How we built a compliant blockchain trading platform for digital securities

Undisclosed

USA

Digital Securities Platform

November 2021 - May 2023

The client hired us for our blockchain and SEC compliance expertise. They needed support in refining their solution to meet regulatory requirements and in converting legacy code into a production-ready platform.

What we built

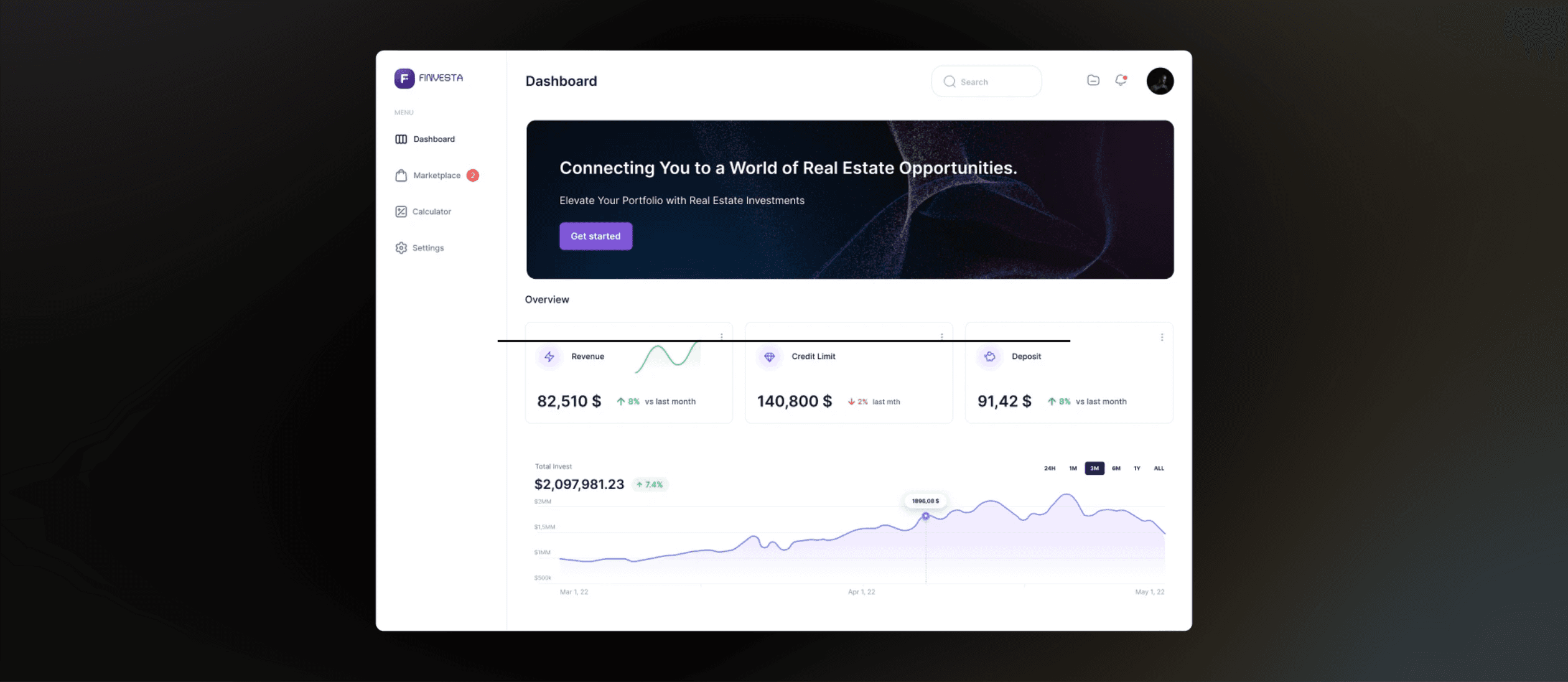

We delivered a compliant Alternative Trading System (ATS) for trading digital securities backed by real-world assets such as real estate, financial instruments, and commodities. The platform was designed for accredited investors, issuers, and institutions. It supports both crypto and fiat in primary and secondary markets, using tokenization, transfer agents, and smart contracts.

Primary & Secondary Trading

- Primary: Offering configuration and integration with blockchain-based tokenization agents

- Secondary: Integration with ATS via API and FIX protocol, with features such as portfolio tracking, notifications, and trading restrictions managed through transfer agent approvals

Blockchain Integration

- Integration with securities smart contracts on multiple blockchains

- Real-time transaction observability

- On-chain payment processing

Tokenization & Transfer Agents

- Tokenization Agents: Integrated with leading tokenization and compliance platforms

- Transfer Agents: Connected via standardized protocols for approvals and restrictions

Compliance & Onboarding Panel

- Versioned form reviews: Workflow-based form management, including requests for changes or additional information

- Wallet screening: Automated KYT/AML checks

- User screening: Integrated KYC/AML checks for individuals and institutions

- Audit tracking: Full audit trails covering wallet approvals, orders, and whitelist activity

Key Challenges

- Inherited Code: We took over a poorly documented legacy codebase and transformed it into a production-ready system

- Poor UX: The original product lacked a user-centered design, making it unintuitive and difficult to use

- Regulatory Complexity: We navigated strict SEC requirements while keeping the platform flexible

- Evolving Integrations: External systems (custodians, agents) were still under development, with widely varying APIs

- Data Fragmentation: We had to balance and verify both on-chain and off-chain data in an environment where blockchain was not the only source of truth

- Trading Restrictions: Consistent enforcement of restrictions and approval logic across multiple agents via FIX and API protocols was particularly complex during integration

How we overcame them

To meet SEC requirements with minimal user friction, we integrated KYC for institutional users.

We built a unified middleware layer to standardize connections with custodians and transfer agents. This eliminated the need for custom code and made API updates far easier.

We modernized the legacy codebase while preserving SEC-approved features, added real-time error monitoring, and developed a sync engine to ensure data integrity across blockchain and off-chain sources.

Despite UX constraints, we delivered a secure and compliant foundation. The platform now supports multiple wallets and provides a compliance panel for onboarding, audits, and regulatory workflows.

Architecture and platform modernization

| Area | Before | After |

|---|---|---|

| Integrations | 3rd party integrations (transfer agents, tokenization providers, blockchains, ATS, data feeds, market data) was hardcoded into business logic creating tight coupling, duplicated logic and hard to read and maintain. | Abstracted integrations into adapters and strategy patterns allowing to extend business logic with extendable and switchable building blocks and made adding new integrations save and fast. |

| Workflows | Workflows were fragmented across codebase. | Separated codebase into modular architecture based on business responsibilities, workflows, composition and kohesion. Discovered core domain, subdomains and supportive modules. Added communication based on event driven architecture to reduce coupling and separate processes. |

| Blockchain | Solution built for one chain was bound into business logic. | Blockchain operations were separated from business logic and rebuilt for multi-chain use with better error handling and easier addition of new contract types. |

| Onboarding | Onboarding was difficult to update. It grew into a complex compliance process built on top of old code, making changes and testing hard. | Rules were moved into structured, testable modules, making updates safer and faster. |

| Compliance & Trading Rules | Compliance and trading rules were buried in legacy code. Hard-coded rules slowed regulatory changes and increased compliance risk. | Rules were moved into structured, reusable and testable modules, making updates safer and faster. Added data changes history for audit purposes. |

| Performance | Performance dropped with scale due to synchronous calls, database growth and system size, APIs slowed and DB load increased. | Modular separation, event driven architecture and caching allowed to scale busy components, backpressure bursts. |

| Observability | No proper observability was in place. | Added observability and tracing allowing to catch bugs faster, recognizing bottlenecks. |

| DX experience | No E2E tests, git flow and poor CI/CD made any changes dangerous and prone to bugs. | Trunk based development (fast and small changes), proper CI/CD, E2E testing and modular separation allowed to develop new features faster in safe matter. |

| Documentation | No proper documentation about system flaws. | Introduced Architecture Decision Records, Technical Debt and Risk Management documents which allowed to track legacy code and prioritize fixes. |

Client Benefits

- For Issuers: Lower costs, simpler processes, and broader investor access made raising capital easier.

- For Investors: Easier entry, faster settlement, improved liquidity through secondary markets, and full regulatory compliance.

- For Financial Institutions: Simple API integration, regulatory clarity, and advanced blockchain features to stay competitive.

The result: A platform that bridges traditional finance and blockchain, making private market investing more accessible, efficient, and transparent.

Contents

Let's talk

We’ve got answers on anything connected with software development.

Ask a question

You can ask us a question using the form below. We will respond as soon as possible.

Schedule a meeting

You can also schedule an online meeting with Wojciech, our Senior Business Consultant.

founders who contacted us wanted

to work with our team.

Check our blockchain-related articles

Newsletter

You are just one click away from receiving our 1-min business newsletter. Get insights on product management, product design, Agile, fintech, digital health, and AI.