Top 6 Banking Industry Challenges Fintech Can Solve in 2025

FinTechs are the main competitors of banks. This is no longer an opinion; it’s a fact backed by numbers. Their total annual global revenue is projected to exceed $141.18 billion by the year 2028. That’s almost a 50% increase in five years! FinTech offers solutions to problems customers have with financial services provided by banks. And so, this trend will continue. Or will it?

To stay competitive in this landscape, banks have to adapt. They need to become flexible and responsive to meet the growing customer expectations. Recognizing this, banks have started making significant investments in their own fintech software ventures. By doing so, they aim to address the challenges facing the banking industry.

In this article, we will showcase the 5 main challenges that traditional banks currently face. We will also explain why FnTechs might not outcompete banks in the long run. On the contrary, they might end up being just another asset.

Banks are prone to macroeconomic shifts

The banking sector is profoundly influenced by macroeconomic factors such as interest rates, inflation, and GDP growth. In low-growth and low-interest-rate environments, traditional banks often experience compressed net interest margins, affecting profitability. Additionally, geopolitical shocks and regulatory changes can introduce uncertainties that challenge conventional banking models.

To navigate these complexities, banks can:

- Diversify Income Streams: Moving beyond interest-based revenue by expanding fee-based services (asset management, advisory, etc.) helps offset the impact of rate fluctuations.

- Optimize Capital Utilization: Using advanced analytics and data-driven insights ensures that resources are funneled into the most profitable and secure opportunities.

- Strengthen Risk Management: Setting up robust frameworks to anticipate and mitigate credit losses is crucial. Tools like stress testing and scenario analysis can help banks stay prepared for potential downturns.

By partnering with FinTech companies, banks gain access to innovative analytics and forecasting tools. This collaboration makes it easier to adjust strategies on the fly, helping banks remain resilient in an ever-changing economic landscape. But wait—aren’t FinTechs direct competitors and a threat to traditional banks?

Fintech software: banking industry competitor or potential asset in 2025?

FinTechs target the most profitable areas in the banking industry and easily adopt new technologies. They operate with precision and offer innovative solutions. Their offerings are customer-centered and simple to understand. Thus, they are very appealing to the modern consumer.

Banks and other big financial institutions are simply too big and, as a result, too rigid to compete on these terms. Fortunately for them, however, they do possess some distinct advantages.

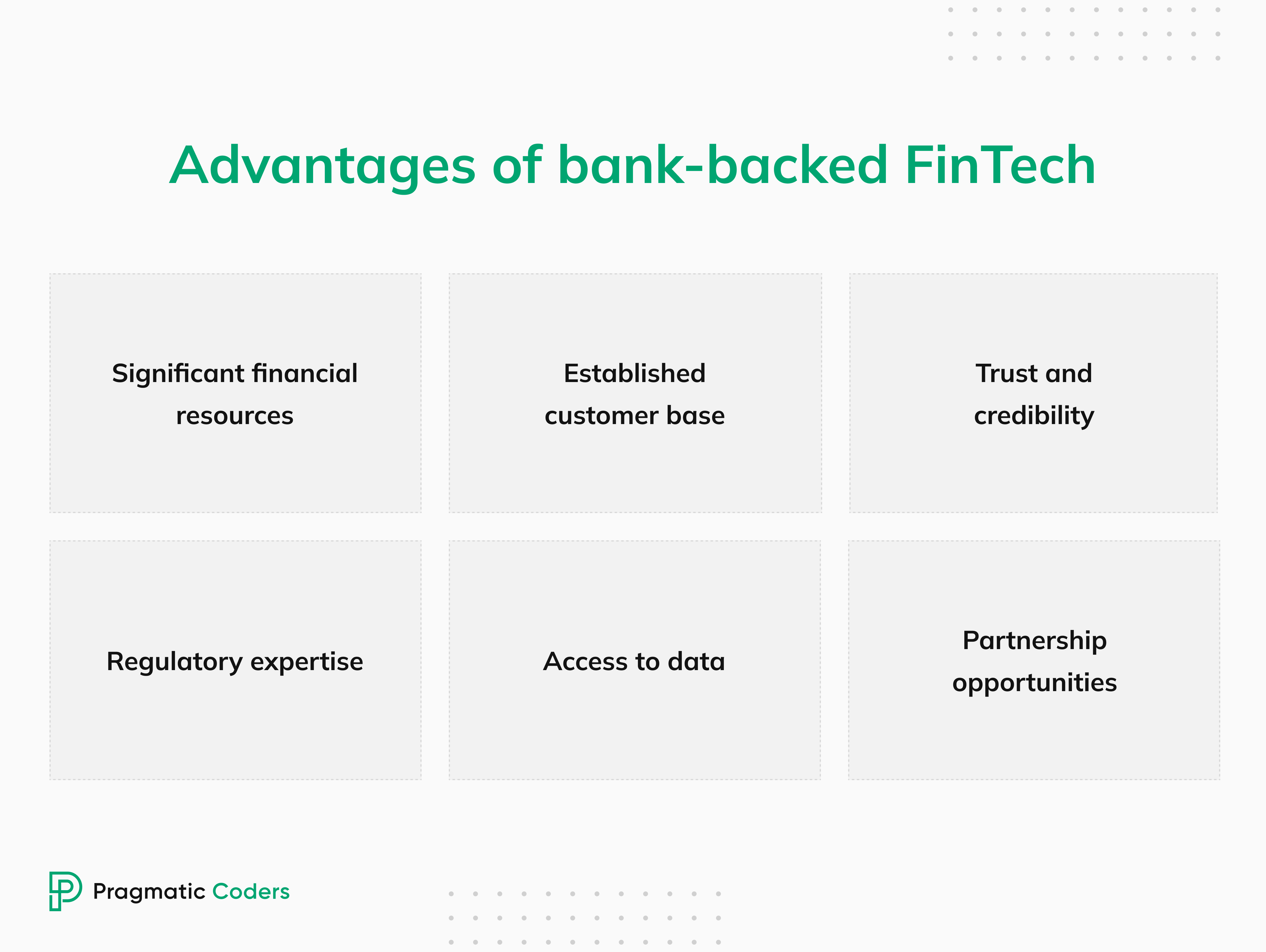

Where banks have the upper hand

- Capital – Retail banks typically have significant financial resources.

- Customers – They have existing customer bases of significant sizes for their banking services.

- Trust and credibility – An established reputation goes a long way in finance.

- Regulatory expertise – Banks are well-versed in financial regulations and compliance.

- Access to data – They possess a wealth of customer data.

- Partnership opportunities – Banks boast broad business connections.

When used properly, these advantages enable banks to redefine the playing field. In fact, this change is already underway.

The rise of bank-backed Fintechs

Matteo Rizzi, a fintech expert, highlights a big shift within banks. Mainly, banks today are launching their own FinTech startups. Moreover, they are partnering with fintech software companies.

Why is this a game-changer? Because, in this way, banking firms can bypass their corporate structure. Small organizations backed by banks benefit from not only substantial funding but also increased flexibility in adopting banking trends. Furthermore, they can also leverage other advantages from their benefactors.

In the future, this trend might result in banks and other large financial organizations outcompeting FinTechs. How? By gaining flexibility through partnerships. Prominent players will no longer have to be jacks of all trades. Instead, they will specialize in various competitive niches, within the fintech industry, through their business associations. Think of Banking as a Service and Embedded Finance, for example.

Top 6 banking industry challenges solvable with Fintech in 2025

However, there are still some pressing challenges in the banking industry. Let’s explore them and examine how they can be addressed through partnerships with fintech software developers or by establishing startups.

1. Legacy mobile banking software: the need for digital transformation

Traditional banks often struggle with their outdated mobile apps. Once innovative, their online banking solutions now lag behind in usability and user experience. Moreover, many of them have reached the limits of their upgradability. Thus, they can’t compete with sleek and intuitive digital banking apps offered by FinTechs.

Remote access to bank accounts and transactions simply doesn’t cut it anymore. Customers expect their banking software to cover all their needs. They need a universal product, something approaching the “everything app” proposed by Elon Musk. Customer satisfaction from the banking experience is a top priority nowadays.

To address this, banks are partnering with mobile FinTech software development companies. This approach offers several advantages:

- Expertise: FinTech development firms possess the necessary know-how to design cutting-edge mobile banking apps.

- Cost-Efficiency: Developing apps in-house can be costly; partnerships ensure efficient budgeting.

- Time-Saving: Building apps from scratch takes time; partnerships accelerate the development process.

- Synergy: Banks bring financial expertise, while software development companies offer technical proficiency and top talent.

Traditional banks can match FinTechs and challenger banks by using these advantages. As a result, the mobile banking sector will speed up its evolution.

2. Demand for personalized offers: customer experience is king

Despite the vast amount of customer information they collect, banks often struggle to provide personalized offers. They mostly operate with big data, employing the “one-size-fits-all” approach. This was effective nine years ago but no longer works in 2025. The younger generation not only wants financial stability, they want personalized financial advice.

In today’s world, clients expect to be treated as individuals. They require personalized offers to remain engaged. They won’t remain loyal to a bank that doesn’t meet their needs. Recognizing this and adapting better business models is essential if banks want to retain their clients.

To meet this demand, banks have to leverage AI-based data analytics and machine learning. These data science technologies can decode complex customer data to predict customers’ needs. With them, banks will be able to transform raw information into actionable insights and hyperpersonalized services.

This smoothly transitions us to the next challenge banks face in today’s industry landscape.

3. Adopting AI banking solutions: a revolution in the financial services sector

Artificial Intelligence is redefining the financial services industry as we speak. Its adoption is accelerating as algorithms become increasingly sophisticated. However, this revolution is mostly led by FinTech startups, with most major players lagging behind. If retail banks want to remain competitive, this needs to change. This is one of, if not the biggest, challenges facing the industry.

Why are large banks struggling with AI adoption? We’ve identified three major reasons:

- Lack of Strategy: Many banks have been slow to formulate a comprehensive approach to integrating AI into their operations.

- Employee Apprehension: Bank employees often fear AI could render their roles redundant.

- Expertise Gap: Banks lack the in-house expertise needed to harness the full potential of AI.

To overcome these hurdles, banks must develop cohesive AI adoption plans. They’ll have to educate their employees about AI and its use cases. But most importantly, they will have to implement AI Fintech Solutions.

To do all of this efficiently, banks must consider collaborating with specialists. Remaining competitive is at stake here, so knowledge and experience must be sourced. There’s no time to start from square one.

4. Enhancing security and authentication: fraud prevention in the age of AI

As digital banking continues to grow, the need for strong security measures has never been greater. Cyber threats are advancing rapidly, with fraudsters using increasingly sophisticated methods to breach systems and steal sensitive customer data. Consider this: AI has made social engineering and phishing not only easier but scalable on an unprecedented level. In 2025, the threat landscape is unlike anything we’ve seen before—and the fraud statistics speak for themselves.

To combat these threats, banks should:

- Implement Dynamic Multi-Factor Authentication (MFA): Move beyond static codes by adopting risk-based verification. This approach escalates authentication requirements based on context (e.g., transaction value or user behavior), enhancing protection without disrupting user experience.

- Adopt Next-Generation Biometric Authentication: Go beyond traditional fingerprints and facial recognition. Explore advanced solutions like behavioral biometrics (e.g., keystroke dynamics or voiceprint analysis) that are more resistant to spoofing and deepfake attacks.

- Embrace a Zero-Trust Architecture: Treat every network segment as potentially hostile, verifying each user and device continuously rather than assuming internal traffic is safe. This limits lateral movement in case of a breach.

- Leverage Continuous Threat Intelligence: Partner with FinTech security platforms and industry consortia to receive real-time updates on emerging threats. Use AI-driven analytics to quickly detect anomalies and anticipate new attack vectors.

By integrating advanced FinTech security solutions, banks can bolster their defenses against cyber threats, maintaining customer trust and safeguarding financial assets.

5. The need for user-centered innovation: improving customer engagement

The landscape of banking technology is ever-evolving. AI-based solutions and modern banking apps are just the tip of the iceberg. The truth is, financial innovation is no longer a choice; it’s a necessity. Banks that wish to remain relevant must embrace it.

To be innovative, banks must learn how to listen to their customers. Furthermore, they have to learn how to respond to their needs swiftly. However, customers vary greatly from one another, so this is easier said than done.

The main factor here is their age. There’s a considerable gap between the expectations of younger and older generations. Banks capable of innovating in a way that satisfies both are bound to forge ahead.

Separate bank branches tailored for different generations are the most likely solution here. The times of trying to appeal to everyone with one product are over. The new direction is a deluge of tailor-made solutions aimed at different demographics of banking customers.

6. Combating the increasing costs: the financial industry faces an overhead challenge

The financial burden on retail banks continues to mount. Costs are increasing in nearly every aspect of banking. As a result, the cost of acquiring and retaining customers rises exponentially. When we factor in the ever-increasing competition, the magnitude of this problem becomes quite apparent.

It’s no surprise that retail banks and credit unions strive to reduce costs wherever possible. From layoffs to outsourcing, they employ every trick from the playbook. However, their efforts often fall short. Why? One word: recession.

Looking ahead, the only real solution to mounting operating costs is automation through FinTech. By leveraging automated solutions, banks can:

- Reduce manual workloads

- Streamline operating procedures

- Optimize customer experience with AI

- Efficiently ensure compliance with RegTech

To harness fintech’s cost management potential, banks should embrace collaboration. Partnering with fintech firms grants access to advanced tech and expertise, reducing the need for in-house development.

Conclusions

The evolving financial industry presents significant challenges for banks. To address these challenges, banks should collaborate with FinTech companies. Such partnerships could streamline operations, enhance customer experiences, and ensure competitiveness. The synergy between traditional banking and FinTech is key to the industry’s future success.