Congrify: Building a comprehensive payment data analysis solution from kick-off to MVP in 3 months

With so many new tools expanding the fintech landscape each year, there’s still a problem nobody has provided a solution for: a lack of tools that can help merchants store, analyze and make sense of the data from various payment providers.

That’s how Congrify was born.

About Congrify

Over the years, the founders of Congrify, while working in the payment industry, identified several common challenges that merchants face daily, including fragmented payment data and a lack of transparent analytics tools.

- Fragmented data. It’s hard to collect fragmented data from multiple payment providers.

- Inefficient processes. There’s no easy-to-use solution that could help merchants standardize and analyze payment data; those that exist are insufficient.

They decided to create a solution to help merchants easily understand and access their transaction information. To do that, they needed a software development partner to help them turn their concept into an actual product.

Challenge

When the client came to us, they wanted to build something they could show to investors and get funding for future development. The client already had a list of features they wanted in their app and were looking for a software provider to build it within a given budget.

At Pragmatic Coders, we always first want to understand what a client’s real goals and motivations are. This way, we can ensure the solution we further develop is really something users crave – which might not always overlap with a client’s initial idea of their product scope. One challenge was to encourage the client to give this way of thinking a chance.

To overcome the other challenge (create a version of the product that the founders could show to investors to raise funds) we carried a Product Discovery Workshop. It let us cut down the long list of features to just the essentials and make sure we could develop the product quickly and affordably within the clients’ budget.

Product Discovery Workshop

The energetic discussions during the workshop led our clients to rethink their plans, which was key to making sure the product would be successful.

Defining the target audience

The UX research carried out by our team refined the clients’ initial ideas about their target audience and had a direct impact on the design and functionality of the Congrify app.

The research revealed that the target user group was much more varied than initially anticipated, including beginners, intermediates, and advanced data analysts, each with specific needs.

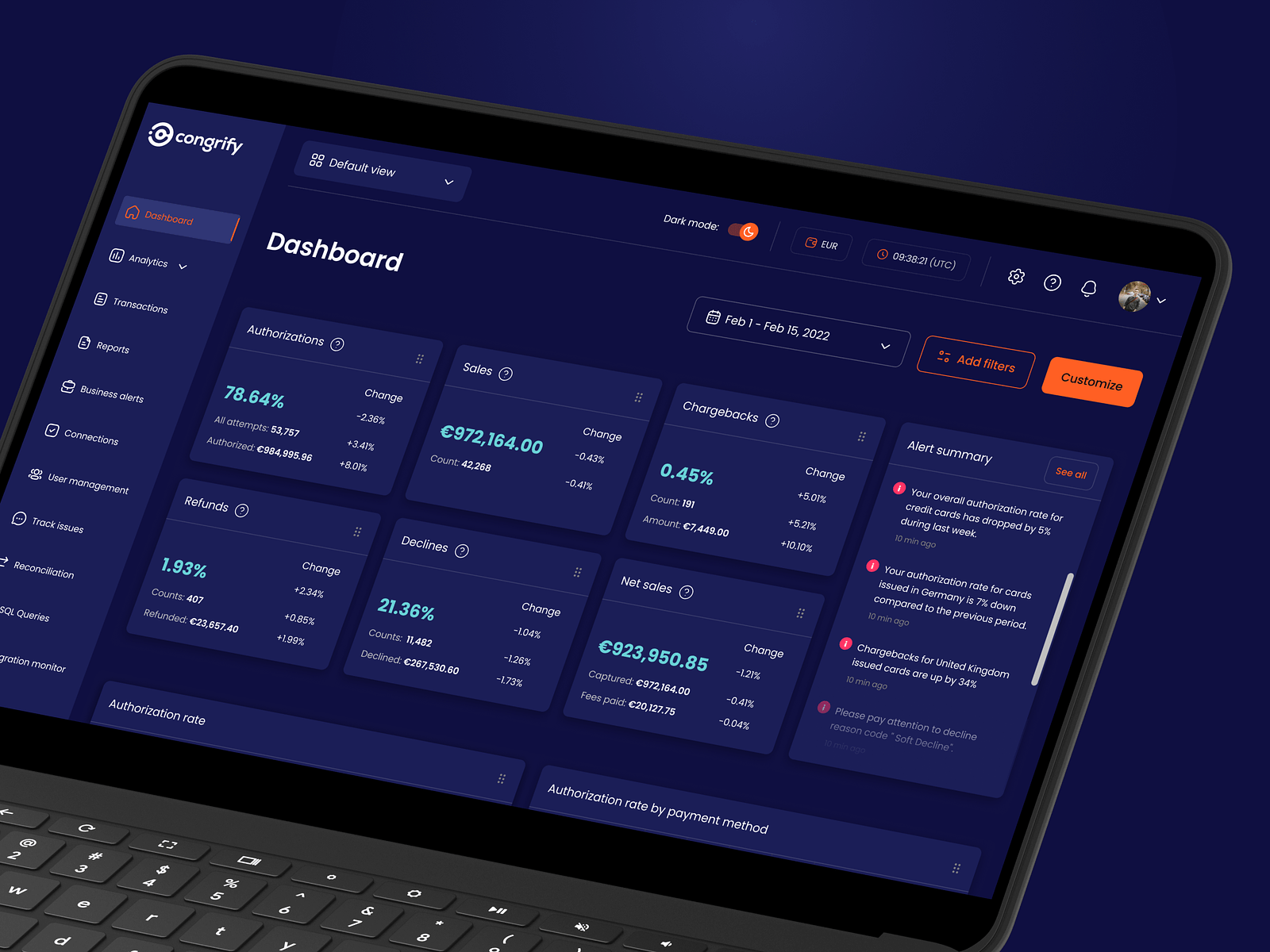

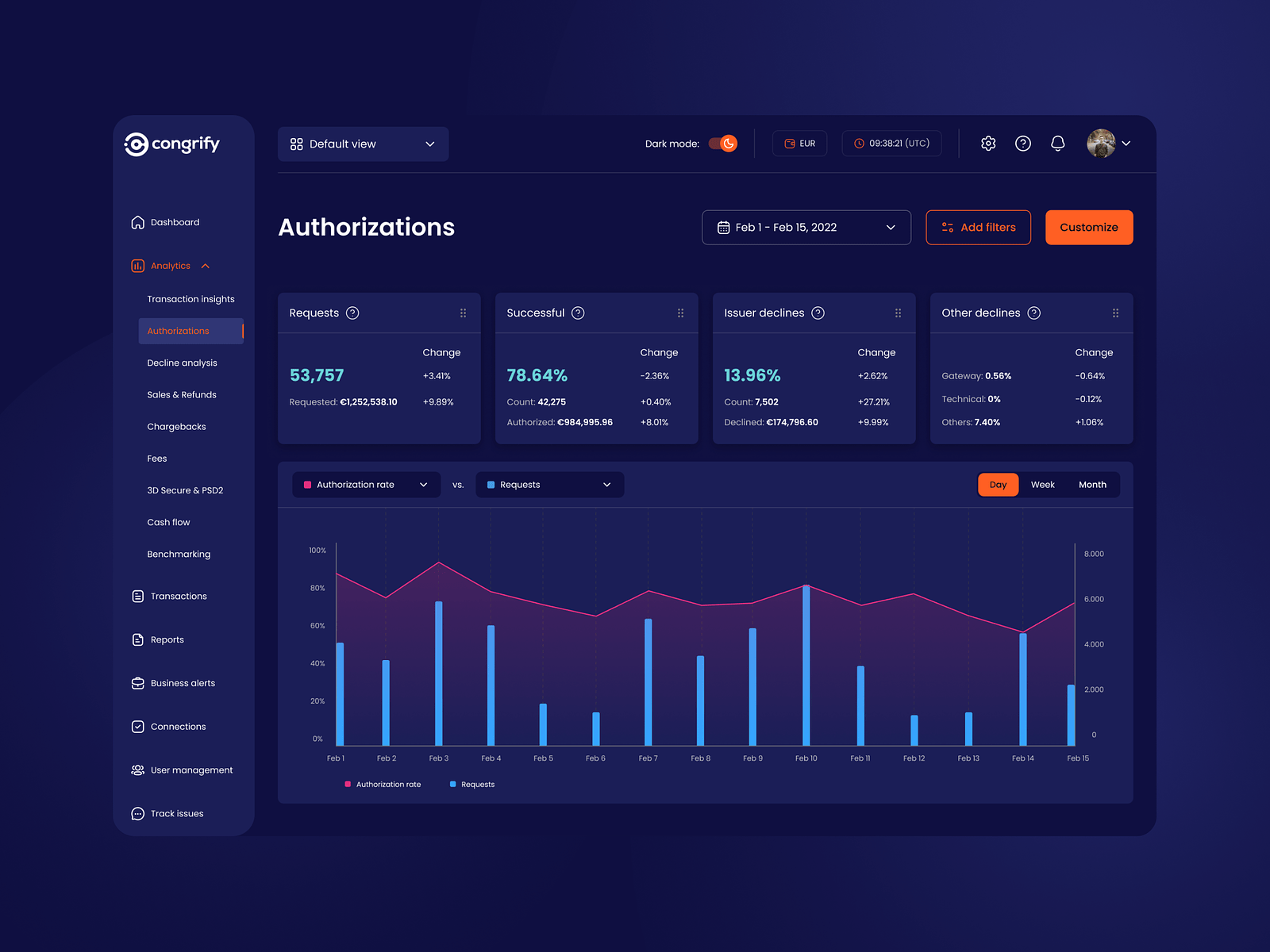

This discovery prompted us to design a customizable dashboard with modular options, allowing users to tailor the Congrify tool to their requirements. As a result, a novice merchant can easily navigate their data using the app’s straightforward default dashboard, while an experienced data analyst can enhance their dashboard with additional financial data charts for in-depth analysis.

Prioritizing & reducing the product scope

During the workshop, a key activity was the user journey mapping session. Instead of focusing on the desired features for Congrify’s app, we first defined our objectives with the product. This approach helped us prioritize the product goals and narrow the project’s scope to the essentials. As a result, our client was able to launch the product quickly and stay under budget.

With a clear understanding of priorities, we developed a plan for both prototype development and a funding strategy. We outlined the steps our clients needed to follow to improve their chances of securing funding.

Building market strategy

To ensure Congrify could accurately target the appropriate audience, we conducted market research. This involved segmenting the market and then identifying those segments with the lowest barriers to entry. By focusing on the most accessible markets first, our clients were able to minimize additional costs during the early phases of their startup’s development.

Solution

Prototype

First, our UX designer, Kasia, developed the app prototype. She initiated the process with a kick-off meeting with our clients to discuss the workings of payment systems and analyze the competition. Following this, she constructed the product’s information architecture and applied the card sorting technique for validation. Kasia then proceeded to draft the initial sketches, prioritizing the application’s main data analysis flow.

As the project advanced and other parts of the application were fleshed out, she shifted her focus to crafting a high-fidelity prototype. This approach enabled our clients to showcase a polished product prototype to potential investors within just a month, all without incurring any development costs.

Additionally, we aimed to leverage the visual elements on their landing page to draw in the first wave of users. In the final stages of working on the hi-fi prototype, Kasia compiled a style guide. This guide was designed to streamline the development process, providing a clear visual and technical reference for the developers tasked with building the application.

Working alongside the development team, our designer showcased the benefits of having a design team integrated within a software development agency. Communication between the UX specialist and developers was seamless; questions and clarifications could be addressed in real-time, delays eliminated, and productivity boosted.

MPV

Finally, after five months of collaboration, which included three months of actual development, we launched Congrify.

The development team devised a modular solution featuring two key components: data processing and visualization modules. The data processing functionality was built using a serverless architecture, leveraging AWS Lambda for efficiency and scalability. Visualization capabilities were developed using Elasticsearch & Kibana, allowing for flexible and code-free exploration of visualization options.

Moreover, the emphasis on modularity meant that Congrify could be easily expanded in various directions beyond the Minimum Viable Product phase, without the need to overhaul the entire solution. We identified ways to scale the product based on what our clients might need in the future:

- Adding new charts and changing the visualization method (thanks to the integration with Kibana, the clients could create and manage dashboards themselves);

- Adding new data mappings from providers to a unified model;

- Onboarding new merchants;

- Adding a new payment service provider for offline data upload.

Results

Congrify is a no-code SaaS payment analytics solution for merchants that helps them unify all payment data to analyze and understand it better.

The tool:

- Facilitates payment analytics and deposit management from various payment providers (Klarna, PayPal, and more).

- Supports different types of payments, e.g., recurring payments, one-time payments, or currency payments.

- Collects all payment information in one place (including customer behavior information).

Can we help you the way we’ve helped Congrify?

Collaboration highlights

- Quick, budget-friendly launch: We focused right away on what was really needed, making sure Congrify could start fast without overspending.

- No false assumptions: UX research conducted by us revealed new, unknown facts about Congrify’s target audience. We used them to inform the client’s business strategy.

- Accelerated time to market: With a polished prototype ready in no time, showing off Congrify’s potential to get that crucial funding was a breeze.

Contents

8 out of 10 founders who contacted us wanted to work with our team.

Want to learn why?

Talk with Wojtek - startup founder, business analyst, and our most experienced Business Consultant.

Contact us

Newsletter

You are just one click away from receiving our 1-min business newsletter. Get insights on product management, product design, Agile, fintech, digital health, and AI.