Payment Tokenization Explained: How to Tokenize Payments?

Payment security is critical in today’s world. Cyber attacks are increasing every day. Businesses must protect customer payment information. A single breach can damage trust forever.

This article is here to help. We’ll explain payment tokenization clearly. You’ll learn what it is and how it works. We’ll guide you on implementing it in your business.

Our goal is to make complex ideas simple. We want to help you secure your transactions. By the end, you’ll know how to keep payments safe.

Key Points

|

What Is Payment Tokenization?

Payment tokenization secures payment data by replacing it with tokens. A token is a random string of characters. It holds no meaningful information. If someone steals the token, they can’t use it to get the original data.

How Tokenization Enhances Payment Security

By using tokens, businesses don’t store actual digital payment details. This means even if hackers breach the system, they find only useless tokens. The real payment data stays safe on secure servers elsewhere. This greatly reduces the risk of data theft.

Tokenization vs. Encryption

Both tokenization and encryption aim to protect data. But they work differently.

- Encryption scrambles data using a key. With the key, you can unscramble it. If hackers get the key, they can access the data.

- Tokenization replaces data with a token that has no relation to the original information. Without access to the secure token vault, the token is meaningless.

Why Tokenization Is More Secure for Payments

Tokens can’t be reversed to reveal the original data. This makes tokenization more secure against cyber attacks. Encryption can be vulnerable if someone cracks the key. Tokenization removes sensitive data from your systems. This minimizes the targets for hackers.

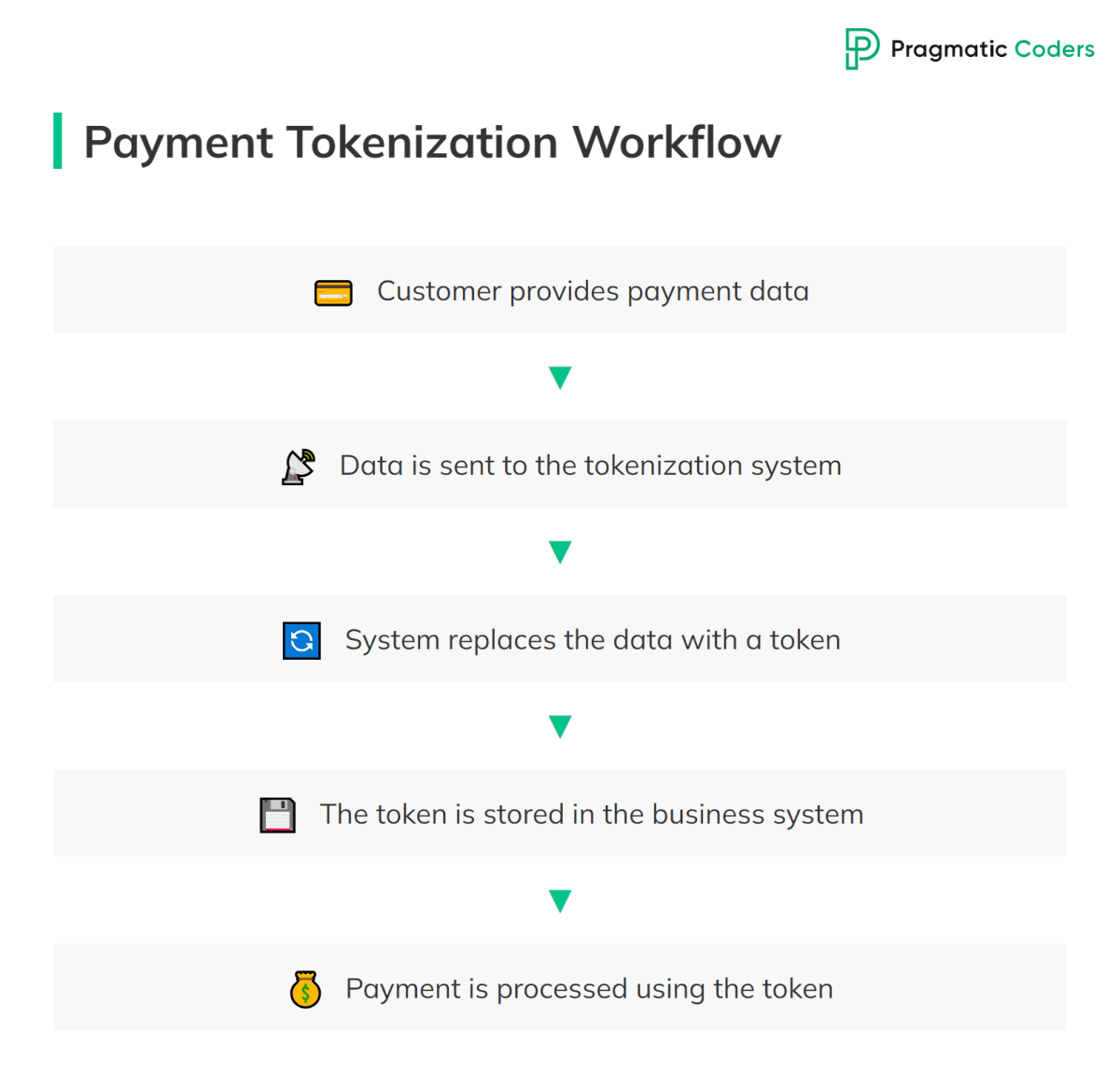

How Does Payment Tokenization Work?

Payment tokenization might seem complex. But it’s simple when broken down. Let’s walk through the process step by step.

The Tokenization Process Explained Step by Step

- Step 1: Capturing the Customer’s Payment Data

A customer makes a purchase. They provide their payment details. This could be a card number or bank info.

- Step 2: Replacing Sensitive Data with a Token

The payment data goes to a secure system. The system replaces it with a token. The token is a random string. It reveals nothing about the original data.

- Step 3: Storing Tokens Securely

Your business stores the token, not the payment data. The actual data is kept safe elsewhere. You don’t hold any sensitive information.

- Step 4: Processing Payments Using Tokens

To process a payment, you use the token. The payment processor accepts the token. The real data is used behind the scenes. You never handle it directly.

Example of Payment Tokenization

A customer saves their Visa card details on an online store. The store uses the Visa Token Service (VTS) to tokenize the customer’s payment information. Instead of storing the actual card number, the store saves a token provided by VTS.

- Tokenization with VTS: When the customer enters their card details, the information is sent to Visa. VTS generates a unique token that replaces the actual card number. For example, the real card number “4111 1111 1111 1111” becomes a token like “a1b2c3d4e5f6g7h8”.

- Secure Storage: The online store stores this token instead of the real card number. The actual card data is securely held by Visa, not the merchant.

- Protection in Case of a Data Breach: If hackers breach the store’s database, they only find the tokens. These tokens are useless without access to Visa’s secure system. Hackers cannot reverse-engineer the token to get the actual card details.

Benefits of Payment Tokenization

Payment tokenization offers many advantages. Let’s explore how it helps your business.

Enhanced Security

Data breaches can cost millions. They harm your reputation. Tokenization reduces this risk greatly. By not storing real data, you minimize attack targets. Tokens hold no value to thieves. If stolen, they can’t be used to access payment data.

Simplified Compliance

Payment regulations can be complex. The Payment Card Industry Data Security Standard (PCI DSS) has strict rules. With tokenization, you reduce compliance scope. You don’t store sensitive data. There are fewer requirements to meet. This saves time and money on audits. Tokenization makes compliance both easier and cheaper.

Customer Trust

Customers feel safer knowing their data is protected. By using tokenization, you show commitment to security. This builds trust and loyalty with your brand.

Operational Efficiency

Tokens can speed up transactions. They simplify payment workflows. This leads to a smoother experience and reduces the need for extensive security measures.

Reduced Fraud and Chargebacks

By securing data, tokenization lowers the risk of fraud. This can reduce chargebacks and associated costs. And we all know that fraud is costly to manage.

Which Businesses Benefit from Tokenization?

Many types of businesses can benefit. Here’s who gains the most:

E-Commerce Retailers

Online stores process many payments daily. They collect customer card details. Tokenization secures these online transactions.

Tokens replace real card numbers. This protects buyer information. It reduces fraud risks. Customers feel safer shopping online.

Subscription Services

Businesses with recurring billing can securely store payment info. This makes repeat transactions smooth and safe.

Tokenization allows safe storage of payment details. It minimizes data breach risks. Customers enjoy seamless renewals.

Hospitality and Travel

Hotels and airlines process payments for bookings. Tokenization secures customer data throughout the reservation process.

Tokenization secures payment information. It prevents unauthorized access. Guests can book with confidence.

Healthcare Providers

Medical offices handle sensitive payment and personal data. Tokenization helps protect this information and meet regulations.

Tokenization protects payment info. It helps meet HIPAA requirements. Patients trust providers who secure their data.

Brick-and-Mortar Stores

Physical stores using point-of-sale (POS) systems can use tokenization. It secures in-store transactions against data theft.

Tokenization secures POS transactions. It reduces fraud and data theft. Customers feel safe using their cards.

How to Implement Payment Tokenization in Your Business

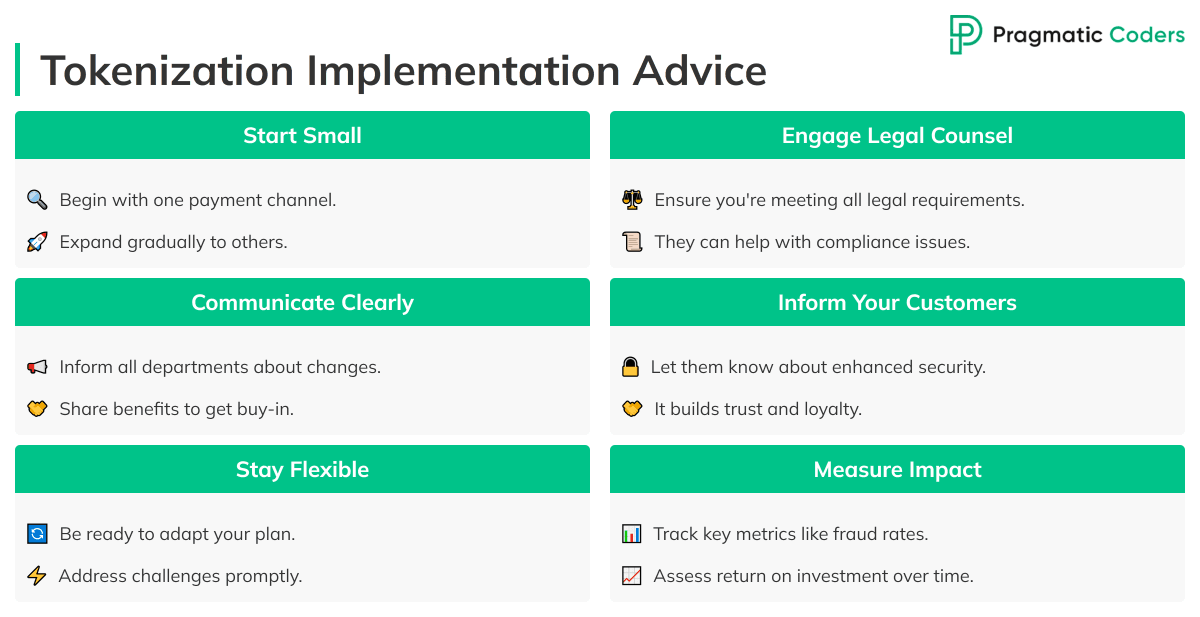

Implementing payment tokenization might seem complex. But with a clear plan, it’s manageable. Here’s how to do it step by step.

By the way, we can help with payment gateway integration. We’ll make implementation a walk in the park.

Step 1: Assess Your Payment Systems

Start by examining how you process payments now. Map out every step.

- Identify Data Entry Points: Where do customers enter payment info? Online checkouts, mobile apps, or in-store terminals?

- Locate Sensitive Data Storage: Find out where you store payment details. This includes databases and backups.

- Review Data Transmission Paths: How does payment data move through your systems? Are there any weak spots?

Tip: Create a visual flowchart. It helps spot vulnerabilities easily.

Step 2: Choose a Tokenization Provider

Selecting the right provider is crucial. They will handle sensitive data for you.

- Research Reputable Providers: Look for companies with strong security records.

- Check Certifications: Ensure they comply with PCI DSS standards.

- Read Reviews and Case Studies: Learn from other businesses’ experiences.

Questions to Ask Providers:

- How do you store and secure tokens?

- Do they use advanced encryption methods?

- What are their data breach prevention measures?

- What compliance standards do you meet?

- Are they PCI DSS certified?

- Do they comply with other relevant regulations?

- How easy is integration with my existing systems?

- Do they offer APIs or plugins? (Learn more: What is API integration?)

- Is technical support available during integration?

Tip: Request a demo or trial period. Test their system before committing.

Step 3: Plan the Integration

Work with your IT team to develop a plan.

- Set Clear Objectives: Define what you want to achieve.

- Establish a Timeline: Set realistic deadlines for each phase.

- Allocate Resources: Determine budget and staff needed.

Tip: Hold a kickoff meeting. Ensure everyone understands their roles.

Step 4: Train Your Staff

Your team needs to understand the new system.

- Organize Training Sessions: Teach staff how tokenization works.

- Update Internal Policies: Reflect changes in your documentation.

- Provide Ongoing Support: Be available to answer questions.

Tip: Create a simple user guide. Include FAQs for quick reference.

Step 5: Implement the Solution

Now, put your plan into action.

- Set Up the Tokenization System: Work closely with the provider.

- Migrate Existing Data Securely: Transfer data carefully to avoid leaks.

- Conduct Thorough Testing: Test all scenarios to catch issues.

Tip: Start with a pilot program. Test with a small group first.

Step 6: Monitor and Update

After launching, keep an eye on the system.

- Regularly Audit the System: Check for any irregularities.

- Stay Updated on Security Trends: Cyber threats evolve quickly.

- Maintain Open Communication with Provider: They can offer valuable insights.

Tip: Schedule periodic reviews. Adjust your strategies as needed.

Frequently Asked Questions (FAQs)

Is Tokenization Expensive to Implement?

Costs vary, but many providers offer scalable solutions. The investment often pays off through reduced fraud and compliance costs.

Can Tokenization Work with Existing Payment Systems?

Yes, most tokenization solutions integrate with current systems. Providers can assist with the technical setup.

What Happens if a Token is Compromised?

Since tokens don’t reveal sensitive data, a compromised token is useless to attackers.

Does Tokenization Affect Payment Speed?

Tokenization usually doesn’t slow down transactions. In some cases, it can make processes more efficient.

Is Tokenization Only for Large Businesses?

No, businesses of all sizes can benefit. Many providers offer solutions suitable for small and medium enterprises.

Conclusion

Payment tokenization is a powerful tool for securing payments. It replaces sensitive data with useless tokens, protecting both businesses and customers. Implementing tokenization can enhance security, build trust, and streamline operations. By following the steps outlined, businesses can adopt tokenization effectively.