How to fundraise: 5 steps to successful funding for your startup

Superheroes are made, not born. Startup founders such as yourself are one of those rare breeds whose perseverance and multitasking abilities are among the best developed. Apart from setting up the company’s vision, growing the team, and devising marketing and sales strategies, founders are fundraising all the time during the startup’s lifetime. You can also check our fundraising consulting services.

Thanks to our experience in startup consulting, we prepared this list of 5 steps to close your funding round without breaking (much) sweat.

Know your enemy – define who are you raising funds from?

There’s a difference between pre-seed/seed funding and later A/B/C… Rounds – here’s a short comparison between VCs and Angels/3F’s (Family, Friends, and Fools):

| VCs | Angels | |

| Money | LPs | Their own |

| Objective | Returns | Experience / Returns |

| Decision making | Partners / Investment committee | “Checkbox” |

| Timescale | Months | Weeks |

| Investment strategy | Defined | Flexible (& typically local) |

When there’s no universal advice on approaching both groups, the Founder must know the advantages and disadvantages of VC and Angel fundraising. Founders need flexibility and speed when starting with a fresh project; thus, Angels/3F are a much better match than VCs. They typically invest in a matter of weeks, with far easier legal structure (e.g., convertible notes) and different motives. Angels generally are people who are both financially and career-wise successful – they often value the experience, the thrill of joining an early-stage venture rather than expecting pure returns from their investment. VCs are different kinds – they expect founders to meet their KPIs / milestones and have a much more complex legal and funding structure. The fundraising process with VCs can take months and could as well lead to failure in negotiations, thus hampering startup growth or even means its death if handled incorrectly.

Get introductions to relevant investors

There’s no better way to approach your potential investors than getting that warm, fuzzy introduction from mutual contacts. You can download a VC database from Techstars, which is publicly available here. Alternatively, you can effortlessly search through LinkedIn Sales Navigator (or even use tools like Skrapp.io to have a complete CSV list generated from Sales Navigator). Identify investors who are:

- Actively investing (if they fully deployed fund).

- Investing in your area of expertise – their investment focus should match the startup’s vertical.

- Matched based on geographical focus, stage/ amount of investment.

Move them through the pipeline

The fundraising pipeline should be approached in the same way as a Sales Pipeline. A “No” doesn’t always actually mean “No” forever; keep the investor in the loop and build long-term relationships, but be decisive about when to close the round (remember, the longer your runway, the better you can fundraise). Try to qualify or disqualify as quickly as possible and try to move them through the pipeline swiftly.

Automate the fundraising tools – your weapons in fundraising

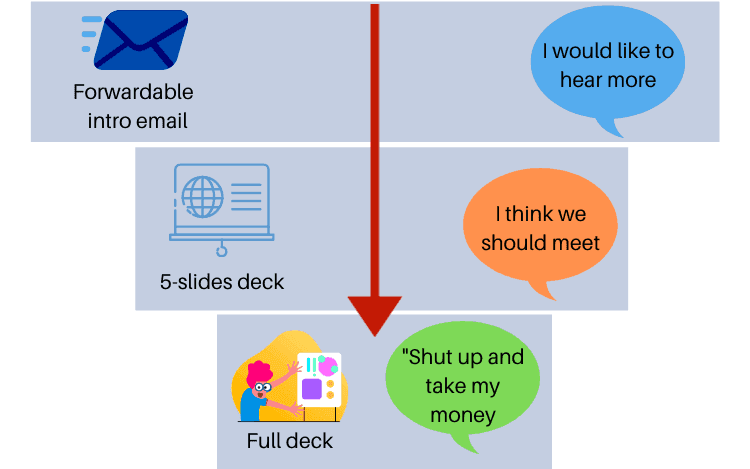

Your best tools are the ones automated. Be prepared with:

- A forwardable intro email

- 5-slide Teaser Pitch Deck

- A Full-Slide Deck.

Close the deal!

Startups’ valuations can vary greatly depending on the timing. Once you have your first Termsheet – use it as a FOMO (Fear-Of-Missing-Out) weapon. This is the time to close and onboard as many investors as possible. The ones that said “No” will eventually come back and ask you for a slice of the pie if they see that other well-known investors are involved. Use it as your negotiation edge and leverage your startup’s valuation.

Conclusions

Fundraising shouldn’t be hard; if you successfully manage your startup into growing revenue, there will always be potential investors. It’s just a matter of speed and timing to successfully close the round and drive your venture’s valuation. Your first “No” will hurt a bit, but if you have a couple of hundreds of VCs down along the list – then you should treat this as your sales process – the larger top of the funnel, the greater chance of closing the round.

Update: Startup fundraising during the recession might be a challenge! Check our thoughts on that topic here >>