How to Do Market Research For a Startup

You came up with a grand idea for the next big thing that’s going to change the world. But before you dive in deep there is a crucial element you cannot ignore, which is figuring out your potential target market. According to CB Insights, in 35% of cases, no market need was the reason for product failure. To find out if there truly is demand for your product it is necessary to conduct market research.

For those looking to streamline this crucial process, consider using our AI market research tool, which automates and optimizes your market research efforts, providing you with accurate and timely insights. For those interested in the nooks and crannies of market research, let us continue.

Market research may seem like a complex task but relying solely on your intuition won’t bring you any closer to success or convincing potential investors and business partners. Knowing who your potential customers are, and what are their needs and wants will significantly help you establish a good foundation for your business.

So where do you start? What are the ways you can truly understand what your customers want? In this guide, we will teach you how to do market research for your startup. However, if you want to learn more on the topic of market research, our Startup Consulting Services are something worth looking into!

What is market research?

First and foremost, what do those two words actually mean? Market research is defined as a set of techniques used to collect information about consumers’ preferences to discover a company’s target market and make informed decisions. It is an essential tool for any small business that wants to survive and thrive in today’s competitive landscape. Without market research, businesses risk wasting time and money on products that have no chance of success.

Why conduct market research for your startup?

As a startup, it is important to gather all the necessary knowledge needed before launching an MVP. By conducting market research you can:

- get a better understanding of what products or services your customers need by learning about their preferences and needs

- identify potential competitors in the industry and understand their strengths and weaknesses which can be used to develop strategies to gain a competitive advantage

- gain valuable insights into consumer behavior trends that can be used to adjust marketing strategies

- get the chance for exposure by identifying opportunities for promotion or partnerships

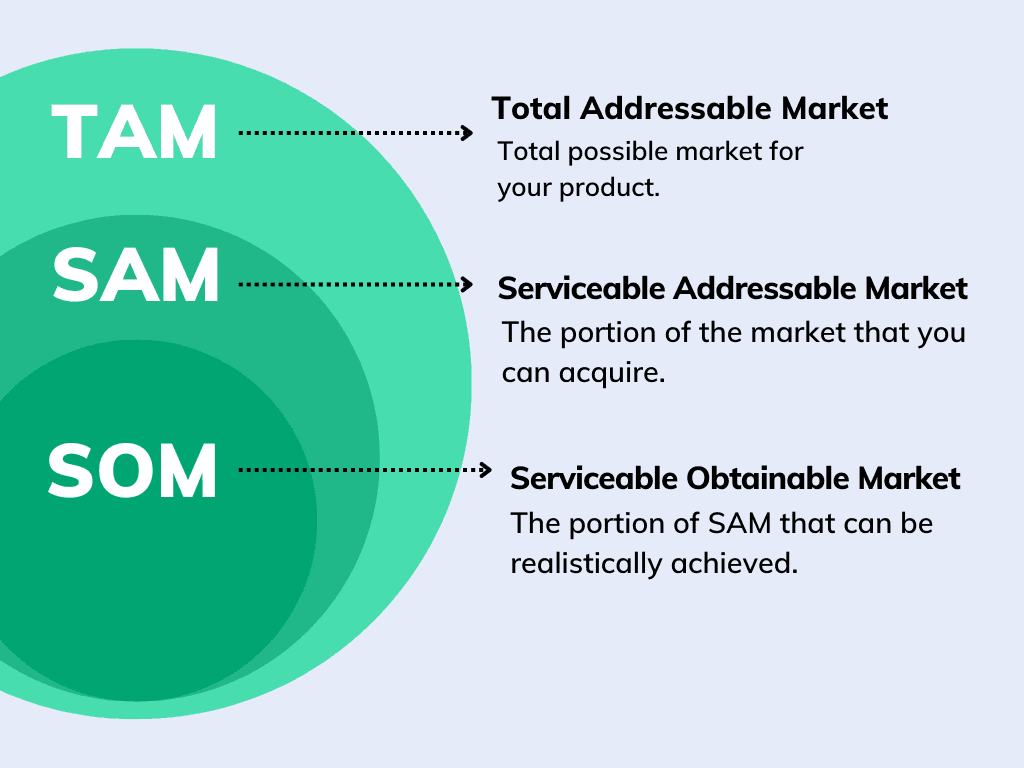

What are TAM, SAM, and SOM, and why are they especially important for startups?

As mentioned earlier, in order to forecast your startup’s chances of success your assumptions must be rooted in reality. So how do you do this? By using three fundamental market size metrics which are TAM, SAM, and SOM.

We use market sizing to estimate the potential size of a market and gauge our product’s opportunities. It can also help identify the major competitors in a given market and determine the profile of our target audience. Let’s break down the acronyms and find out the meaning behind them.

TAM – Total Addressable Market

TAM refers to the total number of people who could potentially buy your product or service. It shows the maximum amount of revenue possible for a company and is usually unattainable by any business. It helps companies understand how much of the market they can realistically hope to capture.

How do you calculate TAM?

The way you can approach this is by using three methods which are:

Top-down

This approach to identifying TAM uses data and studies extracted from research done by third-party market research companies. The information we receive is often very broad and can sometimes not be kept up to date. So in order to achieve more specified conclusions it is necessary to narrow it down and further refine it.

Bottom-up

This strategy will provide you with a more accurate representation of TAM as it is based on your own previous sales data instead of an educated guess. First, calculate your annual contract value (ACV) by multiplying your average sales price by the number of your current clients. Then multiply your ACV by the total number of your potential customers.

Here is the formula for calculating TAM using the bottom-up method:

TAM = (Annual Contract Value) x (number of possible Accounts)

Value theory

This method is best for when you are bringing something completely new to the market and there is no data you could build upon, or when you are adding new features to an existing product. You start by asking “how much would our potential client be willing to pay for this based on the value it provides them?” Next, you need to consider the number of people who would notice this value and choose it over existing alternatives. Once you have both of these factors you simply need to multiply them to receive the TAM.

SAM – Serviceable Addressable Market

SAM is the portion of the TAM that a company can realistically hope to capture. It is important to remember that not every person in the TAM will be interested in your product or service. SAM takes into account factors like geographic limitations, competition, and distribution channels.

To calculate SAM multiply the group of potential customers that would be a good fit for your business by the average annual revenue each customer generates.

SOM – Serviceable Obtainable Market

It is unlikely for you to penetrate the entire market and persuade people to purchase your product or service. This is why it’s important to measure your SOM so that you can set realistic short-term goals that you can stick to in the first few years of your business journey.

In order to calculate your SOM you need to divide your revenue from last year by last year’s SAM. The result is your market share. Next, multiply your market share from last year by your industry’s serviceable addressable market from this year.

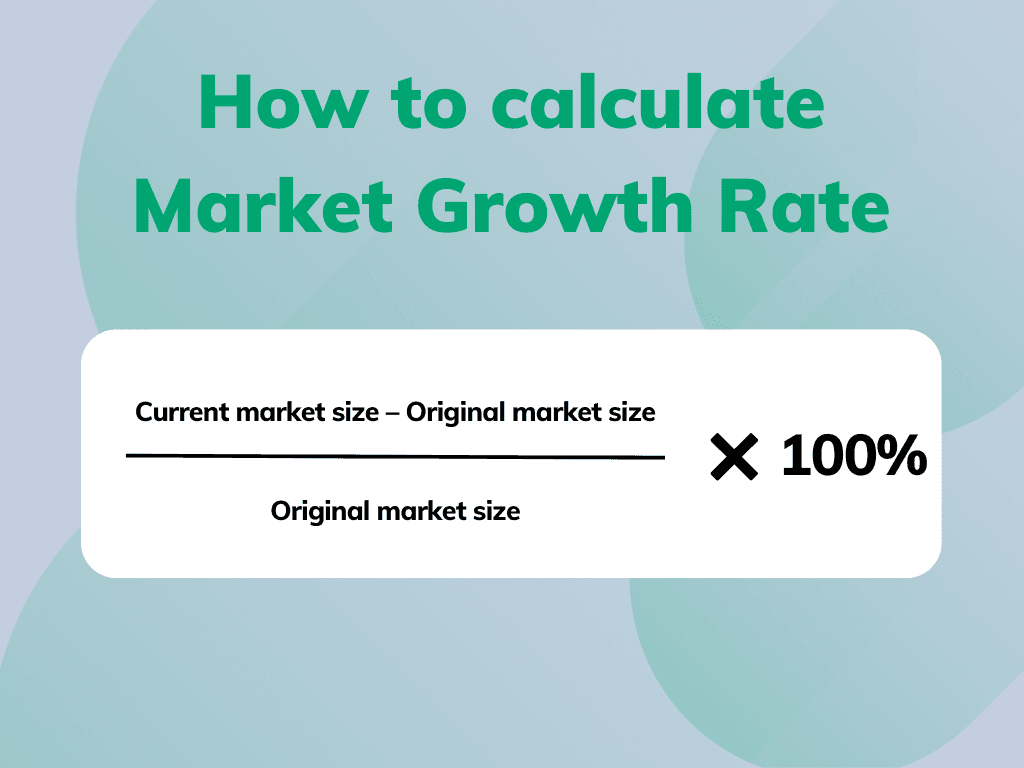

What is the Market Growth Rate and how do you calculate it?

The market growth rate is the predicted rate of growth for your industry over a given period of time. It is often expressed as a percentage and can be beneficial for checking the opportunities we have in a specific area. The reason this metric is so important is that it helps us decide if there is a demand for our product and whether it will still be useful in the future. If you are on the lookout for investors this is even more important since they want to be sure that the product they will invest in stands the test of time.

The formula for the market growth rate is as follows:

Market growth rate = ((Current market size – Original market size) / (Original market size)) * 100%

What is the Cost of Goods Sold and how do you calculate it?

The COGS is the amount of money your business paid as a cost that was related directly to selling a product. We can calculate the COGS by following the formula presented below:

Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory

When it comes to a company that is just starting out, it may not have any inventory on hand. In this case, the COGS would be equal to the beginning of the period’s expenses. This includes the cost of labor, materials, and certain overhead costs.

The different types of market research

Before starting out with any market research process you will encounter various terms related to the types of it. Let’s break down the key differences between these research types.

Qualitative research vs Quantitative research

One of the ways we can categorize market research is by dividing it into qualitative research and quantitative research. Qualitative research is the collection of structured data that is numerical and can be analyzed using statistical methods. Quantitative research on the other hand provides us with explanations and general truths rather than hard cold facts.

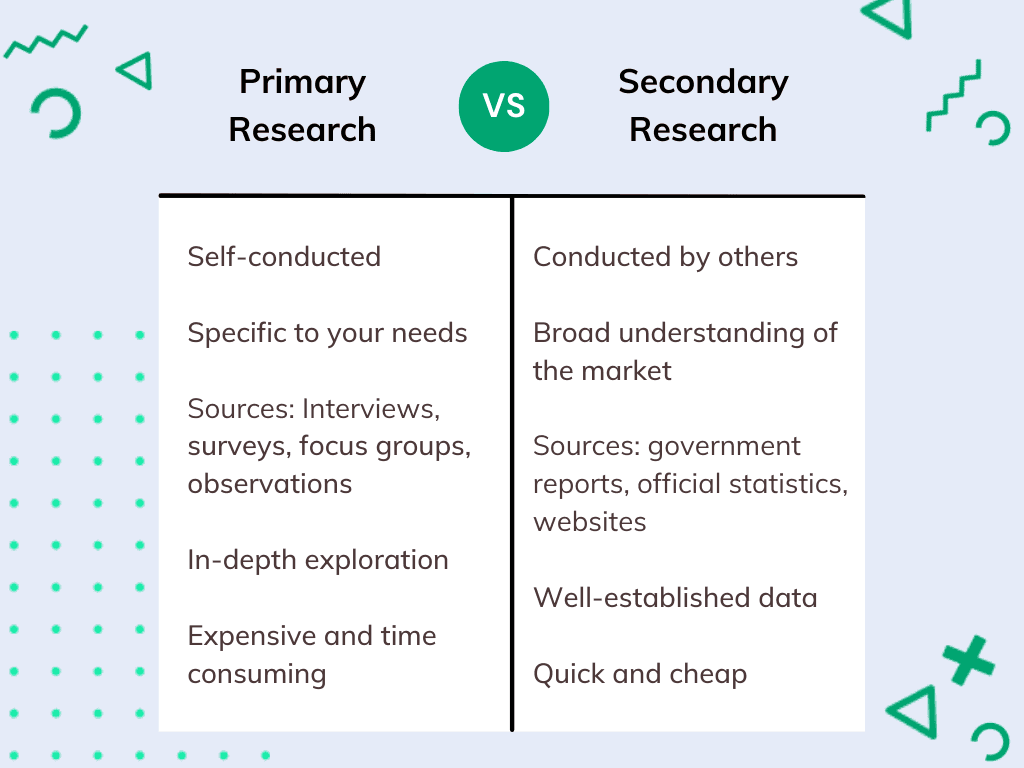

Primary research vs Secondary research

The are two ways we collect data throughout the process of market research. One is by gathering all the findings that are already at our disposal and the other is by browsing sources of information that have been provided by others in our industry.

Primary research

Primary research involves collecting data directly, rather than relying on pre-existing data. It is essential for getting a first-hand account of a particular situation or for gathering data that might not be available through secondary sources. Data authenticity is essential for many companies, which is why they choose to collect data themselves instead of relying on others. This also allows them to get accurate information without any alterations. The four common types of market research techniques are interviews, surveys, focus groups, and observations.

Secondary Research

Secondary research (also known as desk research) is the process of gathering information that has already been published or made available in some form. This could involve using data from academic journals, industry reports, newspapers, magazines, or other sources of information that have already been collected by someone else.

Sources of primary market research

Interviews

This method provides a more personal one-on-one interaction with our prospects. It gives us the chance to speak with them directly and ask probing questions. The results we achieve from this method heavily rely on the responsiveness of our interviewee and their ability to form a satisfactory answer.

Surveys

These are one of the most common methods of data collection in primary market research. They can be conducted in a number of ways, including online, by phone, or in person. Surveys can be tailored to collect specific information so they can be helpful when trying to understand a specific issue or target a specific audience. However, one of the drawbacks of this method is that it can be difficult to ensure that everyone who is surveyed will respond, which can lead to inaccurate results.

Focus groups

A focus group is a group of people who are selected to participate in organized sessions where they are asked to discuss a product or idea and provide feedback on it.

Some benefits of focus groups include:

- gathering a variety of opinions and perspectives from a large group of people

- helping researchers understand consumer needs and preferences

- uncovering important information about potential customers that might not otherwise be available through other methods such as surveys or interviews

- receiving feedback on a larger scale and instant ideas for product improvement

Although this method can be quite costly it can provide feedback on a larger scale and instant ideas for the improvement of our product.

Observations

As you may have guessed, this method of primary research involves observing or video recording individuals interacting with our product in a natural setting. It can be as simple as seeing the reaction on someone’s face when they come across our product. This approach can be time-consuming but it offers unique and unbiased results as there are no expectations towards our consumers.

Sources of secondary market research

Internal sources

Sometimes the things that we are looking for the most can be right under our noses. You can conduct your desk research using data sets, internal reports, and statistics gathered by your organization.

Public sources

These include all of the information that is widely available and free, such as government statistics, industry-specific reports, forums, and news articles.

If you are interested to find out more about desk research we have a separate blog post that goes into further detail about how to conduct it. Check it out!

Should I go for primary or secondary research?

If you’re a startup founder you most likely don’t want to sink all of your money into research, so the pragmatic option would be to first conduct secondary research to make use of what is widely available and is budget-friendly. After that, you can fill in the gaps with primary research by conducting it only in the areas you’re not too sure about.

A step-by-step guide to market research for startups

1. Establish the purpose of your market research

Before you get your feet wet, you should ask yourself what is your main goal and what you hope to achieve by conducting market research. How will you apply your findings and collected data? The most common goals of market research can be split into a few categories which are:

Attracting investors

Every great idea has to be backed up by numbers and statistics, especially when you’re pitching your product to investors, who naturally expect you to provide tangible proof that your product is worthy of their capital. By researching the market you can understand the business environment, and identify potential competitive advantages. With a well-researched plan in hand, you will be in a much better position to attract investors.

Exploring your startup idea

A business idea can appear in the spur of the moment but it doesn’t always have to be so spontaneous. We may not always be sure what exactly we have in mind but that can be a good thing. In fact, if we focus on the problem that we’re trying to solve instead of the solution we get the chance to explore our startup idea. Instead of inventing the hammer before finding the nail, you can slowly shape your idea by identifying the pain points of potential customers.

Validating your startup idea

If you have a crystal clear startup idea market research is a good way of testing its viability and getting an understanding of what you need to do to execute it properly. Through market research, you will also be able to see where you stand in comparison to your competitors. It can help you determine your USP (Unique Selling Point) and view the product or service from your client’s perspective.

You can choose to focus on one of these aspects or you can assign each of them to particular experts on your team. For example, your finance specialists can take care of the areas that will be crucial for receiving funding or building a pitch deck for potential investors. Likewise, your marketing or UX team can focus on examining user behavior. This will allow you to make the most out of your market research and gather useful data on each angle.

2. Select your approach for market research

We already established the two methods that are used to perform market research which is primary research and secondary research. At this stage, you will need to make a decision on which one you need to use for your research aims.

When to choose secondary research

If your main purpose is to get an overview of where you are in the startup ecosystem you can utilize secondary market research. It will help you identify trends in the industry or market, as well as new opportunities or risks, and track changing customer demands. Secondary research can help you determine the state of the market and see where your brand stands in comparison with your competitors.

When to choose primary research

If your main goal is to collect raw data and first-hand information about customer satisfaction and brand awareness you should opt for primary market research which includes the use of online surveys, interviews, and focus groups. If you want to gain a unique insight into specific customer segments or market niches in order to better tailor your product or service offerings, then primary market research can help you achieve these goals.

3. Get to know your market

It is extremely important you understand the industry of your niche and find as much information as possible on it. First and foremost you need to understand which market you fall into. Sometimes we may think we understand where we fit in the market landscape but it often turns out that we are incorrect. After some afterthought, you might come to the conclusion that you would excel in a completely different market.

The goal here should be finding that sweet spot which is a market where the product demand is large enough and where you could actually make an impact and differentiate yourself from your competitors.

To get a thorough understanding of the market you can combine primary and secondary research methods:

Read industry reports

There are many resources available online that can help you gain insight into the trends in your market and where it’s headed. Industry reports are one of them but another great way of keeping up with industry trends is by following relevant blog posts and news articles.

Use online research tools

Making use of online research tools allows you to keep an eye out for market trends in your industry and ensure that you always have fresh data at your fingertips.

Get the advice of experts

Receiving information and tips from someone who’s been in the field for years is definitely something worth leveraging. After all, what better source of information than someone who has hands-on experience and can provide you with insights based on the real-world environment? Our Startup Consultants can give you their advice and tips for your business so that you can take a step in the right direction when starting out.

4. Define your target audience

Defining your target audience is an essential step for startups, as it allows you to better understand and connect with potential customers. The hard truth is that not every person will be interested in your product or service. This is why it’s important to have a clear idea of your target market and create buyer personas for your ideal customer. Try to picture a typical user of your product and think of aspects such as their age, location, needs, habits, and how all of these shape their purchasing decisions. As you move forward in your startup journey you may find the need to update this data regularly when the needs and wants of your customers evolve over time.

5. Analyze your competitors

To thoroughly understand the market you need to know who you’re up against. So fruitful market research doesn’t end with analyzing the potential clients. You also have to study market saturation and your competitors to figure out their strengths and weaknesses. Startup founders can see where they need to aim by benchmarking their competitors and their KPIs. Your findings will help you see the areas that require improvement in your business plan. This will allow you to develop sales goals that will enable your company to stay ahead of or surpass competitors. We have a separate blog post dedicated to this subject so be sure to check it out to get a more in-depth view of competitor analysis.

6. Choose the right tools

Data collection can be a tedious and time-consuming task, but collecting all the data is just one thing. Once you’ve gathered it, it’s important to analyze it accurately to ensure your research is successful. Having the right tools in your arsenal is essential to conducting effective market research. Thankfully, there is no shortage of tools you can use to get useful business insights. A few examples include Answer the Public, Google Trends, Statista, and BuzzSumo.

7. Review the data

Once you have completed your market research and all of your questions have been answered you hopefully found out whether it’s advantageous to enter the market or if your vision requires some tweaking.

You should compile all of the gathered data into a research brief or report. This will help organize your findings in a succinct way and provide your team and key stakeholders with something to discuss and refer to when making strategic decisions. Data presented in the form of cold statistics can be dull and overwhelming. An awesome way you can present your information in a more visually appealing format is by using tools like Miro.

How to use market research to make informed decisions about your business

The next step is to take action based on the insights and information you have gathered. For this purpose, you can use Lean Canvas to brainstorm and interpret all of the data that you collected. Learn more about Lean Canvas and how to use it to investigate your business idea in one of our blog posts.

Performing market research before launching your product is a no-brainer, but apart from that, you should also continue doing research with each version of your product. Be open to the possibility of changing your product if it doesn’t meet the goals you set for it. This way, you can ensure gradual improvement and that it continues to fulfill the needs of your target customers.

Common mistakes to avoid when performing market research

Not defining your target market

Your target market is the group of people that you are trying to reach with your product or service. If you don’t know who your target market is, it will be very difficult to create a marketing campaign that resonates with them.

Not asking the right questions

An important step in market research is to brainstorm the key questions that need answers. If you don’t ask the right questions, you likely won’t get the information needed to make informed business decisions.

Not using multiple methods

While it may be tempting to save time and money by only using one method, this is not an effective way to conduct market research. Instead, you should use multiple methods in order to get a well-rounded view of the market. This includes things like surveys, interviews, focus groups, and secondary research.

Conclusion & key takeaways

Starting a new business is no easy feat and you may encounter many twists and turns on your journey. With a proper understanding of the market, you can put your startup well on its way to success. Market research can benefit startup founders in many areas. It can help in getting a better understanding of your target market, validating your business idea, identifying problems, and establishing attainable goals.

Hopefully, this article cleared any doubts you had and you are ready to start your own market research! However, it is always good to have a shoulder to rely on in your startup venture which is why we can provide assistance from our side to get you started! If you have any questions don’t hesitate to reach out to us for a free Startup Consulting session!