How to fundraise in 2024 recession? Early-stage startup fundraising

As the world economy heads into another financial crisis, startups will find it increasingly difficult to raise money from venture capitalists. As a result, Tech giants and big VC companies such as Sequoia Capital, Andreessen Horowitz, Y Combinator and Lightspeed Venture Partners are warning founders to brace for tough times ahead.

None can predict the future, but we can learn from the past. Our experience and data from the last two financial crises (the stock market crash in 2008/2009 and during the 2020/21 COVID-19 pandemic) help us make predictions and look for analogies. We found a range of financing options for early-stage startups still available. So how can founders manage startups during a recession and deal with a bear market? You’ll find the answer in the article below.

Introduction

While VCs may still be willing to invest in some companies, they will be far more selective than during boom times. To be prepared for that, as a startup founder, you should read this article and check our Startup Fundraising Consulting Services.

VCs are likely to emphasize companies with a solid plan for how they will use the funding and how they will generate revenue. They will also be looking for companies with strong management teams with the experience and expertise to navigate a challenging economic landscape.

Pre-Seed, Seed round vs Serie A, Serie B, and beyond

Pre-Seed and Seed funding rounds are smaller fundraising rounds that allow startups to get their business off the ground without needing as much capital. History shows that early-stage startups during a challenging global economic period should not worry about initial funding as much as growing companies looking for the next investment rounds.

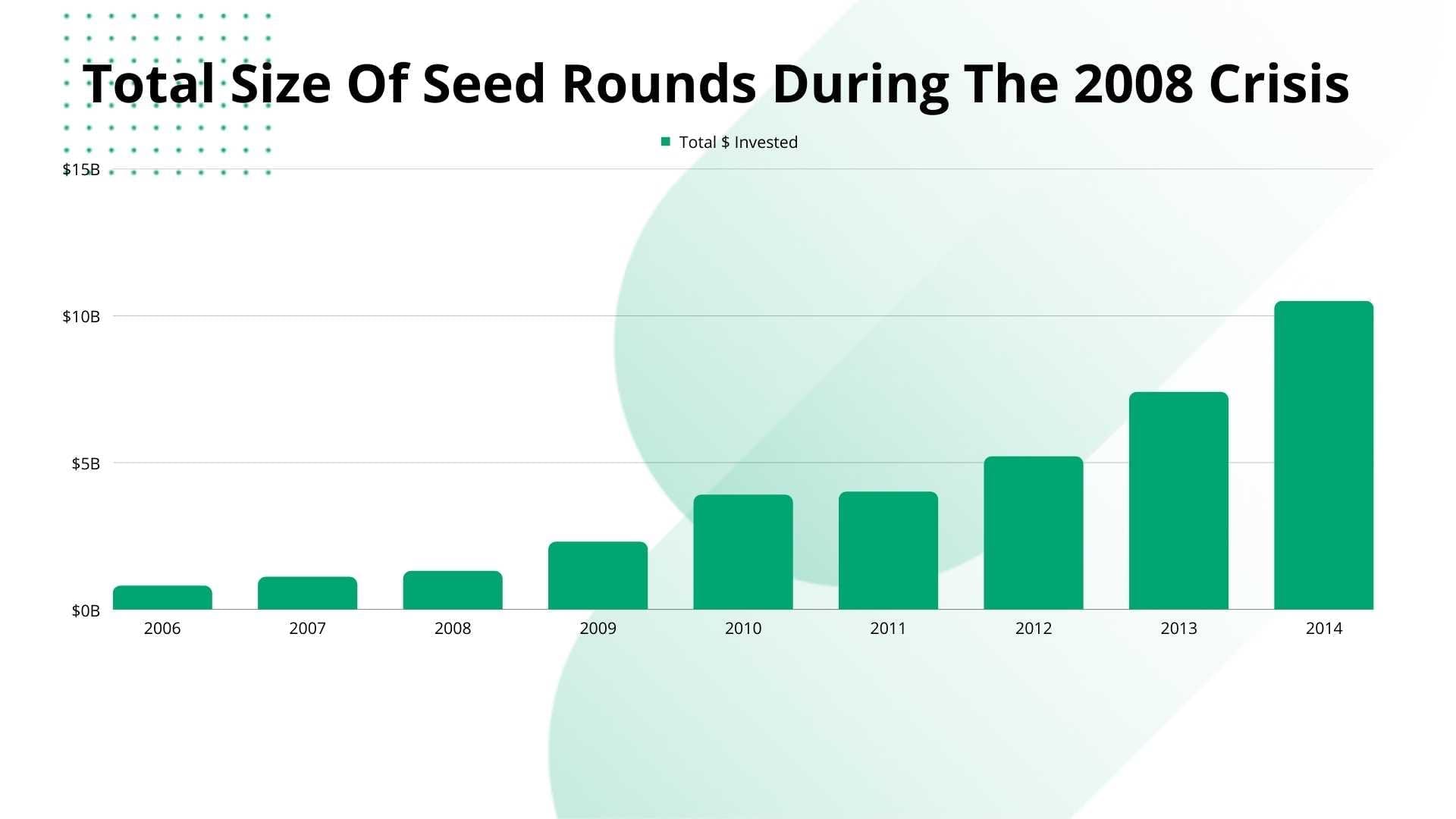

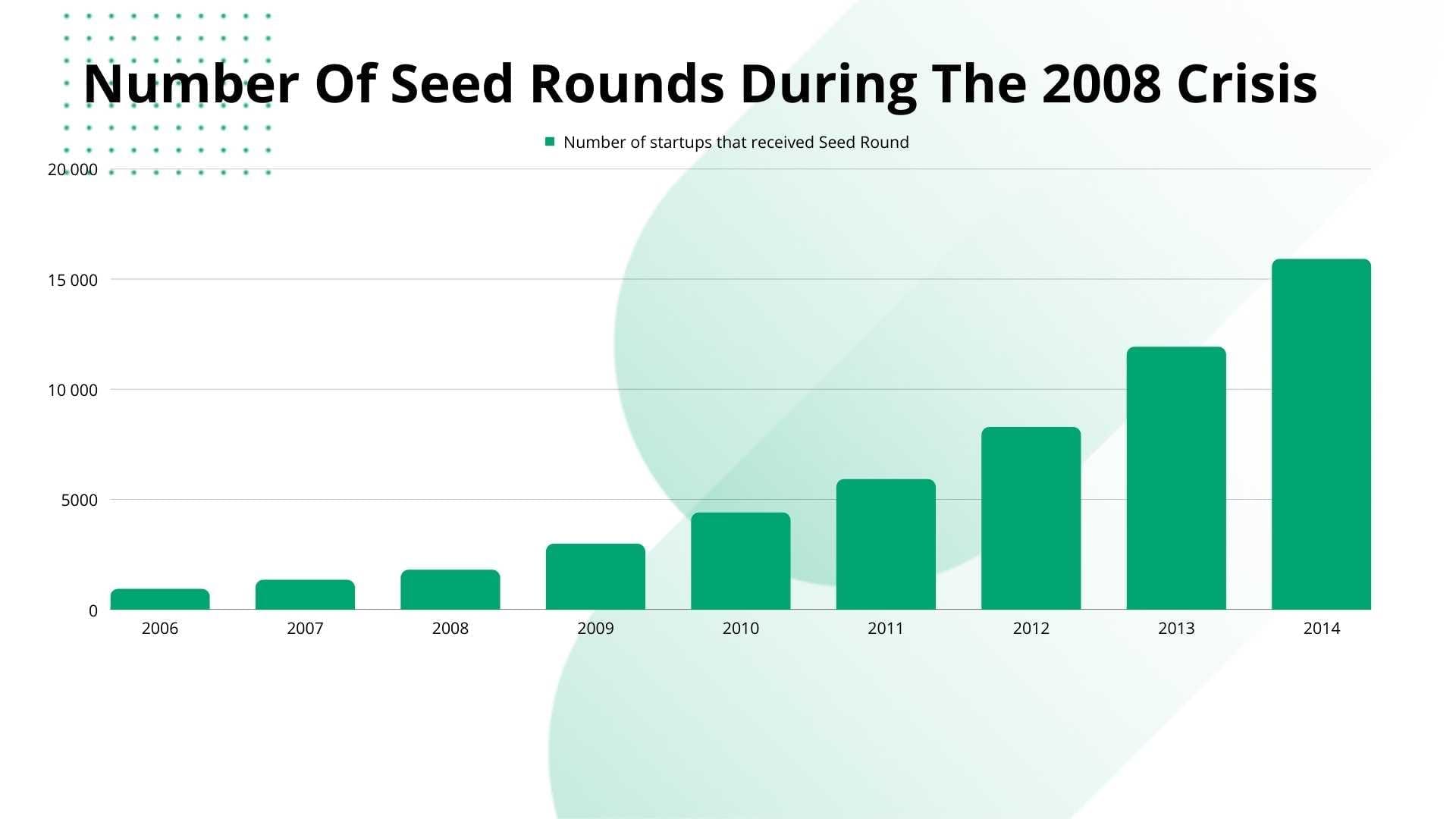

The startup market in the last decade and before has shown that the economic crisis (COVID-19 pandemic, 2008 crisis) impacts VC investing but does not stop investing totally. The market is changing, but money is still there. Investors are more likely to invest in early-stage companies and startups, opening up some opportunities for new founders. Although it does not mean that raising capital might be easier than before – even if money is there, investors’ risk awareness is growing, so they will make their investment decisions more carefully.

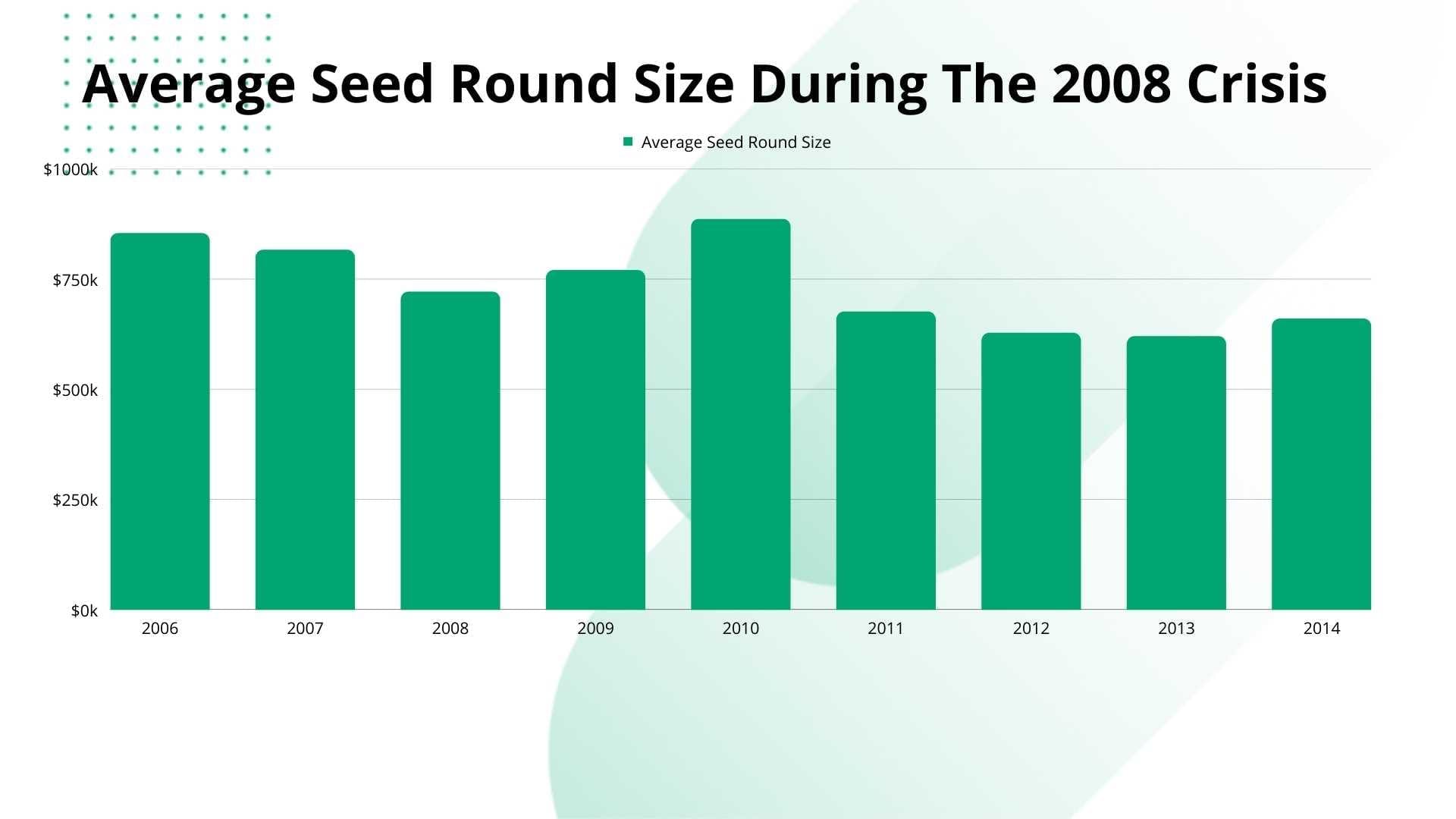

History shows that the average Seed round size dropped during the 2008 economic crisis, but the total amount of money available for early-stage startups increased. Smaller ticket sizes, combined with the overall goods and services prices increase (inflation) nowadays, might be problematic, but good product management and planning should let you survive those tough times.

So, if you’re an early-stage startup looking for funding nowadays, be prepared to make a strong case for your business. And be realistic about the amount of money you’re seeking. Otherwise, you may find securing the funding you need challenging.

The situation in the 2008/2009 crisis was not so good for more mature startups looking for Serie A, Serie B, and Serie C. According to Crunchbase, data shows that amount of money available for startups in their next financing rounds decreased by more than 40% (Serie A -40%, Serie B -42%, Serie C -47%). This is why startup fundraising may require additional work and support nowadays in the front of the next economic crisis. If you need help or advice with fundraising, do not hesitate to contact us, our startup consultants are ready to support you in your fundraising efforts.

Tips and Tricks for early-stage startup fundraising during a recession

As a startup, there are a few key things you can do to increase your chances of securing funding during a recession:

1. Understand the VC landscape during a recession

As a startup, it is crucial to understand the venture capitalist landscape during a recession.

VC money is likely to be tight during tough times. So while some VCs may still be willing to invest in startups, they will be far more selective than during boom times. This is because the venture funding process depends on VC companies and VC investors who provide funds invested in startups.

source: https://news.crunchbase.com/business/2022-vc-funding-outlook-compare-2008-financial-crisis-pandemic/

source: https://news.crunchbase.com/business/2022-vc-funding-outlook-compare-2008-financial-crisis-pandemic/

On the one hand, those investors may look for good opportunities of allocating their cash and protect it from inflation, even if a high risk is involved. On the other hand, investing capital in bonds is less risky and may pay well. “Risk” is the keyword that you will hear and read a lot when searching for fundraising opportunities at this time.

2. Be sector-specific

A lot depends on the sector that a startup is in. In general, fundraising slows down during a recession, and companies have to be more selective with the investments they make. However, some sectors are more likely to experience a downturn than others.

For example, in 2008, the technology sector was hit particularly hard by the recession. As a result, fundraising for tech startups slowed down significantly, and many companies were forced to lay off employees or shut down entirely.

In contrast, the healthcare sector fared relatively well during the last recession. Fundraising for healthcare startups increased during the downturn as investors saw potential in the industry. Check the top 10 consumer healthcare startups investors want to fund in 2025.

So, what can we expect for fundraising in the 2022 recession? It’s hard to say, but fundraising will likely slow down across all sectors. As a result, startups will need to be more careful with their spending, and investors will be more cautious with their money. However, some sectors may weather the storm better than others. For example, Healthcare and clean energy are two sectors that could see relatively strong fundraising during the next financial crisis.

As a startup, it is crucial to understand how your sector is likely to fare during a recession. If you’re in a particularly vulnerable sector to a financial crisis, you may need to adjust your fundraising strategy accordingly in order to raise capital.

💡 Curious how fintech startups dealt with the 2022/2023 recession?

Check out our fintech case studies!

3. Have a solid plan for how you will use the funding

A crucial part of startup fundraising during the recession is having a solid business plan. Potential investors will be looking for companies with a well-thought-out plan for using the funding they receive. They will also want to see evidence that your business is viable and has a growth strategy.

If you’re seeking funding during a financial crisis, it’s essential to have a strong pitch that outlines how your business will survive and thrive in challenging economic conditions. You’ll need to be convincing about your business model and your ability to generate revenue. Be prepared to answer tough questions from investors about your business plan and risks.

This is why you need proper UX and Market Research that will help you understand what people are looking for and how they would want to use your product. This will help reduce the risk of making wrong assumptions. Early-stage investors will be looking for this kind of risk management proof from early-stage startups.

4. Have a long-term vision

In addition to having a solid business plan, it’s also important to have a long-term vision for your company. Potential investors will want to see that you’re thinking about the future and that you have a clear strategy for how you will grow your business during and beyond the financial crisis.

When fundraising during a recession, it’s important to make the case that your business is recession-proof. Explain how your product or service will continue to be in demand even if the economy slows down. Describe your plans for expansion and growth, and show how you will continue to generate revenue even in tough times.

Prepare projections on how your business will look after the financial crisis and what its real potential is. Proper UX research and current market analysis would provide you with data to prove your business model.

5. Be prepared to accept less money

Fundraising during a recession can be more challenging than fundraising in good economic times. As a result, startups may have to accept less money from investors and may also have to give up a larger equity stake in their startup.

This doesn’t mean that you should accept any offer that comes your way. On the contrary, it’s still important to negotiate with investors and get the best deal possible. But you may need to be prepared to accept less money than you would in a strong economy.

Many startups and new companies raising record amounts of money in normal times may receive a much lower valuation from VC funds in tough times.

source: https://news.crunchbase.com/business/2022-vc-funding-outlook-compare-2008-financial-crisis-pandemic/

source: https://news.crunchbase.com/business/2022-vc-funding-outlook-compare-2008-financial-crisis-pandemic/

6. Be patient

Fundraising during a financial crisis can take longer than fundraising in good economic times. It’s important to be patient and to keep working hard to reach your fundraising goals.

Don’t get discouraged if you don’t receive funding right away. Instead, keep pitching your business to potential investors, and eventually, you will find the right people willing to invest in your company.

Venture funds may need more time to make decisions. Their budgets are limited because of the financial crisis and must be allocated wisely. Venture capital firms need to choose their portfolio companies wisely. Their cash flow might not be as liquid as in good time, so sometimes, it might be required to wait for the money even after a positive decision.

💡 Need help with raising funds?

Read more about our Startup Consulting services!

7. Focus on revenue

Another important thing to keep in mind when fundraising during a recession is that VCs will be placing a greater emphasis on companies that are focused on generating revenue. In other words, they will be looking for businesses that have a clear path to profitability. If you already have some market data showing your product’s potential revenue, do not hesitate to show it to investors.

The shorter the time to market path of your product idea, the more likely you are to secure funding during a financial crisis. So, if you’re fundraising during a recession, it’s important to focus on ideas that can be quickly brought to market and generate revenue. This is why proper product management supported by UX research is essential at this stage.

8. Consider alternative funding sources

Finally, it’s worth considering alternative sources of funding during a recession. Government grants and loans may be available to help startups and tech companies weather the economic downturn. In addition, angel investors and family and friends may be more willing to invest in a startup during a financial crisis and growing inflation.

Raising money from venture capital is not the one and only way to finance your startup idea.

9. Be realistic about the amount of money you are seeking

Investors are more likely to invest in a startup that is seeking a smaller amount of money. This is because they perceive less risk when investing in a company that is not trying to raise too much money. Especially in a pre-seed round, being realistic and having a good plan might be crucial.

When fundraising during a recession, it’s essential to be realistic about the amount of money you seek from investors. Don’t ask for more money than you need, and be prepared to accept a smaller amount than you originally wanted.

💡 Watch our 40-minute comprehensive webinar

“How to prepare for fundraising” to learn about fundraising mechanisms!

10. Showcase other forms of support and investment you’ve secured

If you’ve been able to secure investment from other sources, such as angel investors or family and friends, be sure to showcase this to potential VCs. This will show that there is interest in your company and that you are able to attract investment even in tough economic times.

Additionally, if you’ve been able to generate revenue or secure, efficient customer acquisition, be sure to highlight this to potential investors as well. This will show that your company is viable and that there is a market for your product or service.

Show the amount of work you and your team have already performed to bring the company to life. For example, if you invested your money before raising capital, you could show it too. That will give more confidence to investors that you will make their money work.

11. Be prepared to cut costs

During a recession, startups must be very careful with their spending. Unfortunately, this means that you may need to cut your budget to maintain more favourable balance sheets.

Be prepared to make cuts to any areas of your budget that are not essential to the operation of your business (for example, you might limit your marketing spending). You may also need to reduce employee salaries or let go of staff members to reduce costs.

You may think about outsourcing some of the work to save money. But, be careful with this strategy, as it can backfire and make your company less efficient. Choose your outsourcing partners wisely.

Summary

Fundraising during a recession can be difficult, but there are things startups can do to increase their chances of success. First, focus on ideas that can be quickly brought to market and generate revenue. Second, consider alternative funding sources, such as government grants or loans. Third, be realistic about the amount of money you seek from investors. Fourth, showcase other forms of support and investment you’ve secured. Finally, be prepared to cut costs if necessary. By following these tips, startups can increase their chances of successfully fundraising during a recession.

Additionally, if you’re in the early stages of startup development and need a quick way to validate your business idea, check out our AI-based Market Research Tool. This innovative tool provides comprehensive market analysis, competitor insights, and potential revenue opportunities in just seconds, helping you to refine your strategies and present a compelling case to investors.

If you need any help with fundraising, check out our startup fundraising consulting services that helped several startup founders to build their businesses.

Did you like this article? Then, please share it with your network!