Top AI Trading Tools in 2026

From automating chart analysis to generating data-driven trade signals, AI-based software has become a practical force in modern trading. When used effectively, these intelligent tools can enhance analysis, spot patterns, and unlock insights that lead to smarter strategies and faster, more accurate decisions.

But choosing the right AI trading tool isn’t simple. The market is crowded, and the best choice depends on your trading style, goals, and level of technical comfort. This guide breaks down the top AI-based trading platforms and tools, highlighting their unique strengths to help you find the solution that fits your path forward.

Best AI Trading Tools to Use in 2026

The following list highlights a diverse range of AI-powered tools for traders. Our selection process focused on several key factors. We looked for demonstrated AI functionality, a clear target audience, unique and proven features, and overall usability. We also considered pricing models, user reviews, and expert analysis to create a balanced overview. While many capable tools exist, these profiles offer a solid starting point for traders seeking to enhance their game using AI.

TradeEasy AI

Key Features | |

|

|

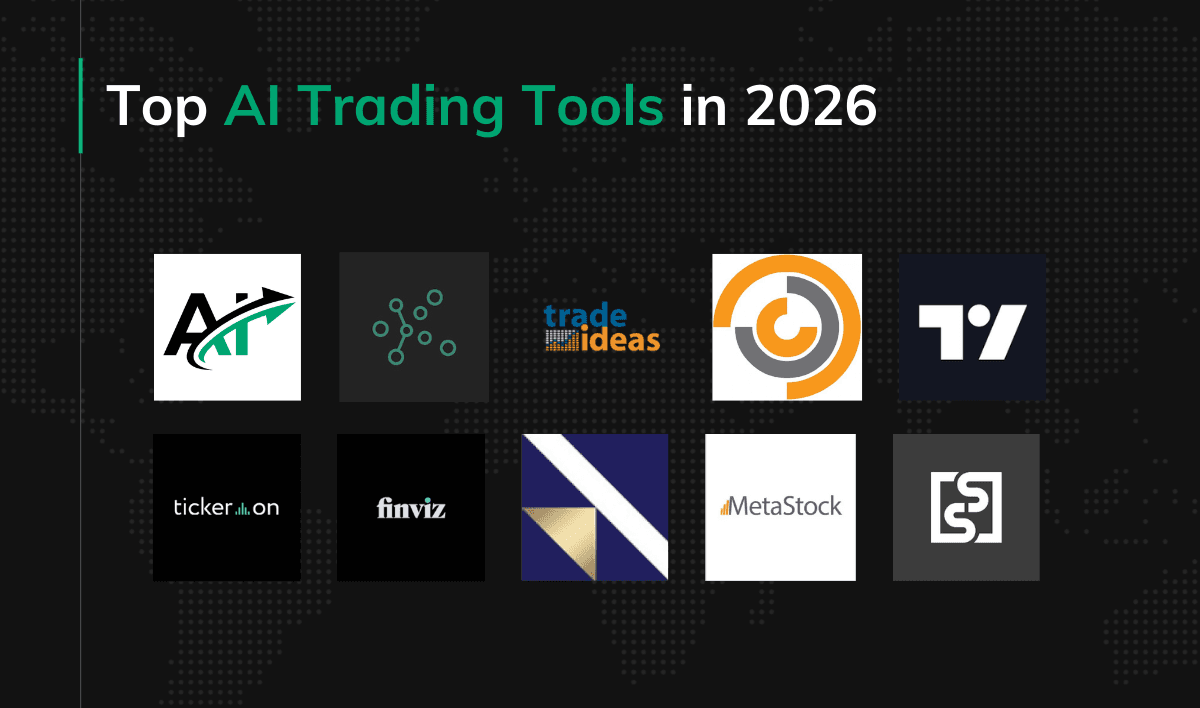

TradeEasy.ai is an AI-powered financial intelligence platform designed to help traders understand the narrative driving market movements. It operates by aggregating financial articles in real-time from a wide variety of reputable sources. The platform covers a comprehensive range of assets, including traditional markets (stocks, bonds), commodities, forex, and cryptocurrencies.

The core of the platform lies in its analysis engine. For every article it fetches, the AI performs two key actions:

- Sentiment Analysis: It assigns a “Bullish,” “Neutral,” or “Bearish” label to determine the tone and potential market perception of the news.

- Impact Analysis: It estimates the potential significance of the news, classifying it as “Low,” “Medium,” or “High” impact.

This structured data is presented through an asset overview dashboard, allowing traders to quickly see which assets are generating the most positive or negative buzz. The tool also provides concise summaries and key takeaways for each article.

A key component of TradeEasy.ai is its AI assistant. This conversational interface allows users to ask financial questions and receive contextual answers based on the latest news feed and conversation history. The assistant is explicitly designed to provide general market insights and clarify trends rather than offer specific investment advice. A recent update has significantly improved the accuracy of its sentiment analysis. Additionally, the aggregation system has been refined to ensure comprehensive news coverage.

Why Use It?

TradeEasy.ai is designed for traders who want to enhance, not replace, their research. It’s built for news-driven traders, fundamental analysts, and portfolio managers who rely on understanding market narratives—not just reacting to automated signals.

Its core strength lies in transforming unstructured financial news into organized, actionable intelligence. Instead of pushing buy or sell signals, it equips users with contextual data to explain why assets move. With broad coverage across major asset classes, it supports comprehensive portfolio monitoring. And as a completely free platform, TradeEasy.ai makes AI-powered news analysis accessible to anyone looking to form a more nuanced, informed market view.

TrendSpider

Source: Trendspider.com

Key Features | |

|

|

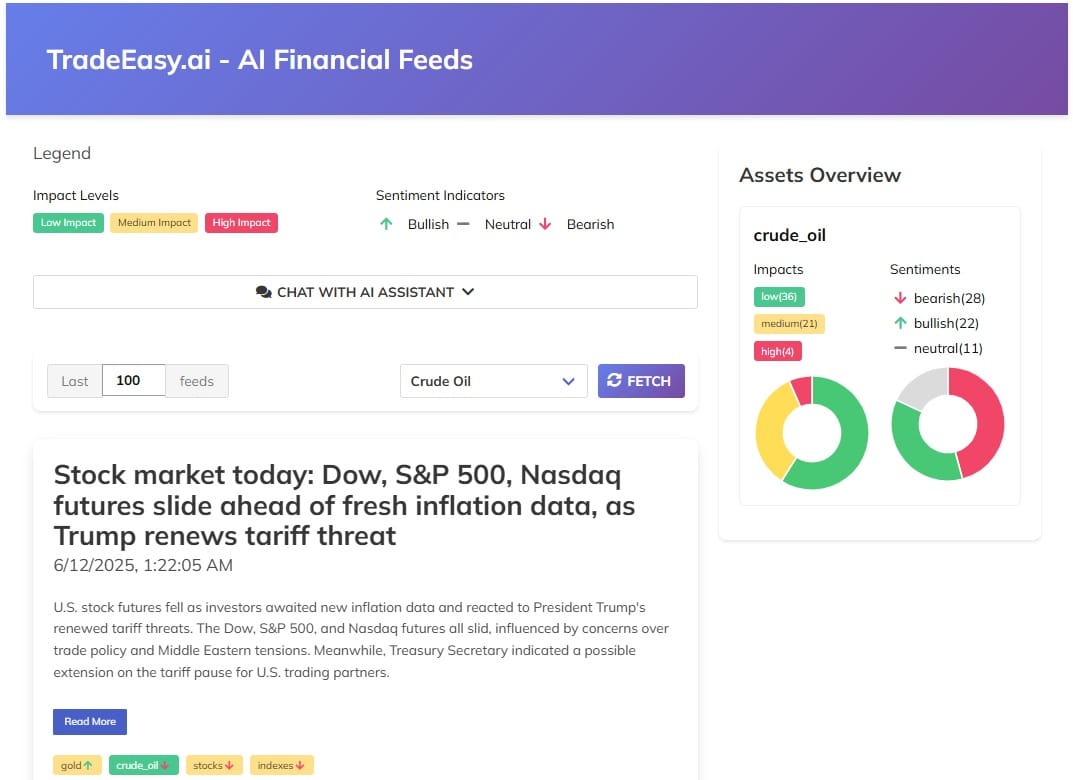

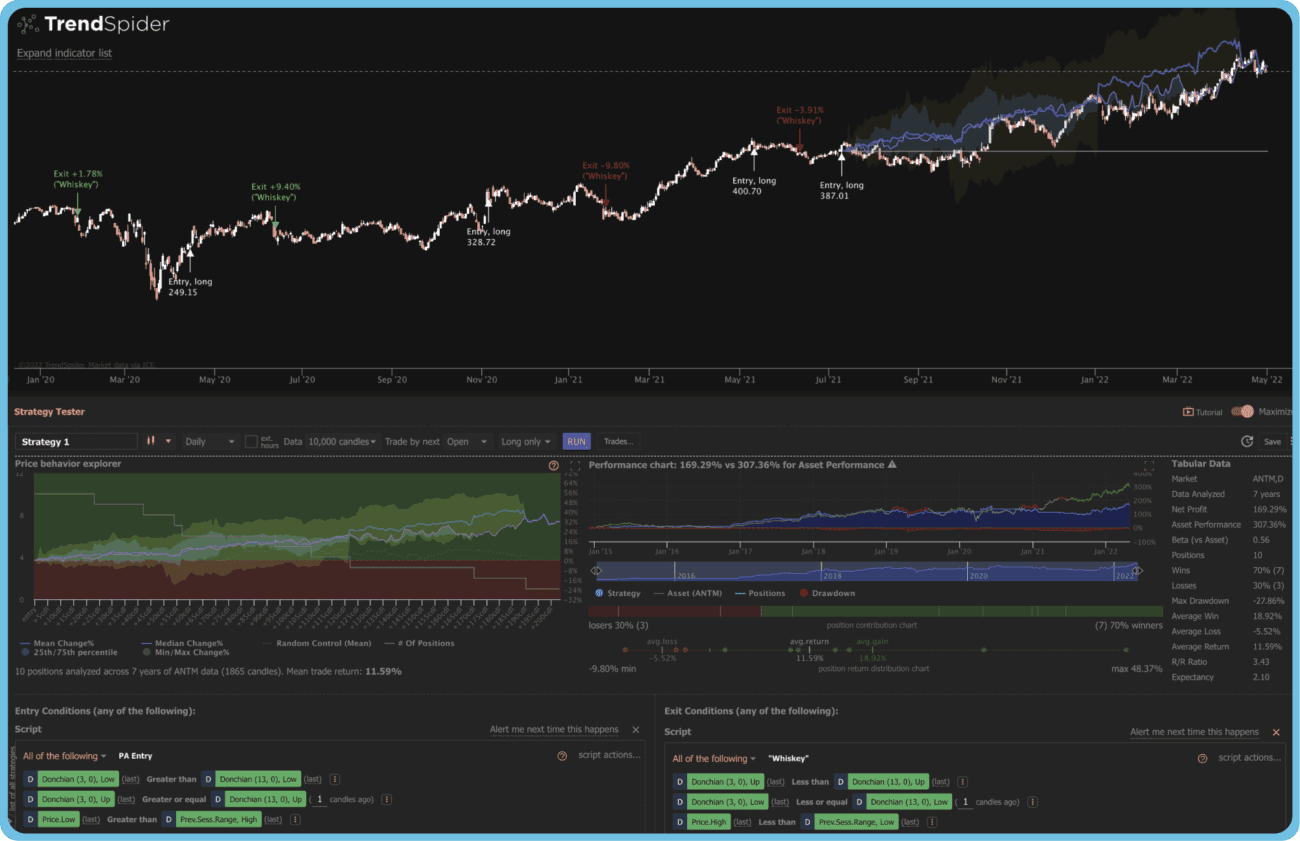

TrendSpider is a comprehensive, AI-driven trading platform designed to automate the heavy lifting of technical analysis. It consolidates advanced charting, market scanning, strategy backtesting, and automated execution into a single, integrated toolkit, providing retail traders with access to institutional-grade capabilities.

The platform’s standout feature is its automated analysis. TrendSpider’s algorithms automatically identify and draw trendlines, detect over 150 candlestick patterns, and recognize dozens of classic chart patterns. A key innovation is its multi-timeframe analysis, which allows users to overlay indicators and trendlines from various timeframes (e.g., weekly, daily, hourly) onto one chart, revealing deeper market context.

For strategy development, TrendSpider offers a powerful, no-code backtesting engine. Traders can build and test strategies using a point-and-click interface against 50 years of historical data. The platform also features an advanced market scanner that goes beyond technicals to screen for fundamentals, news events, analyst ratings, and alternative data like insider trades and unusual options flow.

Completed strategies can be deployed as dynamic alerts or as fully automated trading bots. Through its integration with services like SignalStack, these bots can execute trades directly in a user’s brokerage account.

Why Use It?

TrendSpider is built for active technical traders who want to save time, reduce manual errors, and gain a competitive edge through automation. It is ideal for systematic traders looking to build, test, and deploy strategies without needing deep coding knowledge.

The platform excels at eliminating manual grunt work, now significantly faster with Sidekick AI handling complex tasks like scan generation and script writing. The addition of a paid content store also allows successful traders to monetize their custom strategies and indicators. With real-time data included and powerful automation tools, TrendSpider provides a robust, all-in-one ecosystem for traders who value speed and precision.

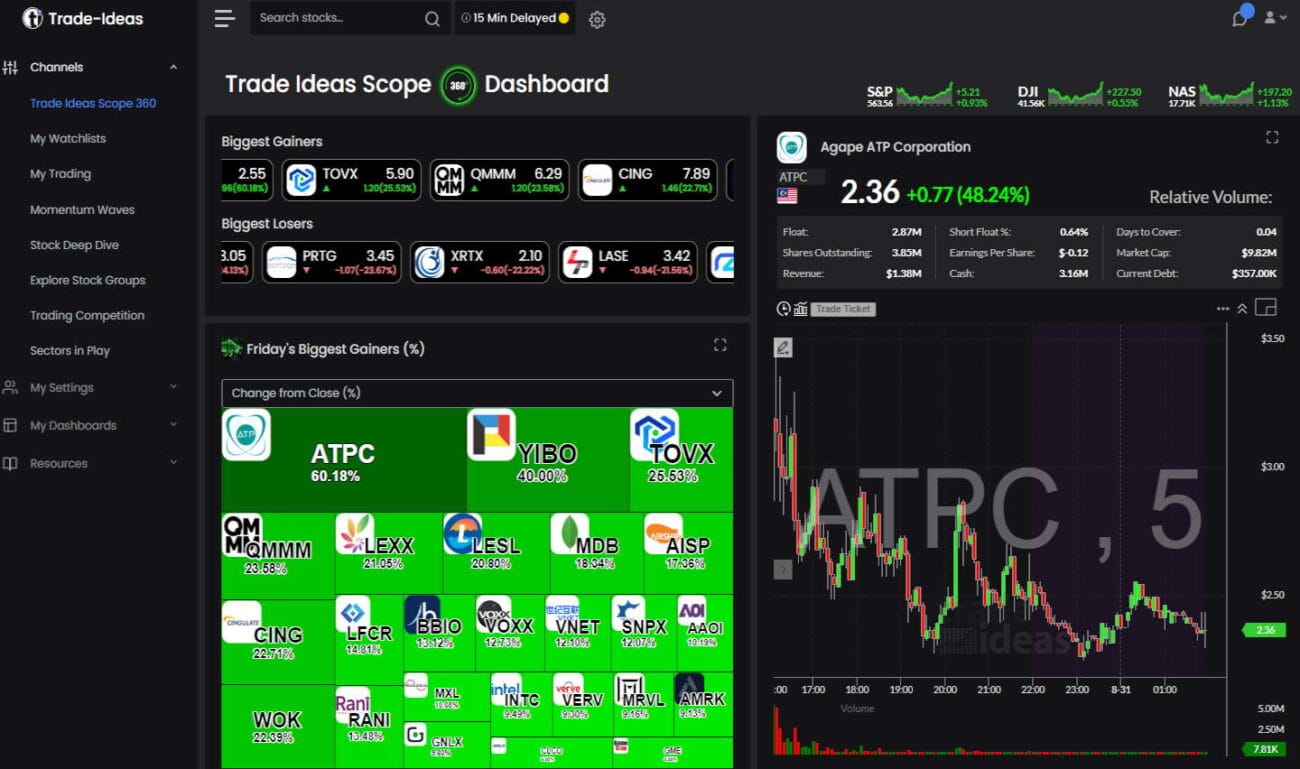

Trade Ideas (Holly AI)

Source: Trade-ideas.com

Key Features | |

|

|

Trade Ideas is a professional trading platform built specifically for day traders, centered around its powerful AI engine, “Holly.” Unlike tools that simply help you perform your own analysis, Trade Ideas is designed to provide specific, actionable trade signals generated by a sophisticated statistical engine.

The platform is driven by three distinct AI algorithms—Holly, Holly 2.0, and Holly Neo—that collectively run millions of backtests on over 70 different strategies every single night. The system then presents only the handful of strategies with the highest probability of success for the upcoming trading day, based on strict criteria like a historical win rate of over 60% and a 2:1 risk-to-reward ratio. These signals, complete with entry and exit points, are displayed clearly on the charts.

Beyond its AI, Trade Ideas features a powerful real-time market scanner with dozens of pre-configured channels and customizable filters, including unique scans for social media mentions. It also includes the “OddsMaker,” a point-and-click backtesting tool that allows traders to test their own ideas without any programming.

For execution, the platform’s Brokerage Plus module allows traders to automate their own scanned strategies by connecting directly to brokers like Interactive Brokers and E*Trade.

Why Use It?

Trade Ideas is built for active, systematic day traders who value a data-driven, “black box” approach over manual analysis. It is best for those looking to automate their edge using proven statistical models without needing to code.

The platform’s core strength remains the audited performance of its AI, now enhanced by the Money Machine (Trade Ideas’ completely integrated, end-to-end automated trading engine) for seamless, code-free automated execution. With the addition of “Market Story” for better macro-context and “Idea Surfing” for faster scanning, it offers a robust ecosystem for traders who want to combine institutional-grade automation with intuitive real-time monitoring.

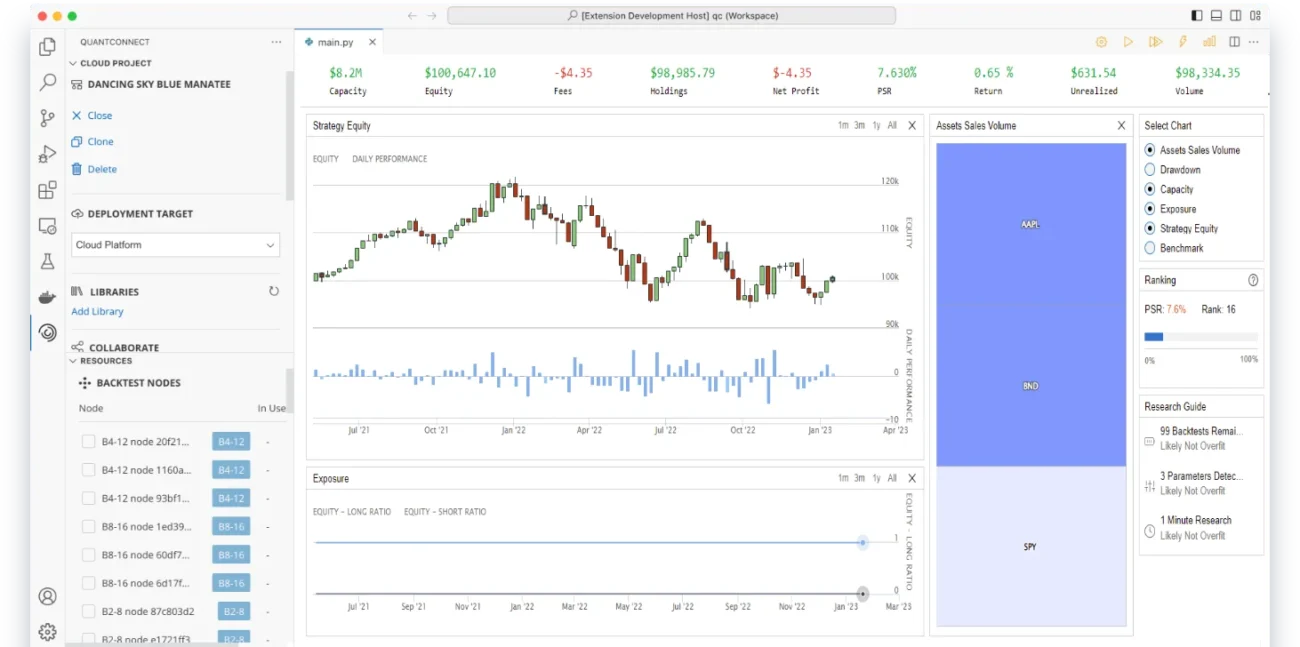

QuantConnect

Source: Quantconnect.com

Key Features | |

|

|

QuantConnect is an institutional-grade algorithmic trading platform designed for quants, data scientists, and developers who build, backtest, and deploy trading strategies using code. It provides an end-to-end infrastructure that covers the entire quantitative finance workflow, from initial research to live trading execution.

The platform is built on LEAN, its powerful open-source trading engine, which supports strategy development in both Python and C#. This gives developers enormous flexibility and control. QuantConnect’s environment is broken into three main components: a cloud-based research terminal with Jupyter-style notebooks for exploring data and training machine learning models; a high-performance, event-driven backtesting engine for strategy validation; and a live trading module that integrates with over 20 brokers for seamless deployment.

A key strength of QuantConnect is its vast, integrated data library. It offers terabytes of financial data (equities, options, futures, crypto) and a rich collection of alternative datasets, all pre-formatted and point-in-time to prevent look-ahead bias. For organizations with strict security needs, the entire platform can be deployed on-premise.

Why Use It?

QuantConnect is designed for quantitative developers, professional traders, and trading firms who need a robust, scalable infrastructure for systematic trading. It’s best suited for users comfortable with coding and is not aimed at discretionary traders or those seeking no-code tools.

Its core value lies in solving the “build vs. buy” dilemma by offering a complete, end-to-end quant infrastructure out of the box. This can save firms millions in development costs and years of build time. The platform’s open-source foundation ensures transparency, while recent 2025 updates—including SS&C Eze support and deep IDE integrations (like Copilot and Cursor)—further streamline the path from research to deployment for serious algorithmic traders.

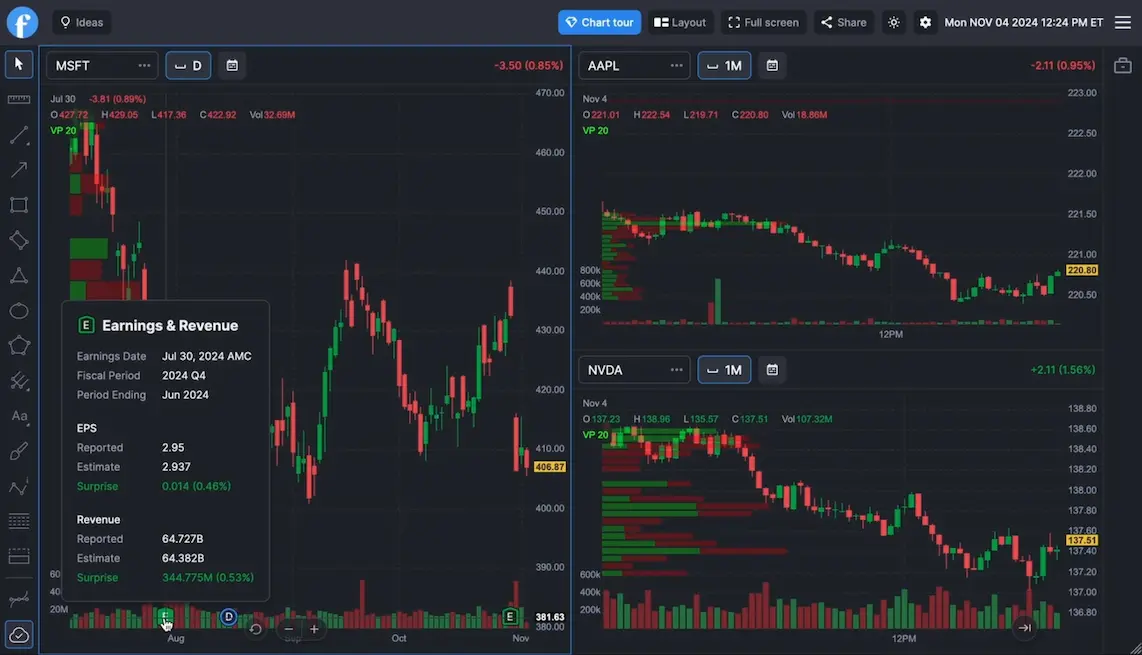

TradingView

Source: Tradingview.com

Key Features | |

|

|

TradingView is the world’s most popular charting platform and social network for traders. It combines best-in-class technical analysis tools with a massive, active community, making it the go-to platform for millions of international traders analyzing stocks, forex, and cryptocurrencies. Its 2025 updates focus on workflow refinement, introducing alerts on rectangle drawings for tracking price zones and cross-tab synchronization to keep watchlists and intervals aligned across multiple windows.

At its heart, TradingView offers exceptionally powerful and intuitive charts, featuring over 160 built-in indicators, extensive drawing tools, and specialty chart types like Renko and Kagi. The platform leverages AI for its automated pattern recognition, which automatically identifies dozens of candlestick and chart patterns as they form. For users looking to build custom tools, an AI-powered assistant can help generate code for its proprietary Pine Script language.

Beyond charting, TradingView includes powerful screeners for stocks, forex, and crypto, allowing users to filter for opportunities based on hundreds of technical and fundamental metrics. However, its most unique aspect is its social ecosystem. Traders can publish their own chart analysis, follow other traders, and tap into a library of over 100,000 community-built indicators and strategies.

Why Use It?

TradingView is the go-to choice for discretionary traders and technical analysts of all levels who need world-class charting without installing desktop software. It is ideal for those who value a collaborative environment where they can share ideas and use community-created tools.

Its primary strength is the balance of usability and depth. The platform remains incredibly intuitive while offering powerful features like the new Volume Candles visualization and continuous Pine Script enhancements. By combining top-tier charting, a vast library of community scripts, and seamless cross-device syncing, TradingView offers an unmatched “analyze anywhere” experience.

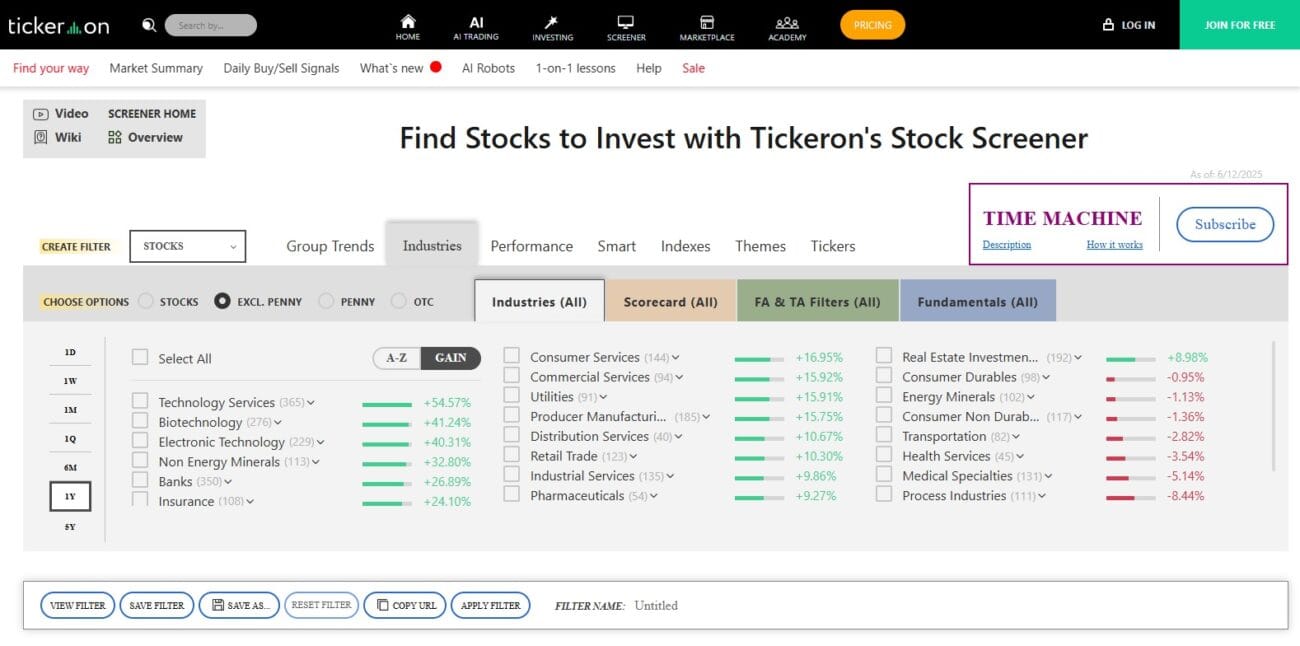

Tickeron

Source: Tickeron.com

Key Features | |

|

|

Tickeron is an AI-powered trading and investment platform that uses sophisticated algorithms to identify opportunities for traders and investors. It is built around a core of AI-driven pattern recognition, scanning the market in real-time for stocks, ETFs, forex, and crypto pairs that are exhibiting one of 40 distinct chart patterns.

Once a pattern is identified, Tickeron’s AI Trend Prediction Engine analyzes its historical success rate and current market conditions to forecast price direction. Crucially, it assigns a “Confidence Level” to each prediction and allows users to review the AI’s past accuracy on that specific pattern and stock, adding a layer of transparency.

The platform’s most distinct features are its AI Robots. These are essentially pre-packaged algorithmic trading strategies with fully audited, public track records. Users can browse these robots, review their performance statistics (win rate, annual return, etc.), and subscribe to receive their real-time trade alerts. Its 2025 updates introduce high-frequency 5-minute and 15-minute AI Agents, enabling the platform to identify and act on intraday trends with significantly reduced latency compared to older models.

For longer-term investors, Tickeron offers AI Portfolio Wizards that help create well-diversified portfolios based on user-defined goals and risk tolerance, providing tools to ensure proper asset allocation.

Why Use It?

Tickeron is designed for active day and swing traders who want to leverage institutional-grade AI without needing to code algorithms themselves. It is ideal for users who want a “glass box” approach—where they can see the AI’s logic, success probability, and track record before committing capital.

Its primary strength is transparency and speed. Unlike black-box bots, Tickeron provides detailed “Confidence Levels” and public track records for every agent. The shift to shorter 5-minute AI cycles allows traders to capitalize on rapid market shifts that slower tools miss. With the addition of the $TICKERON token ecosystem and specialized agents for hedging (like Inverse ETF bots), it offers a sophisticated, modern toolkit for data-driven traders.

FinViz Elite

Source: Finviz.com

Key Features | |

|

|

Finviz is a browser-based market analysis platform celebrated for its exceptionally fast stock screener and innovative market heatmaps. It is designed to help traders and investors visually digest market data and quickly identify potential trading opportunities without requiring any software installation.

The platform’s centerpiece is its screener, which allows users to filter over 8,500 stocks based on 67 different fundamental and technical criteria. A key feature of the screener is its ability to scan for stocks exhibiting 30 specific chart patterns (like wedges and triangles) and numerous candlestick patterns. The Elite plan enhances this with real-time data, advanced filtering options, and data export capabilities.

Finviz is also famous for its heatmaps, a powerful visualization tool that provides a color-coded, at-a-glance view of sector, industry, or broad market performance. For deeper analysis, the Elite plan includes a no-code backtesting engine, allowing users to test trading strategies based on over 100 technical indicators against 24 years of historical data.

Why Use It?

Finviz Elite is best for active swing and day traders who prioritize speed and need to identify market-moving opportunities instantly. It acts as a powerful “top-of-funnel” tool for finding trade ideas without software bloat.

Its primary strength is the ability to distill complex market noise into clear, actionable visuals. With the recent addition of intraday screening capabilities, traders can now hunt for technical patterns on shorter timeframes (down to 1 minute), making it an indispensable resource for answering the question: “What is moving right now?”

VectorVest

Source: Vectorvest.com

Key Features | |

|

|

VectorVest is an all-in-one stock analysis and portfolio management platform designed to simplify the investment process through its unique, rules-based system. It analyzes over 16,000 stocks daily, providing investors with clear buy, sell, or hold recommendations to remove guesswork and emotion from trading.

The platform’s foundation is its proprietary VST (Value, Safety, Timing) system, which analyzes over 16,000 stocks daily. This engine assesses every stock on three key criteria: its current valuation, its financial safety and consistency, and its price trend. These factors are then combined into a single VST score, allowing users to instantly see which stocks are safe, undervalued, and rising in price.

A flagship feature is the VectorVest Market Timing Gauge, which gives subscribers explicit signals on the overall market’s health. It advises when conditions are favorable to buy stocks and, more importantly, when to tighten stops or move to cash to protect capital during downturns. The platform also includes pre-built watchlists of the highest-rated VST stocks and integrates with popular brokers to help manage portfolios efficiently.

Why Use It?

VectorVest is ideal for investors and active traders who prefer a disciplined, rules-based system over complex manual charting. It is particularly valuable for those seeking clear market timing guidance to protect capital during downturns while capturing upside volatility.

Its primary strength is clarity and automation. By converting complex market data into simple signals and offering tools like AutoTimer to manage trades, it helps users stay consistent. The 2025 addition of advanced options analysis and real-time scanning reinforces its position as a complete ecosystem for data-driven wealth management.

MetaStock

Source: Metastock.com

Key Features | |

|

|

MetaStock is a professional-grade desktop charting and technical analysis software that has been a trusted tool for serious traders for over 30 years. Unlike modern web-based platforms, MetaStock is a powerful, installable application designed for in-depth system development, backtesting, and forecasting.

The platform is renowned for its comprehensive analytical toolkit, offering an industry-leading library of over 275 technical indicators, advanced drawing tools, and numerous chart types. MetaStock comes in two primary versions: MetaStock D/C for end-of-day analysis favored by swing and position traders, and MetaStock R/T, which integrates with the professional-grade Refinitiv XENITH data feed for real-time day trading.

Its two standout features are the System Tester and the Forecaster. The System Tester allows traders to build and backtest complex trading strategies. The downside is that it requires knowledge of MetaStock’s proprietary scripting language. The unique Forecaster tool analyzes historical price action to generate a visual probability cloud. It projects where future prices are most likely to trade.

Why Use It?

MetaStock is built for dedicated technical analysts and system traders who demand maximum control and depth in a stable desktop environment. It is ideal for users who want to go beyond standard charting to build, code, and rigorously backtest their own trading systems.

Its primary strength is the combination of AI-driven forecasting and institutional-quality data. While web-based platforms focus on convenience, MetaStock prioritizes analytical power, offering a vast library of indicators (including new 2025 additions like Ichimoku Master) and predictive modeling tools that give serious traders a forward-looking edge.

SignalStack

Source: Signalstack.com

Key Features | |

|

|

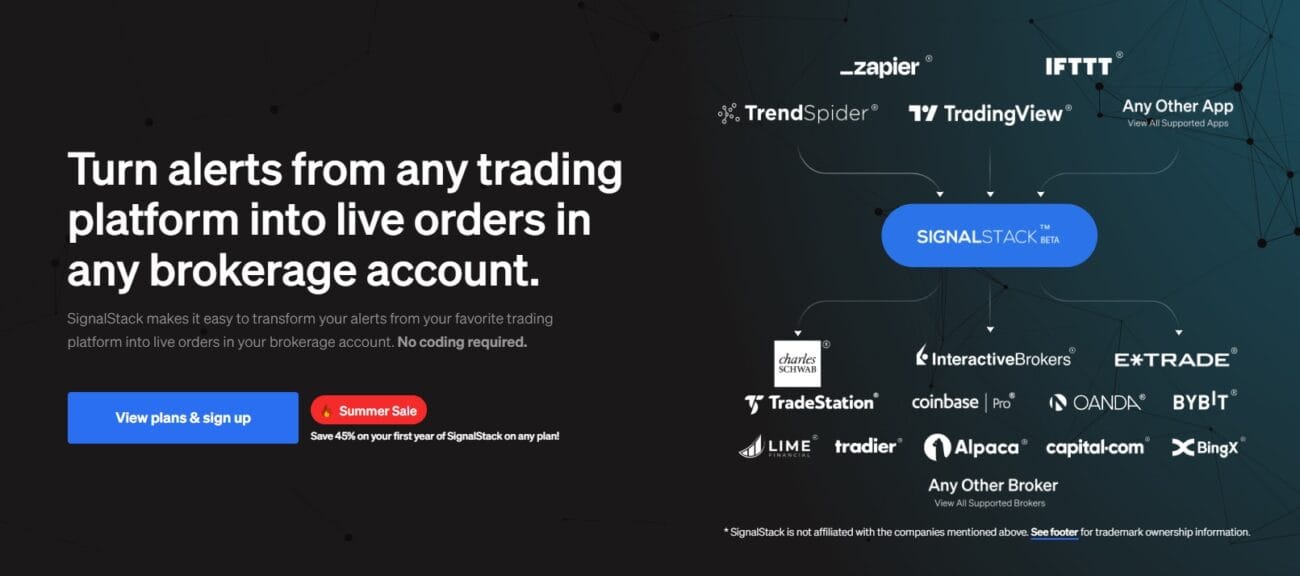

SignalStack is a unique middleware tool designed to bridge the gap between your favorite charting software and your brokerage account, enabling fully automated trade execution. It doesn’t generate its own signals or charts; instead, it intelligently converts alerts from other platforms into live trade orders.

The platform works by using webhooks, a common web notification technology. When a predefined alert is triggered in a user’s charting software (e.g., a price crossover in TradingView), it sends a signal to SignalStack. SignalStack then instantly converts that signal into a market or limit order and places it in the user’s linked brokerage account in under half a second. The entire process is designed to be incredibly simple, with no coding required.

Why Use It?

SignalStack is the perfect solution for traders who want to automate execution from their favorite charting platform without learning to code. It is ideal for those managing diverse portfolios who need a single tool to route orders to different brokers.

The platform’s primary strength is its simplicity and universal compatibility. By effectively “translating” alerts into orders, it allows traders to turn any analysis tool into an automated bot. The 2025 updates, emphasizing sub-second speed and expanded asset coverage (including options and futures), make it a highly reliable execution engine for time-sensitive strategies.

Conclusion

Leveraging AI is a strategic step toward smarter, more efficient trading. But the right tool is key to navigating this evolving landscape with confidence. Each platform in this guide brings unique strengths, specialized focus, and a distinct approach to solving real trading challenges.

To find the best fit, start by assessing your specific needs. These should include your trading style, comfort with technology, required features, and budget. Use this guide to build your shortlist. The market offers a range of solutions, from advanced tools for deep quant analysis to user-friendly, free options like TradeEasy AI. Each is designed to help you unlock more value in the markets.