How to design digital onboarding to retain users: App founder’s guide

You can’t make the first impression twice, right?

In the digital world, that first impression often comes from your app’s onboarding process.

A seamless first-time experience can turn new users into long-term customers, making customer onboarding crucial across many industries, especially in fintech and digital banking.

We’ll explore how to create a system that not only welcomes users smoothly but also meets the stringent requirements of the financial industry.

What is digital onboarding?

Digital onboarding is the process of welcoming new customers to a business using digital tools and platforms. Instead of filling out paper forms or visiting a physical location, customers can sign up and start using a service entirely through a computer or smartphone.

3 types of onboarding

- On-site (traditional) onboarding: Customers visit a physical location for face-to-face interactions with staff.

- Hybrid onboarding: Combines digital and traditional methods. Customers start online but may need to visit in person for certain steps

- Fully digital onboarding: The entire process is completed online or via a mobile app. It offers speed, convenience, and 24/7 availability, and we’ll explore it more in just a few seconds.

Benefits of digital onboarding

Digital onboarding has several advantages for both users and companies that implement it:

- It’s faster than traditional methods. Users can often start using a service right away.

- It’s more convenient. Customers can onboard at any time, from anywhere.

- It saves money for companies, as you don’t need staff to help with every new user.

- It can be personalized easily, giving each user a tailored experience.

- It’s easier to track and analyze, helping companies improve their process over time.

- It improves customer retention. A good first impression and seamless onboarding increase the likelihood of customers staying long-term.

As I mentioned earlier, digital onboarding is important because it creates that vital first impression. A smooth process can make customers feel positive about the company from the start. It also sets the tone for how they’ll use the product or service going forward.

Finally, digital onboarding can positively impact whether the users will stick with you. If designed well, it keeps customers engaged and reduces the chance they’ll switch to a competitor. Why? When people understand the value of what they’re getting right from the beginning, they’re more likely to become loyal users.

How digital onboarding works. Digital onboarding process

The digital onboarding process usually consists of the four main phases, and contains all or some of the subphases listed below.

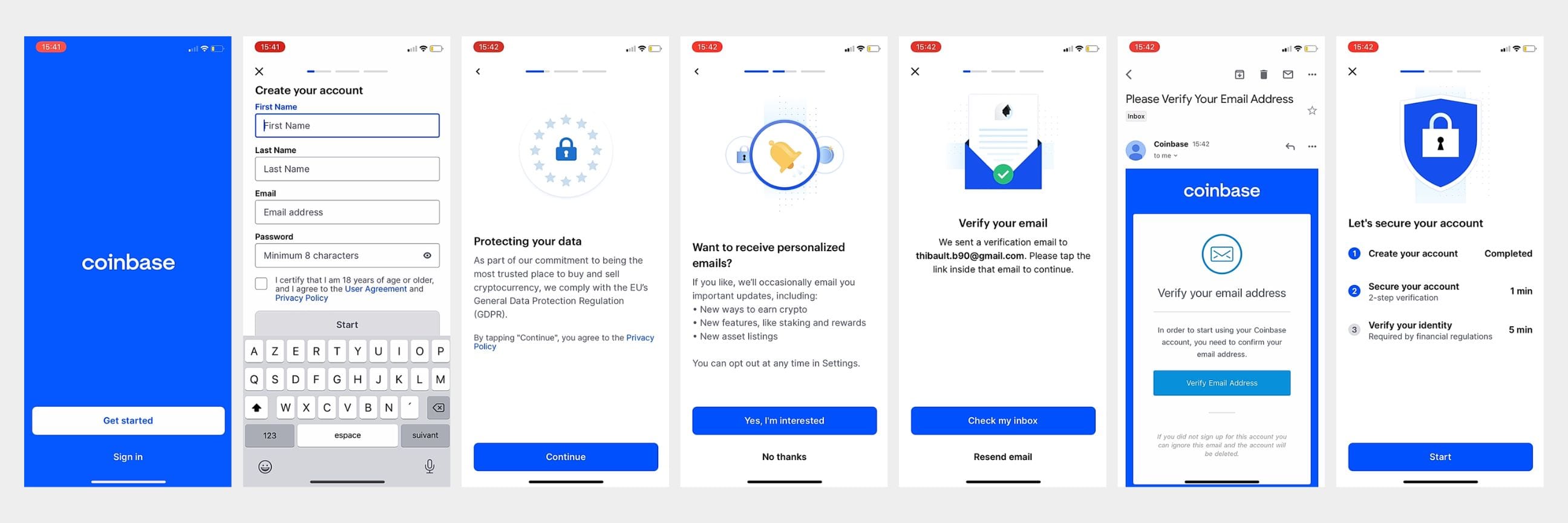

Of course, some steps might take place earlier of later in the process; for example, in Coinbase’s onboarding flow, users are asked to set up 2-step verification already after they’ve created their account, not in the final part of the process (as in the process example below).

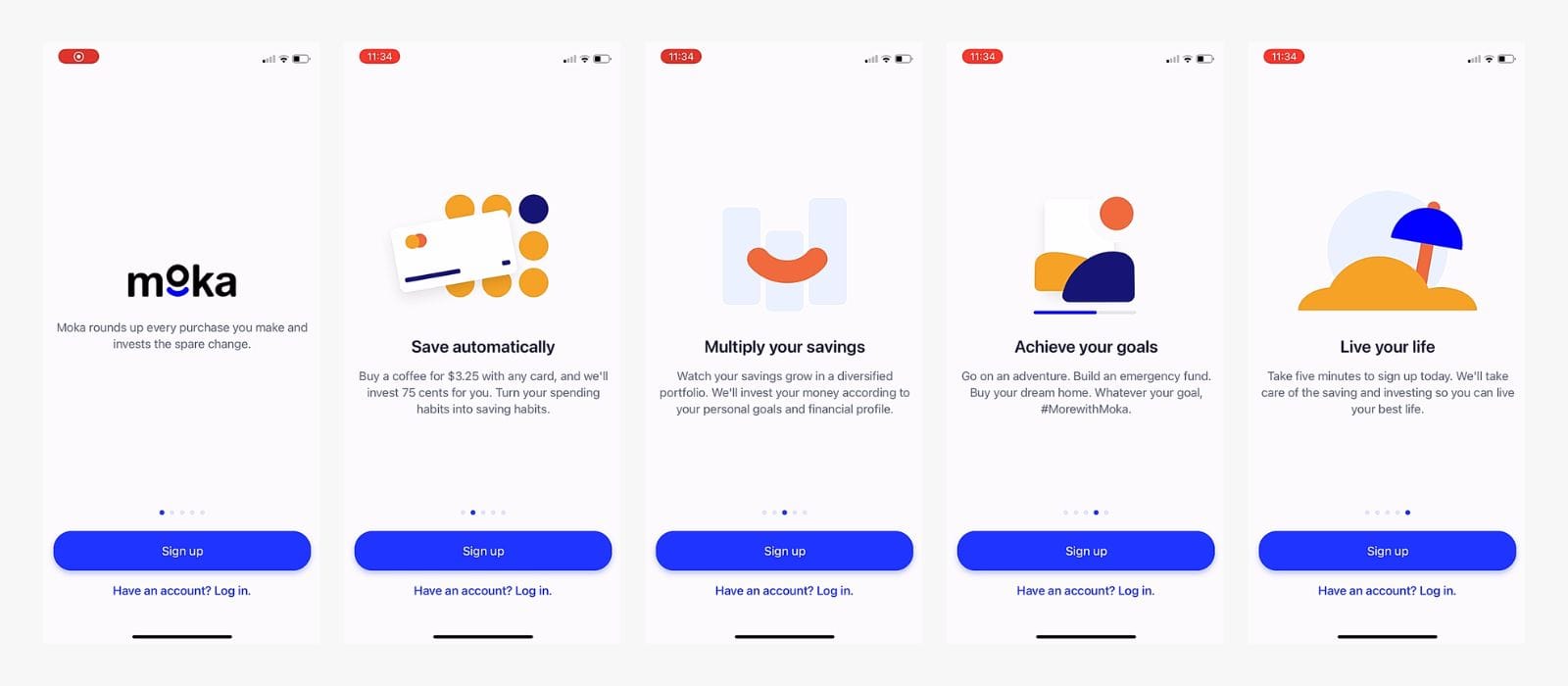

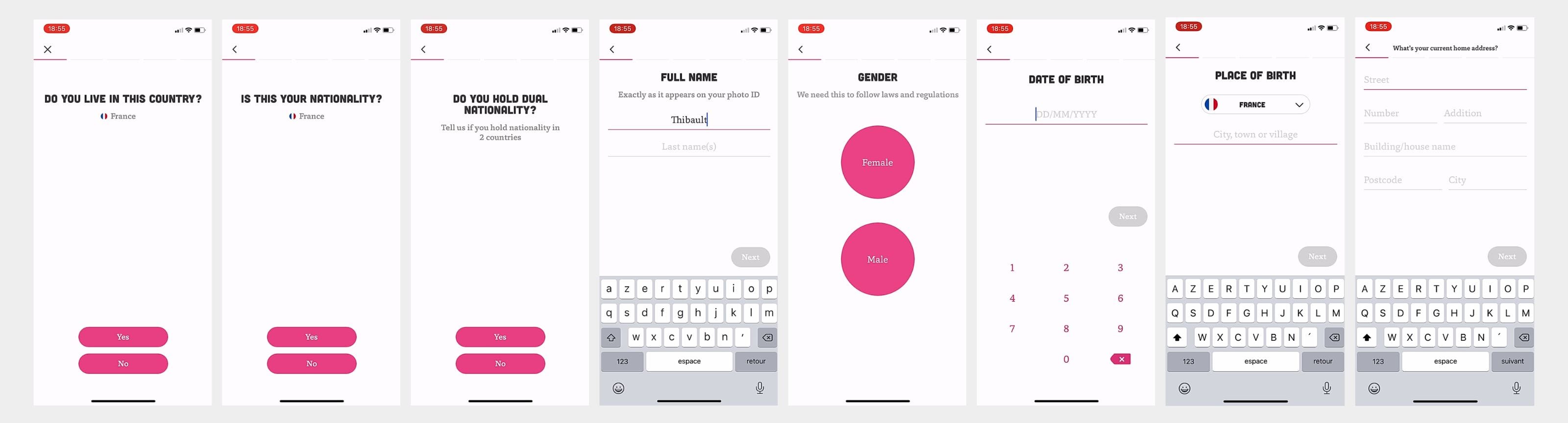

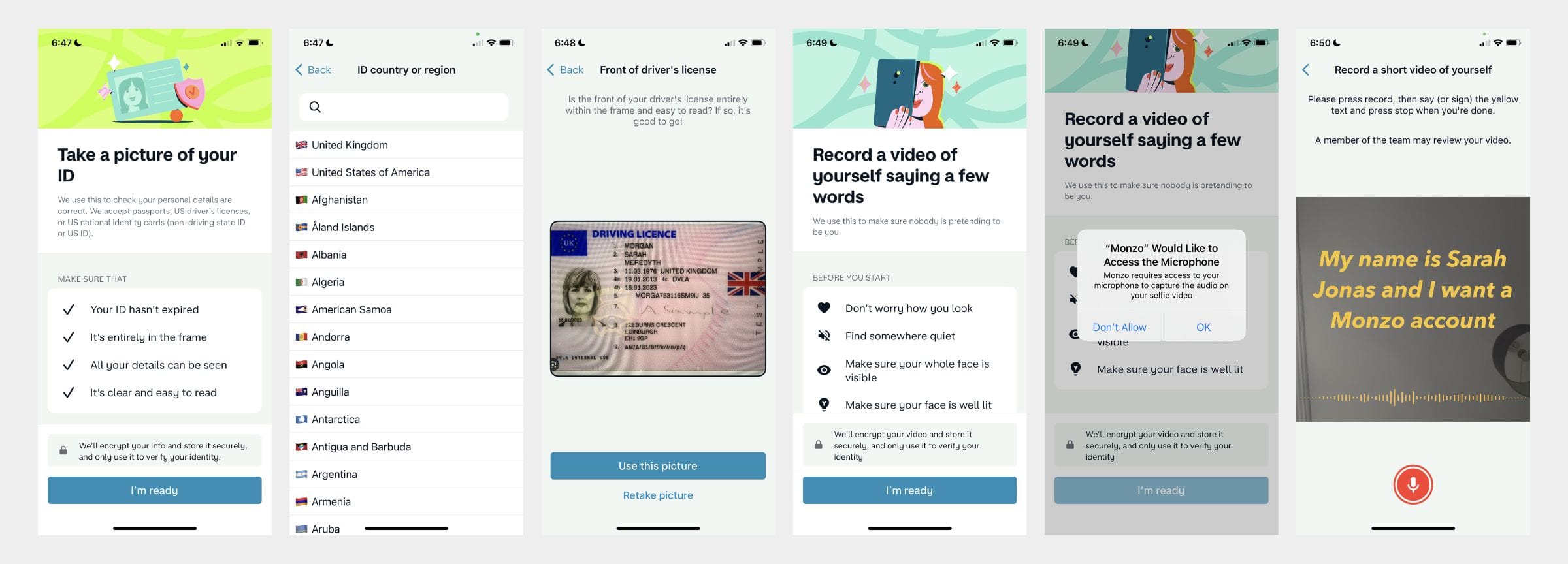

Additionally, I’ve attached screen flows of various fintech apps for each part so that you can better visualize the process. The apps in order of appearance are: Moka, Coinbase, Bux Zero, Monzo & Trade Republic.

Initial engagement

This step marks the beginning of the user’s interaction with the service. It’s designed to be quick and straightforward, capturing the user’s interest and basic details.

Benefits & opportunities walkthrough (optional)

Sometimes, before a user is even asked to insert any data, they go through a simple mini-onboarding.

It usually consists of a few screens with key messages. It’s designed to be quick, engaging, and informative.

The ultimate goal is to convert interested visitors into active, engaged users by clearly communicating the app’s value and easing them into the more detailed registration process that follows.

Account Initiation

- User provides basic information

- Selection of account type or service

This phase marks the beginning of the user’s interaction with the service. It’s designed to be quick and straightforward to capture the user’s interest and basic details.

Identity verification and data collection

This phase focuses on confirming the user’s identity and gathering necessary personal information. It’s crucial for compliance and security purposes.

Personal information collection

- Detailed personal data entry

- Address verification

- Contact information confirmation

Identity verification

- Document upload (ID, passport, driver’s license)

- Facial recognition or selfie capture, or, as in the case of Monzo–video recording verification

- Liveness detection: It’s often integrated into the selfie or video capture step of onboarding. May require users to follow specific prompts (e.g., “Turn your head slightly to the right”)

Risk assessment and due diligence

Background and eligibility checks

This step usually involves credit checks (if applicable), AML (Anti-Money Laundering) screening, and sanctions list checking.

What does it look like on the user’s end? They can see a loading screen or progress bar indicating that the app is “Processing your application”, or a message stating “We’re reviewing your information”. No direct user interaction is usually required for this step.

Risk Assessment

During the risk assessment and due diligence phase many processes take place in the background, so the user experience in a mobile app is typically designed to be as seamless and non-intrusive as possible

These processes include:

- device fingerprinting,

- digital footprint analysis,

- behavioral biometrics.

Device fingerprinting is widely used in digital onboarding across various industries. It collects information about the user’s device, such as operating system, browser type, screen resolution, and IP address. This technology helps identify suspicious login attempts, detect if the same device is used for multiple accounts, and flag potential fraud based on device characteristics.

Digital footprint analysis examines a user’s online presence and activities. It looks at social media profiles, online shopping habits, web browsing history, and email usage patterns. This analysis helps verify user identity, assess fraud risk, and identify inconsistencies in provided information. However, it’s less common in standard onboarding processes and more frequently used in high-risk scenarios or financial services.

Behavioral biometrics analyzes unique patterns in user behavior, such as typing rhythm, mouse movements, swipe patterns on mobile devices, and app navigation habits. While increasingly adopted, it’s not universal in onboarding. It’s more commonly used for ongoing authentication after the account is created, with some advanced systems beginning data collection during onboarding for future use.

These technologies enhance security by providing additional layers of authentication. However, their use raises important privacy concerns.

Additional verification (if needed)

If extra verification is required, the user might see messages like “We need a bit more information”, “Please upload a recent utility bill or bank statement”, “Help us understand your financial situation” or even “Schedule a quick video call to complete your verification”.

This phase involves thorough checks to assess the risk associated with the user and ensure compliance with regulations. The level of scrutiny may vary based on initial risk assessments.

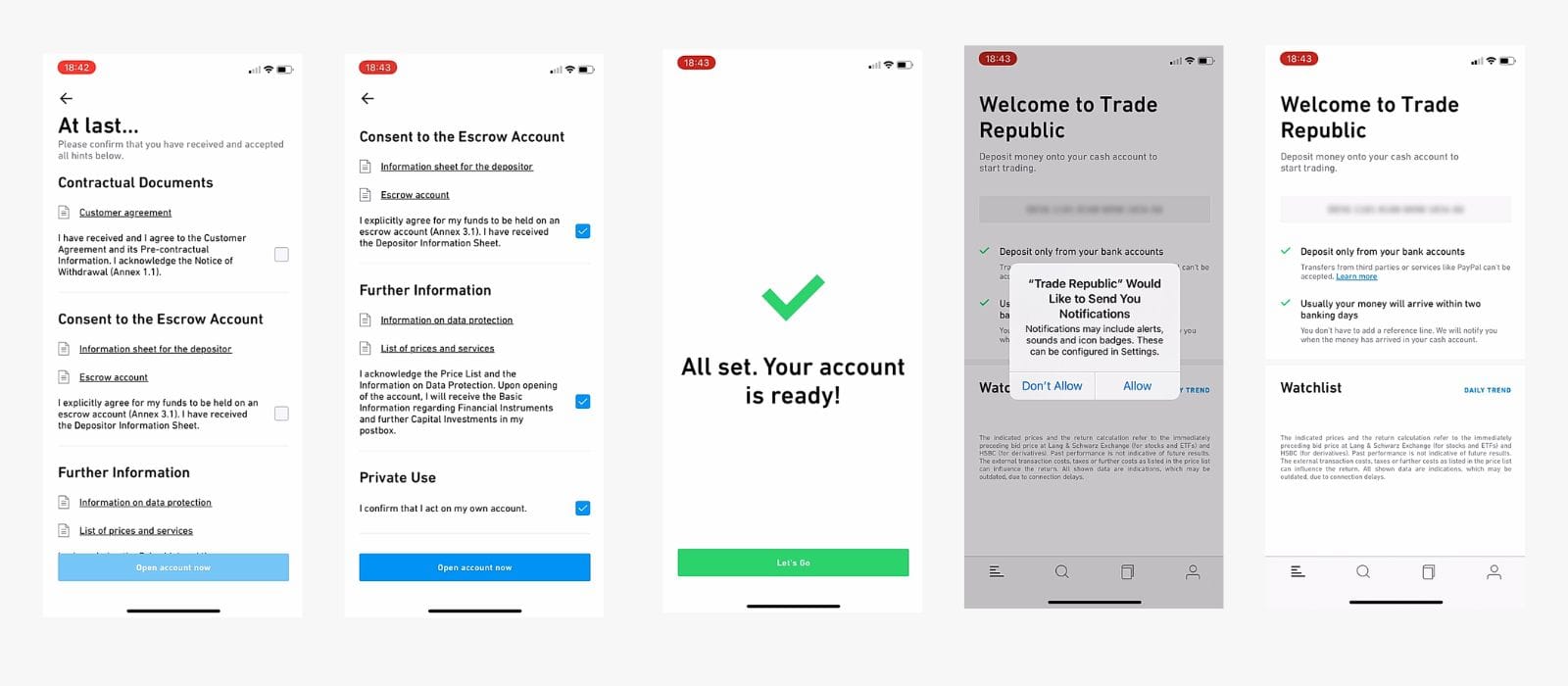

Account finalization

The last step a user takes is accepting terms and conditions (presentation of terms of service, privacy policy agreement, consent for data processing). Often, they can opt in for notifications or choose services (for example, activate cashback,add card details to Apple Wallet, enable local permissions and Face ID, etc.). Once this phase is over, a customer is ready to use the app.

Digital onboarding technologies and solutions

Digital onboarding technologies and solutions can be grouped into four main categories:

- Verification and security: This group includes Know Your Customer (KYC), identity verification, digital identity verification, security checks, and fraud prevention features. These technologies form the core of digital onboarding, and ensure that users are who they claim to be.

- Advanced analytics and AI: This category encompasses artificial intelligence, digital footprint analysis, and alternative data. AI powers many aspects of digital onboarding, from document verification to risk assessment. Digital footprint analysis examines a user’s online presence and behavior to verify their identity and assess risk. Alternative data refers to non-traditional information sources used to make decisions about users, especially useful for those with limited credit history.

- Biometric technologies: Biometrics, facial verification, liveness detection, and presentation attack detection fall into this group. These technologies use unique physical characteristics to verify identity. Facial verification compares a user’s face to their ID photo, while liveness detection ensures that a real person is present during the verification process. Presentation attack detection goes a step further: it identifies sophisticated attempts to fool the system with fake biometrics.

- Remote interaction solutions: This group includes real-time video call verification, unattended video identity verification, face-to-face onboarding, digitalized face-to-face office onboarding, and video conferencing. These solutions allow for remote yet personal interaction during the onboarding process.

Sign up to our Fintech Newsletter

Sign up for blog updates. Get exclusive resources and industry insights directly to you inbox:

Challenges in digital onboarding

There are two main challenges that come with digital onboarding: regulatory compliance and fraud detection and prevention.

Regulatory considerations

Digital onboarding is subject to various regulatory considerations. These regulations aim to prevent fraud, protect consumer data, and ensure financial security. Let’s explore the key regulatory aspects relevant here:

- Anti-money laundering (AML) directives: AML directives require financial institutions to verify customer identities and monitor transactions. This includes performing due diligence and reporting suspicious activities. For digital onboarding, this means implementing KYC (Know Your Customer) verification processes.

- Customer due diligence (CDD) obligations: CDD is a critical part of AML compliance. It involves assessing the risk associated with new customers and ongoing monitoring of existing ones. In digital onboarding, this translates to thorough identity verification and risk assessment procedures.

- General Data Protection Regulation (GDPR): GDPR sets strict rules for handling personal data in the EU. For digital onboarding, this means:

- Obtaining clear consent for data collection

- Ensuring data security

- Allowing users to access and delete their data

- Limiting data collection to what’s necessary

- eIDAS regulation: The eIDAS (electronic IDentification, Authentication and trust Services) regulation provides a framework for secure electronic interactions across the EU. It’s particularly relevant for digital onboarding as it covers:

- Electronic identification

- Trust services, including electronic signatures and seals

- Digital footprint analysis: While not a regulation itself, the use of digital footprint analysis in onboarding is subject to privacy regulations. Companies must ensure they comply with data protection laws when analyzing users’ online behavior.

- Fintech institutions and neobanks: These new financial players are subject to the same regulations as traditional banks. However, their digital-first approach often requires innovative solutions to meet regulatory requirements in the online space.

- Identity verification: Regulations often require multi-factor authentication for identity verification. This might include:

- Something the user knows (like a password)

- Something the user has (like a phone)

- Something the user is (biometric data)

Fraud prevention

- Anti-fraud controls

- Synthetic identity fraud

- Rent-an-ID service

As digital onboarding becomes more common, so do sophisticated fraud techniques. Synthetic identity fraud, where criminals combine real and fake information to create new identities, is on the rise. The emergence of “rent-an-ID” services, where fraudsters temporarily use real people’s identities, further complicates verification processes. Implementing robust anti-fraud controls without hindering the user experience is a major challenge.

Fraud detection in digital onboarding involves several key methods and technologies. These can be grouped into four main categories:

- Identity verification: This group includes KYC checks, document verification, and identity verification. KYC checks form the foundation of customer verification. Document verification uses technologies like OCR (Optical Character Recognition) and NFC (Near-Field Communication) to authenticate IDs. These methods work together to confirm a user’s identity during the onboarding process.

- Biometric checks: Liveness detection is a crucial part of this category. It helps confirm that a real person is present during the verification process, not just a photo or video. This technology is essential in preventing spoofing attempts, where fraudsters try to trick the system with fake biometric data.

- Behavioral analysis: This group includes digital footprint analysis and data enrichment tools. Digital footprint analysis examines a user’s online behavior patterns to identify suspicious activities. Data enrichment tools add extra information to help verify identities more thoroughly.

- Risk assessment: Here we have risk scoring and dynamic friction. Risk scoring assesses the likelihood of fraudulent attempts based on various factors. Dynamic friction adjusts the level of security measures based on the perceived risk, making the process more secure for high-risk situations while keeping it smooth for low-risk users.

- Biometric technology

- Automated facial recognition

- Biometrics technology

- Deepfakes

- Digital injection attacks

Biometric technology, including automated facial recognition, offers enhanced security but comes with its own set of challenges. The rise of deepfakes makes it harder to trust video-based verification. Digital injection attacks, where fake biometric data is inserted into the verification process, pose a serious threat. Ensuring the reliability and security of biometrics technology in the face of these evolving threats is a significant challenge in digital onboarding.

Banking APIs in digital onboarding

Even though building a fintech app might seem daunting given all these regulatory and technological challenges, the good news is that a great deal of it can be managed through APIs.

Simplifying the tech stuff, APIs are mechanisms that enable you to connect ready-made solutions to your app. For example, you don’t need to design and build an entire fraud detection system from scratch to have it in your product; you can use SaaS that’s already developed to manage it.

This not only speeds up the development process but also ensures compliance with regulatory standards, as many of these APIs are designed with financial regulations in mind.

Learn more about API here: Bank API Integration: A Complete Guide to API Banking

And feel free to contact us if you need expert help with managing APIs in your app.

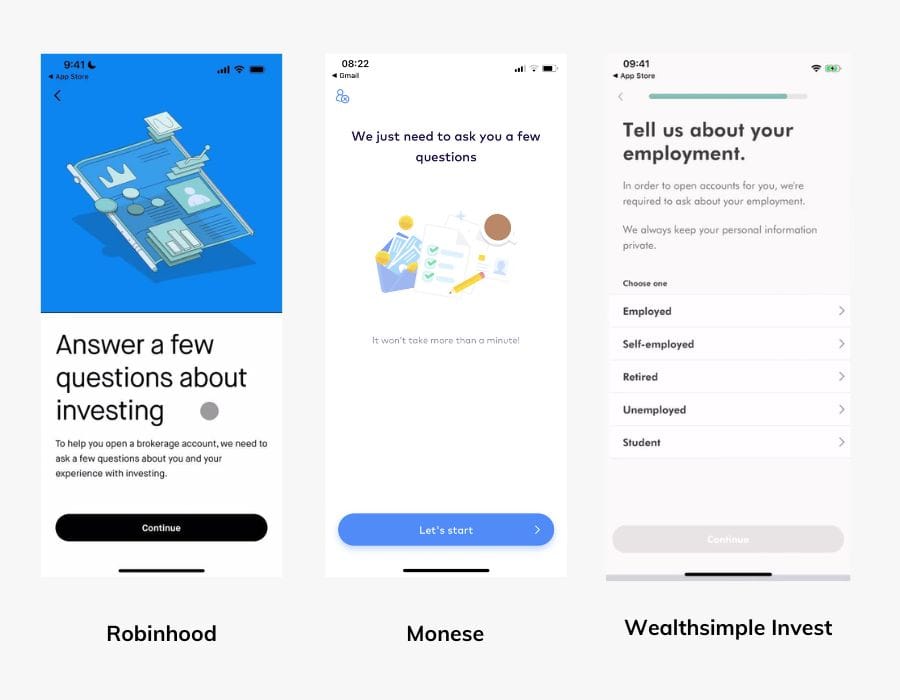

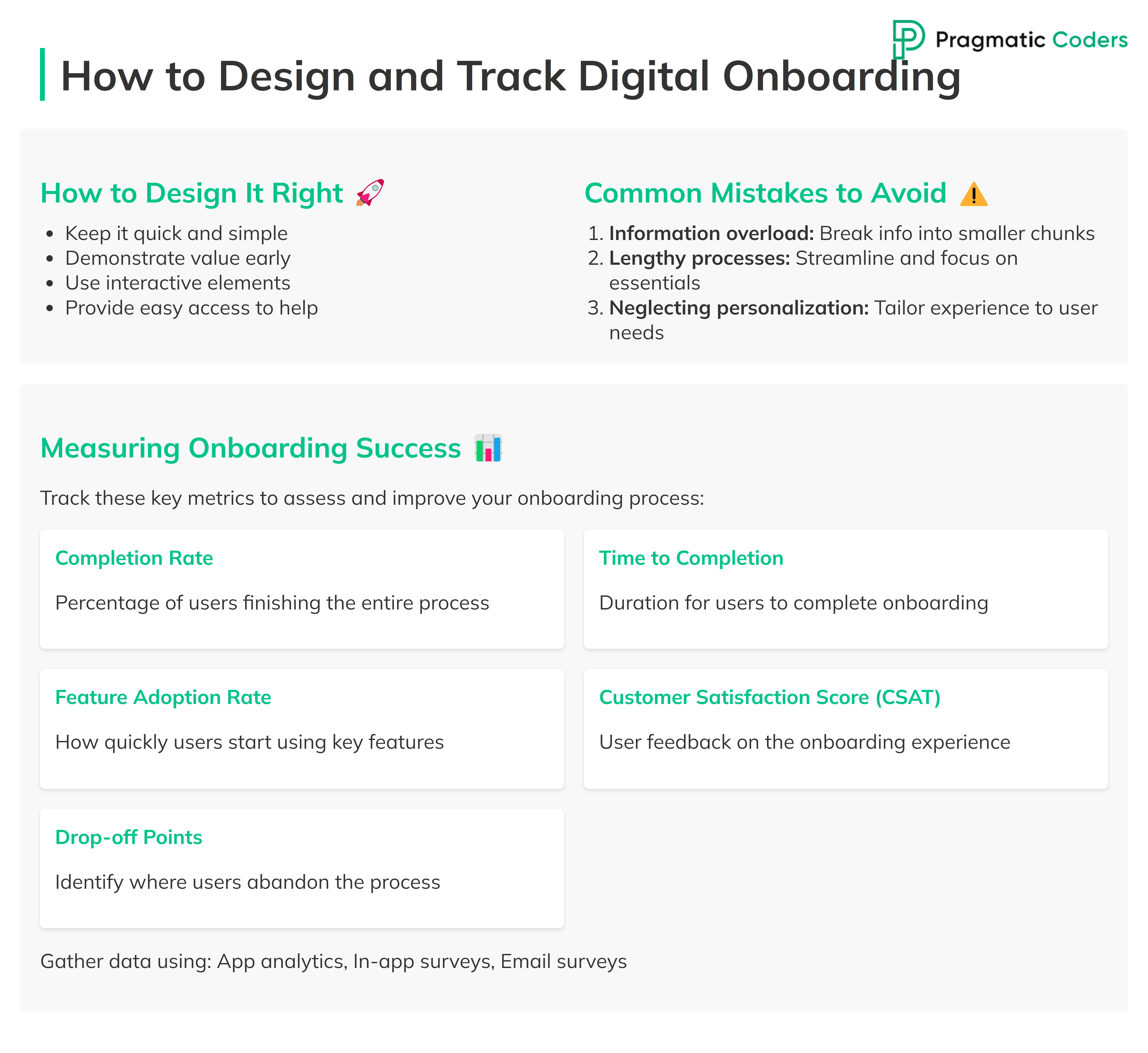

How to design a digital onboarding process right. Best practices

When designing your onboarding, keep these tips in mind:

- Keep it quick and simple. Users appreciate a fast setup process.

- Demonstrate value early. Show how your product solves their problems right away.

- Use interactive elements to make it more engaging.

- Provide easy access to help if users need it.

- Consider how your monetization strategies impact the onboarding experience.

Digital onboarding mistakes

Now, let’s dive deeper into common mistakes and how to avoid them:

- Information overload: Bombarding users with too much information at once can be overwhelming. This might cause them to abandon the process entirely. To avoid this, break information into smaller, manageable chunks. Introduce features and information gradually as users progress.

- Lengthy processes: Long, complicated onboarding can frustrate users and lead to high drop-off rates. Streamline your process by eliminating unnecessary steps. Focus on collecting only essential information upfront, and consider allowing users to complete additional steps later.

- Neglecting personalization: A one-size-fits-all approach might not meet the diverse needs of your users. Try to personalize the onboarding experience based on user data or preferences they’ve shared.

Metrics. Measuring onboarding success

Tracking key metrics is crucial to assess and improve your digital onboarding process. Here are important metrics to monitor:

- Completion rate: This shows the percentage of users who finish the entire onboarding process. A low completion rate might indicate that your process is too long or complicated.

- Time to completion: Track how long it takes users to complete onboarding. If it’s taking too long, consider ways to streamline the process.

- Feature adoption rate: Monitor how quickly users start using key features of your product or service after onboarding. This can indicate how well your onboarding prepares users to engage with your product.

- Customer satisfaction score (CSAT): Gather feedback to gauge user satisfaction with the onboarding experience. This can provide valuable insights into areas for improvement.

- Drop-off points: Identify where in the process users are most likely to abandon onboarding. This can help you pinpoint specific areas that need improvement.

To gather this data, use methods like:

- App analytics

- In-app surveys at different stages of onboarding

- Email surveys after onboarding completion

Use this feedback to continuously refine and improve your onboarding process.

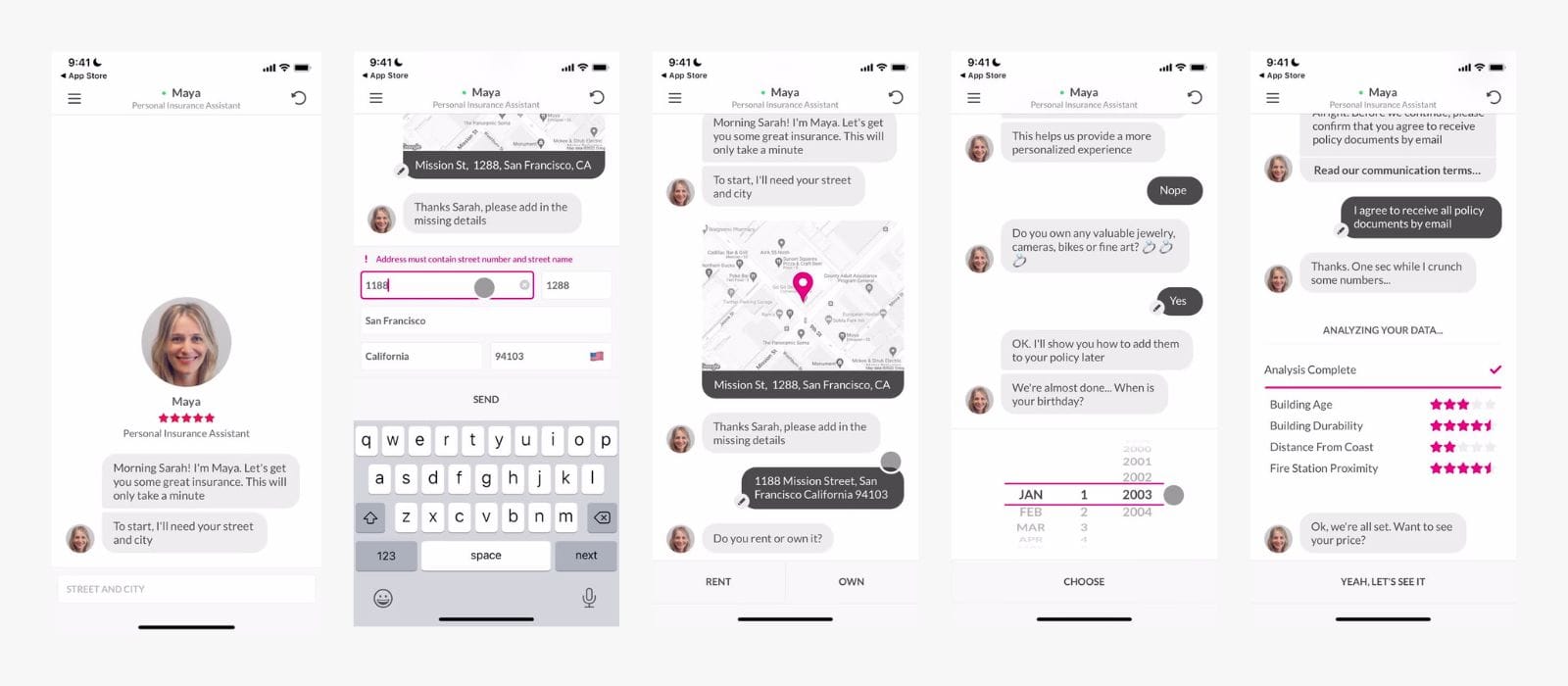

Future trends in digital onboarding: AI

As technology evolves, so does digital onboarding. Unsurprisingly, we can expect the process to be more and more infused with AI technologies that will provide deeper personalization and better fraud detection.

One interesting new approach is the use of conversational AI: chatbots that guide users through complex steps or answer questions in real-time.

You could experience a chatbot-guided onboarding if you’ve ever used Lemonade Insurance (they actually clearly state it in their Welcome screen: “Forget Everything You Know About Insurance. The world’s most loved insurance, powered by bots and AI”). The digital onboarding process is all about answering Maya’s questions one by one:

Learn more about the use of AI in banking apps: Conversational banking: How to implement conversational AI in banking?

What about other trends? Check:

Conclusions

Digital onboarding is your app’s first impression – make it count.

From security checks to user experience, it’s a balancing act that can make or break user adoption, especially in fintech and digital banking.

Want to create an onboarding process that turns new users into loyal customers? Or, maybe, you want to build an entire fintech app from scratch?

Contact us to design and develop a digital onboarding solution that will actually help you retain and engage your users.

Image sources: Page Flows, App Fuel