Conversational banking: How to implement conversational AI in banking?

Today, the world’s most innovative consumer banks are placing digital conversations at the core of their strategy.

Accenture’s research, based on experience with global banks, found that conversational banking can accelerate revenue growth by 25% and reduce costs by up to 30%.

- What is conversational banking then?

- How does it fit into the digital banking landscape?

- And why is it such a hot topic right now?

Let’s explain.

What do people want from online banking?

Before we move on to the concept of conversational banking itself, let’s quickly explain the reasons behind this approach.

The shift towards conversational banking is supported by customer preferences. What do people want from banks today?

- 76% of consumers want the option to seamlessly switch between calling and messaging based on their preference at the moment. (source)

- 82% of customers expect responses within 10 minutes, according to ServiceBell.

- 71% expect a consistent customer experience across channels, as per Forbes research.

- 73% of customers expect better personalization as technology advances, according to a Salesforce study.

People demand personalization. They expect seamless journeys and fast service. These elements will improve your customer retention. So, what traits does a bank need to meet these expectations?

What are the banks of tomorrow like?

As we look towards the future of banking, some characteristics emerge:

- Intelligent: Future banks will leverage AI to offer proactive suggestions, forecast critical decisions, and automate routine operations. This intelligent approach will transform how customers interact with their financial institutions.

- Personalized: By harnessing customers’ historical behaviors and present circumstances, banks will deliver solutions that are bespoke, timely, relevant, and predictive (they will anticipate the needs and intents customers have or might have in the near future based on their previous and current actions).

- Omnichannel: Banks will adopt a ‘jobs to be done’ philosophy, focusing on facilitating customer goals across all touchpoints. This approach will blur the lines between digital and physical services, core banking functions, and related non-banking products.

Learn more: Artificial intelligence bank: the future of finance?

What is conversational banking?

Conversational banking (chat banking) is the use of conversational AI to let a bank’s customers perform various banking tasks and get information by simply chatting with an AI system.

The solution perfectly aligns with the characteristics defined above: it provides a fast, anticipatory personalized and accessible, yet still human-like banking experience.

How does conversational AI in banking work?

From a user perspective, conversational banking is like having a knowledgeable banking assistant available 24/7 through your preferred communication channel.

You can access the conversational banking interface through various channels:

- Your bank’s mobile app

- The bank’s website

- Popular messaging platforms (e.g., WhatsApp, Facebook Messenger)

- Other (SMS, RCS)

You start a conversation by typing a message or speaking to the AI assistant. For example, you might ask “What’s my account balance?” or “I need help with a transfer” in a WhatsApp chat or reply to an SMS from your bank.

Thanks to Natural Language Processing (NLP), the AI understands your request, even if you use casual language or make typos. You don’t need to use specific commands or keywords, as it is with rule-based chatbots.

The AI assistant responds promptly. For simple tasks like checking balances, the AI can execute them directly.

Based on your banking history and profile, the AI might also offer personalized financial advice or product recommendations. For more complex issues, it might guide you through a series of questions to understand your needs better. The more you interact with the system, the better it becomes at understanding your preferences and anticipating your needs.

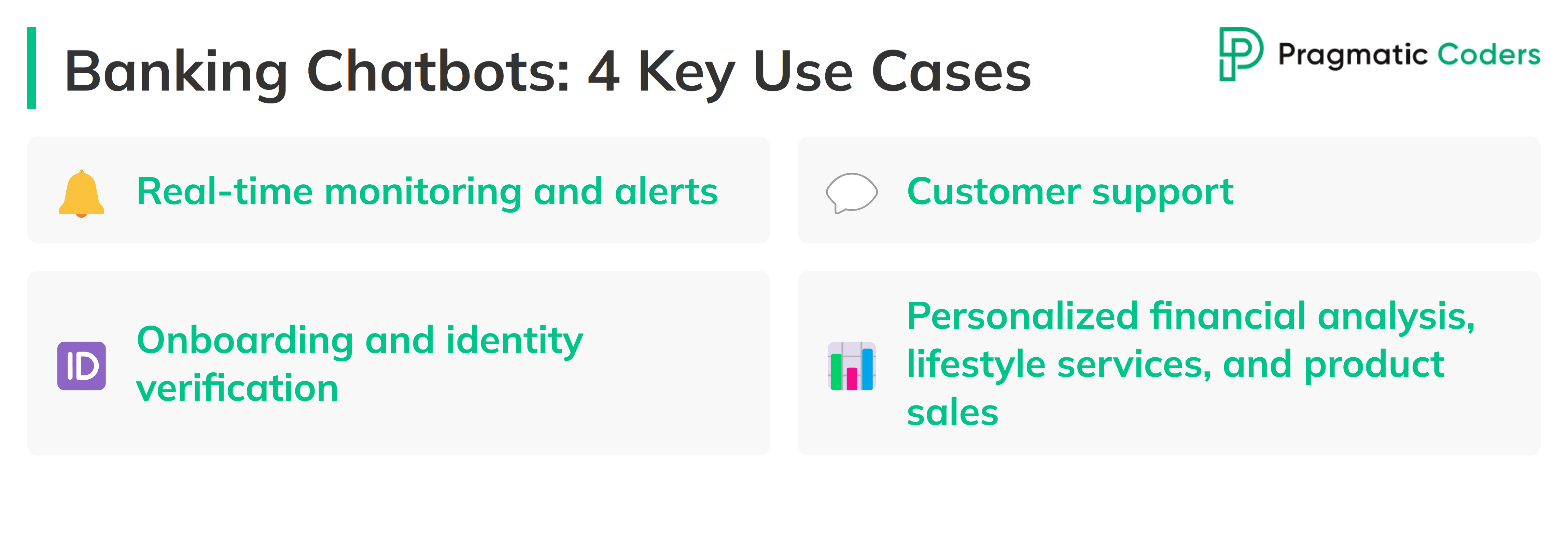

What can conversational banking chatbots do? 4 banking use cases

Real-time monitoring and alerts

Imagine you’re on vacation and your credit card shows an unusual purchase in your home city. AI will flag this suspicious activity immediately and send you an alert.

Of course, real-time monitoring doesn’t limit to just such extreme cases. Conversational AI could simply remind you about upcoming bill payments based on your typical spending patterns.

Learn more: Machine learning for fraud detection in fintech

Customer support

With conversational AI, you don’t have to navigate complex menus or sift through FAQs.

You can ask a simple question like “What’s my current balance?” and get an immediate response. What’s more, these AI systems are emotionally intelligent. They can detect if you’re frustrated and adjust their tone accordingly* or transfer you to a human agent if needed.

*Or, quite the contrary, you can turn on “Roast mode” to have AI roast you for balance overdraft–more on it in a while in the 3 real-world applications of conversational AI paragraph.

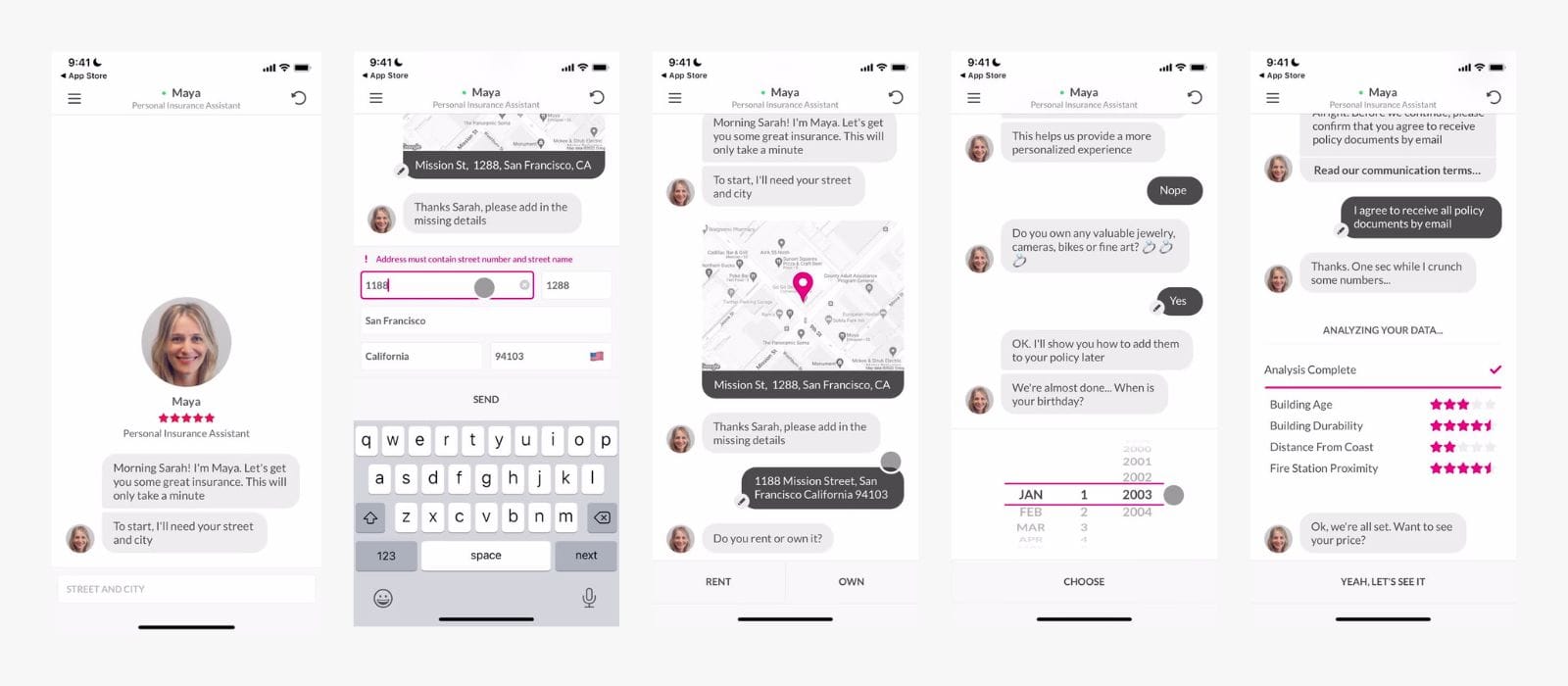

Digital onboarding

The AI assistant can also take charge of guiding users through the onboarding process. It helps users through document submission and requests necessary IDs. Moreover, it can perform initial validity checks. Once the AI has collected all required data and documents, it moves on to account setup.

The best thing about conversational AI in this case is that the chatbot doesn’t leave customers in the dark during this process.

Instead, it provides real-time updates on progress and estimated completion times. When the account creation is complete, the system promptly confirms this to the customer. Furthermore, it offers guidance on account access and navigation. This comprehensive support ensures a smooth start to the customer’s banking experience.

If you’d like to see an AI chatbot in action during digital onboarding, check out the Lemonade Insurance app (or simply the screenshots from it).

We’ve wrote a short guide to digital onboarding in fintech. Be sure to give it a read: How to design digital onboarding to retain users: App founder’s guide

Personalized financial analysis, lifestyle services, and product sales

Gone are the days of one-size-fits-all banking solutions.

Now, AI systems delve deep into your financial data to offer advice that’s truly tailored to your needs–even beyond traditional financial services.

For example, if you’re a young professional saving for your first home, the AI might suggest a high-yield savings account and provide tips on reducing unnecessary expenses.

And as far-fetched as it might sound, it’s actually what finance leaders are talking about, and conversational banking seems to align perfectly with these insights:

- Boston Consulting Group: To be sure, personalization in banking is not primarily about selling. It’s about providing service, information, and advice, often on a daily basis or even several times a day.

- Kavin Mistry, head of digital marketing and personalization at TSB Bank says in an interview for ZDNET: We want to use AI and ML to identify key events in the customer’s life that might necessitate financial support and use that response to help customers ultimately achieve their life ambitions.

Learn more: Personalized banking & AI: How to build a loyal customer base

3 real-world applications of conversational AI

1. bunq’s Finn

I’ve already mentioned bunq in our article on climate banking. Apart from being a sustainable banking app, bunq’s expanding its services with an AI-based assistant, Finn.

Launched to help users better manage their finances and navigate the banking app, Finn replaces the traditional search function with a more intelligent, conversational interface.

Using powerful language models, Finn allows users to ask complex questions about their spending habits, budgets, and transactions through a chat-style interface. For example, users can inquire about their average monthly grocery spending, yearly expenditure on specific merchants like Amazon, or even ask contextual questions like identifying a restaurant they visited with a friend in a particular city.

Finn’s capabilities extend to combining data to answer nuanced questions, such as detailing spending at a specific location on a certain date. This level of detail and context-awareness aims to provide users with deeper insights into their financial behaviors.

That’s for the theory, because bunq’s conversational AI didn’t seem to work very well. To be objective, I must mention these comments:

- Please make Finn an optional feature

- [SUGGESTION] Possibility to opt out of Finn

- Finn is horrible : r/bunq

2. Bank of America’s Erica

Erica is an AI-powered virtual financial assistant launched by Bank of America, one of the largest banks in the United States.

The AI assistant handles a wide range of customer inquiries and transactions, acting as a comprehensive financial management tool. Erica can help customers with tasks such as checking account balances, transferring money, paying bills, and even providing personalized financial advice.

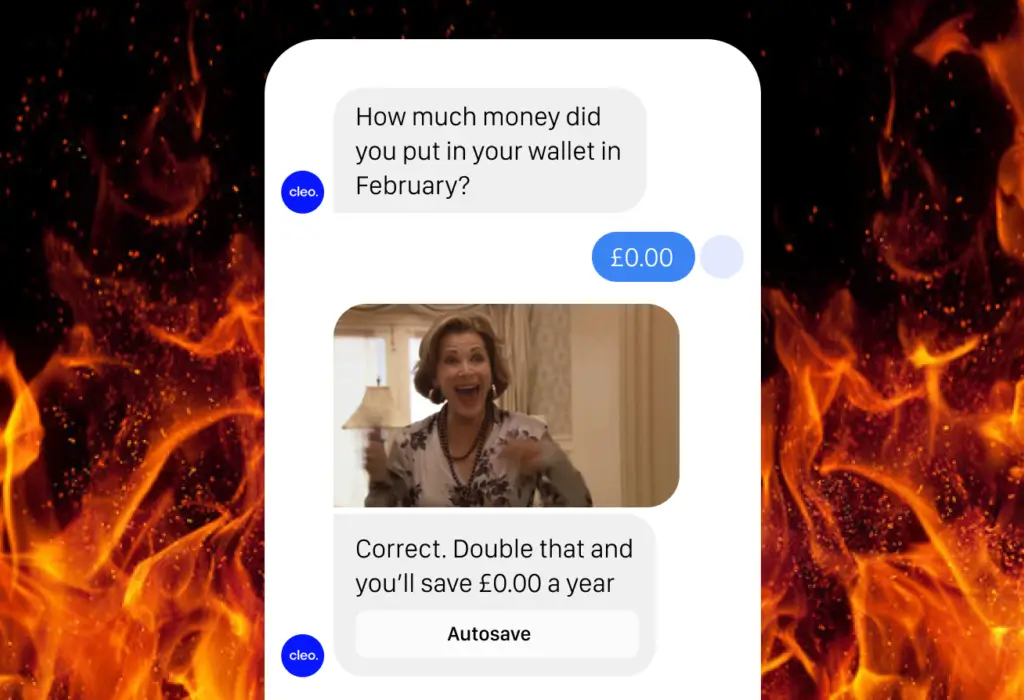

3. Cleo AI

Cleo is a unique player in the conversational banking space.

It’s an independent financial management app that connects to users’ existing bank accounts.

The app is primarily targeted at millennials and Gen Z financial needs, with a focus on making money management more engaging and less intimidating. That’s why it uses a conversational interface with a distinct personality, often using humor and sass in its interactions. This way, Cleo can really differentiate itself from traditional finance-related style and tone.

The AI provides insights into spending habits, helps with budgeting, and offers personalized financial advice. It can set aside money automatically for savings goals and even offer small cash advances to help users avoid overdraft fees.

Learn more: How to design a mobile banking app for Gen Z

Why? The benefits of conversational banking experience

Conversational banking offers key advantages for financial institutions.

- Enhanced customer engagement: Conversational AI allows banks to offer personalized, round-the-clock service. As customers receive prompt, tailored assistance whenever they need it, their satisfaction and loyalty increase.

- Increased revenue and Customer Lifetime Value (CLV): AI can analyze a customer’s spending patterns and financial goals, then suggest relevant products. For instance, if a customer frequently travels abroad, the AI might recommend a credit card with no foreign transaction fees, leading to to more successful cross-selling, and increasing the customer’s lifetime value.

- Operational efficiency and innovation: Banks can automate routine tasks, such as password resets or account balance inquiries, through conversational AI. As a result, human agents have more time to handle complex issues. Moreover, banks can quickly test and deploy new features. For example, a bank could easily add a feature that allows customers to temporarily freeze their credit cards via chat, and then analyze user adoption rates.

- Competitive edge: As customers increasingly expect digital-first services, banks that offer advanced (and properly working) conversational AI can stand out.

- Data-driven insights: Every interaction with a conversational AI system provides valuable data. For example, if many customers ask about overdraft fees, the bank might realize there’s confusion about this policy and decide to clarify it or create an educational campaign. Therefore, banks can make more informed decisions about product development and marketing strategies based on real customer needs and behaviors.

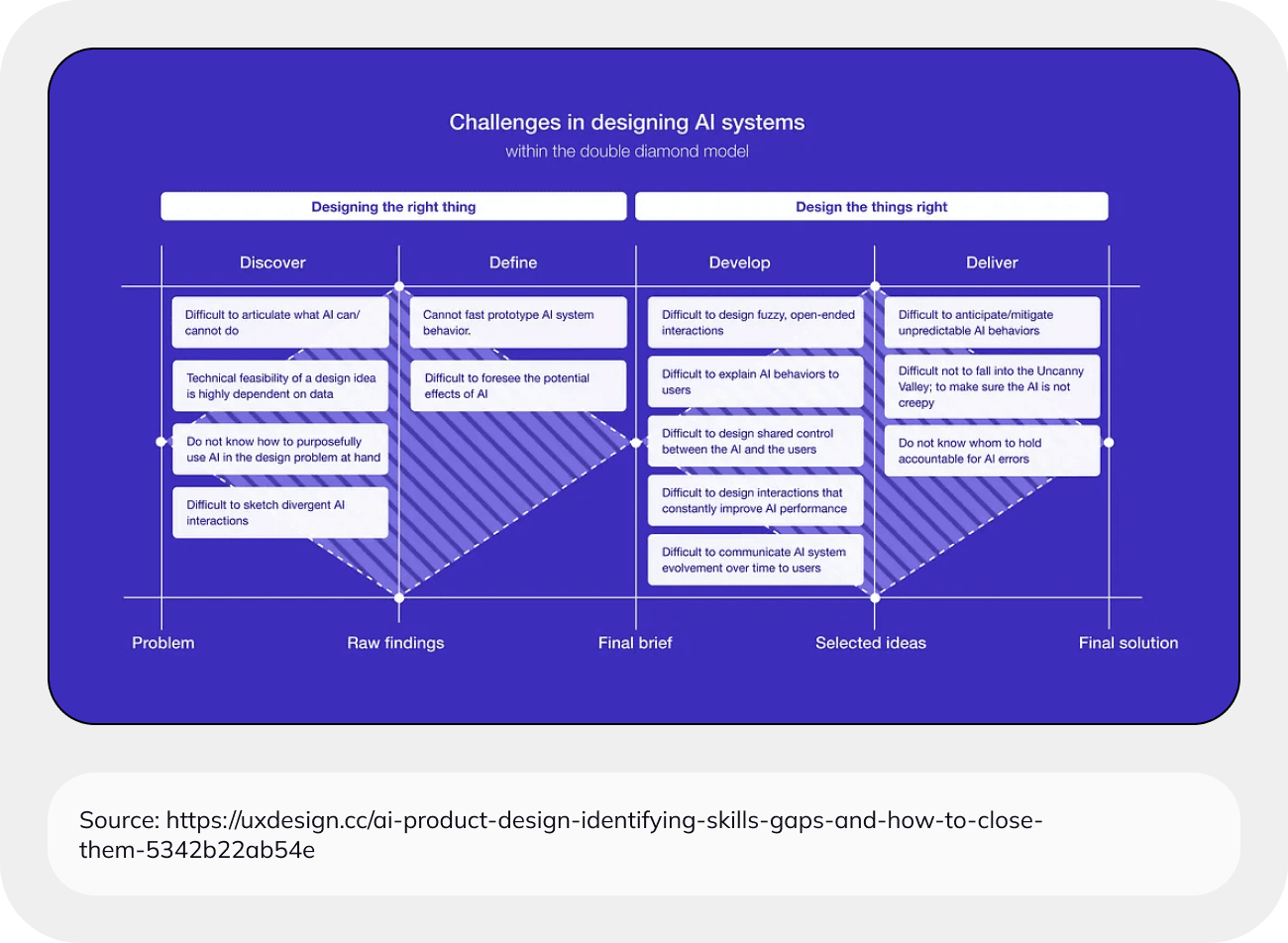

How to design conversational AI?

If you’re building an artificial intelligence-powered product, understanding the nuances of designing non-confusing AI interfaces is super-important.

The 3️ main design challenges you must face are:

- Prompt-based input barriers: Many AI tools rely on text prompts, which can be challenging for users with low literacy. And with nearly half of the world’s adults having reading skills below a sixth-grade level, making effective prompt creation is a significant hurdle.

- Managing unpredictable AI outputs: AI systems can produce unexpected or unexplainable results, and designers simply can’t plan for every possible scenario. This unpredictability can make your users confused and frustrated if not properly managed through the interface design.

- Balancing AI capabilities with user-friendly design: How to create powerful AI features that won’t overwhelm users with complexity?

Damian Lipiński, UX Designer at Pragmatic Coders, explained common design patterns and good practices to design AI interfaces RIGHT: Designing AI interfaces: Challenges, trends & future prospects

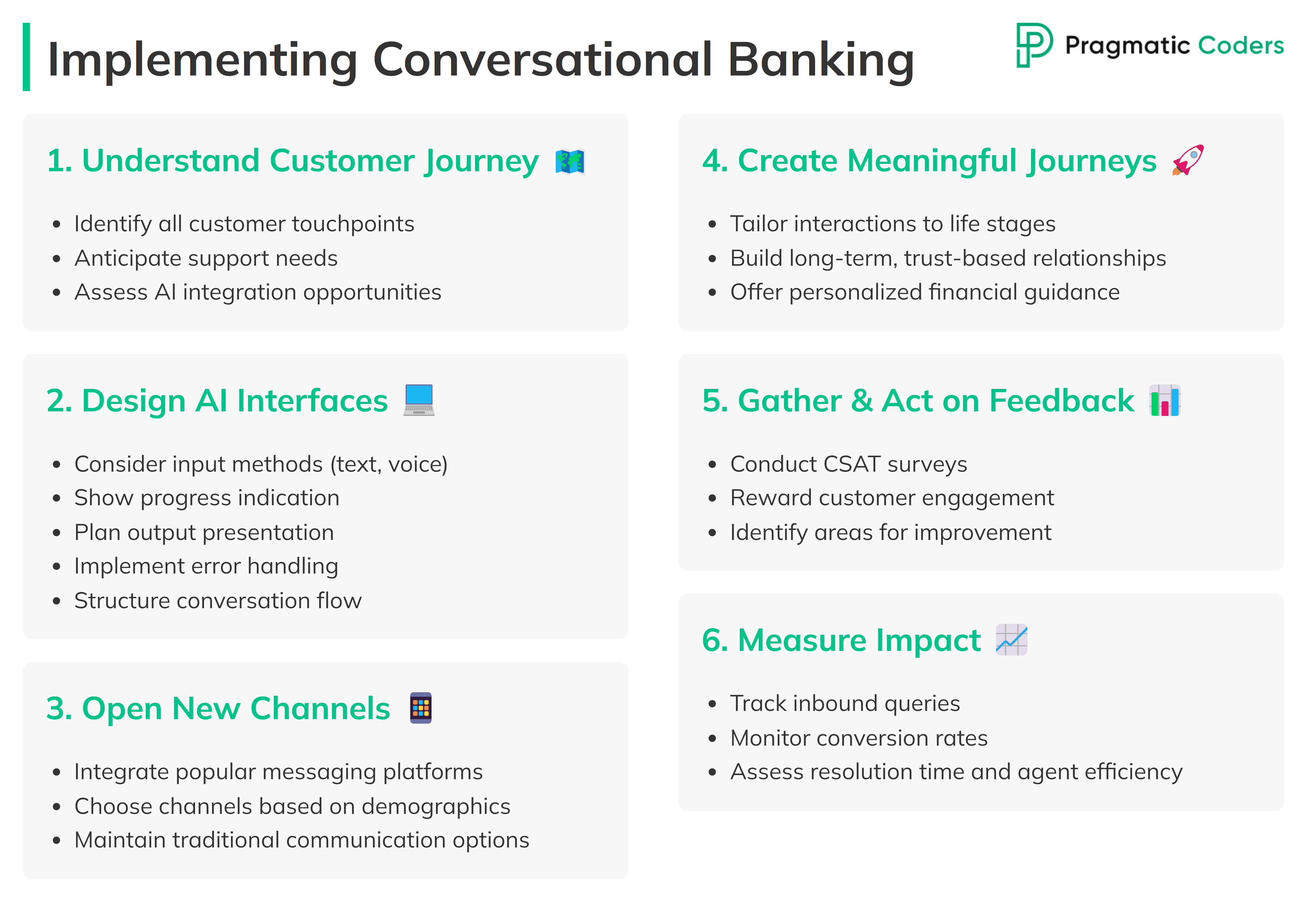

How to implement conversational banking: A guide for app creators

To develop an effective conversational banking experience, consider the following steps:

1. Understand your customer journey

This step is about mapping out how customers interact with your banking service.

- Identify every touchpoint: List all the ways customers engage with your bank, from website visits to app usage, phone calls, and in-person visits.

- Anticipate support needs: Predict when and where customers are most likely to need assistance. For example, during account opening, while making transactions, or when facing issues.

- Assess AI integration opportunities: Determine which interactions could benefit from AI chatbot support. This might include FAQ responses, basic account inquiries, or transaction assistance.

Check: AI Integration Services

2. Design AI interfaces right

As I mentioned above, to make conversational banking work, you need interfaces through which customers can communicate with AI assistants. However, designing for AI presents unique challenges because these systems can produce unexpected or difficult-to-explain results.

Learn more: Designing AI interfaces: Challenges, trends & future prospects

3. Open new channels

This involves expanding your communication avenues:

- Integrate popular messaging platforms: Incorporate widely-used apps like WhatsApp or Facebook Messenger into your banking communication strategy.

- Consider demographics: Choose channels based on your target audience. Younger users might prefer chat apps, while older customers might favor traditional methods like SMS or phone banking.

- Maintain traditional options: While embracing new technologies, remember to keep traditional communication methods available for customers who prefer them. It’s important to remember that a customer journey in banking involves various touchpoints, both offline and online. A bank should provide their customers with various contact channels to make sure they can seamlessly move from one to the other.

4. Orchestrate meaningful customer journeys

Focuses on personalizing the banking experience. As Samantha Searle, director analyst at Gartner noticed, hyper-personalized banking service should assist customers in achieving their financial objectives. What’s more, it should set its focal point on a customer’s life stages and provide support during major life events, such as marriage.

- Life stage-appropriate interactions: Tailor conversations and product offerings to customers’ life stages. For instance, offer student loans to college-age customers or retirement planning to older demographics.

- Build long-term relationships: Use conversational banking to create ongoing, trust-based relationships with customers, not just for transactional interactions.

5. Gather and act on customer feedback

This step is crucial for continuous improvement:

- Conduct CSAT surveys: Use customer satisfaction surveys to understand user experiences with your conversational banking tools. You can leverage conversation banking tools to collect user feedback.

- Reward engagement: Offer incentives like discounts to encourage customers to provide feedback and engage with your AI tools.

- Identify improvement areas: Analyze feedback to find ways to enhance your services.

6. Measure impact

Keep track of important data points like the number of inbound queries or conversion rates. Assess how well your conversational channels are performing by looking at metrics like average resolution time and time saved for human agents.

Conclusions

Conversational banking is changing customer interactions because it offers immediate, personalized, and seamless services.

Because consumers now expect faster and more personalized experiences, banks need AI tools to anticipate user needs and provide relevant financial advice. That’s why app creators must focus on AI interfaces that provide relevant and efficient services over time.

However, creating a conversational banking AI that is actually useable and doesn’t make users want to switch to a human agent immediately is a huge challenge. Gartner’s research showed that only 8% of nearly 500 B2B and B2C customers surveyed had interacted with a chatbot during their most recent customer service experience.

We’ve worked with financial organizations from and outside Europe to help them remain competitive in today’s mobile banking landscape.

Drop a line–we’ll help you design and build a truly personalized conversational banking experience.