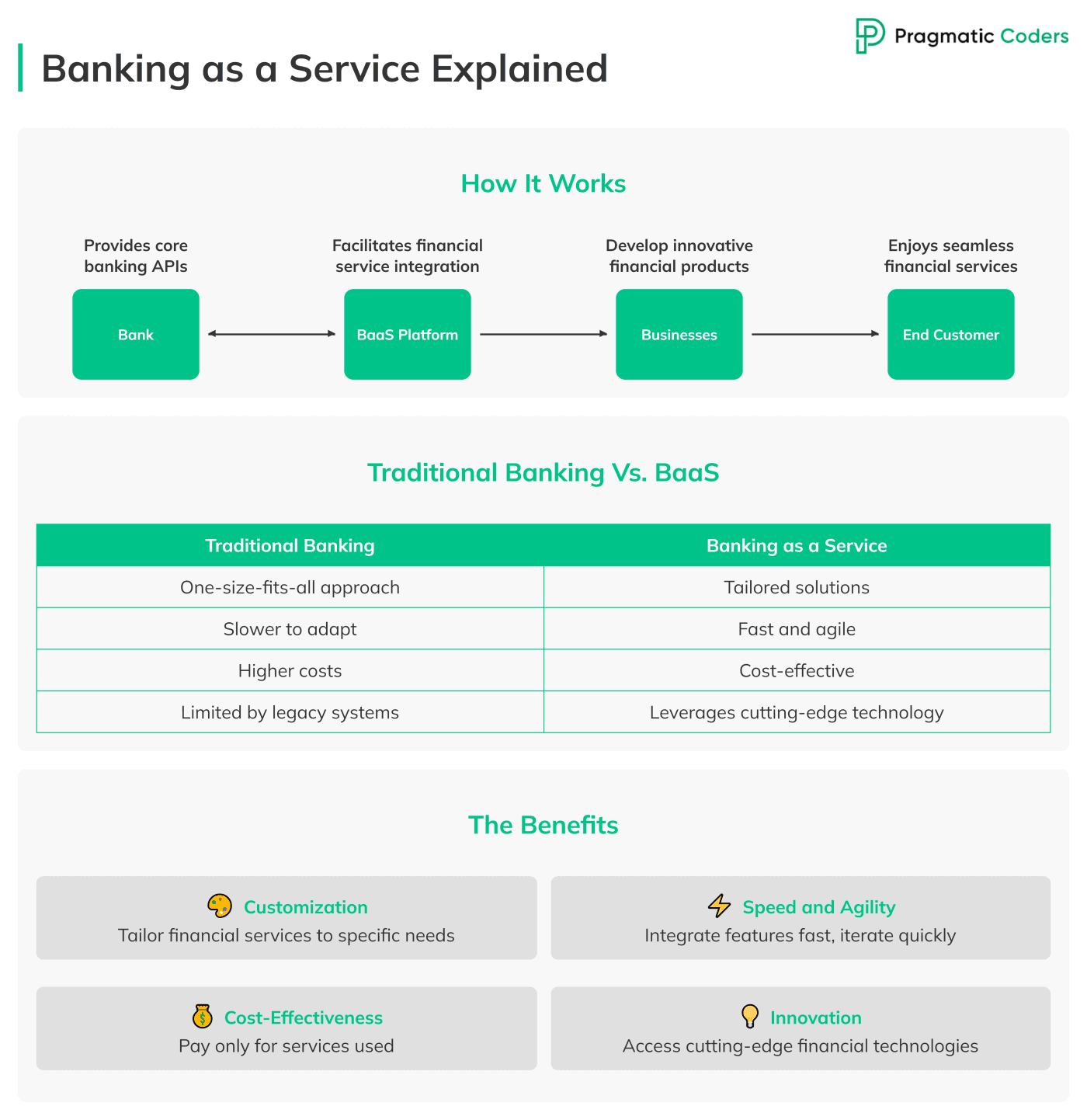

6. Banking as a Service (BaaS) and API Integration

Another big shift in mobile banking is the rise of Banking as a Service (BaaS). This model lets non-bank businesses offer financial services. They do this by using the technology and regulations of traditional banks. With BaaS, companies can easily add features like payments, lending, and account management to their own platforms. This opens up new opportunities for partnerships and modernization.

APIs are at the heart of this change. They allow seamless integration between banks and third-party providers. For example, e-commerce platforms can use APIs to offer branded payment solutions. Fintech apps can connect directly to bank accounts to provide real-time financial tools. This makes banking more accessible and better tailored to customer needs.

Looking ahead, BaaS will drive more innovation in the banking sector. It opens new revenue streams by letting businesses offer customized financial services without a banking license. As BaaS evolves, it will shape the future of open banking. It will foster collaboration between traditional banks and tech companies, creating a more inclusive financial ecosystem.

7. Digital-Only Banks

Banks like Atom and neobanks like Revolut demonstrate the success of this model. Atom, based in the UK, offers a fully digital experience with no hidden fees. Revolut provides services like currency exchange and cryptocurrency trading worldwide, all within a single app. Both have attracted millions of customers by focusing on convenience, transparency, and advancement.

The competitive edge of digital-only banks comes from their lower costs and greater flexibility. They can quickly introduce new features and adapt to what customers want. Without physical branches, they can focus on improving their digital platforms. This flexibility helps them stay ahead of traditional banks and attract tech-savvy customers.

8. Cybersecurity

Cybersecurity remains one of the key trends shaping mobile banking services. And today, it’s more important than ever. As the mobile banking industry grows, the risks increase. Thus, protecting sensitive financial data is a top priority. Cybercriminals are constantly finding new ways to breach systems. This makes advanced security protocols a necessity.

Threats like phishing, malware, and data breaches are becoming more sophisticated. Banks can’t rely on outdated methods anymore. They need to adopt stronger, enhanced security measures.

Proactive steps are key to staying safe. Multi-factor authentication can add an extra layer of protection by requiring multiple forms of verification. Biometrics, like fingerprint and facial recognition, provide a secure and convenient way to access accounts. Payment tokenization replaces sensitive payment information with unique tokens, reducing the risk of data breaches. AI-driven threat detection systems can monitor for suspicious activities in real-time, allowing banks to respond quickly to potential threats.

Conclusion

Modern banking is evolving fast, with the industry experiencing constant change and innovation. If you’re a bank decision-maker, now is the time to adopt the latest trends. Staying ahead in the mobile banking landscape means embracing innovation to meet customer needs and drive growth. Don’t hesitate to contact us to discuss mobile banking app development!