Baby Boomers’ 20 Financial Habits and Attitudes (Spending, Saving, Investing, & More)

Baby boomers grew up in a different time, and their financial habits show it. Many started investing later, focused on saving slowly, and worked toward long-term goals like owning a home. Now, as they move into retirement, their priorities have shifted. In this article, I look at how boomers save, spend, and plan, and what their choices say about their values.gen

|

Spending

1. What are boomers’ spending priorities? (Experiences vs. goods)

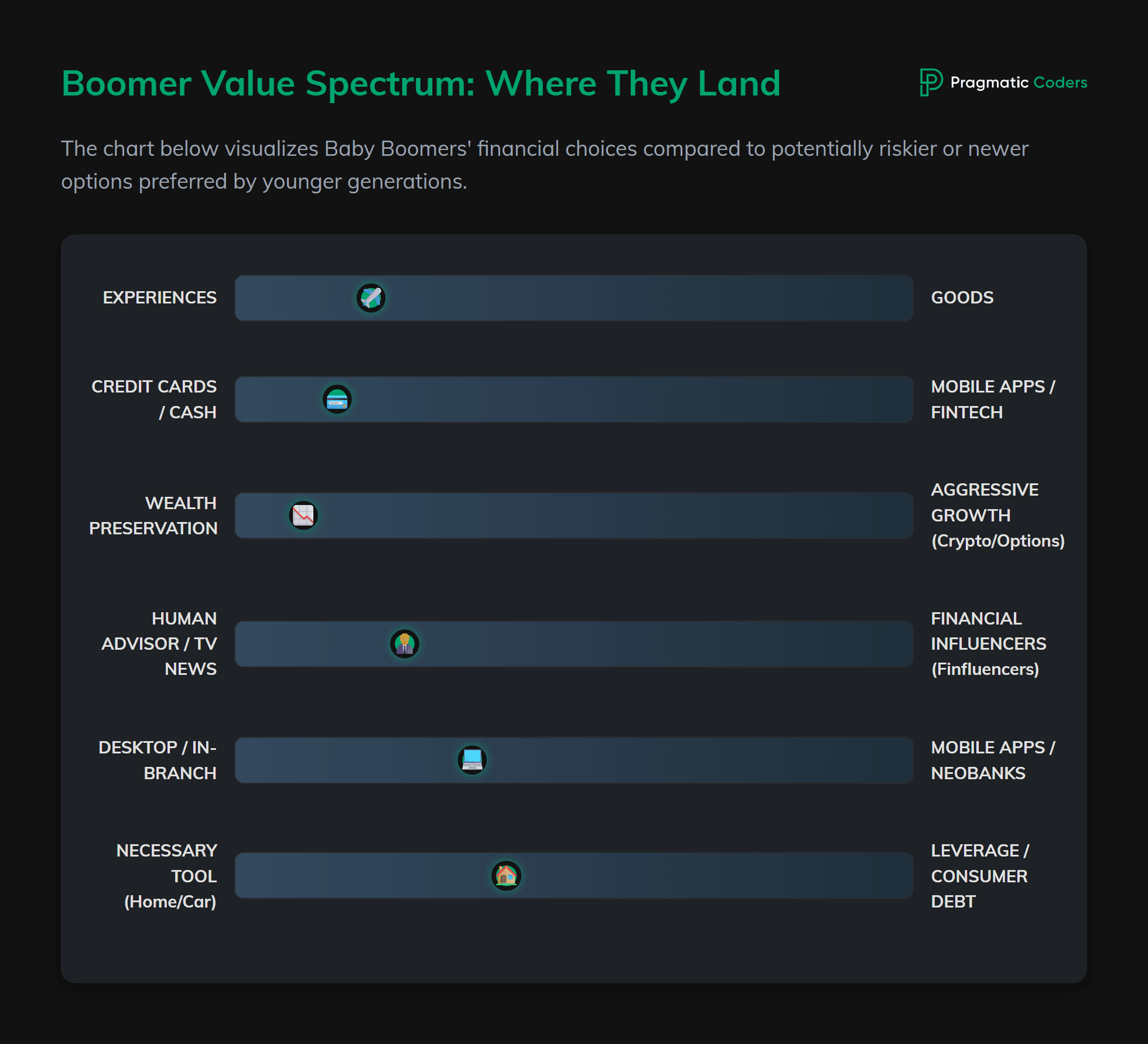

As they age, baby boomers overwhelmingly prefer experiences over things.

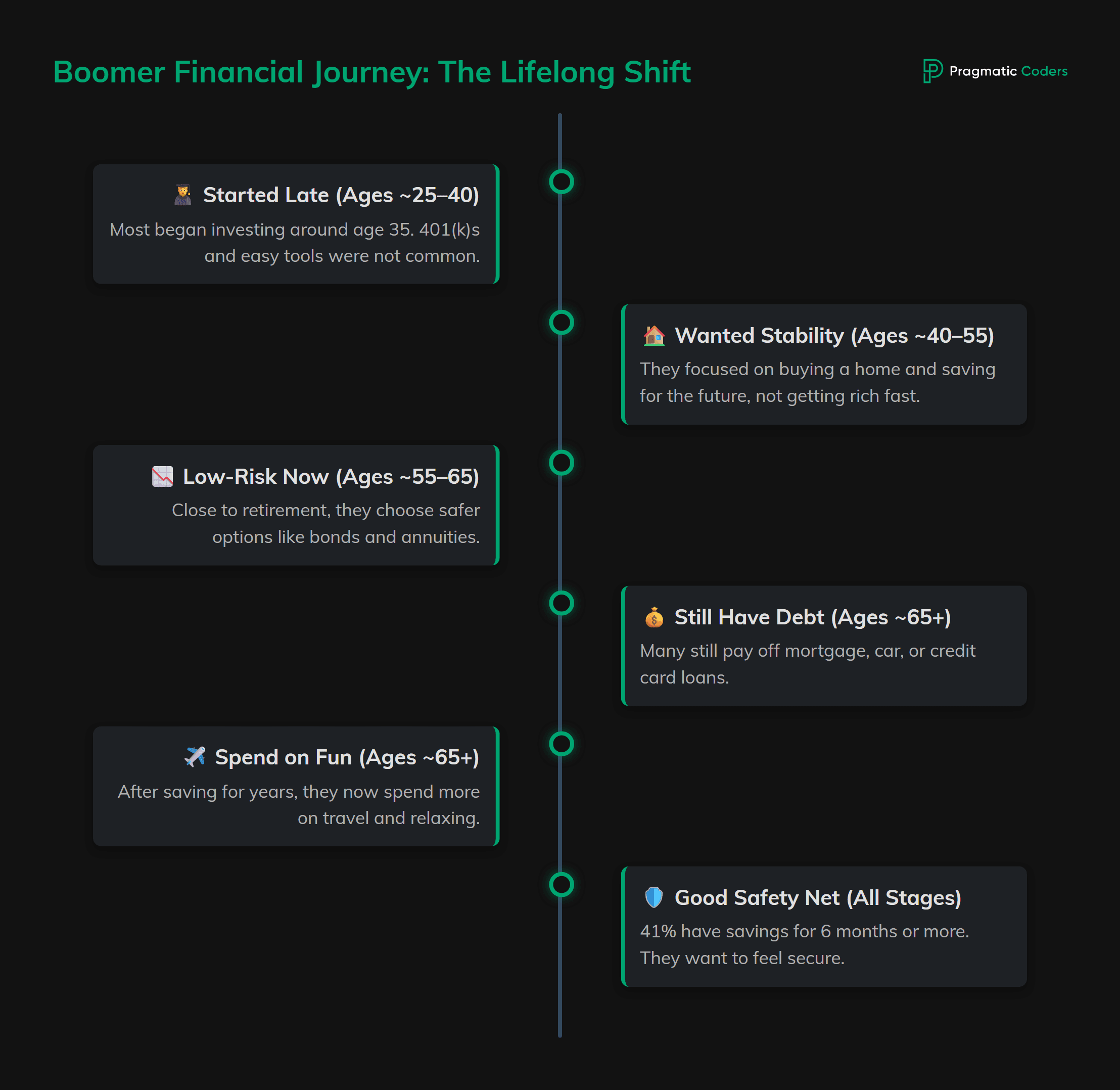

Their biggest expense is travel and leisure (like vacations and sightseeing) spending more on this than on any other category. They are 159% more likely than average to book trips on impulse, and retired boomers are 211% more likely. About 63% say vacations are a key part of life, and 70 percent consider nonessential spending on things like dining out to be a basic part of their lifestyle.

While they still buy products (like e-readers or smart TVs), their focus is on enjoying life, not collecting stuff. In retirement, many plan to use their money on themselves for travel, hobbies, and enjoyment (GWI, 2025; Money, 2025).

2. Are baby boomers budget conscious?

Baby boomers watch their budgets but still spend on extras.

They spend about $683 a month on non-essentials like dining, travel, and hobbies—more than Gen X (~$588) but less than millennials (~$838). While 15–20% of their income goes to these extras, the remaining ~80% covers basics like housing, food, and insurance.

They are the most likely generation to cut non-essentials when money gets tight, showing they know the difference between needs and wants. Those with limited finances cut extras first, while wealthier boomers usually keep spending the same (AARP, 2019; McKinsey).

3. What’s the boomer’s preferred payment method?

Boomers mostly stick with familiar ways to pay. They prefer credit cards and are the most likely to pay off balances monthly. Cash is used for small daily purchases.

They are less enthusiastic about new tech: Only 18% of boomers use mobile payment apps like Google Pay or Apple Pay, compared to over half of younger generations. They worry about mobile payment security (43%) but are comfortable entering credit card info online and prefer credit cards for online shopping (Kantar, 2024; Consumer Money Matters, 2022).

4. How do you discover, interact with, and remain loyal to brands?

Baby Boomers are more likely to discover brands through traditional media, with 45% citing TV ads as their primary source (way higher than Gen Z’s 32%).

Only 35% of Boomers use social media for brand discovery. When it comes to shopping, around 60% prefer in-store experiences, valuing the ability to see and test products firsthand and engage with staff. Brand loyalty is strongly tied to quality and reliability, with 88% prioritizing product quality as their main driver (GWI).

![]()

Saving

5. How much do baby boomers save?

Baby boomers are generally regular savers.

In a recent survey, 62% of boomers self-identified as “savers” rather than spenders, the highest of any generation. On average, they were putting about 17% of their monthly income into savings (11.9% into 401(k) plans plus a 5.0% employer match). Many adhered to the financial advisor rule of thumb to “save 10% of each paycheck.”

However, wealth varies greatly: a 2025 study noted that 1 in 5 boomers had less than $5,000 in personal savings (Advisor, 2020; Fidelity, 2025).

6. Do boomers have emergency funds?

Boomers are relatively well-prepared with rainy-day funds. Around 84% have at least something set aside for emergencies, and 41% have an emergency fund that could cover 6+ months of expenses—the highest of any generation. Barely 16% reported having no emergency savings at all. This suggests most boomers aim for the classic “3–6 months” rule, with an average emergency savings balance (for those who have one) noted at over $22k. This safety net is a priority, especially for retirees needing to handle medical bills or home repairs (Bankrate, 2025).

7. Where do boomers save money?

Baby boomers favor traditional, safe places for their savings, prioritizing liquidity and security (like FDIC insurance) over chasing higher returns. They typically use bank savings accounts, money market accounts, or certificates of deposit (CDs). Many even leave large sums in checking/current accounts for convenience. They are less inclined than younger generations to adopt fintech alternatives for saving, such as micro-investment apps or crypto savings accounts, and instead place their trust in bank-based solutions (Virgin Money UK, 2024; MX, 2024).

Investing

8. Do they invest, and in what?

Yes, a large portion of baby boomers invest their money, controlling a massive amount of invested wealth. They primarily invest in traditional assets like stocks, bonds, and real estate. Many built their retirement nest eggs through employer plans (401(k)/IRA), buying equity mutual funds, blue-chip stocks, and bonds.

They also heavily invested in real estate (homeownership rates are highest for boomers). Boomers tend to stick to what they know: diversified funds, blue-chip dividend stocks, and annuities for income, often shifting toward bonds and cash as they near or enter retirement (MX, 2024).

9. What’s the boomers’ main motivation to invest?

The primary motivation for boomer investors has been retirement security – making sure they have enough money to retire comfortably.

Unlike younger generations who might invest to “get rich” or out of curiosity, boomers invested with clear goals: to grow a nest egg, provide future security, and achieve financial independence. They cite stability and long-term value as key drivers. Speculative motives are less common; they aim to fund 20-30 years of retirement and sometimes generate current income (dividends or rent). A notable share also invests with legacy in mind, though many wealthy boomers now plan to spend their wealth rather than just leave it all to heirs (Money, 2025).

10. When did boomers start investing?

Most baby boomers began investing later in life compared to today’s young adults, with one survey finding the average boomer started around age 35.

This contrasts sharply with Gen Z, many of whom start before 20. The reasons are historical: when boomers were young in the 1970s–80s, easy investment channels were fewer, and workplace retirement plans (like the 401(k)) were just becoming popular. Many got into the market after they bought homes and settled down. Broadly, this generation’s investing journey began later in mid-career, but ramped up, so by their 50s and 60s nearly all had investments (Downtown Josh Brown, 2024; World Economic Forum, 2025).

For more about Zoomers, read:

- Gen Z reveals 6 true yet overlooked banking trends

- How to design a mobile banking app for Gen Z

- Gen Z healthcare in 2025: Expectations & trends

Also check our articles on other generations:

- What Are Gen Alpha’s Money Habits and How Can They Inspire Product Design?

- Generation Alpha Statistics (220+ stats for 2025)

- What you need to know about Generation Beta 👶

11. What is the boomers’ risk tolerance?

As a rule, baby boomers lean toward lower risk investments, prioritizing wealth preservation over big gambles. Now in their 60s and 70s, they typically shift heavily into low-volatility assets—think bonds, Treasury bills, annuity products, and cash—to ensure they don’t lose principal.

They are more likely than younger investors to say that bonds, annuities, or gold are the “best investment” choices. Any high-risk/high-reward investing (like crypto or options trading) has very limited participation (only 5% have any cryptocurrency account). Boomers generally prioritize capital preservation and income generation over aggressive growth (The Motley Fool, 2025).

Debt & borrowing

12. Do boomers carry debt? What kind?

Many boomers do carry debt. A lot still have mortgage debt (average owes around $188k) or auto loans (average ~$22.5k).

Most also use credit cards (81% have at least one), and a high number carry credit card balances month-to-month.

In fact, 22% of Baby Boomers said their top financial goal for 2024 was paying off credit card debt.

Some also have personal loans, medical debt, or even Parent PLUS student loans taken on for their children. The typical boomer’s debt profile includes a mortgage, a possible car loan, and persistent credit card debt (Yahoo!Finance, 2024; MX, 2024).

13. What is the boomers’ relationship with debt?

For boomers, debt is seen as a necessary tool for big-ticket needs, but a potential burden if not managed.

They justify loans for major purchases like a home or car, viewing the house as an investment.

However, they are culturally more debt-averse regarding consumer debt. They strive to be debt-free before or during retirement, knowing that carrying high-interest obligations can squeeze a fixed income. Surveys show about one-third of boomers worry they’ll never be fully financially secure, with fear of lingering debts being a key reason. In their ideal, debt is something to use prudently and eventually escape (FoxBusiness, 2019; Watchman Group, 2023).

14. Do they spend their income on debt repayment?

Yes, baby boomers spend a significant portion of their income on debt repayment, with an average monthly debt payment of $1,529.

This amount represents the second-highest monthly debt burden among generations (behind Gen X). Their debt payments include mortgages (a major contributor), auto loans, and student loans (boomers pay the most on student loans of any generation—$327 on average—due in part to Parent PLUS loans) (CBS News, 2024).

Financial tools & technology

15. What are boomers’ budgeting methods?

Boomers span the gap between old-school and digital.

A sizeable segment still uses manual methods: about 1 in 4 (23%) track their finances with spreadsheets or pen-and-paper ledgers.

Nearly half (45%) manage their money mainly by reviewing account balances and transactions (mental accounting), rather than using dedicated budgeting apps. Online banking via computer is common, but when it comes to budgeting apps (like Mint or YNAB), boomers are less engaged.

Nearly 1 in 4 never use mobile apps for finance tasks, preferring approaches they’ve trusted for years (MX, 2024).

16. Do they follow influencers or traditional media?

Baby boomers are less likely to follow “finfluencers” on social media.

Their information sources tend to be traditional media and trusted professionals.

They get financial news from newspapers, cable news (CNBC), finance TV, magazines (Kiplinger’s), and rely heavily on advice from financial advisors, accountants, or well-known finance personalities (e.g., Suze Orman or Dave Ramsey).

They value advice with a track record and are not typically plugged into the influencer-driven finance media environment that younger folks are immersed in (Motley Fool, Seeking Alpha).

17. What is boomers’ attitude to digital banking?

Digital banking is important to baby boomers, but mostly via computers; mobile banking is adopted more slowly.

A large majority log into bank websites to check balances, transfer funds, or pay bills. Many prefer the bigger screen and perceived security of a desktop/PC (41% primarily manage accounts this way).

While some have adopted mobile apps for convenience (like depositing checks), nearly 1 in 4 still do no finance tasks on mobile apps, often citing comfort and security concerns. They appreciate not having to visit a bank branch for every task, but they won’t embrace tech for tech’s sake (American Bankers Association, 2024; MX, 2024).

18. Do baby boomers trust AI advisors?

Overall, boomers are skeptical about AI-driven money management and tend to trust human judgment or their own experience more.

Only a small fraction of boomers currently use robo-advisors (automated investment services). Many either manage investments themselves or work with a human financial advisor, valuing that personal touch. Replacing a long-term relationship with an algorithm feels impersonal or risky. They are less familiar with emerging financial technologies and are more concerned about security and privacy. They might use AI in limited ways, but prefer oversight (MX, 2024).

Attitudes & goals

19. What is money to boomers, and what are their top goals?

For boomers, money represents a combination of security and freedom, with enjoyment coming as a reward for a life of hard work. The feeling of financial security is paramount—about 31% of boomers report feeling completely secure, the highest among age groups. Their top financial goals now revolve around preserving and enjoying that security:

1) Ensuring a comfortable retirement and that their money lasts,

2) Paying off credit card debt (a top goal for 22%), and

3) Funding leisure activities such as travel and hobbies.

While helping family is a goal for some, many prioritize spending on themselves to fully enjoy the fruits of their labor (Bankrate, 2025; MX, 2024).

20. Long-term planning vs living in the moment?

Boomers are historically a planning-oriented generation.

They pioneered the widespread use of retirement plans and diligently saved and invested for decades, with the goal of achieving a secure retirement. This mindset persists; even in retirement, they often budget carefully to ensure their money lasts. That said, after years of hard work, many are now shifting towards “living in the now.” They believe in enjoying the fruits of their labor, which allows them to be more spontaneous with spending on experiences (e.g., booking vacations on a whim). Their long-term planning is what allows them to now cautiously enjoy the present (McKinsey, 2025).

AARP (2019): Are You Wasting Money on Nonessentials? Advisor (2020): How boomers, gen X and millennials spend and save American Bankers Association (2024): National Survey: Record Number of Bank Customers Use Mobile Apps More Than Any Other Channel to Manage Their Accounts Bankrate (2025): More Than 1 in 4 Americans Feel They Need To Make At Least $150,000 A Year To Live Comfortably Business (2025): Know Your Customers: How Different Generations Prefer to Pay CBS News (2024): Here’s how much the typical American pays in debt each month Consumer Money Matters (2022): Consumer Money Matters: Debt on the Rise, Savings on the Decline Cornerstone Advisors (2021): Mobile Banking Adoption In The United States Has Skyrocketed (But So Have Fraud Concerns) Downtown Josh Brown (2024): Boomers Began Investing at 35. Gen Z Started at 19. Think about that. Empower (2024): 37% can’t afford an unexpected expense over $400: new Empower research Enterprise Bank (2021), The Rise of Digital Banking: Financial Trends Within the Baby-Boomer Generation Fidelity (2025), How do your retirement savings stack up? FoxBusiness (2019): 20% of Baby Boomers Are Making This Huge Financial Mistake GWI (2025): Baby boomers’ spending habits in 2025 Kantar (2024): Paper, Plastic or Pixels: Payment Preferences by Generation McKinsey: An update on US consumer sentiment: Settling in for a tepid holiday season Money (2025): Wealthy Boomers Would Rather Enjoy Their Money Now Than Save It for Their Kids MX (2024): Baby Boomer Behaviors: Stats and Data on How This Generation Manages Money MX? (2023): What is Financial Wellness? It’s Not Today’s Consumer Money Experience The Motley Fool (2025): Gen Z vs. Boomers: What Each Generation Thinks About Long-Term Investing Virgin Money UK (2024): New research explores how different generations approach saving and investing Watchman Group (2023): Generational Views on Financial Security: Survey Unveils Varied Perspectives World Economic Forum (2025): New research finds retail investing shift towards younger investors, reshaping market trends Yahoo!Finance (2024): 6 Fun Baby Boomer Retirement Activities That Are Bolstering the EconomySources