What Are Gen Alpha’s Money Habits and How Can They Inspire Product Design?

Generation Alpha, born roughly between 2010 and 2024, isn’t just the generation of the future; they are actively shaping its financial contours today – even though the oldest Alphas are just 15 years old as of 2025.

And, although they’re sometimes called “mini-Millenials”, they are far more than just minimized versions of their parents.

Here are six untapped financial habits of Gen Alpha that your next digital product should be designed for.

You might also want to check our big list of Gen Alpha statistics.

1. What is the Kid-Preneur Economy for Gen Alpha?

- IN SHORT: The Kid-Preneur Economy refers to the growing trend of children aged 6–14 using technology and social media to start side hustles. As of 2025, 69% of Gen Alpha are either already engaged in or planning micro-businesses.

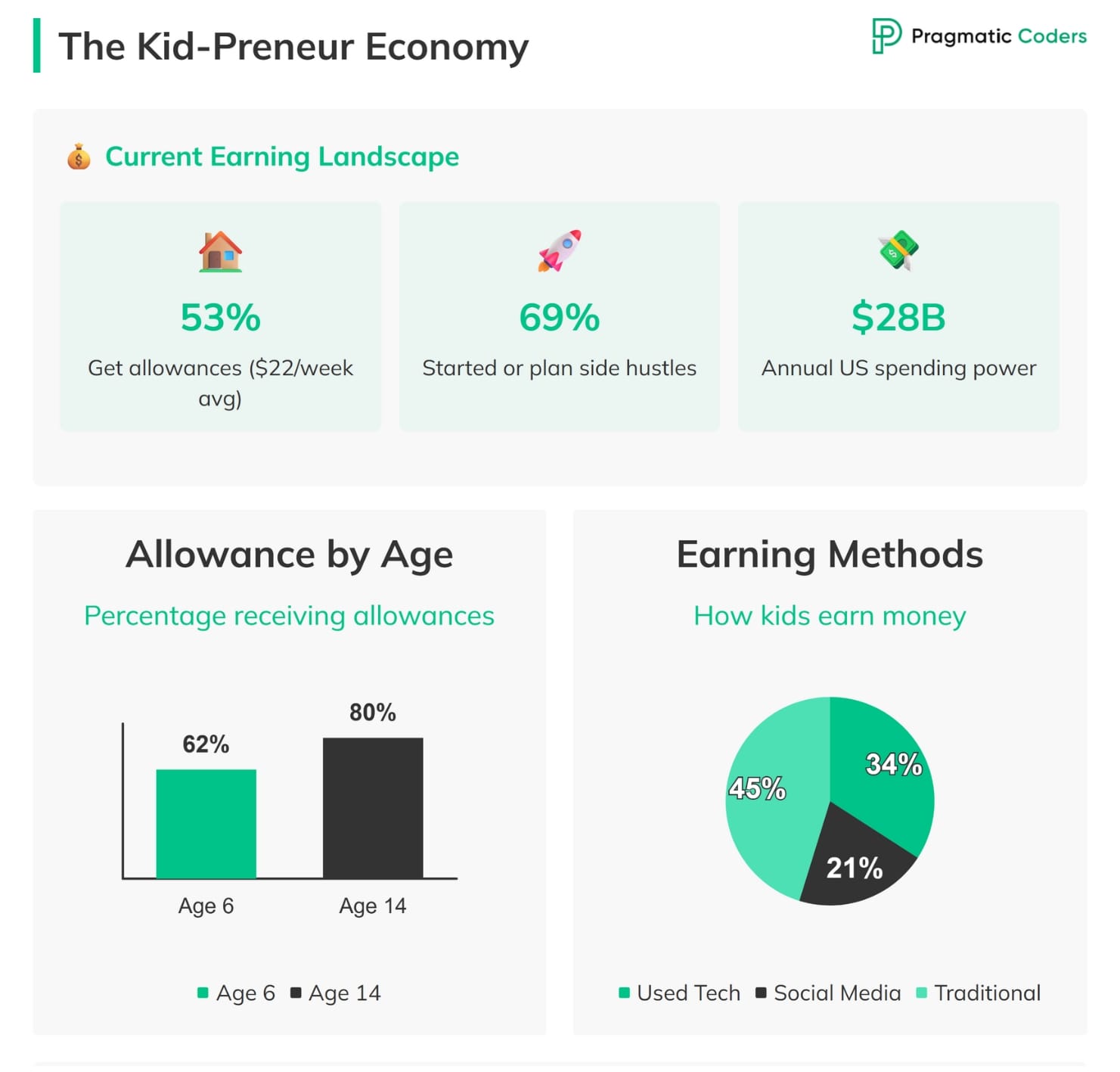

Gen Alpha usually starts with old-school allowances but quickly moves into tech-savvy ways of making money. By age six, 62% are already getting an allowance, and by 14, it’s up to 80%.

On average, they’re pulling in $22 a week—adding up to over $28 billion in yearly spending power across the U.S. (Numerator). For most, it’s their first shot at learning how to save, budget, and spend.

A lot are diving into side hustles early.

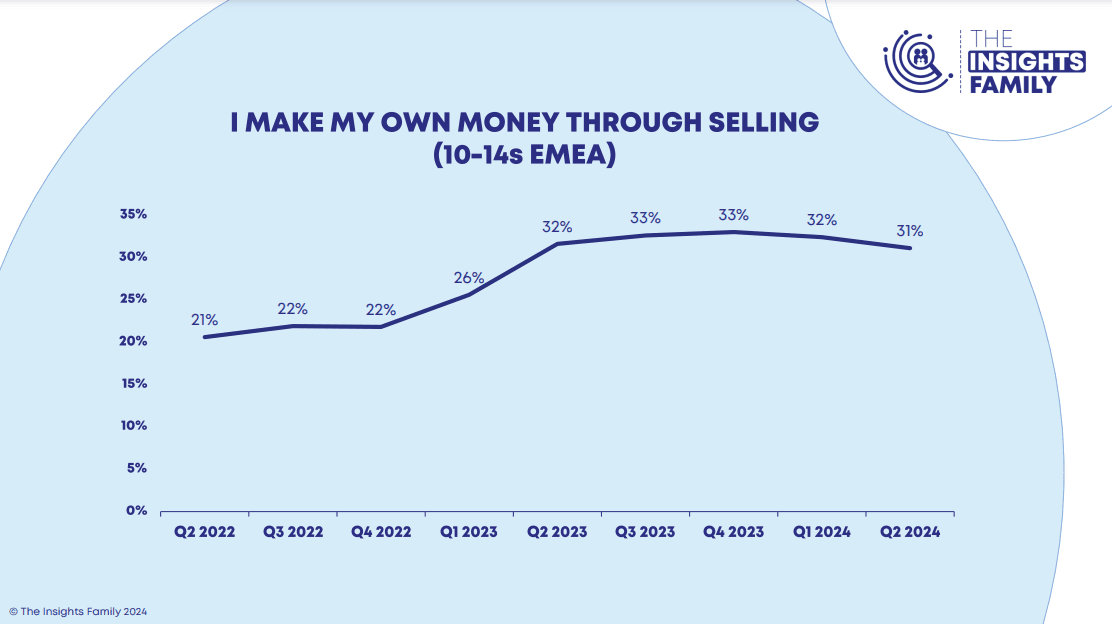

About 69% of kids aged 6–14 have either started one or plan to (Acorns), and a 2023 Visa study backs this up: 78% of 8–14-year-olds made money last year—mostly from chores or projects they came up with themselves. Some want extra cash, others are saving, and plenty are picking up useful skills.

Tech is a big part of how they earn. Of those making money, 43% used tech, and 26% social media—selling crafts, posting content, or running mini online businesses.

They’re not just earning to spend, either. Many are saving with clear goals, which could shape how they see work long-term—more side gigs, more freedom, less 9-to-5.

- Untapped Opportunity: Gen Alpha isn’t just selling lemonade—they’re making digital content, selling crafts online, and offering gaming tutorials. But tools to support these “kid-preneurs” are still emerging. What if your product gave them a safe, easy way to manage their micro-business finances—built just for how they think and work online?

Most Gen Alpha children begin receiving allowances by age six. By age 14, around 80% receive regular allowance payments, averaging $22 per week in the U.S. 26% of Gen Alpha who earn money use social media platforms like TikTok and YouTube to run businesses, sell crafts, or create monetized content such as tutorials or product reviews.At what age does Gen Alpha typically start earning money?

How do Gen Alpha kids use social media to make money?

2. How Are Gen Alpha Kids Saving Money?

- IN SHORT: Gen Alpha is notably future-focused, with saving goals being: first car, education, emergencies, home… and even retirement. Among those with side hustles, 31% are setting aside earnings for these goals (Acorn). Their saving habits are digital by default.

Alongside earning and spending, Gen Alpha is already showing a strong interest in saving and planning for the future.

- Early Savings Habits: Many Gen Alpha kids set aside part of their allowance for savings, and parents confirm much of it ends up there. Among those with side hustles, 31% do it specifically to save. This points to an early grasp of saving’s value—likely shaped by parents or awareness of today’s economic realities.

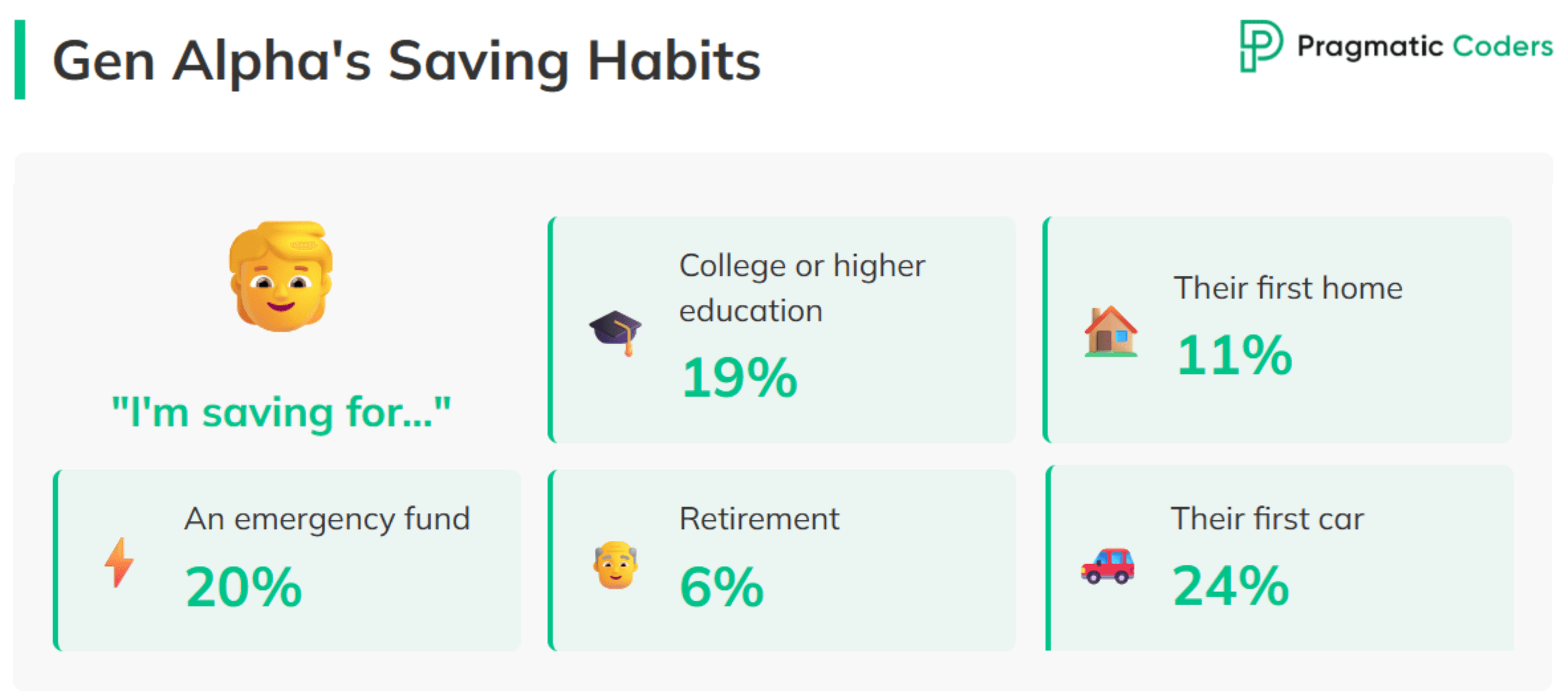

- Specific Savings Goals: Gen Alpha’s savings goals are impressively long-term for their age. According to the Acorns Money Matters Report, they’re putting money aside for things like:

- Their first car (24%)

- College or other higher education (19%)

- Their first home (11%)

- Retirement (6%)

- An emergency fund (20%). The fact that 20% of Gen Alpha are saving for emergencies stands out—especially compared to 2024 Acorns data showing 25% of adults lack an emergency fund and 46% don’t plan to start one. It shows a surprisingly mature, future-focused approach to money.

- Untapped Opportunity: Traditional piggy banks don’t cut it for a generation raised on apps and interactivity. Gen Alpha needs saving tools that feel digital, visual, and hands-on. How can your product bring that to life? Think goal trackers with progress bars toward a new bike or console, gamified savings challenges with virtual rewards, or shared family “pots” where parents can chip in or match funds—all in a safe, kid-friendly space.

Gen Alpha saves money for major goals including their first car (24%), college or higher education (19%), emergency funds (20%), a first home (11%), and even retirement (6%). Gen Alpha favors mobile-first financial tools—so apps with visual goal trackers, gamified savings, and shared family pots could “do the job”.What are the top financial goals of Gen Alpha?

What digital tools could help Gen Alpha manage money?

3. Where Does Gen Alpha Learn About Money?

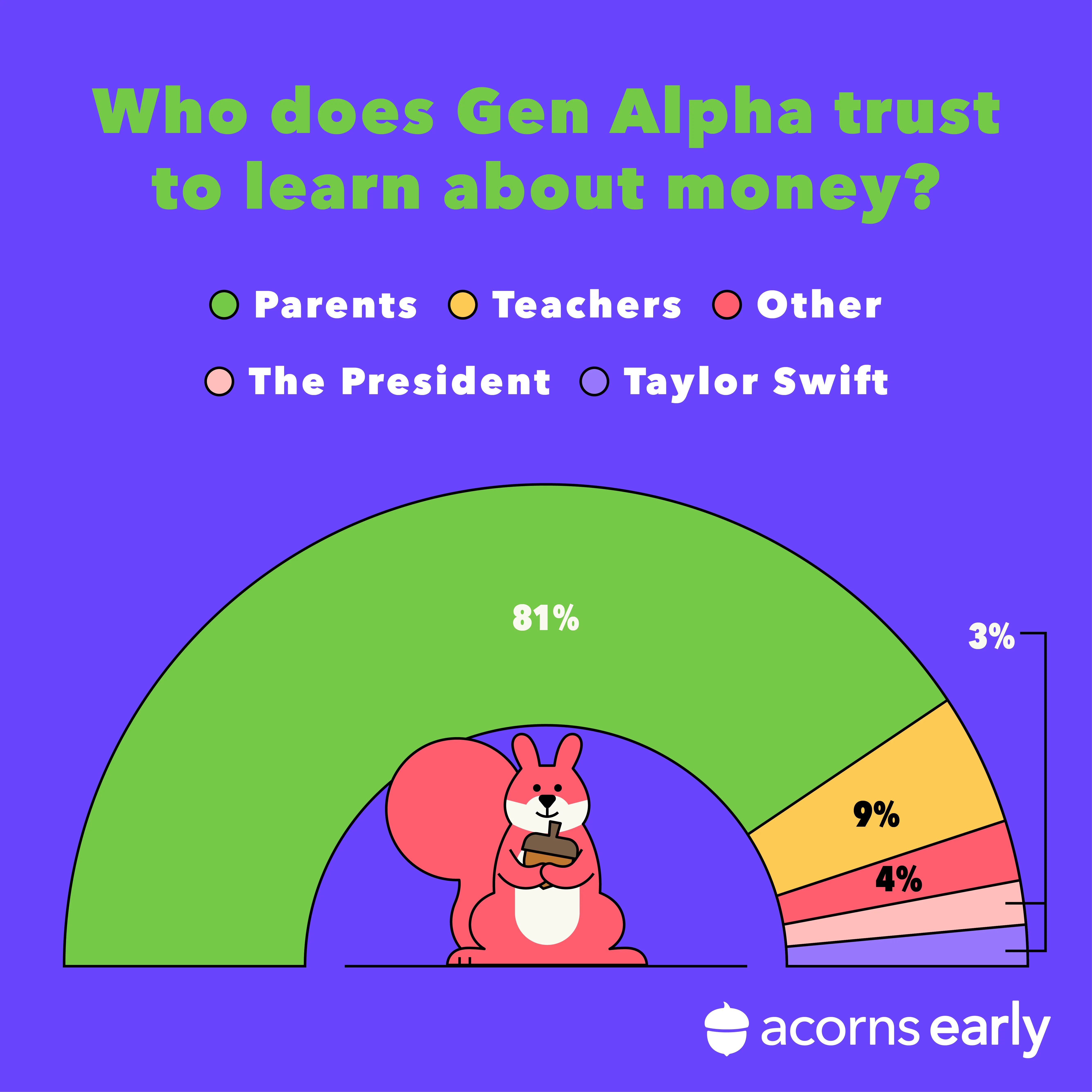

- IN SHORT: Gen Alpha may live online, but they still turn to parents first for money advice—81% say they trust them most. They’re learning on two tracks: traditional advice at home and digital insights from social media.

The Millennial Parent Factor

Millennial parents, shaped by the 2008 crash and student debt, are talking more openly about money with their Gen Alpha kids. Most (63%) kids aged 10–14 hear financial conversations at home, and over a third (36%) want even more. For 81% , parents are their main source of money advice.

This marks a big shift from previous generations. While 73% of Millennials grew up hearing some financial talk, only 41% of Boomers did (BizCommunity). Now, Millennials are passing that openness down.

But it’s not all positive.

Kids also pick up on financial anxiety. If parents are stressed about money, kids often feel it too. And while Millennials aim to teach smart habits, they can also pass along blind spots—like not using credit unions or showing inconsistent spending behavior.

Saying “save” but always splurging sends a mixed message. Combine that with Gen Alpha’s constant exposure to glam online spending, and the picture gets more complicated.

@lizbettalksmoney Kids learn best hands on, so start that allowance if it fits in your budget 🫶 #kidsallowance #allowanceforkids #kidsandmoney

The Digital Ecosystem Factor

Gen Alpha’s money mindset is shaped as much by TikTok and YouTube as it is by their parents. They’re not just watching—they’re creating content, joining challenges, running review channels, and interacting with brands daily.

YouTube reaches 81.4% of them each month, with 84 minutes of daily use (Britopian), but TikTok has pulled ahead in the U.S., with kids averaging 112 minutes a day (LS:N Global).

This goes way beyond entertainment. About 37% say they’re learning about money from media figures—be it “The President” or “Taylor Swift”—who also shape what they want and what they buy.

Pair that with lessons from financially conscious Millennial parents, and you’ve got a fast-moving, complex financial learning environment..

- Untapped Opportunity: There’s a clear gap for platforms that help parents teach money skills in a way Gen Alpha actually connects with. Could your product be the go-to tool that helps families start real financial conversations? Or maybe a safe, smart hub for bite-sized money tips from normfluencers or experts—think TikTok-style, but with verified content and built-in learning?

Primarily from parents—81% of Gen Alpha kids cite their parents as the most trusted source for financial advice. However, many also learn from influencers and content on YouTube and TikTok. YouTube and TikTok dominate Gen Alpha’s media use—YouTube reaches 81.4% monthly, and U.S. TikTok users average 112 minutes daily. Both platforms shape their learning, spending, and brand choices.Where does Gen Alpha learn about money?

What are Gen Alpha’s most trusted platforms?

4. How Does Gen Alpha Influence Household Spending?

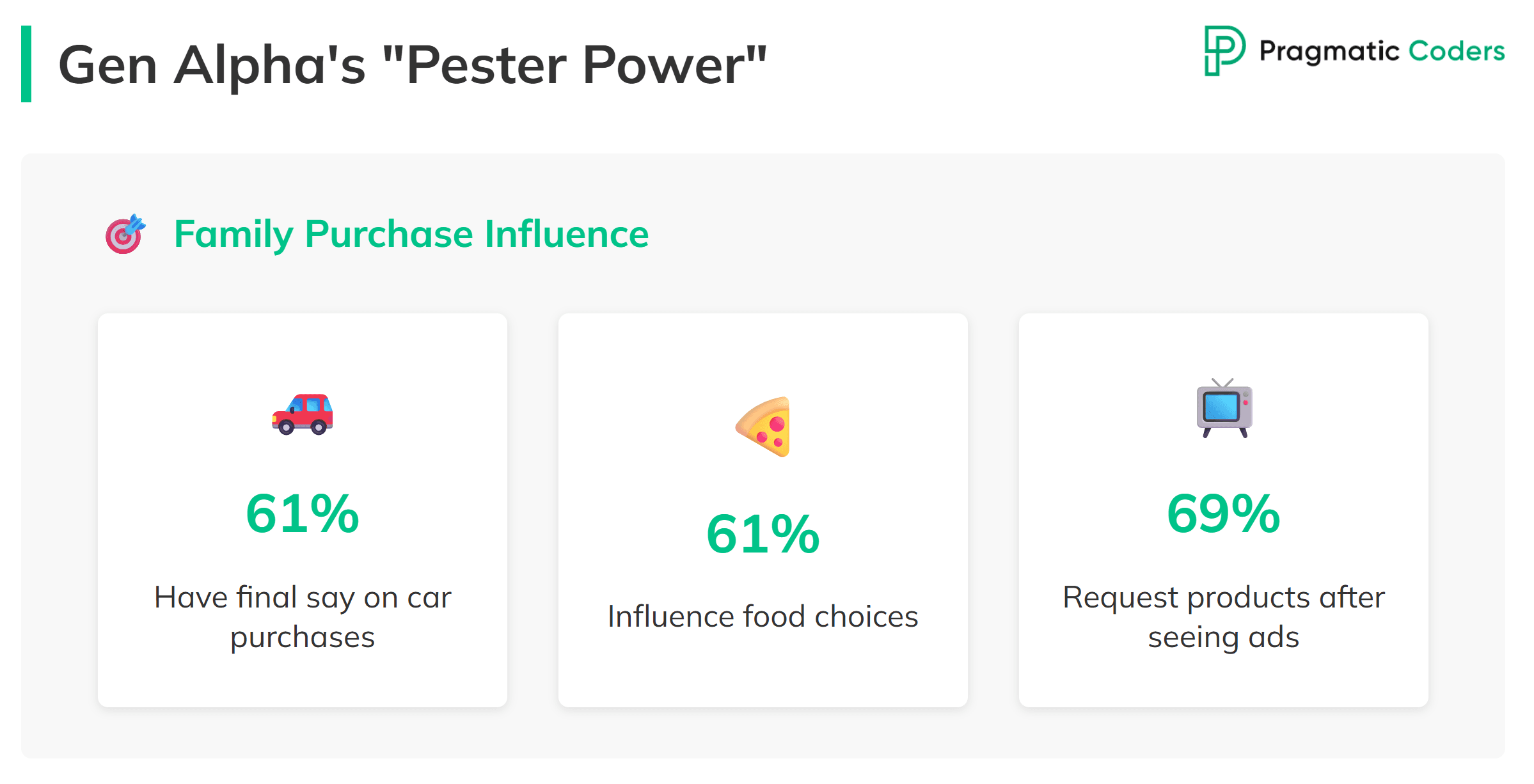

- IN SHORT: Don’t underestimate Gen Alpha’s sway over the household budget – they’re reported to have the final say in 61% of family car choices and food decisions.

Gen Alpha’s constant screen time and ad exposure give them serious sway at home—especially when it comes to food, entertainment, learning, and even personal care.

According to Razorfish, 61% of parents say their kid helps decide what car to buy and what’s for dinner. And Numerator reports 69% of kids request products after seeing ads, 58% after YouTube—and 75% of parents comply.

Parents might pay, but Gen Alpha calls the shots.

- Untapped Opportunity: “Pester power” is now digital. Gen Alpha finds products online and influences buys today—not just in the future. Tools like shared wish lists and kid-safe marketplaces let them suggest, parents approve, and everyone stays in sync.

Gen Alpha has major sway—61% of parents say their kids help pick cars and meals. Many also buy what their kids see online.How does Gen Alpha influence household spending decisions?

5. What Are Gen Alpha’s Views on Digital Currencies?

- IN SHORT: Gen Alpha is growing up with digital assets as second nature. In-game currencies like Robux and V-Bucks, digital wallets, and even crypto feel normal to them. They’re likely to know more about Bitcoin than certificates of deposit.

Bitcoin might be Gen Alpha’s allowance of choice.

I know it’s a bold claim, but the statistics are really interesting here. Gen Alpha is more likely to recognize Bitcoin than a Certificate of Deposit—and they’ll favor banks that support crypto.

Surprisingly, 79% of 10–14-year-olds in Germany who earn their own money already own crypto—showing just how fast digital assets are becoming normal for some kids.

@the_parkerlab_family The money lasts about 5 mins, is she buying mansions or what???? 💸💸💸💸 #roblox #robloxtiktok #robux #ipad #kidsbelike #familytiktok #funny #fyp #girldad

Crypto is redefining financial literacy for Gen Alpha. They’re not just learning terms like blockchain, DeFi, and volatility—they’re setting up wallets, buying tokens, and joining presales. It’s hands-on learning that builds real money skills.

But, as we all know, crypto’s risky.

Even adults struggle with scams, volatility, and complex crypto projects. The more you know, the safer decisions you make. And just because Gen Alpha is tech-savvy doesn’t mean they truly get it. Without the right education, Gen Alpha could get overconfident—thinking they know more than they do. That’s why fun, age-appropriate learning tools really matter.

- Untapped Opportunity: Kids might be too young for crypto, but they’re already comfortable with digital value—think game coins and crypto lingo. The real win? Education. Gamified tools like trading sims, token demos, or in-game rewards can teach them how digital assets work in a fun, safe way.

Yes, particularly in places like Germany where 79% of 10–14-year-olds who earn money already own some form of cryptocurrency, indicating comfort with digital assets. Games like Roblox and Fortnite get Gen Alpha used to digital money early—like Robux and V-Bucks—making virtual spending feel normal and shaping how they think about money online.Is Gen Alpha using cryptocurrency?

How does gaming influence Gen Alpha’s financial behavior?

6. What Do Gen Alpha Kids Spend Money On?

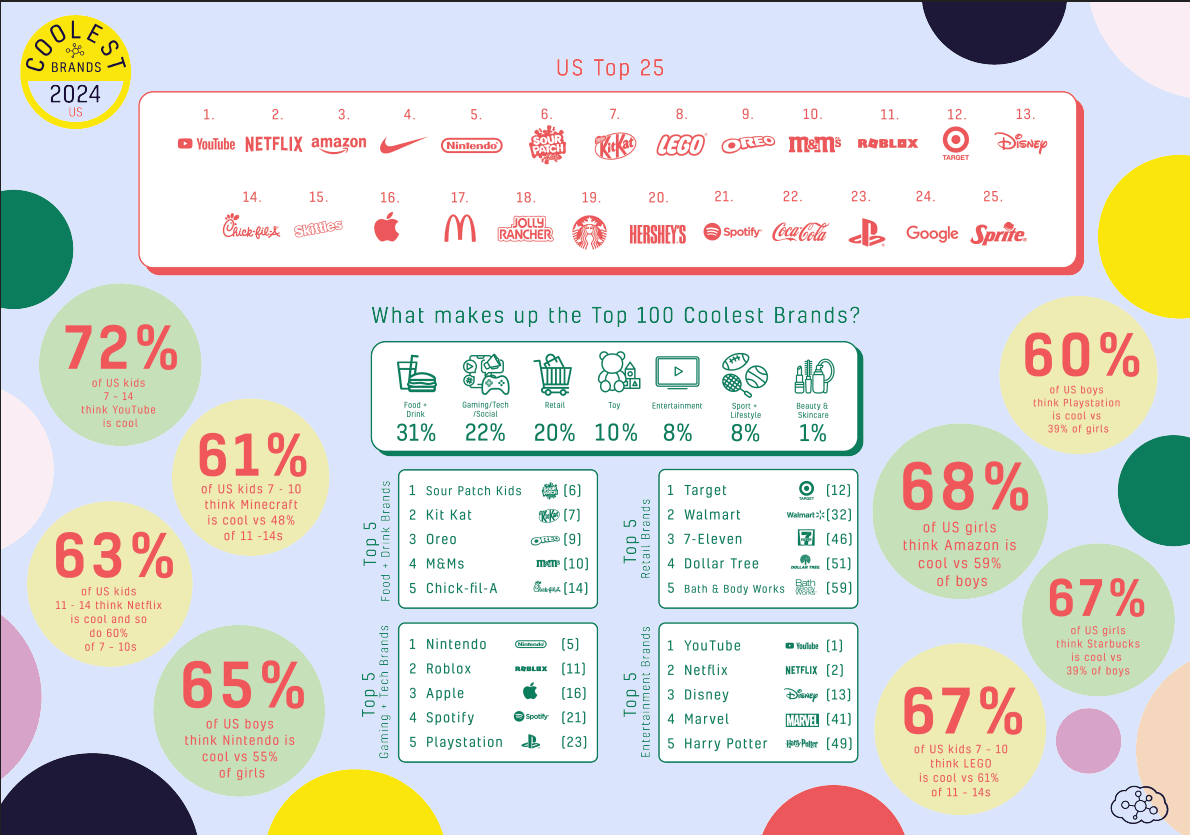

Source: Beano Brain, 2024 Coolest Brands

- IN SHORT: Gen Alpha’s spending evolves with age but consistently centers on digital experiences. Younger children buy toys and snacks; older ones prioritize streaming, gaming, beauty, and electronics.

Gen Alpha’s wallets grow up with them—but always stay online.

Younger kids lean toward toys and snacks, while older ones start spending more on entertainment, electronics, fast food, and drinks.

According to Beano Brain, their top spending goals include YouTube, Netflix, Amazon, Xbox/PlayStation, Apple, Target, Walmart, Roblox, and Google—proof their habits are rooted in tech, gaming, and digital convenience.

(It’s also worth noticing that the preferences here can vary a lot depending on a kid’s sex; for example, 61% of US kids 7-10 think Minecraft is cool vs. 48% of 11-14s).

Beauty and personal care matter to Gen Alpha—across all genders. In fact, they’re even called Sephora Kids (sic!). Razorfish reports (1, 2) that:

- For 36% of Alphas it’s more important to look good online than in real life;

- 80% of Alpha girls have already applied a filter or used a retouching app to change the way they look;

- A third of tweens use three or more products daily, and 75% follow beauty content online.

Luxury habits start early too, with 68% owning a luxury item by age 10.

In Germany, most 10–14-year-olds who earn their own money are spending it online, showing just how much digital platforms influence what they want and buy. Their tastes are maturing fast, driven largely by what they see in their feeds.

- Untapped Opportunity: Gen Alpha’s online world is shaping early brand loyalty and surprisingly mature spending habits. There’s a clear chance to reach Gen Alpha through digital-first platforms that mix shopping, beauty, and gaming.

Top spending areas include toys, snacks, fast food, beverages, entertainment (Netflix, YouTube), electronics, and beauty products. They often follow brand trends driven by digital content. The term reflects Gen Alpha’s early dive into beauty. They use filters, follow influencers, and stick to skincare routines—regardless of gender. By 10, 68% already own something luxury.What are Gen Alpha’s main spending categories?

Why is Gen Alpha called “Sephora Kids”?

7. How Will AI and BNPL Affect Gen Alpha’s Financial Behavior?

- IN SHORT: Gen Alpha faces a perfect storm: crypto, AI-driven financial tools, and instant credit through BNPL That mix could reshape how they see money—less like a limited resource, more like a digital number to move around. Debt might feel normal, even casual.

Gen Alpha & AI-induced laziness

The biggest game changer to come in the next five to 10 years is not Gen AI, it is Gen Alpha and how they utilise the emerging technologies of today to disrupt the future of business tomorrow. — Writer and futurist Amelia Kallman at 2024’s PWM Innovation in Wealth Management Summit.

Gen Alpha, the first virtual-native generation, will enter the workforce by 2030. By then, AI will be deeply integrated into business—and, ideally, major current challenges resolved.

And what does Gen Alpha think?

76% want to be their own boss or have a side hustle.

Only 13% want traditional employment.

40% expect AI, VR, and smart assistants to be central to their careers.

Seems fine, until you start thinking about the potential consequences.

Overreliance on AI may reduce critical thinking and lead to complacency. or decision making crutches – term proposed by Mansoor Soomro, a futurist and senior lecturer in Sustainability and International Business at Teesside University International Business School in the UK.

A decision-making crutch is when we rely heavily on something, in this case, AI, to make choices for us to make decisions for us, instead of human judgement.

Is the finance industry ready for this? Currently, the adoption of AI in decision-making is limited. Focus is on automating admin and compliance tasks, and it’s humans that still made final decisions. But what will it be link in 5 or 10 years…?

- Untapped Opportunity: Gen Alpha will naturally use AI for money management (budgeting, robo-advisors). Think robo-advisors that explain decisions, flag risks like BNPL or bias, and adapt to learning levels—under parental oversight.

Gen Alpha & BNPL

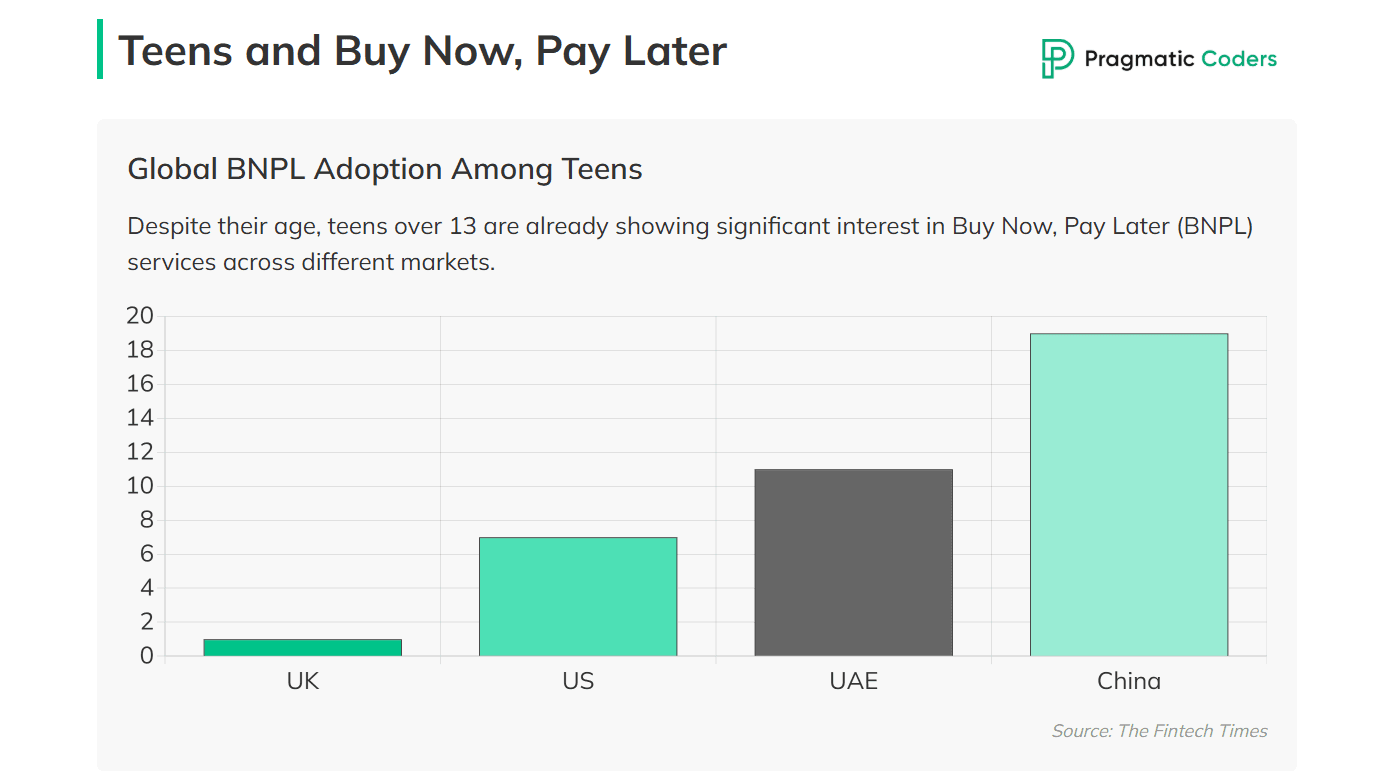

Despite their age, over 13s in the UAE are already showing interest in buy now, pay later (BNPL) services—11% prefer it. The trend is growing among teens in the US (7%), UAE (11%), and China (19%), though it’s still under 1% in the UK (The Fintech Times).

The problem? Overspending is common, and users fear missed payments and late fees. 57% of Gen Z believe BNPL encourages debt. As Gen Alpha gains spending power, BNPL will target them—fitting their habits but posing risks without strong financial literacy.

- Untapped Opportunity: Design “BNPL Antidotes”: Create savings-first platforms that gamify goal-setting and reward progress, offering the same instant gratification as BNPL—minus the debt. For older Gen Alpha, build educational BNPL simulators that let them experience the full debt cycle—interest, fees, and repayment—before using real, parent-approved deferred payment tools.

Gen Alpha teens are starting to use BNPL, especially in China (19%) and the UAE (11%). But like Gen Z, worries about debt and missed payments are growing.What is Gen Alpha’s relationship with Buy Now, Pay Later (BNPL) services?

What are the risks of AI and digital tools in Gen Alpha's financial future?

How do Gen Alpha’s financial habits differ from Gen Z?

Related content |

Next Steps

Account for Regional Behavior

Financial habits differ by country—e.g., BNPL is more popular with teens in China than the UK (19% vs. 1%). Use targeted UX research to ensure cultural fit.Design Secure, Kid-Friendly Apps

Mobile-first apps for young users must address privacy and design challenges. Review our Gen Alpha–specific mobile development practices.Use AI Responsibly

AI tools like budgeting assistants or robo-advisors can build financial literacy—when tailored to kids’ developmental stages. Explore our youth-focused AI frameworks.

Don’t hesitate to contact us – we can help.

Gen Alpha & Finances: Key Terms Glossary

Systems that mimic human decision-making. Gen Alpha will rely on AI tools for budgeting, money management, and potentially even investment decisions in the future.

A financial service that allows consumers to defer payments over time. While attractive to Gen Alpha’s instant gratification habits, it carries debt risks.

A Kid-Preneur is a child entrepreneur who starts and runs a business—often using technology, social media, or online platforms.

A decentralized digital currency that operates without a central bank.

Blockchain-based financial systems without traditional intermediaries. Gen Alpha is increasingly exposed to these concepts through early crypto involvement.

Virtual currency used in the Roblox platform.

The in-game currency used in Fortnite.

The influence children have on household purchasing decisions. Gen Alpha wields significant sway, especially through digital content and advertising exposure.

A traditional savings product offered by banks, where users deposit money for a fixed term and earn interest.

The degree of price variation over time. Gen Alpha is exposed to financial volatility through crypto markets, often without fully understanding the associated risks—a key reason why financial education is essential.