5 Ways Smart Underwriting Transforms Insurance in 2025

Billions in premiums already flow through algorithmic underwriting. Pilots are moving into production at leading carriers. Manual review and fragmented data can’t match the speed, consistency, and portfolio performance now possible. Smart underwriting combines data, automation, and models to deliver audit‑ready decisions in seconds. In specialty lines, smart placement and smart underwriting are moving from advantage to requirement over the next five years.

This article defines smart underwriting and charts 2025 adoption. It presents five reasons it matters and a low‑risk path to start.

Key Points

|

What Is Smart Underwriting?

Smart underwriting uses data, rules, and models to make accurate, auditable decisions with minimal manual work. It augments underwriters and enables straight‑through processing for low‑complexity risks.

Digital data is ingested and enriched. Rules drive eligibility and pricing. Edge cases go to underwriters with full context. Low‑risk submissions flow straight through. The system learns from outcomes and is monitored with clear, auditable controls.

The State Of Smart Underwriting In 2025

Adoption is moving from pilots to broader rollouts, especially in specialty and commercial lines. Leaders treat it as a strategic differentiator, not a one‑off tooling upgrade.

Market signals point to rapid scale‑up across lines. Projections for AI‑enabled underwriting are increasingly bullish. For example, $2.6B (2023) to $41.1B (2033). In cyber, growth from $15.3 billion in 2024 to $16.3 billion in 2025 is supported by digital and AI‑powered techniques.

The hard parts are integration, data quality/coverage, and governance. That is why industry leaders and innovators invest in platforms that standardize data capture, decision orchestration, model monitoring, and audit.

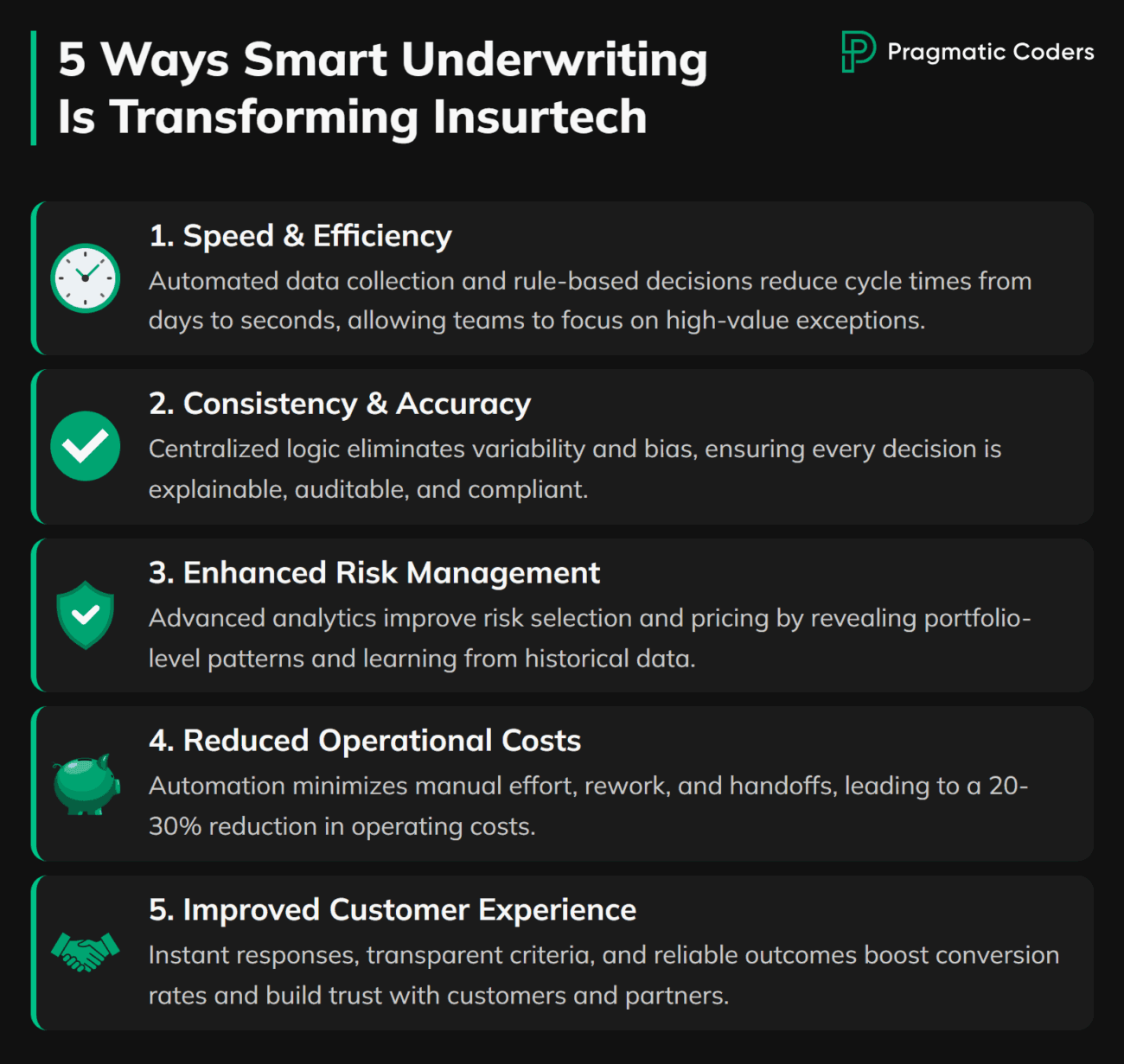

5 Ways Smart Underwriting Is Shaping Insurtech

1. Speed And Efficiency

Speed is the most visible win. Automation handles data collection and enrichment. Clear rules handle straightforward eligibility. Cycle time drops from days to seconds. Teams process more submissions without adding headcount. Underwriters focus on exceptions where judgment adds the most value.

- Prefill and third‑party enrichment cut friction and raise data quality, collapsing intake time.

- Straight‑through (fully automated) tiers handle low‑complexity risks within guardrails, escalating edge cases with context.

- A unified workbench brings evidence, prior decisions, and recommendations together while prioritizing high‑value submissions.

The result is shorter lead times, higher first‑time‑right decisions, and far fewer reworks.

2. Consistency And Accuracy

Centralized decision logic reduces variability and bias. Rules and models apply the same criteria every time, and decisions are logged with the evidence behind them. That produces predictable outcomes. Compliance improves because every decision is explainable and auditable.

- Versioned inputs, rules, and model artifacts link each decision to its exact configuration and reason codes, enabling full traceability and audit.

- Champion–challenger testing promotes changes only when they improve accuracy within predefined risk and fairness guardrails.

- Shadow releases validate new logic on live traffic with zero‑impact decisions and instant rollback, preserving stability.

- Ongoing calibration, drift detection, and fairness monitoring keep performance consistent across segments and over time.

3. Enhanced Risk Management

Advanced analytics reveal patterns that are hard to spot manually. With cleaner data and ongoing feedback, risk selection and pricing improve. You also see portfolio‑level signals that guide capacity. Over time, models learn from wins and losses. Performance compounds.

A portfolio‑level lens exposes price gaps, rising loss frequency, and leakage from inconsistent underwriting. Cohort tracking shows how vintages perform. Those insights guide targeted adjustments to rules and pricing.

Closed‑won and closed‑lost patterns, loss development, and renewals feed the loop. Selection and pricing improve, and the portfolio reshapes over time. A centralized dashboard (“control‑tower view”) tracks funnel conversion, hit ratio, expected versus actual loss, and renewals. Those signals keep daily decisions aligned with portfolio goals.

4. Reduced Operational Costs

Automation lowers cost‑to‑serve. Rework disappears, handoffs shrink, and first‑time‑right rates rise. Standardized digital intake replaces email and spreadsheets, while automated evidence gathering and sanctions checks remove manual effort. Reusable data pipelines, rules, and monitors compound savings across products and regions.

- 20–30% lower operating costs once foundations are in place

- Underwriter time shifts toward higher‑judgment cases; routine touches drop

5. Improved Customer Experience

Customers and partners value speed and clarity. Instant or near-real-time responses boost conversion and reduce drop-offs. Transparent criteria and clear next steps cut back‑and‑forth. Audit‑ready trails build trust with regulators and enterprise buyers.

Broker and partner experiences matter. Simple digital submissions with early validation cut rework. Fast, indicative pricing keeps momentum. A clear path to bind removes uncertainty. When instant decisions aren’t possible, defined SLAs and transparent status updates maintain confidence.

Consistency is a CX feature. Similar risks get similar outcomes with clear reasons. Appeals and friction fall. Over time, that reliability becomes a differentiator, especially where speed and confidence win deals.

Publishing response‑time targets in portals and broker interfaces sets expectations. It builds trust and reduces follow‑ups. This holds even when human review is required.

How To Get Started With Smart Underwriting

Start small, prove value, and scale deliberately. A focused pilot shows measurable gains without risky, big‑bang rewrites.

- Identify a high‑impact product or segment where delays or variability hurt outcomes.

- Map data sources and decision criteria, including third‑party enrichment you can integrate quickly.

- Build a pilot with human‑in‑the‑loop review on edge cases while allowing straight‑through processing for low‑risk submissions.

- Measure improvements in decision time, accuracy, conversion, and loss ratio drivers.

- Industrialize with robust integration, monitoring, and governance as you scale to adjacent products and geographies.

If you want help executing this playbook, we build production smart underwriting systems. We start with a scoped pilot and human-in-the-loop guardrails, track clear KPIs, and then scale. Our team handles data ingestion, decision orchestration, model integration, monitoring, and governance so underwriters see value fast. Explore our insurance software development services or contact us to get started.

Conclusion

Smart underwriting is becoming foundational across insurance and fintech. The carriers and lenders that win will pair speed and consistency with disciplined rollout and model governance. The practical move is to validate a targeted pilot now, prove the metrics that matter, and expand from a position of evidence.