Dedicated Fintech Software Development Company

We build financial apps with a strong understanding of industry regulations and a deep commitment to security and compliance.

Trading Software Development Services

Craft intuitive trading platforms for diverse financial assets, providing seamless transactions and real-time analytics to boost trading experiences.

Insurance Software Development Services

Tailored insurance software solutions, optimizing underwriting, claims processing, policy management, and risk assessment.

Custom Banking Software Development

Modernize banking services through mobile apps and blockchain integration. Improve customer experiences while maintaining security.

Custom Financial Software Development

AI, no-code, low-code - we create custom financial software solutions that match the needs of both fintech startups and well-established financial institutions.

Custom Mobile Banking App Development

Build a cutting-edge mobile banking app with seasoned fintech developers and UX designers. Leverage our decade of experience.

Accounting Software Development Services

Save time and money by automating book keeping processes in your business. General ledger solutions, inventory management platforms & more.

Custom Blockchain Development Services

Everything you need

to build blockchain products in one place:

New blockchains, smart contracts, tokens, NFT, cryptocurrency exchanges.

Custom Asset Management Software

Create investment solutions that boost revenue and ease wealth management. Expertly designed to meet your financial goals.

NFT Trading Platforms Development

Lead in the realm of digital assets with secure, scalable, and user-centric NFT exchange platforms. Liquidity, performance, and regulatory adherence.

Custom Lending Software Development

Streamline lending operations and empower borrowers with custom loan origination systems, credit risk management, and tracking systems.

Digital Wallet App Development Services

Secure, trusted mobile and web e-wallet solutions for businesses & their clients. Convenient payments at your fingertips!

Payment Gateway Integration Services

Protect your business with our secure payment gateway integration services. Accept payments from all major credit cards and debit cards.

Financial software development services since 2014

We are a fintech software development company with 10 years of experience. During the last few years, we have delivered fintech applications for several challenger and mobile banks, trading platforms, cryptocurrency exchanges, secondary shares trading platforms, and many more.

We are fintech industry specialists, and we use our expertise to build custom, scalable, and effective solutions for our clients.

Let’s build your custom fintech software together.

Fintech app development services

Explore a world of financial innovation through our expertise in fintech application development. Our seasoned fintech app developers guarantee the highest quality, crafting cutting-edge solutions tailored to a variety of end user needs, including banking, investment, payments, and more.

Mobile banking

Payment processors

P2P lending platforms

Investment platforms

Digital wallet development

Fraud detection software

Payment gateways

Financial data visualization tools

Regtech solutions

Fintech AI solutions

Success stories

Bloc-X: A new way to trade commodities

Bloc-X is an OTC trading platform for Oil Blocs Future markets. Independent, fully compliant and regulated platform that connects ICE, NYMEX and SGX.

Read Case Study

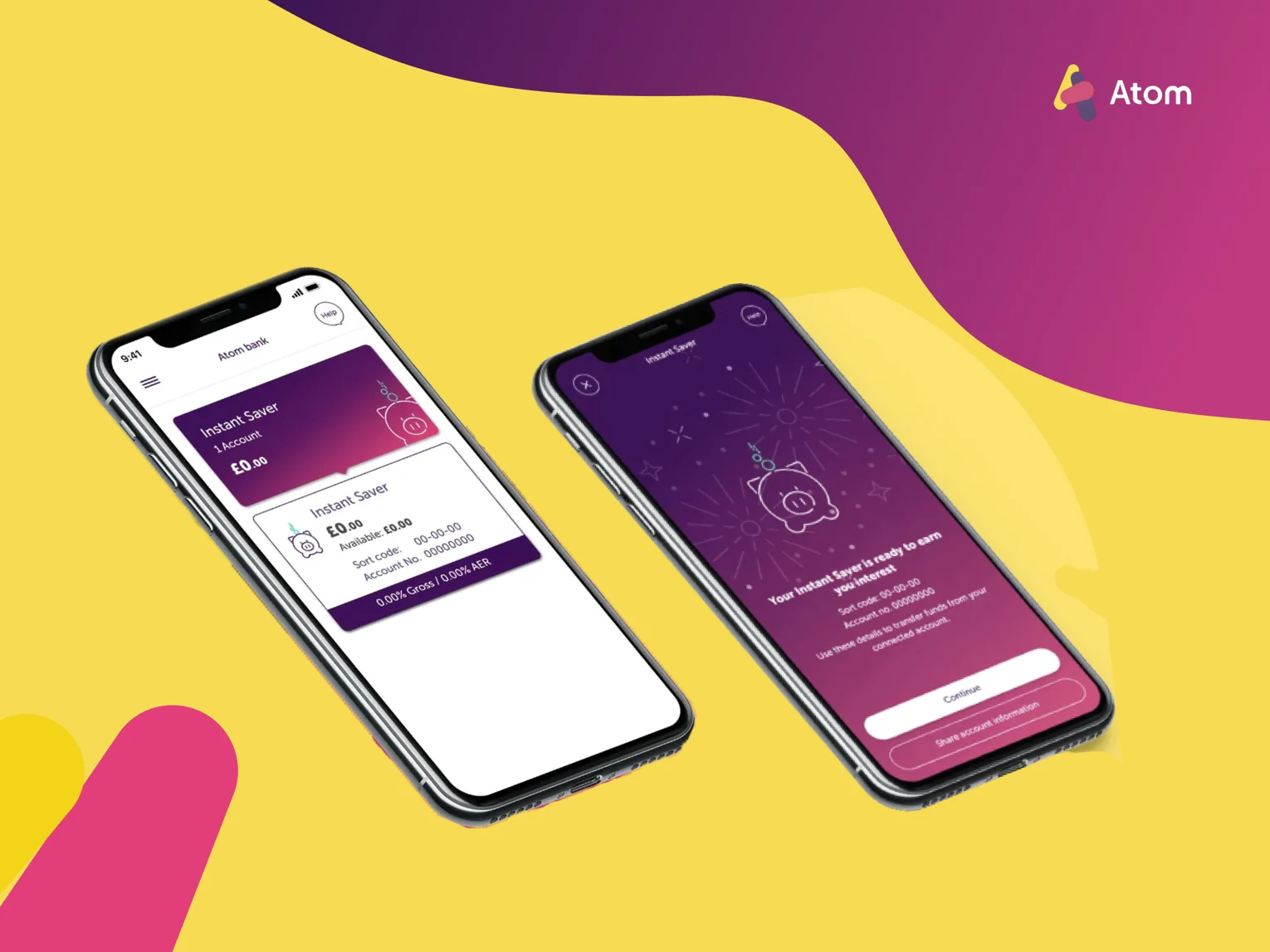

Atom Bank: Establishing an entirely new, remote team for the UK’s first fully digital bank

Atom Bank was looking for a solution that could increase their ability to deliver business changes fast. We've provided experienced, high-quality programmers to complement the existing UK team and add engineering capacity.

Read Case Study

Why is it worth using our fintech software development services

Over 9 years of developing financial software solutions

Experience in web & mobile fintech solutions

We will help you scale your business

Services for fintech companies of all sizes

Trusted financial software solutions

Multiple programming languages and frameworks

We ensure the regulatory compliance of your fintech project

Technical expertise alone is not enough in such highly regulated sectors as fintech and banking.

We understand the unique challenges and requirements of the finance industry.

That’s why we ensure the software we develop is always secure and compliant with all the fintech regulations and standards.

FinTech software development company - FAQ

Here are the frequently asked questions about our experience building fintech software applications.

If you have any more doubts regarding fintech app development, don’t hesitate to contact us.

What's your experience with challenger banks?

Modern banking is rapidly evolving. Our dedicated Banking Software Development services allow you to surpass the market and become the next challenger bank. Our experience covers:

- Mobile banking

- Core banking

- Blockchain - banking integrations

Here's an example of a challenger bank project we worked on:

What's your trading software development experience?

Trading platforms are online tools or apps that allow users to buy and sell financial instruments like stocks, bonds, or cryptocurrencies in financial markets.

Trading commodities, stocks, shares, cryptocurrencies, and derivatives often require dedicated platforms that meet users' needs. Our experience covers:

- Commodity trading platforms

- Primary and secondary shares trading marketplaces

- Cryptocurrency exchanges

- Derivatives trading software

BLOC-X: OTC commodity trading platform. From design, through MVP, to the full-scale trading solution

What types of investment platforms can you build?

Investment platforms are online platforms that enable individuals to invest in various assets, such as stocks, mutual funds, or real estate, often providing portfolio management and financial planning services.

Investment portfolio management companies often need custom solutions that allow them to better serve their customers and manage their funds. What we can do for you:

- Investment portfolio management solutions

- Automatic ETF trading software and exchange integrations

Choose a trusted fintech outsourcing company

Need to outsource fintech developers? We’ve assisted numerous small, medium, and large enterprises in overcoming challenges when establishing successful remote fintech software development teams or entire IT hubs in Poland.

KodyPay: Scaling a software development team for one of the best mobile payment startups

Back in 2022, KodyPay faced a shortage of skillful developers in the UK pool and high salary requirements in its sector.

Thanks to Poland's competitive developer rates & high expertise, we helped them scale their existing team in Berkshire and improved the development process.

Read the case study

Client testimonials for our fintech app development services

I'm impressed by how flexible Pragmatic Coders is (...). Culturally, they're a really good fit for us, and the team is very responsive to feedback. Whenever I ask them to do something, they look at it, and they're not scared to push back. I've found it very easy to work with them — we have more of a partnership than a client-supplier relationship.

Pragmatic Coders pay attention to detail and understand the business domain correctly. They led us to a successful launch of our product this year. We’re happy with the effects of their work. Our team is still using the platform and building on top of it.

The entire focus was on the product and the customer, and I loved it. (...) The team was turning up with solutions to problems I didn't know we had.

It’s truly been a partnership. They have an in-depth understanding of our client base and what services we provide, anticipating evolving needs and addressing them by adding new features into our system. Their team also makes sure that there is a shared understanding so that what they deliver meets my organization's and our clients’ expectations.

(...) Pragmatic has highly skilled engineers available immediately but most importantly, passionate people who love what they do and learn new things very quickly. I recommend Pragmatic Coders to anyone who requires expert software development no matter the stage of their business.

They responded to our queries almost immediately, and they were consistently polite and professional in their interactions. If there was something even more impressive than their communication, it was definitely their transparency. We were well informed about every aspect of their work, including what they did, why they did it, and how long it was going to take (...).

Pragmatic Coders - your fintech software development partner

Why fintech is the best industry to build a product in right now

According to Statista, 64% of the global population used at least one fintech app in 2019. The same source reports that global fintech investment is projected to reach $300 billion by 2025.

Fintech is disrupting traditional financial services, creating new opportunities for startups to innovate and offer better products and services to consumers and businesses.

Fintech technology solutions do not need to be complex

Financial companies face a considerable challenge in providing software to their customers while enduring high time and budget constraints. Fintech products must be user-friendly, responsive, secure, and offer optimal performance at all times.

To deliver such software products to the market, financial companies must focus on their core business models. Their ability to source fintech software development from a trusted technology partner is vital in their quest for success.

Custom software to leverage your financial services

When it comes to fintech, custom software is the key to success. Financial institutions and their clients have different needs, and a “one size fits all” software solution won’t do.

That’s where Pragmatic Coders comes in. We are a financial software development company specializing in creating customized fintech software solutions for our clients.

Our team of experienced developers understands the challenges that fintech companies face. We have the skillset and resources to deliver top-quality financial software products on time and within budget.

Contents

Work with a trusted fintech app development company

The years we’ve been on the market

The number of specialists on board

The revenue our products generated

Let's talk

We’ve got answers on anything connected with software development.

Message us

Feel free to reach out using the form below, and we’ll get back to you as soon as possible.

Schedule a meeting

You can also schedule an online meeting with Wojciech, our Senior Business Consultant.

founders who contacted us wanted

to work with our team.

Check our fintech-related articles

Newsletter

You are just one click away from receiving our 1-min business newsletter. Get insights on product management, product design, Agile, fintech, digital health, and AI.