5 Proven Ways to Increase Market Share (Backed by Classic Strategy Books)

Growing market share used to be simple. You built a better product, marketed it aggressively, and scaled operations until competitors ran out of energy. But business today moves faster, customers have more options, and switching costs keep shrinking. Because of that, companies need a smarter, more structured approach — not just scattered tactics.

So here’s the deal: when you look at the most influential strategy books of the last 30 years — Blue Ocean Strategy, Crossing the Chasm, The Discipline of Market Leaders, and The Innovator’s Dilemma — you start to notice that their ideas overlap. Even though they were written for different audiences, they all point in the same direction.

To sum it up, when you merge these ideas together you get one powerful system anyone can use to grow (and defend) market share. I’ve turned those overlapping concepts into a single, practical, five-part framework you can immediately apply to your business.

Let’s walk through it step by step.

1. Choose Your Strategic Position (and Commit to It)

Most companies fail to grow market share because they try to be good at everything: great product, great support, great price, great innovation, great customization… and they end up average everywhere.

The best companies decide one primary way they win and align their entire business around it. You have three choices — and choosing one is the entire point.

A) Product Leadership — Win by setting the pace (Innovation-first)

Who this works for: tech, AI, hardware, consumer products, any category shaped by speed or creativity.

What this really means:

- You release new features faster than rivals.

- You solve problems competitors consider impossible or too expensive.

- Your product becomes the industry benchmark for “this is how it should be done.”

How product leaders capture market share:

- Early adopters switch immediately.

- The market migrates toward “whatever solution is the most advanced.”

- Competitors struggle to imitate because they’re stuck with legacy systems.

Who should choose this strategy

Companies where technology, speed, or creativity are the main drivers of customer value.

Product leaders compete on creativity, speed of innovation, and category-defining ideas. Their customers expect them to be first — first with new features, first with new design approaches, first with new technology. Apple didn’t invent smartphones or MP3 players, but it reimagined them so completely that the categories restarted around its vision. Nvidia did something similar in AI: its GPU architecture and CUDA ecosystem gave the company a multi-year lead that competitors still struggle to match.

In all these cases, innovation is the product. Market share grows because customers associate these brands with progress. Early adopters switch quickly, and mainstream customers follow once the product becomes the “obvious” choice.

B) Operational Excellence — Win by being the easiest and most efficient option

Who this works for: logistics-heavy businesses, ecommerce, marketplaces, airlines, retail, B2B SaaS with large user bases.

How these companies grow market share:

- lowest cost structure

- fastest delivery or fulfillment

- near-zero friction

- predictable, reliable experience

How operational excellence captures market share:

- Customers switch because the experience is smoother, cheaper, and faster.

- Competitors struggle because matching your efficiency requires deep structural changes.

Who should choose this strategy:

Companies where speed, cost, logistics, and reliability matter more than novelty.

Operationally excellent companies grow market share because choosing them feels effortless. Amazon is the clearest example: one-click checkout, next-day delivery, and a supply chain so optimized that competitors simply can’t replicate the experience without rebuilding their entire infrastructure. Costco uses a different model but the same discipline — a tightly controlled product selection, high volumes, and low margins that deliver unbeatable value.

C) Customer Intimacy — Win by knowing your customers better than anyone

Who this works for: fintech, healthcare, enterprise SaaS, consulting, any relationship-driven industry.

How these companies grow market share:

- personalized solutions

- deep domain knowledge

- strong account management

- long-term trust

Who should choose this strategy:

Companies serving complex, high-stakes, or high-touch markets (e.g., fintech, healthcare, enterprise software, consulting).

Customer-intimate companies rely on relationships and deep understanding. Salesforce built its enterprise success not just on CRM features but on customizations, integrations, and a strong ecosystem of support and consulting. HubSpot excels in the SMB space because it pairs its product with extensive education, onboarding, and customer success programs that guide users for years. Professional services firms succeed when they learn a client’s business so well that the partnership becomes a competitive edge.

What all of these companies share is that they remove uncertainty for the buyer. Customers stay — and bring in more business — because they feel understood, safe, and supported. Market share grows through long-term trust, not aggressive expansion.

| Discipline | Customers choose you because… | You invest in… | You do NOT focus on… |

| Product Leadership | You’re the most advanced or innovative | R&D, talent, rapid iteration | Being cheap or deeply customized |

| Operational Excellence | You’re the easiest, fastest, and lowest-cost | Automation, logistics, process discipline | Constant innovation or personalization |

| Customer Intimacy | You understand them and adapt to them | Support, account management, customization | Cutting costs to the bone or bleeding-edge innovation |

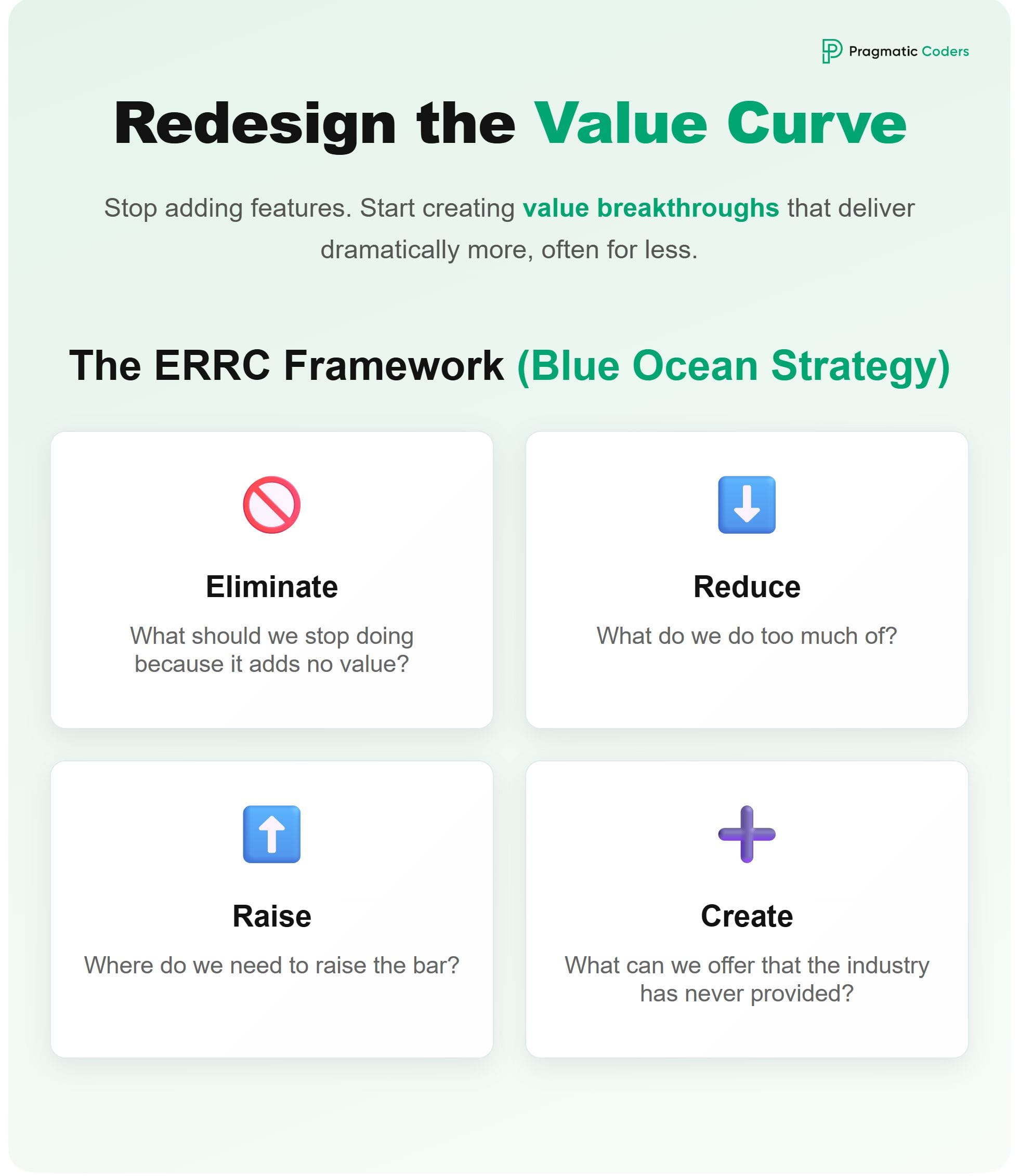

2. Redesign the Value Curve (Not the Feature List)

Win by delivering dramatically more value while lowering your internal cost structure.

Most companies compete by adding features. High-performing companies rewrite the rules completely by creating what Blue Ocean Strategy calls a value breakthrough.

Instead of piling on features, you rethink the entire offer so customers get something meaningfully better and simpler, often at a lower price. This is the core idea behind the ERRC framework (Eliminate, Reduce, Raise, Create).

Companies known for breakthrough value creation:

- Southwest Airlines

- Canva

- Netflix

Southwest Airlines didn’t try to outperform competitors by offering fancier seats or free meals. Instead, it eliminated the parts of air travel customers didn’t truly value and reinvested in what they did value: low prices, frequent flights, and on-time reliability. By redesigning the flying experience around simplicity, Southwest cut internal costs significantly while giving passengers a clearer, more consistent value proposition. As a result, it didn’t just steal market share — it expanded the market by making flying accessible to people who previously couldn’t afford it.

Canva applied the same principle to design software. Traditional tools like Adobe Photoshop and Illustrator were powerful but intimidating. Canva removed the complexity, reduced the learning curve, and raised ease of use to the point where anyone could produce professional-looking graphics. The result was a massive new category of casual creators who previously didn’t use design tools at all. Canva’s value breakthrough wasn’t “better editing tools”; it was radically simpler creation, which turned non-designers into a new market segment.

Netflix is another strong example. The company eliminated physical rental stores and late fees, reduced customer effort to almost zero, and raised convenience through a growing digital catalog. When streaming arrived, Netflix did the same thing again — eliminating shipping, reducing wait times, and creating on-demand access. That value redesign didn’t just win them Blockbuster’s customers; it fundamentally changed how the entire world consumes entertainment.

Why this boosts market share

Because customers switch for value they immediately understand. Value breakthroughs do three things at once:

- Create a compelling reason to switch

- Lower internal costs

- Open entirely new segments competitors ignored

This is how companies create “blue oceans” instead of fighting in crowded red ones.

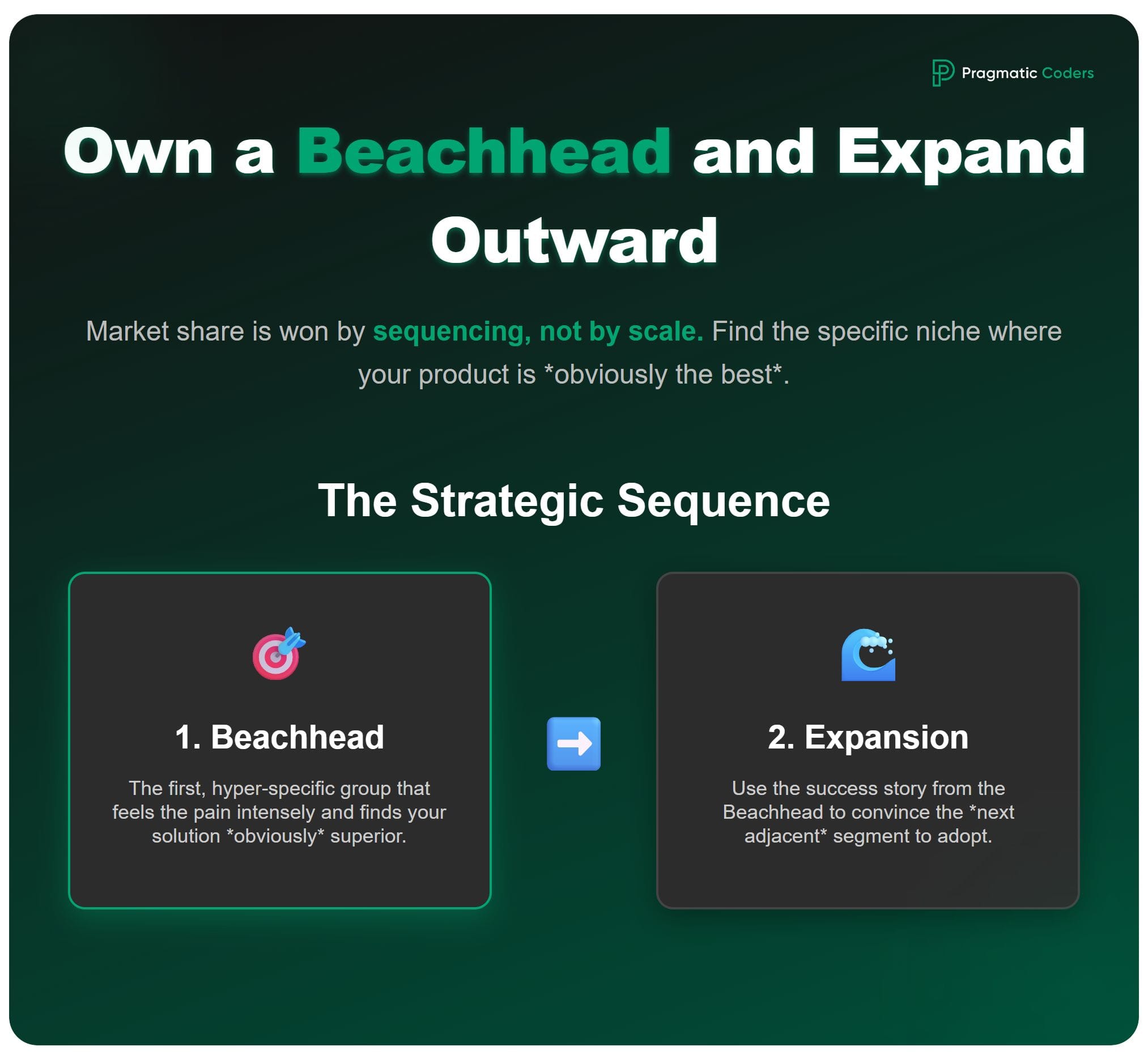

3. Own a Beachhead and Expand Outward

Market share is won by sequencing, not by scale.

When companies imagine growth, they often picture a straight line: build a product, market it broadly, and watch adoption rise across the entire industry. But real markets don’t work that way. Real adoption spreads unevenly — through pockets, clusters, and niches where the product resonates most intensely.

Every fast-scaling company wins one specific segment first — the group for whom the product is obviously the best fit.

This is your beachhead:

- Slack → Engineering teams: Not “everyone.” Just dev teams drowning in email.

- Shopify → Indie creators: Small merchants who needed a simple way to sell online.

- Salesforce → Early tech startups: Companies who couldn’t afford on-premise CRM software.

A beachhead is that “someone.” It’s the first group of customers for whom your product is not just good — it’s obviously the best. They feel the pain intensely, they’re actively looking for alternatives, and they’re willing to adopt something new even if it’s not perfect yet. When you win this group, you earn something far more valuable than revenue: you earn a story the next group will believe.

A beachhead gives you:

- strong case studies

- repeatable sales motions

- predictable onboarding

- champions inside companies

- a story the next segment will believe

Mainstream buyers don’t adopt products because of features; they adopt because “people like us” succeeded with it.

4. Build a Complete Solution Ecosystem

Adoption accelerates when the product feels low-risk, fully supported, and deeply integrated into the customer’s environment.

Companies often think that market share is defined by product quality, feature sets, or pricing. In practice, those factors matter less than a single decisive variable: the perceived completeness of the solution. In mature markets, the company with the strongest ecosystem — not the strongest product — usually wins.

Customers don’t buy products. They buy reduced risk. A complete solution lowers friction everywhere: onboarding, migration, integration, and long-term usage.

Analytically, a “complete ecosystem” is composed of four layers:

Layer 1 — Functional coverage

Customers prefer a “one-stop shop.” Using multiple tools to finish a single task is frustrating and inefficient. If your product covers the entire process from start to finish, it becomes indispensable.

Effect on market share: The more useful the product is, the more customers you will win—and keep.

Layer 2 — Integration Density

The easier it is to plug a product into the tools a company already uses (like their sales or payment software), the more likely they are to buy it.

However, these connections also act as an anchor. Once a product sits at the center of a company’s data flow, acting as the bridge between different systems, it becomes very difficult and costly to remove.

Effect on market share: Being highly connected makes it easier to win new customers (because setup is easy) and harder to lose them (because leaving causes technical chaos).

Layer 3 — Support Infrastructure

Mainstream customers hate surprises. They aren’t just buying your software; they are buying the safety net around it. They want to know: Will you help us install it? Will you train our team? Do you promise it won’t crash?

Even if a competitor has better features, you can still win by having better service. If you make the purchase feel risk-free, you win.

Effect on market share: When buyers feel safe, they make decisions faster. Your product becomes the standard choice for companies that want stability.

Layer 4 — Trust Signals

Business buyers, especially in B2B, need proof that the product actually works for companies like theirs. They look for concrete evidence, such as:

- Success stories

- Certifications

- Benchmarks

- Endorsements

Effect on market share: If you can prove you are trustworthy, you sell faster. External approval acts like a shortcut for the buyer’s brain, especially when the stakes are high.

Why this boosts market share

From an analytical perspective, adoption is a function of value minus friction.

Even a high-value product fails to scale if friction is high.

An ecosystem reduces friction at every step:

- faster buying decisions

- shorter sales cycles

- fewer objections

- lower churn

- higher retention

- stronger lock-in

- more referrals

This is how you become the default choice — and default choices dominate.

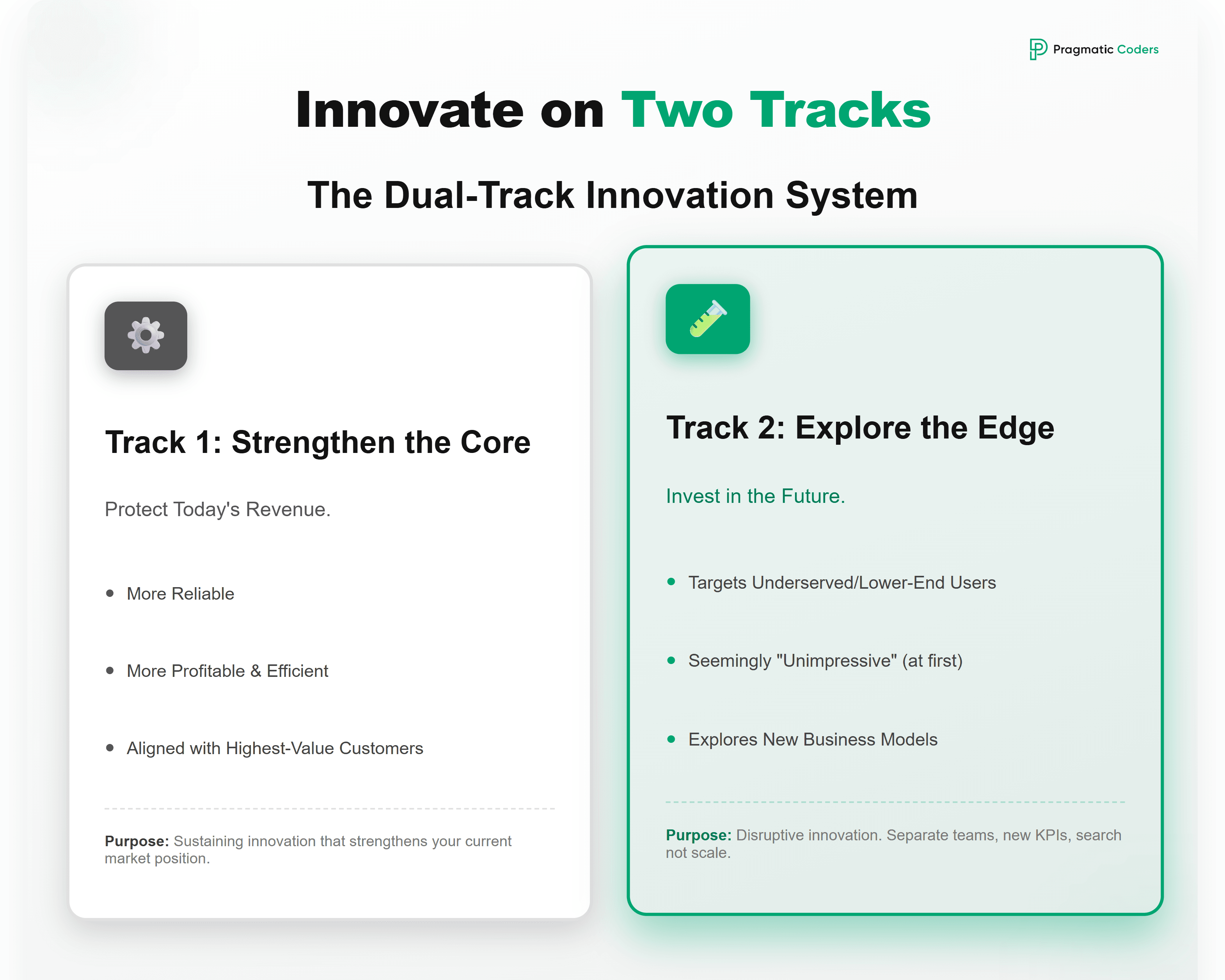

5. Innovate on Two Tracks (Disrupt Yourself Before Someone Else Does)

Market share doesn’t disappear gradually — it collapses. The only companies that stay ahead are the ones willing to challenge their own success.

Most organizations overestimate the strength of their competitive position because they’re looking at the wrong threats. Competitors rarely take your market share by building a slightly better version of what you already have. They take it by offering something that seems insignificant at first — a cheaper, simpler, more accessible alternative that your best customers initially ignore.

This is the essence of disruptive innovation: the threat is invisible until it’s too late to respond. And by the time leadership takes it seriously, the slope of the curve has already turned against them.

Strategically, the companies that stay ahead follow one principle: treat your own core product as a potential liability, not an asset. It creates revenue today, but it also hardens your operations, your thinking, and your roadmap. The longer you rely on it, the harder it becomes to reinvent yourself.

The solution is a dual-track innovation system.

Track 1: Strengthen the core

This is the operational engine. Its job is to make the existing product:

- more reliable,

- more profitable,

- more efficient, and

- more aligned with the expectations of your highest-value customers.

Strategically, this protects today’s revenue. It also raises the barrier for direct competitors. But it’s not enough, because sustaining innovation only strengthens your current position, not your future one.

Track 2: Explore the edge

This is where you intentionally work on products that look too small, too low-margin, or too risky for the main business. These initiatives:

- start with lower-end or underserved users,

- look unimpressive compared to the core product, and

- don’t fit your usual profitability models.

Which is exactly why they work. These edge bets explore new customer behaviors and new business models before anyone else does.

And here’s the strategic move: you separate them from your core organization.

New teams, new KPIs, and no pressure to justify themselves with enterprise-level revenue from day one. Their job is to search, not to scale.

What this means for market share

If you want to defend or grow share over the next three to five years, you can’t rely solely on what’s working today. You need a portfolio that covers:

- Core → your current market

- Adjacent → the next vertical, next persona, next pricing model

- Speculative → the category that doesn’t exist yet but will matter soon

This structure ensures that when the market shifts — and it will — you’re already positioned where the demand is moving.

The companies that fall behind don’t fail because they stop innovating. They fail because they keep innovating in the wrong direction — reinforcing the past instead of investing in the future. A strategic leader’s job is to prevent that.

Conclusion

To sum it up, increasing market share is about making a small number of strategic decisions that compound over time.

Companies that grow consistently do five things extremely well:

- Pick a dominant strategic position and align around it.

- Redesign value instead of adding complexity.

- Win one segment decisively, then expand.

- Build an ecosystem that removes friction and reduces risk.

- Innovate on two tracks — one for today, one for tomorrow.

Pragmatic Coders helps companies turn strategy into results. We deliver AI automation, UX-focused design, cloud solutions, and ready-to-launch MVPs.

We support you in:

✅ Defining your competitive edge

✅ Reworking your value proposition

✅ Growing your initial market

✅ Building smooth, connected systems

✅ Innovating quickly without losing focus

Need help with any of the above? Let’s talk.